Texas Probate Freedom—Requesting Independent Administration

Streamlining Probate: Your Path to Independent Administration in Texas

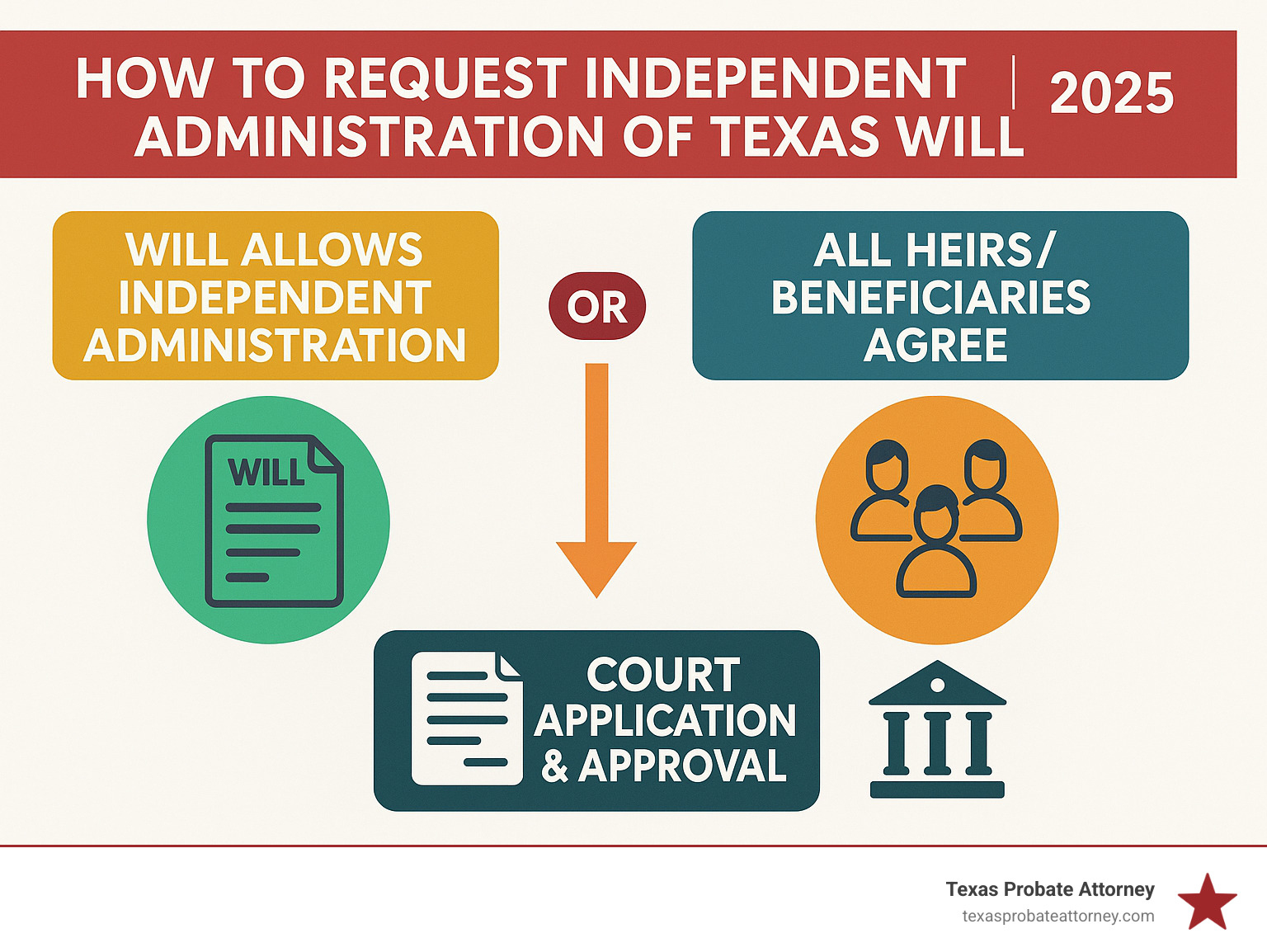

If you’re searching for how to request independent administration of a Texas will, here’s the quick answer:

- Check the Will: If the will names an “independent executor” or requests “independent administration,” the process is straightforward. The will is submitted to the probate court in Houston, Fort Worth, or Austin.

- Get Everyone’s Agreement: If the will is silent on the matter, or if there is no will, all adult heirs must agree to independent administration. This agreement is then presented to the probate court in Harris, Tarrant, or Travis County.

- File the Application: Your attorney files a formal application with the local probate court in Houston, Fort Worth, or Austin to request independent administration and appoint an administrator.

- Attend a Court Hearing: At a brief hearing in the relevant county court, a judge reviews the application and confirms that independent administration is appropriate.

- Obtain Letters: Once approved, the court clerk in Houston, Fort Worth, or Austin issues “Letters of Independent Administration,” which grant official authority to manage the estate.

Losing a loved one is difficult, and the legal process of settling an estate can feel overwhelming. Fortunately, Texas law offers a simplified path called independent administration. It is the preferred method for families in Houston, Fort Worth, and Austin because it is faster, more cost-effective, and involves less court oversight than traditional probate.

This guide will walk you through what independent administration means and how to request it for a Texas will in Houston, Fort Worth, or Austin, making a challenging time less burdensome.

Related content about how to request independent administration of texas will:

- duties of independent administrator texas

- independent administration texas estates code

- what is an independent administrator in texas

Understanding Independent Administration in Texas

When a person passes away, their estate must go through a legal process called probate to pay debts and distribute assets. In Texas, there are two main ways to handle this: independent administration and dependent administration.

Independent administration is the most common method in Houston, Fort Worth, and Austin. Once the court appoints an independent administrator, that person can manage most estate tasks—like gathering assets, paying debts, and distributing property—without needing the judge’s permission for every action. This freedom comes after an inventory of the estate is filed with the local court in Harris, Tarrant, or Travis County (or an affidavit is filed in its place).

In contrast, dependent administration involves constant court supervision. The administrator must get a judge’s approval for nearly every task, from selling a house to paying a bill. This oversight can make the process much slower and more expensive, making it less efficient for most estates in major metropolitan areas like Houston, Fort Worth, and Austin.

The Benefits of Choosing Independent Administration

Families in Houston, Fort Worth, and Austin prefer independent administration for several key reasons:

- Reduced Legal Fees: Less time in court means lower attorney fees, leaving more assets for beneficiaries.

- Faster Asset Distribution: Decisions are made promptly without waiting for court approval, so beneficiaries receive their inheritance sooner.

- Less Court Involvement: After the initial appointment and inventory filing, the process operates largely outside the court system.

- Greater Flexibility: The administrator can manage the estate efficiently without being slowed down by court petitions.

- A Simplified Process: Overall, it is a more streamlined and less complex way to settle an estate.

For more information, you can refer to Estate Administration in Texas (TexasLawHelp.org) and What is an Independent Administrator in Texas?.

Here’s a quick comparison:

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Oversight | Minimal, after initial appointment and inventory filing with the Harris, Tarrant, or Travis County court | Extensive; court approval needed for most actions |

| Cost | Generally lower due to fewer court filings and appearances | Higher due to continuous court involvement and legal fees |

| Time | Faster, as decisions are made without court delays | Slower, due to required court approvals for each step |

| Executor Freedom | High autonomy in decision-making and asset management | Limited; operates under strict court supervision |

| Privacy | More private, as fewer details are publicly filed | Less private, as more details are publicly filed |

For a broader understanding, explore Texas Probate Law.

When is Independent Administration Allowed?

Independent administration is not automatic. Texas law allows it in two primary scenarios:

- When the Will Authorizes It: The easiest path is when the will (a “testate estate”) explicitly states that the estate should be managed by an “independent executor,” often without requiring a bond. Most modern Texas wills drafted by attorneys in Houston, Fort Worth, and Austin include this language to simplify the process for loved ones.

- By Agreement of All Beneficiaries: If the will is silent or if there is no will (an “intestate estate”), independent administration can still be requested if every person who stands to inherit agrees. This unanimous consent is presented to the probate court in Houston, Fort Worth, or Austin for approval. In cases without a will, the court in Harris, Tarrant, or Travis County must first legally identify the heirs in a separate “heirship proceeding.”

The rules for this are outlined in the Texas Estates Code, such as Section 401.001, which covers when a will can create an independent administration.

How to Request Independent Administration of a Texas Will

Now that you understand the benefits, let’s cover how to request independent administration of a Texas will. The specific path depends on whether a will exists and what it says. The process is consistent across Texas, including in Houston, Fort Worth, and Austin.

Texas probate law provides two main routes to achieve independent administration.

When the Will Explicitly Authorizes It

This is the most direct path. If the deceased person (the “testator”) included specific language in their will, the process is greatly simplified. Most well-drafted Texas wills prepared in Houston, Fort Worth, or Austin contain an “Independent Executor” clause, which may state something like: “I appoint [Name] as independent executor of my estate to serve without bond…”

This clause signals the testator’s trust in the chosen executor to manage the estate without constant court supervision. When a will has this language, the named executor simply files it for probate in the appropriate county court (Harris, Tarrant, or Travis County). The court verifies the will’s validity, confirms the executor is qualified, and grants the independent administration.

This process is based on Texas Estates Code Sec. 401.001. Including this language in your own estate plan is a significant gift to your loved ones. For more guidance, see What Should I Include in My Will?.

How to Request Independent Administration of a Texas Will by Agreement

What if the will is silent about independent administration, or there is no will? Texas law still allows for it if all heirs or beneficiaries unanimously agree.

- When the will is silent: All beneficiaries (or “distributees”) can collectively petition the court in Houston, Fort Worth, or Austin to allow the named executor to serve independently.

- When there is no will (intestate): The court in Harris, Tarrant, or Travis County must first formally identify the legal heirs in an “heirship proceeding.” Once the heirs are determined, they can all agree to an independent administration and choose a qualified person to serve as the administrator.

The key is obtaining unanimous consent. Every person entitled to inherit must agree. This can be challenging for families scattered across different states, but it is achievable. Each distributee must sign consent forms, which streamlines the court process in Houston, Fort Worth, and Austin by eliminating the need for formal legal notices.

If minors or incapacitated adults are involved, their legal guardians must consent on their behalf. If even one person objects, independent administration by agreement is usually not possible, and the estate may have to proceed with a more restrictive dependent administration in the Harris, Tarrant, or Travis County court.

For more details, review Texas Estates Code Section 401.002. If you need help navigating these requirements, our article Do I Need a Probate Attorney in Texas? can help you decide.

The Step-by-Step Process to Become an Independent Administrator

Once you’ve determined independent administration is the right path, the next step is the formal court process. Navigating the local court systems in Harris, Tarrant, and Travis Counties is key.

This process takes you from filing your initial application to distributing assets.

Filing the Application and Attending the Hearing

The process begins when your attorney files an Application for Probate with the court in the county where the deceased lived (e.g., Harris County for Houston). This application specifically requests independent administration.

Next, you will attend a brief “prove-up” hearing. You will provide testimony to the judge to confirm key facts, such as the validity of the will (if one exists) and your qualification to serve as administrator. If all is in order, the judge will sign an order officially appointing you. Our firm has extensive experience guiding clients through this step in the probate courts of Houston, Fort Worth, and Austin. If you need assistance, a Probate Attorney Fort Worth can guide you.

Qualifying and Receiving Your “Letters”

After the judge signs the order, you must “qualify” for the role. This involves two steps:

- Sign an Oath of Office: You must file a sworn oath with the county clerk in Houston, Fort Worth, or Austin within 20 days, promising to faithfully perform your duties.

- Post a Bond (If Required): A bond is an insurance policy to protect the estate. In most independent administrations, a bond is waived. If the court in Houston, Fort Worth, or Austin requires one, it must also be filed within 20 days.

Once you have qualified, the County Clerk in Harris, Tarrant, or Travis County will issue “Letters of Independent Administration.” These official documents are your proof of authority to manage the estate’s assets with banks, title companies, and other institutions.

To learn more, see What Are Letters Testamentary and Letters of Administration? (Holman Law). You can also find information on requesting Letters from the Travis County Clerk.

Key Duties After Appointment

As an independent administrator, you have significant responsibilities. Though you operate without constant court supervision, you must fulfill several key duties:

- Notify Creditors: Publish a general notice to creditors in a newspaper of general circulation in the county where the decedent resided, such as the Houston Chronicle, the Fort Worth Star-Telegram, or the Austin American-Statesman, within one month. You must also send a notice by certified mail to any known secured creditors within two months.

- Notify Beneficiaries: Within 60 days of the will being probated, send a copy of the will and the court order from the Harris, Tarrant, or Travis County probate court to all beneficiaries by certified mail.

- File an Estate Inventory: Within 90 days of your appointment, file a sworn inventory with the appropriate court in Houston, Fort Worth, or Austin, listing all estate assets and their values. In some cases, a simpler “Affidavit in Lieu of Inventory” may be filed.

- Pay Valid Debts: Review creditor claims, pay all valid debts, and reject invalid ones using estate funds.

- Manage and Collect Assets: Gather all estate property, including bank accounts, real estate in Houston, Fort Worth, or Austin, and personal belongings. Keep estate funds separate from your own.

- Distribute Remaining Assets: After all debts and expenses are paid, distribute the remaining property to the beneficiaries or heirs as directed by the will or Texas law.

Working with an attorney is highly recommended to ensure you meet all legal obligations. Learn more about these responsibilities in our guide to the Duties of Independent Administrator Texas.

When Independent Administration Might Not Be the Best Choice

While independent administration is usually preferred for estates in Houston, Fort Worth, and Austin, it’s not always the right choice. The court oversight of a dependent administration may be better in certain situations.

- Beneficiary Disputes: If beneficiaries are likely to disagree over the will or the administrator’s actions, the court’s involvement in a dependent administration in a Harris, Tarrant, or Travis County court can help prevent future lawsuits.

- Insolvent Estates: When an estate’s debts exceed its assets, dependent administration, overseen by a Houston, Fort Worth, or Austin judge, ensures creditors are paid according to legal priorities, protecting the administrator from liability.

- Untrustworthy Executor: If there are concerns about the named executor’s integrity or ability to manage the estate, dependent administration provides necessary supervision from the probate courts in Houston, Fort Worth, and Austin.

- High Risk of Litigation: For complex estates with a history of family conflict, the court-approved steps of dependent administration create a stronger defense against potential lawsuits filed in Harris, Tarrant, or Travis County.

- Administrator Liability Concerns: If you are uncomfortable with the personal liability that comes with the autonomy of an independent administrator, dependent administration, with its required court approvals in Houston, Fort Worth, or Austin, may offer more peace of mind.

Our firm specializes in navigating complex probate situations and Texas Probate Litigation. If you anticipate a Contesting a Will in Texas, we can help determine which administration type offers the most protection and stability for the estate and its fiduciaries in Houston, Fort Worth, or Austin.

Frequently Asked Questions about Requesting Independent Administration

When considering how to request independent administration of a Texas will, many families in Houston, Fort Worth, and Austin have similar questions. Here are answers to some of the most common ones.

How much does independent administration cost in Texas?

Independent administration is generally more affordable than dependent administration because it requires fewer court filings and appearances in Harris, Tarrant, and Travis County courts. However, you should still budget for certain costs:

- Court Filing Fees: A few hundred dollars to file the initial application with the county clerk in Houston, Fort Worth, or Austin.

- Attorney Fees: The largest expense, though our firm’s focus on quick resolutions helps manage this cost.

- Publication Costs: A small fee (typically under $100) to publish a notice to creditors in a local newspaper in Harris, Tarrant, or Travis County.

- Bond Premiums: An annual fee for an administrator’s bond, but this is often waived in independent administrations.

- Other Costs: Minor fees for official copies of documents or property appraisals.

Overall, independent administration is the more cost-effective option. For a detailed breakdown, see our information on Probate Attorney Cost.

Do all beneficiaries have to agree to independent administration?

Yes, if the will does not authorize it. If the will is silent on the matter or if there is no will, every single adult beneficiary or heir (a “distributee”) must agree to independent administration. It must be a unanimous decision.

If even one distributee objects, the court in Houston, Fort Worth, or Austin will generally not grant independent administration by agreement. The estate would then likely proceed as a dependent administration, with full supervision from the local court. This is why obtaining formal consent from everyone is a critical early step. If a beneficiary is a minor or incapacitated, their legal guardian must consent on their behalf.

If you anticipate disagreements, it is wise to speak with an attorney. We can help you understand the Grounds for Challenging a Will.

How long does it take to get Letters of Independent Administration?

The timeline varies depending on the estate’s complexity and the court’s schedule. For a straightforward case where the will authorizes independent administration and there are no disputes, you could receive your Letters within 2 to 6 weeks of filing the application.

Courts in busy areas like Houston (Harris County), Fort Worth (Tarrant County), and Austin (Travis County) can have full dockets, which may affect scheduling, but our firm is experienced in navigating these systems efficiently.

Delays can be caused by:

- No Will: An heirship proceeding in a Houston, Fort Worth, or Austin court to identify legal heirs can add months.

- Locating Heirs: Difficulty finding all beneficiaries to obtain consent will slow the process of getting court approval in Houston, Fort Worth, or Austin.

- Disputes: Any will contest or family disagreement can bring the process in the Harris, Tarrant, or Travis County court to a halt.

- Paperwork Errors: Incomplete or incorrect applications filed with the county clerk must be corrected.

Once the judge signs the order, the physical “Letters” are typically issued by the County Clerk in Houston, Fort Worth, or Austin within a few business days. For more on timelines, see How Long Do You Have to Contest a Will?.

Navigating Your Texas Probate Journey

The probate process does not have to be a complicated ordeal. Independent administration is Texas law’s practical, family-friendly solution for families in Houston, Fort Worth, and Austin to settle an estate with probate efficiency and legal compliance.

By understanding how to request independent administration of a Texas will, you are choosing a path that saves time and money for estates probated in Houston, Fort Worth, or Austin. While the administrator responsibilities are significant, you gain the freedom to manage them without constant court intervention.

Our team at Texas Probate Attorney has over 40 years of combined experience helping families with Houston probate, Fort Worth probate, and Austin probate cases. We have seen how independent administration transforms a potentially lengthy process into a manageable one, allowing families to focus on honoring their loved one’s memory.

Independent administration puts decision-making power where it belongs: with the family. Every situation is unique, and we approach each case with personalized attention to understand your family’s needs and goals within the Houston, Fort Worth, and Austin communities.

For guidance on the Independent Administration Texas Estates Code, contact our office for a consultation. We’re here to help you every step of the way, from the initial filing in the Harris, Tarrant, or Travis County court to the final distribution of assets and the closing of the estate.