Wrapping Up Probate: Closing Independent Administration in Texas

Related Posts

Why Properly Closing Your Texas Estate Matters

Properly closing independent administration texas is the final step that ends your role as executor and protects you from future liability. For estates in Houston, Fort Worth, and Austin, this involves filing specific documents with the probate court to formally terminate the administration.

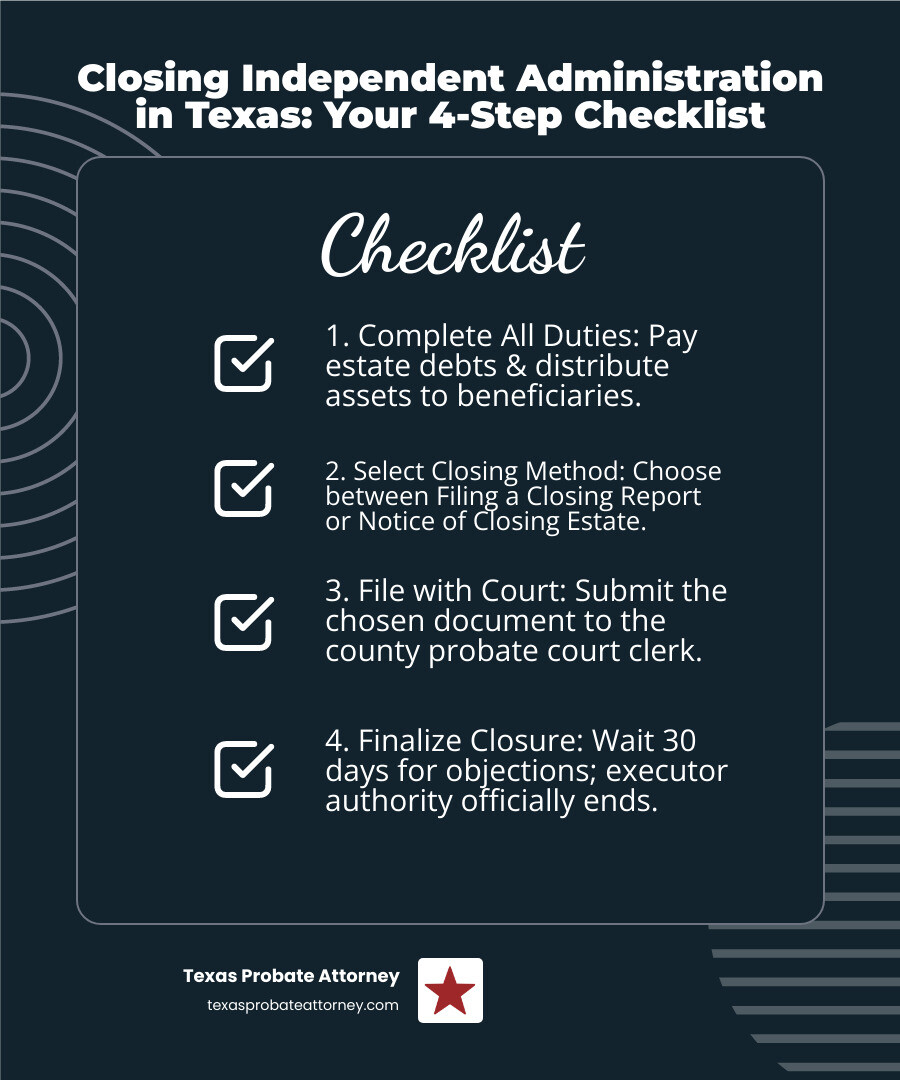

Quick Answer for Closing Independent Administration in Texas:

- Pay all estate debts and distribute assets to beneficiaries.

- Choose your closing method: Filing a Closing Report or Notice of Closing Estate.

- File the document with the probate court clerk in the county of administration (e.g., Harris, Tarrant, or Travis County).

- Wait 30 days for any objections. If none are filed, the estate closes automatically.

- Your executor authority ends and transfers to the distributees.

In the busy probate courts of Houston, Fort Worth, and Austin, many estates are never formally closed, leaving them open indefinitely. As one probate guide notes, “In most cases, the probate administration is never closed.” This practice creates ongoing risks for executors in Harris, Tarrant, and Travis counties who could face liability claims years later.

Fortunately, Texas law provides clear methods to close an independent administration once your duties are fulfilled. The process typically takes just 30 days after filing and provides peace of mind that your responsibilities are complete. Whether you’re managing an estate in Harris County (Houston), Tarrant County (Fort Worth), or Travis County (Austin), understanding the correct closing procedure is key.

Closing independent administration texas terminology:

- duties of independent administrator texas

- independent administration texas estates code

- what is an independent administrator in texas

Why Formally Close an Independent Administration?

After months of work on an estate in Houston, Fort Worth, or Austin, it’s tempting to just distribute the assets and walk away. However, while Texas law doesn’t always require a formal closing, it’s a critical step for your protection.

For an executor managing an estate in Houston, Fort Worth, or Austin, the primary reason to formally close the estate is to limit your personal liability. While closing doesn’t erase past mistakes, it officially terminates your authority over the estate. This means you are no longer responsible for new issues that might arise. Without a formal closing, your executor authority—and your potential liability—could continue indefinitely.

A formal closing also provides clear finality for beneficiaries. It confirms that all known debts are paid and assets are distributed. This is crucial for beneficiaries in Harris, Tarrant, and Travis counties who need to clear title to property or manage their inherited assets. In these major Texas cities, a formal closing allows banks and title companies to work directly with beneficiaries, as it proves the executor’s role is finished.

Risks of Not Closing

Many executors in the Houston, Fort Worth, and Austin areas believe keeping an estate open provides flexibility to handle newly founded assets. While true, this continued authority comes with continued responsibility. If a forgotten bank account or stock certificate appears years later, you are still the one expected to handle it. Furthermore, disgruntled heirs or creditors can still raise questions about your administration long after you believe your work is done. Formal closing is a best practice that provides several key benefits:

- Terminates Executor Power: Your official duties are completely finished.

- Limits Personal Liability: You are protected from future claims related to new issues arising after the closing date.

- Empowers Distributees: Beneficiaries gain full legal authority over their inheritance, allowing them to manage assets without your involvement.

- Simplifies Property Transactions: Heirs can sell, refinance, or transfer property without title issues related to an open estate—a critical benefit in the active real estate markets of Houston, Fort Worth, and Austin.

For more context on your role, review the Duties of Independent Administrator Texas.

Prerequisites: What Must Be Done Before Closing in Houston, Fort Worth, and Austin

Before you can file for closing independent administration texas in the probate courts of Harris, Tarrant, or Travis County, the estate must be fully administered. This foundational work is mandated by Texas law, and skipping any step can invalidate the closing and leave you exposed to future legal issues in these specific jurisdictions.

Under Texas Probate Law, the following tasks must be completed before you can file closing documents:

- File an Inventory: Within 90 days of your appointment, you must file an Inventory, Appraisement, and List of Claims or an Affidavit in Lieu of Inventory with the appropriate county court in Houston, Fort Worth, or Austin.

- Notify Creditors: You must publish a general notice to creditors in a local newspaper (e.g., the Houston Chronicle, Fort Worth Star-Telegram, or Austin American-Statesman) and send specific notices via certified mail to secured creditors.

- Settle All Debts and Claims: All known debts, including taxes, must be paid from estate assets. For estates in Houston, Fort Worth, or Austin, this can involve complex claims from various creditors, which must be settled according to the statutory order of priority before closing.

- File Tax Returns: All necessary tax returns, such as the decedent’s final income tax return and any required federal estate tax returns (Form 706), must be filed and paid.

- Distribute All Remaining Assets: After all debts are settled, you must distribute the remaining property to the rightful heirs or beneficiaries as specified in the will or by state law.

- Obtain Receipts: For your protection in the Harris, Tarrant, or Travis County probate proceedings, you should get signed receipts from each beneficiary confirming they have received their inheritance. This documentation is crucial for your closing report.

These prerequisites are fundamental requirements under the Texas Estates Code chapter 308.054 and must be carefully handled before proceeding to the final step in the Houston, Fort Worth, or Austin probate courts.

Methods for Closing Independent Administration in Texas

Once you have paid all debts and distributed all assets, you can formally complete the closing independent administration texas process. As outlined in Chapter 405 of the Texas Estates Code, you have two primary methods for closing the estate in probate courts across Houston, Fort Worth, and Austin.

While a more complex Judicial Discharge is possible, most executors will choose one of the following two options.

Filing a Closing Report

A Closing Report is a detailed, verified affidavit that you file with the probate court in Harris, Tarrant, or Travis County. It serves as a comprehensive summary of your administration. It must include:

- A list of all estate property that came into your possession.

- A statement of all debts and expenses you paid.

- The names and addresses of all beneficiaries who received estate property.

- Proof, such as signed receipts, that you delivered the property to the beneficiaries.

A key benefit of this method is that if you were required to post a surety bond, filing a complete Closing Report automatically releases the surety from future liability.

Filing a Notice of Closing Estate

The Notice of Closing Estate is a simpler, more streamlined affidavit. It is often a quicker and easier method for closing independent administration texas, making it a popular choice for non-bonded estates in Houston, Fort Worth, and Austin. This notice must state that:

- All known debts of the estate have been paid.

- All remaining assets have been distributed to the beneficiaries.

- You have provided a copy of the notice to all estate distributees.

The primary difference is that filing a Notice of Closing Estate does not release the surety on a bond. Therefore, if you were bonded, the Closing Report is the superior option.

For official details, see the ESTATES CODE CHAPTER 405. CLOSING AND DISTRIBUTIONS.

Comparing a Closing Report vs. a Notice of Closing Estate

Executors in Houston, Fort Worth, and Austin must carefully consider the following differences, especially if a bond was required by the court:

| Feature | Closing Report | Notice of Closing Estate |

|---|---|---|

| Verification | Required (verified affidavit) | Required (affidavit) |

| Content | Detailed accounting of property received, debts paid, remaining property, and distributions | Statement that all known debts are paid and assets are distributed; list of distributees |

| Surety Release | Yes, automatically releases surety on bond from future liability | No, does not release surety on bond |

| Complexity | More detailed and requires more specific information and proofs | Simpler and less detailed |

| Best For | Estates where the executor was required to be bonded and wants surety released | Most non-bonded independent administrations where a simpler closing is desired |

The Step-by-Step Process for Closing Independent Administration Texas

After you have prepared the appropriate document—either the Closing Report or the Notice of Closing Estate—the final process for closing independent administration texas in Houston, Fort Worth, or Austin is straightforward and governed by a specific legal timeline.

Filing, the 30-Day Wait, and Finality

The process begins when you or your attorney file the closing document with the county clerk in the same probate court where the administration was opened (e.g., Harris, Tarrant, or Travis County).

Once filed, a 30-day waiting period starts. During this window, any “interested person,” such as a beneficiary or creditor, can file an objection with the Harris, Tarrant, or Travis County court if they believe the estate was not administered correctly.

If no objections are filed within 30 days, the independent administration is automatically considered closed. Your power and authority as executor are terminated, and your duties are formally complete. This is detailed in Section 405.007 of the Texas Estates Code.

Upon closing, legal authority over the inherited assets transfers to the distributees. Your filed report or notice serves as the official record that allows third parties like banks and title companies in Houston, Fort Worth, and Austin to deal directly with the beneficiaries.

Understanding the Executor’s Ongoing Liability

It is crucial for executors in Houston, Fort Worth, and Austin to understand that closing independent administration texas terminates your future duties, but it does not erase your past liability. The Texas Estates Code clearly states that filing a closing document “does not relieve the independent executor from liability for any mismanagement of the estate or for any false statements contained in the report or notice.”

If you were negligent with estate funds, failed to pay legitimate debts, or included false information in your sworn affidavit filed in the Harris, Tarrant, or Travis County court, you could still be held personally liable even after the estate is closed.

For help with these final steps, see our Probate Attorney in Texas resources.

Navigating Complications and Special Scenarios

Even with careful planning, closing independent administration texas can encounter complications. Disputes among beneficiaries, the appearance of a late-arriving creditor, or questions about the executor’s accounting can turn a simple filing into a contested court matter in Houston, Fort Worth, or Austin.

What Happens if an Objection is Filed?

If an “interested person”—such as a beneficiary or creditor—files an objection to your closing report within the 30-day window, the estate does not close automatically. The process shifts from an administrative filing to a contested legal matter.

The probate court in Houston, Fort Worth, or Austin will schedule a hearing where both you and the objecting party must present evidence. The judge will review your administration to determine if all actions were proper. If the objection is found to be without merit, the court will dismiss it and allow the estate to close. If the objection is valid, the court may order you to take corrective action, such as paying a missed debt or providing a more detailed accounting. This process can significantly delay the final closure of the estate.

The Role of a Distributee in Closing

Beneficiaries (distributees) have legal tools to ensure the estate is closed properly. If an executor has finished all administrative tasks but fails to file closing documents, a distributee can petition the court in Harris, Tarrant, or Travis County to compel closure. Additionally, after two years from the start of the administration, any interested person can demand a formal accounting from the executor. These mechanisms ensure executors remain accountable even with minimal court supervision.

When Formal Closing Isn’t Pursued

In major urban centers like Houston, Fort Worth, and Austin, many estates are never formally closed. The executor completes all tasks and simply moves on, achieving a “practical closure.” While this may work for simple, harmonious estates, it carries significant risks. The executor’s authority and potential liability technically continue indefinitely.

For complex estates or those with family tension, particularly common with high-value assets in the Houston, Fort Worth, and Austin areas, an executor may seek a judicial discharge. This is a formal court order that provides the maximum protection by releasing the executor from all liability except for fraud. It is a more involved and costly process but offers the greatest peace of mind.

For guidance on complex situations, our Houston Probate Attorneys: What You Need to Know resource can help.

Frequently Asked Questions about Closing a Texas Estate

As you approach the final stages of your duties in Houston, Fort Worth, or Austin, questions are common. Here are concise answers to some of the most frequent inquiries about closing independent administration texas.

How long does an executor have to close an estate in Texas?

Texas law sets no strict deadline, but the complexity of estates in Houston, Fort Worth, and Austin—with diverse assets and potential creditor issues—means the process typically takes at least six to twelve months. If an independent administrator in Harris, Tarrant, or Travis County fails to make a final distribution within three years of their appointment, the court can remove them.

What happens if the executor does not close the estate?

If an estate is not formally closed, it remains open indefinitely on the records of the Harris, Tarrant, or Travis County court. The executor’s legal authority and potential liability continue, a significant risk when dealing with high-value assets common in the Houston, Fort Worth, and Austin markets. Beneficiaries can petition the local probate court to compel the executor to provide an accounting and formally close the administration.

Can I close an estate if there are still debts?

No. The probate courts in Houston, Fort Worth, and Austin require a fundamental affirmation under oath that “all known debts against the estate have been paid, or been paid to the extent permitted by the estate assets.” You must settle all valid creditor claims before you can file a Closing Report or Notice of Closing Estate under the Texas Estates Code.

Finalize Your Duties with Confidence

After months of diligent work, closing independent administration texas is the crucial final step that protects an executor in Houston, Fort Worth, or Austin and provides closure for everyone involved. Formally closing the estate limits your future liability, officially ends your authority, and gives beneficiaries clear title to their inheritance.

The process is designed to be straightforward. By filing either a detailed Closing Report or a simpler Notice of Closing Estate, you initiate a 30-day period that, if uncontested, results in the automatic termination of the administration.

We understand the probate process can be a burden, especially while grieving. Our attorneys are here to guide families in Houston, Fort Worth, and Austin through every step, from initial appointment to final closing. In the complex legal environments of Houston, Fort Worth, and Austin, too many estates are left in legal limbo, leaving executors vulnerable. Take the final step to close the estate correctly.

With over 40 years of combined experience in Texas probate courts, we ensure a clean, definitive finish to your administration. Let us help you cross the finish line with confidence, knowing you have fulfilled your duties completely.

For more information on the legal requirements, review the Independent Administration Texas Estates Code.