Estate Planning Without the Headache – Set Up Your Will and Trust Online

Related Posts

Why Setting Up a Will and Trust Is Easier Than Ever

Setting up a will and trust no longer requires multiple office visits or mountains of paperwork. Today, you can create legally binding estate planning documents from your home computer in about 20 minutes.

“It takes most people about 20 minutes to complete their Trust-based Estate Plan and 15 minutes to complete their Will-based Estate Plan online.”

Quick Answer: How to Set Up a Will and Trust Online

- Gather information about your assets, beneficiaries, and final wishes

- Choose an online platform (costs range from free to $600 for DIY options)

- Complete the guided questionnaire (typically 15-20 minutes)

- Print documents and follow your state’s signing requirements

- Store securely and inform key people about their location

Did you know that more than 60% of Americans don’t have a will or estate plan? This leaves their families vulnerable to lengthy court processes, potential family disputes, and unnecessary expenses.

The good news is that creating these essential documents has become remarkably simple with online tools. Whether you need basic protection for a modest estate or comprehensive planning for complex assets, digital solutions now make it possible to secure your legacy without the traditional headaches.

Online wills and trusts are legally valid in all 50 states when properly signed and witnessed according to state law. For Texas residents, this typically means having two witnesses sign your will and, in some cases, getting documents notarized.

Why Online Estate Planning Is Booming

The digital revolution has transformed estate planning in remarkable ways. With over 60% of Americans lacking any form of estate plan, online platforms are filling a critical gap by making these essential legal documents more accessible than ever.

The appeal is clear: most people can complete a trust-based estate plan in about 20 minutes or a will-based plan in just 15 minutes. This efficiency, combined with significant cost savings compared to traditional attorney fees, has fueled the growth of digital estate planning.

Privacy concerns are another driving factor. While wills become public record through probate, trusts maintain privacy. Online platforms allow you to create either document type with equal ease, helping you choose the right option for your privacy needs.

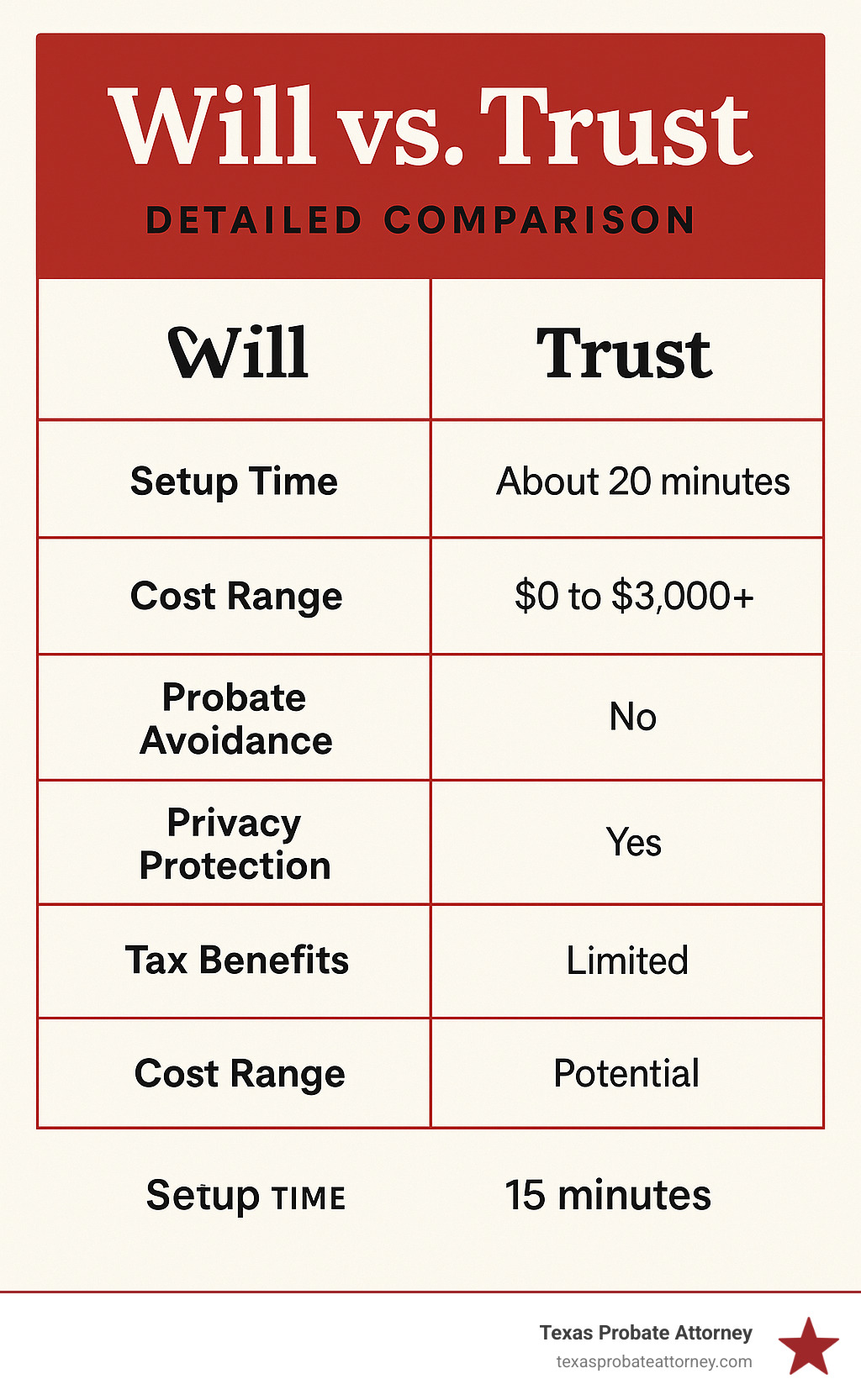

Quick-Glance Comparison: Wills vs. Trusts Online

When you’re thinking about setting up a will and trust, it helps to understand what makes these two estate planning tools different from each other. Think of it as choosing between two paths that lead to the same destination – protecting your loved ones – but with different scenery along the way.

A will is essentially your written instructions for what happens to your stuff after you’re gone. It’s where you can name guardians for your children (something parents find incredibly reassuring) and appoint someone you trust to make sure your wishes are carried out. The catch? Your will must go through probate – that court process that can sometimes feel like it moves at the speed of molasses.

A trust, meanwhile, works more like a container that holds your assets with specific instructions attached. The beauty of a trust is that it starts working the moment you create and fund it – not just after you’re gone. It can help manage things if you become incapacitated and typically sails right past the probate process altogether.

Here’s how they stack up against each other:

| Feature | Will | Trust |

|---|---|---|

| Takes effect | After death | During life and after death |

| Probate required | Yes | No (if properly funded) |

| Privacy | Becomes public record | Remains private |

| Incapacity planning | No | Yes |

| Cost to create online | $0-300 | $300-600 |

| Time to complete online | ~15 minutes | ~20 minutes |

| Guardian designation | Yes | No (use will for this) |

| Tax benefits | Limited | Potentially significant |

Key Advantages at a Glance

Wills shine in their simplicity – they’re the “estate planning 101” that everyone should have at minimum. If you’re a parent, the ability to name guardians for your children is priceless peace of mind that only a will can provide. Creating one online typically takes just 15 minutes, making it a perfect Sunday afternoon project.

Trusts really earn their keep when it comes to avoiding probate. When you place assets in a trust, they can pass directly to your loved ones without getting tangled in court proceedings. For Texans who own property in multiple states, this is particularly valuable – you’ll dodge the hassle of separate probate proceedings in each state where you own property.

Some trusts also offer a shield against creditors. If you set up an irrevocable trust, those assets aren’t legally yours anymore, which can protect them from being claimed by creditors. This can be a lifesaver for folks in professions with high lawsuit risk or those concerned about debt issues.

Common Drawbacks to Note

While wills are wonderfully straightforward, they do become public record during probate. This means your family’s financial details might become available for curious neighbors to find. The probate process itself can sometimes stretch from months into years for complicated estates.

Trusts require a bit more homework upfront, especially the crucial step of “funding” your trust (transferring assets into it). It’s like buying a fancy safe but forgetting to put your valuables inside – many people create trusts but skip this vital step, leaving their trust essentially empty.

There’s also a noticeable price difference. Online wills typically cost between $100-300, while online trusts usually run $300-600. If you were to have an attorney draft these documents traditionally, a trust might cost anywhere from $3,000-10,000 depending on how complex your situation is.

For irrevocable trusts, the main drawback is right in the name – once established, they generally can’t be changed. This permanence has tax advantages but reduces your ability to adapt as life changes.

For the latest research comparing living trusts and wills, you might find this CNBC article on living trust vs will helpful in making your decision.

Step-by-Step Guide to Setting Up a Will and Trust

Setting up a will and trust online follows a structured process that, while straightforward, requires attention to detail. Here’s how to steer each stage effectively:

1. Preparing Before “Setting Up a Will and Trust”

Before you begin the online process, gather all necessary information and documents:

Asset Inventory

* Real estate deeds and property information

* Bank and investment account statements

* Life insurance policies and retirement accounts

* Vehicle titles

* Business ownership documents

* Valuable personal property (jewelry, art, collections)

* Digital assets (online accounts, cryptocurrency, digital media)

Important Personal Information

* Full legal names of all beneficiaries

* Contact information for your executor/trustee choices

* Guardian information if you have minor children

* Details about any specific bequests or distributions

Supporting Documents to Have Ready

* Previous wills or trusts (if updating)

* Marriage certificates or divorce decrees

* Birth certificates for minor children

* Property appraisals for valuable items

* Business valuation documents

* Tax returns (helpful for comprehensive planning)

This preparation phase is crucial—the more organized your information, the smoother the online process will be. We recommend creating a digital folder to store this information securely.

2. Drafting & “Setting Up a Will and Trust” Online

With your information gathered, you’re ready to begin the online drafting process:

- Choose the right platform based on your needs and budget

- Create an account and secure it with a strong password

- Complete the questionnaire, which typically covers:

- Personal information

- Family structure

- Asset details

- Beneficiary designations

- Executor/trustee selections

- Guardian nominations

- Specific bequests

- Distribution instructions

As Texas attorneys with over 40 years of combined experience, we’ve seen that online platforms vary in quality. Look for those that provide state-specific forms and clear guidance on Texas requirements.

For Texas residents, your will must be:

* Signed by you

* Witnessed by two people who aren’t beneficiaries

* Preferably include a self-proving affidavit (which requires notarization)

While online platforms can generate these documents, understanding Texas-specific requirements ensures your documents will stand up in court if challenged.

3. Funding and Finalizing Your Trust

Creating a trust document is only the first step—funding it is equally important:

- Retitle real property by recording new deeds showing the trust as owner

- Transfer financial accounts by submitting trust documentation to your banks and brokerages

- Update beneficiary designations on life insurance and retirement accounts

- Create a pour-over will as a safety net for any assets not transferred to the trust

- Designate a successor trustee who will manage the trust if you become incapacitated or die

Funding is where many DIY trust creators stumble. In our litigation practice, we frequently see cases where trusts failed to work as intended because they weren’t properly funded. Each asset type requires specific steps for transfer, and missing these details can undermine your entire plan.

A pour-over will is essential as it catches any assets not already in your trust and “pours” them into the trust upon your death. However, these assets will still go through probate, so it’s best to fund your trust completely during your lifetime.

Choosing the Right Digital Estate-Planning Tool

The world of online estate planning has blossomed in recent years, giving you more options than ever for setting up a will and trust from the comfort of your home. Let’s walk through your choices together, so you can find the perfect fit for your needs.

DIY Software and Websites offer the most budget-friendly approach, typically costing between free and $300 for basic wills, or $300-600 for trusts. These work wonderfully if your situation is straightforward—perhaps you have a small family, clear wishes about who gets what, and not too many complex assets. The trade-off? Limited customization and varying security standards. If you go this route, look for platforms that promise bank-level encryption to keep your sensitive information safe.

Attorney-Guided Online Platforms strike a nice middle ground, usually ranging from $300-1,000. I often recommend these to folks with moderately complex situations—maybe you own a home, have a few investments, or want specific instructions for certain beneficiaries. The beauty here is that you get state-specific guidance (crucial for us Texans!) and often an attorney review option without the full cost of traditional legal services. These platforms typically invest more in data security, giving you greater peace of mind.

Hybrid Services blend the convenience of online tools with personalized attorney guidance, typically costing between $800-2,500. In our years of helping families across Houston, Fort Worth, and Austin, we’ve found these particularly valuable for more complex situations. You’ll get virtual consultations with an attorney who can address your specific concerns and fully customize your documents. For many Texans, this personalized touch makes all the difference, especially when navigating our state’s particular rules about trust formation.

Decision Factors

When you’re ready to start setting up a will and trust, consider these key factors to guide your choice:

Your estate size and complexity matters tremendously. If your estate is under $100,000 with straightforward distribution plans, a basic online will might be all you need. For estates over $100,000 or with more complex family structures, consider an online trust with some attorney review. And if you’re looking at over $1 million or own a business, I’d strongly suggest a hybrid service where you get direct attorney input custom to your situation.

Your family situation should influence your choice too. If you have minor children, you absolutely must include guardianship provisions in a will. Blended families often benefit from specialized trust provisions to ensure everyone is treated fairly. If you have loved ones with special needs, you’ll need specialized trust planning to protect their benefits. And international beneficiaries? That’s definitely a situation where attorney guidance helps steer the tax implications.

Don’t forget about your property considerations. If you own property in multiple states (as many Texans do), a trust is highly recommended to avoid separate probate proceedings in each state—something we see cause headaches for families all too often. Business interests require specialized provisions, and digital assets—from cryptocurrency to social media accounts—need specific planning language that not all online tools offer.

Your potential tax exposure matters too. While the federal estate tax exemption sits at $13.61 million for 2024, some states have much lower thresholds. The ability of online tools to address tax planning effectively varies widely, so consider this carefully if your estate approaches these limits.

According to scientific research on digital signatures, properly executed online documents are legally valid, but the execution requirements vary by state. This is why choosing a platform that understands Texas-specific requirements is so important when setting up a will and trust.

In our practice, we’ve found that most Texans benefit from at least some professional guidance, particularly for trust creation. Texas has specific rules that many one-size-fits-all platforms might miss, potentially creating problems down the road for your loved ones.

Updating, Storing & Integrating Digital Assets

Once you’ve finished setting up a will and trust, your journey isn’t quite complete. Think of your estate plan as a living document that grows and changes with your life—much like tending a garden rather than building a statue.

Secure Storage Options

Your carefully crafted documents deserve proper safekeeping. For physical storage, a fireproof home safe offers convenient access while providing protection from disasters. Just remember to share access instructions with your executor or trustee—documents nobody can find aren’t much help to your loved ones.

Bank safety deposit boxes might seem like the perfect solution, but proceed with caution. These boxes are often sealed upon death, potentially creating complications when your documents are needed most. If you’re working with our team through hybrid services, storing originals at our office is another secure option many clients appreciate.

The digital world offers equally important storage solutions. Cloud-based document vaults with bank-level encryption keep your information both secure and accessible. Many of our Texas clients maintain password-protected digital copies as backups, while others use the secure storage features offered by their estate planning platforms.

For Texas residents specifically, we recommend a three-pronged approach to storage:

First, keep your original signed and witnessed documents in a secure physical location. Texas courts strongly prefer original wills during probate, though copies can sometimes be accepted in special circumstances.

Second, maintain digital scans of all signed documents for backup purposes. These can be invaluable if originals are damaged or misplaced.

Third, create an asset inventory with account numbers and access information, stored digitally with strong encryption. This practical step saves your loved ones countless hours of detective work during an already difficult time.

Keeping Everything Current

Your estate plan isn’t meant to be a “set it and forget it” arrangement. Life changes, laws evolve, and your documents should keep pace. We generally recommend reviewing your will and trust every 3-5 years as a good practice, even when nothing significant seems to have changed.

Major life events should trigger immediate reviews. Marriage or divorce, the birth or adoption of children, the death of a beneficiary or fiduciary, or a significant change in assets all warrant a fresh look at your documents. Similarly, moving to another state or tax law changes might necessitate updates to keep your plan working as intended.

Digital assets present unique challenges in modern estate planning. Consider appointing a specific digital executor in your will—someone tech-savvy who understands your online presence. Create a digital asset inventory separate from your will (for privacy reasons) and consider using a password manager with legacy access features that allow designated individuals to access your accounts when needed.

In our decades of Texas probate experience, we’ve witnessed growing complications with digital assets. From cryptocurrency to social media accounts, these intangible possessions require specific language and planning. While many online platforms now include digital asset provisions, their effectiveness varies considerably based on how recently they’ve been updated to reflect changing laws.

For more information about keeping beneficiary designations aligned with your estate plan, check out our article on Common Misconceptions About Beneficiary-Designated Accounts.

Frequently Asked Questions about Online Wills and Trusts

Do I really need an attorney if I use an online platform?

It depends on your unique situation. For straightforward estates with simple distribution plans, online platforms can create perfectly valid legal documents without an attorney looking over your shoulder.

That said, life isn’t always simple, is it? In our years helping Texas families, we’ve seen certain situations where professional guidance makes all the difference:

- You have a blended family with children from previous marriages

- You own a business or have complex assets

- You have a loved one with special needs

- Your estate might face estate taxes

- You have international assets or beneficiaries

- You want complex distribution arrangements

Many of our clients take a middle-ground approach – they start with online documents and then have us review them. This “best of both worlds” strategy balances cost savings with legal peace of mind. It’s like having a safety net under your DIY tightrope walk.

How do beneficiary designations interact with my new documents?

Here’s something many online platforms don’t explain clearly enough: beneficiary designations are powerful. They actually override what your will or trust says.

Picture this scenario: Your will states everything goes to your children, but your IRA still names your ex-spouse as beneficiary. Guess who gets the IRA? Your ex-spouse – regardless of what your carefully crafted will declares.

To avoid this common pitfall when setting up a will and trust, we suggest:

Create a master list of all accounts with beneficiary designations (retirement accounts, life insurance, etc.). Then update these designations to align with your overall plan. For trust-based plans, consider whether certain accounts should name the trust as beneficiary. And make reviewing these designations part of your annual financial check-up – circumstances change, and your plan should too.

What happens if I die before funding my trust?

This is where a pour-over will becomes your backup plan. If you create a beautiful trust but don’t transfer all assets into it before you pass away, your pour-over will directs any remaining assets into the trust – but they’ll still have to go through probate first.

And that’s the catch – those assets will still experience the probate process, which defeats one of the main advantages of having a trust in the first place. It’s like buying an umbrella but leaving it in the car during a rainstorm.

While Texas has a relatively streamlined probate process compared to some states (we’re looking at you, California), it still involves court appearances, potential delays, and public records. Proper trust funding helps your loved ones avoid these hassles entirely.

The good news? With proper guidance, funding your trust isn’t as complicated as it might seem. We’ve helped countless Texas families through this process, ensuring their carefully crafted plans work exactly as intended when they’re needed most.

Conclusion & Your Next Step Toward Peace of Mind

The digital revolution has truly transformed how we approach estate planning. Setting up a will and trust online has brought peace of mind within reach for everyone, not just those with substantial wealth or legal connections. The days of multiple attorney visits and overwhelming paperwork stacks are behind us.

Taking this step isn’t just about planning for the inevitable—it’s about giving yourself and your loved ones the gift of clarity and protection. When properly executed according to Texas law, online wills and trusts stand on solid legal ground, providing the same protections as their traditionally drafted counterparts.

Your ideal approach depends largely on your unique situation. For straightforward estates with clear distribution plans, a DIY approach might serve you perfectly. For more complex situations—blended families, business interests, or special needs planning—a hybrid approach with some professional guidance could be your best path forward.

Trusts only work when properly funded. We’ve seen too many families find too late that their loved one created a beautiful trust document but never transferred assets into it. Taking the time to complete this critical step makes all the difference between a plan that works and one that falls short.

Life changes, and your estate plan should too. Marriage, divorce, new children, property purchases, or significant changes in wealth all signal it’s time to review your documents. Even without major life events, we recommend reviewing your plan every 3-5 years to ensure it still reflects your wishes.

As Texas probate attorneys serving Houston, Fort Worth, and Austin, we’ve witnessed how thoughtful estate planning prevents unnecessary conflict and preserves family harmony during difficult times. While online tools have made the process more accessible, there’s immense value in personalized guidance when your situation calls for it.

Stacy Kelly and Stacy L. Kelly, J.D., Partner, bring over 40 years of combined experience to the table, offering the personalized attention Texans need when protecting what matters most. We pride ourselves on providing clear guidance without unnecessary legal jargon, helping you steer these important decisions with confidence.

Ready to secure your legacy and provide true peace of mind for yourself and your loved ones? Contact us today to discuss your estate planning needs and find how we can help create a plan that truly reflects your wishes while protecting your family’s future.