Affordable Probate Attorneys: Don’t Break the Bank on Legal Fees

Understanding Probate and Its Costs in Texas

Finding a low cost probate attorney doesn’t mean sacrificing quality legal help when settling an estate in Houston, Fort Worth, or Austin.

Quick Answer for Low Cost Probate Attorney Options:

- Flat-fee attorneys: $3,000-$4,500 for uncontested probate with a Will in Texas

- Legal aid programs: Free services for families earning 125% of federal poverty level

- Pro bono services: Available through local bar associations in Harris, Tarrant, and Travis counties

- Limited-scope representation: Reduces costs by 30-50% by handling only specific tasks

- Law school clinics: Supervised student attorneys at reduced or no cost

When someone dies in Houston, Fort Worth, or Austin, their estate often goes through probate, a court-supervised process to validate the Will, pay debts, and distribute assets. This can feel overwhelming while grieving.

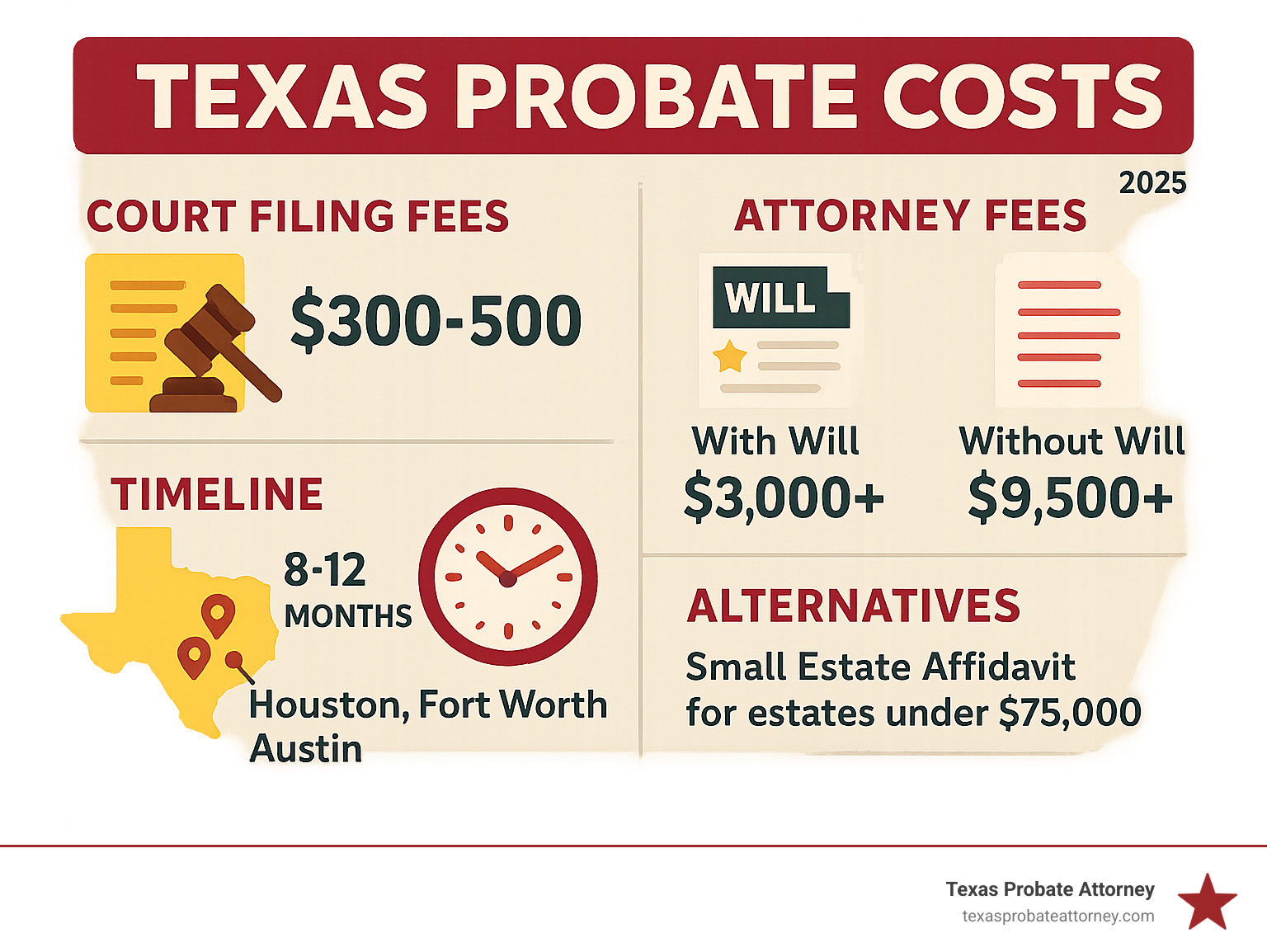

Probate costs in Texas typically range from $3,000 to $9,500, depending on if there’s a Will. In Houston’s Harris County, Fort Worth’s Tarrant County, and Austin’s Travis County, court filing fees alone are $300-$500.

However, for estates in Houston, Fort Worth, and Austin, you have options beyond expensive hourly attorneys. Texas law, as applied in Harris, Tarrant, and Travis County courts, offers cost-effective approaches like flat-fee arrangements and streamlined procedures to reduce legal expenses.

The key is matching your situation’s probate type with the right legal help in Houston, Fort Worth, or Austin. Some estates in these areas qualify for streamlined, less expensive processes like Muniment of Title or Small Estate Affidavits.

Decoding Attorney Fees: Flat, Hourly, and Percentage Models

Understanding how lawyers in Houston, Fort Worth, or Austin charge for services can save you thousands. Key factors affecting cost include estate complexity, family disputes, and an attorney’s familiarity with local courts in Harris, Tarrant, or Travis counties, which can prevent costly errors.

| Fee Structure | Pros | Cons | Best For |

|---|---|---|---|

| Hourly | Flexible for unpredictable cases; you only pay for time actually spent | Costs can spiral quickly; requires upfront retainer; surprise bills common | Complex estates with potential disputes in Houston, Fort Worth, or Austin |

| Flat Fee | Know your total cost upfront; perfect for budgeting; no surprise bills | May not cover highly complex issues; need clear service agreement | Straightforward probate cases with cooperative families – ideal for those seeking a low cost probate attorney |

| Percentage | Simple calculation for large estates | Based on gross value, not equity; can be disproportionately expensive | Mainly used for executor fees in Texas (typically 2-4% of estate value) |

Understanding Different Fee Structures

With hourly billing, attorneys in Houston, Fort Worth, and Austin typically charge $300-$600 per hour, often in six-minute increments. A retainer, or upfront payment, is usually required. While flexible for complex cases, this model can be stressful as the final bill is unpredictable.

Flat fees provide a fixed price, typically $3,000 to $4,500 for uncontested probate in Houston, Fort Worth, and Austin. This predictability is ideal when an estate has a valid Will and cooperative family members. A flat-fee arrangement usually covers essential services like preparing and filing court documents, attending hearings, and providing guidance.

Percentage fees are less common for attorneys in Houston, Fort Worth, and Austin but are sometimes used for executor compensation. The fee is based on the estate’s gross value, not its net value after debts. For example, a fee on a $400,000 house with a $300,000 mortgage is calculated on the full $400,000.

No matter the fee structure, when hiring an attorney in Houston, Fort Worth, or Austin, always insist on a written fee agreement. This document should detail what you’re paying for, what’s included, and what might cost extra to prevent misunderstandings.

The Benefits of a Flat-Fee Low Cost Probate Attorney

For most families in Houston, Fort Worth, and Austin, a flat-fee low cost probate attorney offers professional help with financial peace of mind. The primary benefit is cost certainty, which allows for better budgeting and avoids the surprise bills common with hourly billing.

Uncontested cases with a clear Will and agreeable family members are ideal for flat-fee arrangements in Houston, Fort Worth, and Austin. The attorney can focus on moving the case efficiently through the Harris, Tarrant, or Travis County court system. A typical flat-fee service includes preparing and filing all court documents, representing the estate at hearings, and guiding you through the process.

Be aware that flat fees work best for straightforward situations. If disputes arise or complex issues are found, you may need services outside the original agreement. Discuss what’s included upfront with your Houston, Fort Worth, or Austin attorney.

Your Guide to Finding a Low Cost Probate Attorney in Houston, Fort Worth, and Austin

Finding an affordable probate attorney in Houston, Fort Worth, or Austin while grieving can be stressful, but you have more options than you might realize.

Start your search with bar association referral services in Houston, Fort Worth, and Austin. They connect you with attorneys, many offering reduced-rate consultations. Also, check online directories like LawHelp.org and the Legal Services Corporation (LSC) website, which are curated resources for finding affordable legal aid in your area. A local search for terms like “community legal aid Houston” or “pro bono attorneys Austin” can also reveal non-profit organizations and clinics.

Free and Low-Cost Legal Aid Options in Houston, Fort Worth, and Austin

If finances are tight, your family in Houston, Fort Worth, or Austin may qualify for free legal help.

- Legal aid societies, funded by the LSC, offer free services to families earning up to 125% of the federal poverty level (about $31,200 for a family of four in 2024).

- Law school clinics in Houston (University of Houston, Texas Southern University), Fort Worth (Texas A&M), and Austin (University of Texas) offer another great option. Supervised students provide quality legal help at a reduced cost or for free.

- Pro bono services through local bar associations in Harris, Tarrant, and Travis counties connect you with volunteer attorneys.

Eligibility for these Houston, Fort Worth, and Austin programs is typically income-based, but flexible guidelines may exist for seniors, veterans, or families in emergencies. It’s always worth applying to these local services.

Exploring Alternative Fee Arrangements

Alternative fee arrangements can make legal help more accessible for families in Houston, Fort Worth, and Austin.

- Sliding-scale fees adjust based on your income. Some non-profits and individual attorneys in Houston, Fort Worth, and Austin offer this for families who don’t qualify for free aid but find standard rates too high.

- Limited-scope representation, or “unbundling,” is a smart money-saving strategy. You hire a low cost probate attorney for specific tasks, like court filings and legal strategy, while you handle routine paperwork. This can cut legal costs by 30-50% and works well with free guidance from court self-help centers in Houston, Fort Worth, and Austin.

Smart Strategies to Minimize Overall Probate Expenses

Even with a low cost probate attorney in Houston, Fort Worth, or Austin, you can actively reduce expenses. It’s a team effort: your attorney handles legal complexities while you manage tasks that would otherwise be billable hours. The executor’s role is crucial for controlling costs in a Harris, Tarrant, or Travis County probate case. As the court-appointed manager, your actions directly influence the process’s efficiency.

Key strategies include:

- Clear Communication: Keep beneficiaries informed to prevent disputes. Family conflicts are a primary driver of high legal costs in Houston, Fort Worth, and Austin probate cases.

- Organization: Before meeting your Houston, Fort Worth, or Austin attorney, gather and organize all financial records, policies, and deeds. Being prepared saves your attorney time and saves you money.

- Meeting Deadlines: Missing court dates or filing deadlines in the probate courts of Harris, Tarrant, and Travis counties creates costly complications and requires more attorney time.

Probate Shortcuts and Alternatives in Texas

Texas law, as applied in Houston, Fort Worth, and Austin, offers streamlined procedures that reduce time and costs, making it easier to find a low cost probate attorney solution for straightforward estates.

- Small Estate Affidavit: For estates worth $75,000 or less (excluding homestead and exempt property) with no Will, this process can bypass full probate. It involves filing an affidavit with the court in Harris, Tarrant, or Travis County.

- Muniment of Title: With a valid Will and no unpaid debts (besides a mortgage), this process confirms the Will and transfers property without ongoing court supervision, saving significant costs.

- Independent Administration: If the Will allows or all beneficiaries agree, the executor can manage the estate with minimal court oversight after initial approval. This is widely used in Houston, Fort Worth, and Austin to reduce court appearances and attorney fees.

How to Reduce Costs When You Hire an Attorney

Your approach to working with your Houston, Fort Worth, or Austin attorney impacts the final bill. Communicate efficiently by batching questions for one call or email. Handle administrative tasks like gathering mail and organizing documents yourself. Come prepared to every meeting with questions and documents ready. As an executor in a Texas probate case, you can also consider waiving your fee (typically 2-4% of the estate’s value) if you are also a beneficiary, as this fee is taxable income.

Preparing for Your First Meeting with a Probate Attorney

Your first meeting with a potential low cost probate attorney in Houston, Fort Worth, or Austin is your chance to interview them. Being prepared saves time and money and helps you find the right fit for your family’s needs in the local court system. An organized approach allows a Houston, Fort Worth, or Austin attorney to assess your situation efficiently and provide accurate cost estimates.

Documents to Gather Before Your Consultation

Before your meeting in Harris, Tarrant, or Travis County, gather these essential documents:

- Original Will (if one exists) and a certified copy of the death certificate.

- A comprehensive list of assets (bank accounts, real estate, etc.), noting how each was titled.

- A list of all outstanding debts (mortgages, credit cards, medical bills).

- Contact information for all heirs and beneficiaries.

- Life insurance policies, real estate deeds, and other relevant legal documents like trusts or prenuptial agreements.

Questions to Ask a Potential Low Cost Probate Attorney

When interviewing attorneys in Houston, Fort Worth, or Austin, treat it as your interview and ask direct questions to make an informed decision.

- Fee Structure: “Do you offer flat fees for uncontested probate, and what’s included?” If hourly, ask about rates and billing increments.

- Local Court Experience: How familiar are they with probate courts in Harris, Tarrant, or Travis County? Local knowledge can make the process more efficient.

- Communication Style: How often will you receive updates, and what is their preferred method (phone, email)?

- Timeline: Ask for a realistic timeline estimate for your specific case.

- Case Handler: Who will be your primary contact—the attorney you’re meeting or a junior associate or paralegal?

A good low cost probate attorney in Houston, Fort Worth, or Austin will provide clear, honest answers. If they seem evasive, they may not be the right fit.

Frequently Asked Questions about Affordable Probate in Houston, Fort Worth, and Austin

How much does a simple, uncontested probate cost in Texas?

For a simple, uncontested probate in Houston, Fort Worth, or Austin with a valid Will and cooperative family, attorney fees typically range from $3,000 to $4,500. This is the “best case scenario” with straightforward assets and no major debts.

If there’s no Will (intestate administration), the process is more complex and costly, often running closer to $9,500. The court must identify legal heirs, requiring more attorney work.

Remember to budget for other costs like court filing fees ($300-$500 in Harris, Tarrant, and Travis counties) and potential appraisal fees ($300-$600 per property). Many low cost probate attorneys offer flat fees for uncontested cases, providing cost certainty.

Can I handle probate myself in Texas to save money?

While Texas law allows you to represent yourself (pro se), it’s risky. Probate has strict deadlines and complex rules. Errors can lead to delays, extra costs, and personal liability for the executor. Judges in Houston, Fort Worth, and Austin probate courts strongly encourage legal representation, especially for cases with any complexity.

A smart middle ground is limited-scope representation. You hire a low cost probate attorney for crucial legal tasks (like court filings) while handling administrative duties yourself. This can cut costs by 30-50% while ensuring professional oversight.

How long does probate take in Houston, Fort Worth, or Austin?

A straightforward, uncontested probate in Texas typically takes 8-12 months. This timeline includes mandatory waiting periods, like the four-month creditor claim period, that cannot be expedited.

Local court dockets in Harris, Tarrant, and Travis counties also affect timing. An attorney can’t control the court’s calendar but ensures your case proceeds efficiently when scheduled. Estate complexity is the biggest factor; simple estates with cooperative families move fastest. An experienced attorney helps avoid delays by filing everything correctly the first time.

Secure Your Family’s Inheritance Without Overspending

Settling a loved one’s estate in Houston, Fort Worth, or Austin doesn’t have to be financially or emotionally draining. You now understand your options and what questions to ask a potential attorney in Houston, Fort Worth, or Austin.

This guide has shown that affordable probate help is available in Houston, Fort Worth, and Austin, from a low cost probate attorney offering flat-fee services for $3,000-$4,500 to streamlined procedures like Muniment of Title. You have real choices for handling probate in these areas.

The most important step is to get organized, understand your situation’s needs, and reach out for help. Clear communication and preparation can save significant legal fees and simplify the process in Harris, Tarrant, or Travis County, especially if you qualify for a Texas probate shortcut applicable in these jurisdictions.

At Texas Probate Attorney, Keith Morris and Stacy Kelly bring over 40 years of combined experience to families in Houston, Fort Worth, and Austin. We offer personalized legal representation that fits your needs and budget. While we are prepared for aggressive litigation to protect your interests, we also know many cases can be resolved quickly and affordably with a deep understanding of Texas probate law and local court procedures.

Your loved one’s legacy deserves professional attention without sacrificing your financial peace of mind.