Probate Panic? Here’s the Typical Cost of Solicitors Fees

Understanding the True Cost of Probate Legal Services

When dealing with the loss of a loved one, the average solicitors fees for probate typically range from 3% to 7% of the estate’s value, though this can vary significantly based on your location, the complexity of the estate, and the fee structure your attorney uses.

Quick Answer: Average Probate Attorney Fees

- Hourly rates: $200-$500 per hour (varies by location and experience)

- Flat fees: $3,500-$7,000 for straightforward estates

- Percentage fees: 3-7% of total estate value

- Simple estates: Often qualify for lower flat-fee arrangements

- Complex estates: May require hourly billing due to unpredictable scope

The probate process can feel overwhelming when you’re already grieving. You’re not just dealing with emotional loss – you’re suddenly responsible for navigating court procedures, validating wills, paying debts, and distributing assets according to legal requirements.

Probate is the legal process that validates a deceased person’s will and ensures their assets are distributed properly. It involves court supervision, which means legal compliance is crucial. This is where attorney fees come into play.

Most people don’t realize that probate attorney fees are typically paid from the estate itself – not from your personal funds. This means the costs reduce what beneficiaries ultimately receive, but the executor (you) isn’t personally responsible for these expenses.

The fee structure your attorney uses makes a huge difference in your final costs. Some charge by the hour, others offer flat fees for simpler cases, and in certain states, fees are calculated as a percentage of the estate’s total value.

Introduction to Probate and Associated Costs

When a loved one dies, their estate must be gathered, debts paid, and the remaining property transferred to heirs. The court-supervised roadmap for doing that is called probate. It involves:

- proving a will (or confirming heirs if no will exists),

- appointing an executor or administrator,

- identifying and valuing assets,

- notifying and paying creditors and taxes, and

- distributing what is left to beneficiaries.

Because each step has strict legal requirements, most families rely on an attorney. Keith Morris & Stacy Kelly guide executors through every filing and deadline so mistakes don’t lead to delays, extra costs, or personal liability.

Who Pays the Lawyer?

In almost every Texas estate the legal fees come out of the estate itself. You, as executor, generally do not pay from your own pocket. Although this slightly reduces what beneficiaries receive, it also protects them — a properly handled probate avoids disputes that can drain far more money than the attorney’s bill.

For edge-case situations such as “shortfall clauses” or insolvent estates, see our detailed explainer on Who Pays Probate Attorney Fees in Texas?

How Are Probate Attorney Fees Calculated?

There is no single price tag for probate. Attorneys normally use one of three billing styles. At our offices in Houston, Fort Worth, and Austin we explain the options up front and provide written estimates so you can plan with confidence.

1. Hourly Rates

- Typical range: $200–$500 per hour.

- Higher rates reflect large-city overhead or decades of probate focus.

- Paralegals often handle routine tasks at a lower rate to keep costs down.

Hourly billing works best for estates with unknown problems (missing documents, beneficiary disputes, unusual assets) because it flexes up or down with the actual work required.

2. Flat Fees

For straightforward estates a single price — often $3,500–$7,000 — covers all steps through final distribution. Predictability is the big advantage. An estate is usually “straightforward” when it has a valid will, few assets, no real-estate sales, and cooperative heirs. Always confirm in writing exactly which services the flat fee includes.

3. Percentage of the Estate

Some lawyers quote a percentage (commonly 3%–7%) of the gross estate. California sets those percentages by statute; Texas does not, so percentages here are negotiable. This model ties compensation to estate size but can feel high if the work is simple, so many families ask to cap or convert it to hourly or flat billing.

| Feature | Hourly | Flat | Percentage |

|---|---|---|---|

| Best for | Complex matters | Simple matters | Statutory states or very large estates |

| Up-front certainty | Low | High | Medium |

| Cost control | Requires monitoring | Excellent | Limited |

| Lawyer incentive | Bill efficiently | Finish quickly | Maximize reported value |

What Are the Average Attorney Fees for Probate?

Across Texas, a ballpark figure of 3%–7% of the estate is often quoted, but the real number hinges on complexity. Always request a written quote so everyone knows the ceiling before work starts.

Typical Cost Ranges

- Simple estate (few bank accounts, no real estate): $1,500–$2,500 flat or 10–15 billable hours.

- Estate under $100,000 that qualifies for simplified probate: often under $3,000 total.

- Complex or disputed estate: $10,000 and up, billed hourly.

- High-value estate: percentage fees can reach six figures if not negotiated.

Factors That Move the Needle

- Size and type of assets (cash vs. multiple properties)

- Valid, uncontested will vs. intestacy or ambiguous language

- Number of beneficiaries and likelihood of disputes

- Out-of-state or foreign property

- Business interests or trusts that need separate administration

- Tax filings and creditor claims

- County court costs and local practice rules

For details on Texas-specific problems, see Common Probate Problems That Require Help of a Houston Probate Lawyer.

What’s Included in the Bill? Services vs. Disbursements

An invoice is usually split into two parts:

1. Attorney Services

These cover the lawyer’s time for:

- Initial strategy meeting and advice to the executor

- Drafting and filing court documents

- Attending hearings

- Communicating with beneficiaries and creditors

- Guiding asset valuation, debt payment, and final distributions

Our team handles every step personally, aiming for fast, accurate results. See “The Ins and Outs of Texas Probate Administration” for a fuller checklist.

2. Disbursements (Out-of-Pocket Costs)

Common third-party expenses include:

- Court filing fees (often a few hundred dollars per county)

- Publication of creditor notices (about $150)

- Real-estate appraisals or business valuations

- Accountant charges for required tax returns

- Certified copies, postage, and recording fees

Ask for an estimate of these items at the start so you can set realistic expectations.

Managing and Potentially Reducing Probate Costs

Can Attorney Fees Be Negotiated?

Absolutely. Because Texas has no statutory schedule, fee terms are flexible. To keep costs in check:

- Discuss fees at the first meeting. Clarify hourly, flat, or percentage options.

- Request a cap or milestone billing if going hourly.

- Handle simple admin tasks yourself (collecting statements, forwarding mail) so the lawyer focuses on legal work.

- Get everything in writing before work begins.

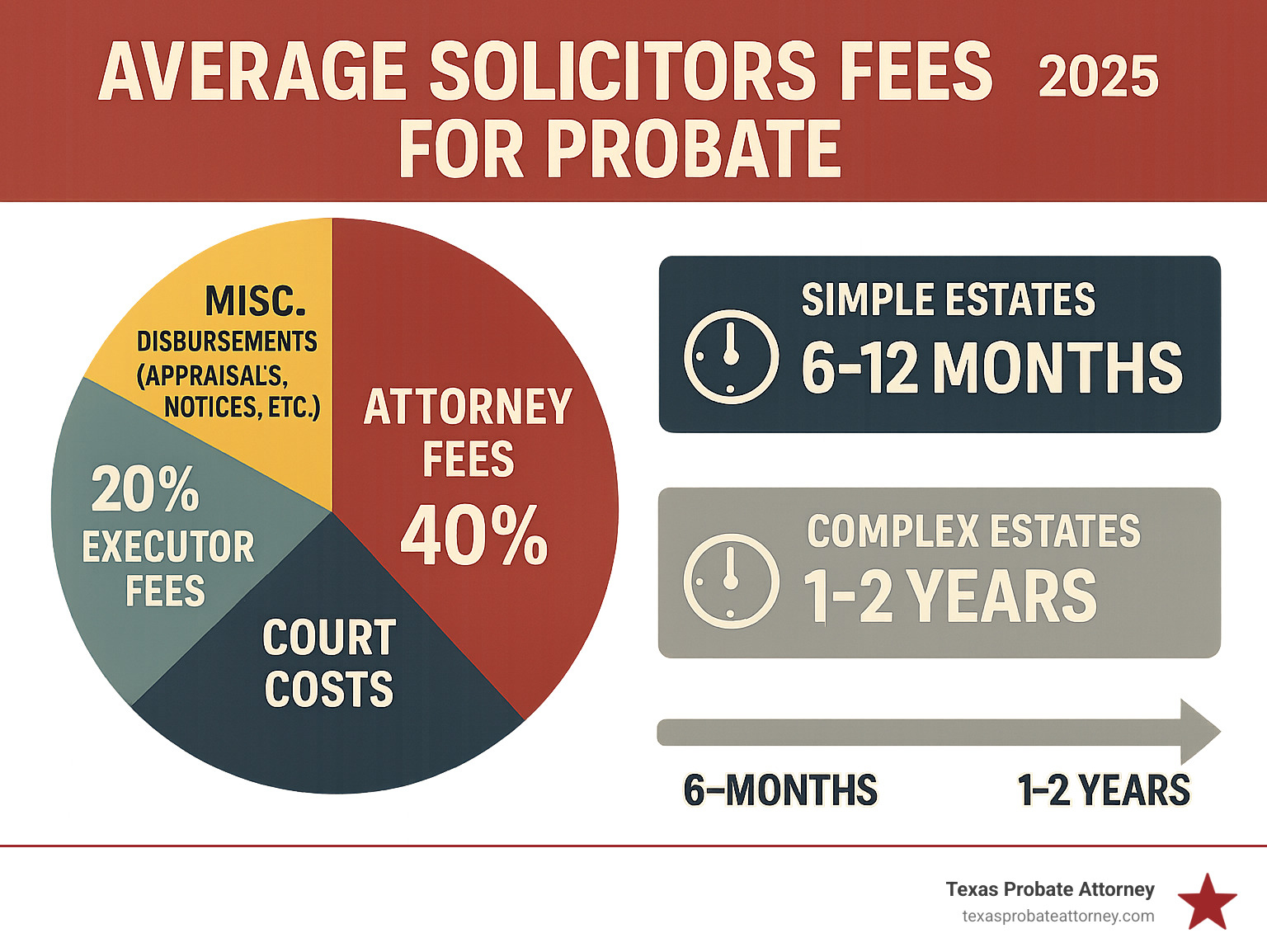

Understanding the Three Main Estate Charges

- Attorney fees – paid from estate funds for legal work.

- Probate court fees – mandatory filing charges, separate from the lawyer’s bill.

- Executor compensation – 3%–5% is common; an executor-beneficiary may waive it to avoid taxable income.

Our Estate Settlement Services combine clear fee agreements with efficient case management so families keep more of what matters.

Frequently Asked Questions about Probate Attorney Fees

How long does probate take?

In Texas, a routine estate can close in 6–8 months. Disputes, multiple properties, or tax issues can stretch the timeline to 12–24 months.

Are attorney fees tax-deductible?

They are deductible on the federal estate-tax return if the estate is large enough to file one. They are not deductible on a personal 1040. Always confirm with a tax professional.

Can I do probate without a lawyer?

Legally, yes for very small, undisputed estates. Practically, any estate with real property, unclear debts, or potential family conflict should have counsel. Mistakes can expose an executor to personal liability. Our Houston team is happy to review your situation and let you know whether professional help will actually save time and money.

Conclusion: Gaining Clarity on Probate Costs

Navigating the probate process can feel a bit like trying to find your way through a dense fog, especially when you’re already carrying the heavy burden of grief. But here’s the good news: by shedding some light on the factors that influence the average solicitors fees for probate, how attorneys calculate their charges, and exactly what services those fees cover, you can step forward with a lot more confidence and a clearer path.

We’ve explored how these costs can really swing, from a few thousand dollars for those wonderfully straightforward cases to a percentage of the estate’s value for larger, more complex situations. The big takeaway? Knowing these things puts you in the driver’s seat.

First, transparency is your best friend. Always push for clear, written fee agreements that lay out every service and potential cost. No hidden surprises, just a clear roadmap. Second, breathe a sigh of relief knowing that, in almost all cases, these fees are paid directly from the estate itself. This means the money comes from the deceased’s assets, not out of your personal bank account. Third, the more intricate an estate, the more legal work it usually requires, which naturally means higher legal fees. And finally, don’t be shy! Negotiation is often on the table, so discussing fee structures and ways to potentially save costs with your attorney is always a smart move.

At Keith Morris & Stacy Kelly, Attorneys at Law, we truly understand the emotional and financial currents that come with probate. With over 40 years of combined experience, we’re dedicated to offering personalized legal representation. We believe in an approach that’s both assertive in litigation and focused on quick, effective resolutions for our clients across Houston, Fort Worth, and Austin, TX. We’re here to help you steer through the complexities of probate with confidence, ensuring your loved one’s final wishes are honored as efficiently and effectively as possible. For an even deeper dive into specific costs, you can explore resources like “How Much Does a Probate Attorney Cost in Texas?”.