Detailed Reviews of the Top 10 Austin Probate Attorneys

Understanding Probate in Austin, Houston, and Fort Worth

When a loved one passes away, settling their affairs through the legal process of probate can feel overwhelming, especially during a time of grief. An austin probate attorney, or one in Houston or Fort Worth, guides families through this difficult time. Probate can be intimidating, and our attorneys understand the challenges families face in Austin, Houston, and Fort Worth during a time of loss.

A probate attorney helps by:

- Proving the will’s validity in Travis, Harris, or Tarrant County probate courts.

- Identifying the estate’s assets and debts across the Austin, Houston, and Fort Worth metro areas.

- Paying creditors from the estate according to Texas law and local court procedures.

- Distributing assets to the correct beneficiaries as ordered by the local probate court.

- Handling all legal paperwork and court appearances required in Austin, Houston, or Fort Worth.

Probate is the court-supervised process of transferring a deceased person’s property and settling their debts. In Texas, this process is necessary when property needs a legal change of ownership, unless arrangements like trusts were made. While some cases are simple, they can become complex in the busy courts of Travis County (Austin), Harris County (Houston), or Tarrant County (Fort Worth).

This guide will explain the probate process in Austin, Houston, and Fort Worth and show how an attorney can make the journey smoother.

Handy austin probate attorney terms:

Criteria for Evaluating an Austin Probate Attorney

Choosing the right austin probate attorney in Austin, Houston, or Fort Worth is crucial when you’re dealing with grief. Finding a lawyer who understands Texas probate law and the local court systems is incredibly important. We focus on factors that ensure effective representation in these specific areas.

First, we look for deep familiarity with the local courts. This means knowing the specific procedures and personnel in Travis County (Austin), Harris County (Houston), Tarrant County (Fort Worth), and surrounding counties like Williamson and Hays. Our attorneys, Keith Morris & Stacy Kelly, have over 40 years of combined experience in these specific court systems.

Experience is also measured by the number of years an attorney has practiced Texas probate law and the volume of cases they’ve handled. An attorney who has managed hundreds of probate matters in Austin, Houston, and Fort Worth has likely encountered challenges similar to yours and knows how to address them efficiently.

Client testimonials from Austin, Houston, and Fort Worth offer invaluable insights. We look for praise regarding clear communication, responsiveness, and genuine care. Clients often appreciate attorneys who are patient and can explain complex issues in simple terms, which is vital during an emotionally difficult time.

Our attorneys are highly regarded by their peers, a testament to their work in the Texas probate field.

The attorney’s communication style is also critical. Our firm ensures you receive clear explanations for each step, patient answers to your questions, and consistent updates, significantly reducing an executor’s stress in Austin, Houston, or Fort Worth.

Finally, a transparent fee structure is essential. We offer clear rates, fixed fees, and payment plans to avoid hidden costs or surprises for our clients in Austin, Houston, and Fort Worth. This allows you to focus on navigating the probate process.

More info about probate attorney services in Texas

Why You Need a Skilled Probate Attorney in Austin, Houston, or Fort Worth

While it may seem possible to handle probate alone, most cases in busy areas like Austin, Houston, and Fort Worth benefit from a skilled probate attorney’s guidance.

The Texas Estates Code is complex and confusing. An attorney who regularly works in Travis, Harris, and Tarrant County probate courts understands its nuances and helps you avoid common pitfalls. A dedicated probate attorney prevents errors that general practice lawyers might make, which can cause significant problems for the family later.

Our attorneys also reduce family stress. They handle the legal burdens in Austin, Houston, and Fort Worth, allowing families to focus on grieving instead of paperwork and court filings. Our firm serves as a steady hand, aiming to help people get through a difficult time with care and compassion.

Furthermore, our attorneys provide objective legal guidance when emotions are high. In court proceedings within Travis, Harris, and Tarrant counties, they act as your advocate, protecting your interests and ensuring the process moves smoothly.

Finally, our probate attorneys help protect the executor or administrator from potential legal risks. They explain your duties, ensure you fulfill them correctly, and shield you from liability, allowing you to manage the estate with confidence in Austin, Houston, or Fort Worth.

How Much Does A Probate Attorney Cost In Texas?

Key Services Offered by a Probate Attorney in Austin, Houston, and Fort Worth

When you work with a probate attorney in Austin, Houston, or Fort Worth, you get a partner to guide you through the legal process. Our attorneys, Keith Morris & Stacy Kelly, offer a full range of services to make this time manageable.

Here are some key services we provide:

- Will Validation: We help prove a will’s authenticity in the probate courts of Travis, Harris, or Tarrant County, ensuring your loved one’s wishes are legally recognized in Austin, Houston, or Fort Worth.

- Asset Inventory: We assist in locating and listing all estate assets—from bank accounts and real estate in the Austin area to business interests in Houston—ensuring nothing is overlooked.

- Debt Settlement: We guide you through notifying creditors and paying legitimate debts from the estate, following the specific procedures required by local courts in Austin, Houston, and Fort Worth.

- Title Transfers: We handle the legal transfer of ownership for property like homes and cars, filing all necessary documents in Travis, Harris, or Tarrant counties.

- Heirship Determination: If there is no will, we manage heirship proceedings in Travis, Harris, or Tarrant County to legally identify the rightful heirs according to Texas law.

- Tax Filings: We guide you through complex tax obligations that affect the estate, such as final income tax returns or federal estate tax issues, as they apply to assets held in the Austin, Houston, or Fort Worth areas.

- Ancillary Administration: If the deceased owned property in another state, we can assist with the secondary probate process required there for our clients in Austin, Houston, and Fort Worth.

- Muniment of Title: For simple cases in Austin, Houston, or Fort Worth with no unsecured debts, we can use this streamlined Texas process to transfer title to property.

- Small Estate Affidavits: For small estates in Travis, Harris, or Tarrant County meeting specific criteria, we can prepare this affidavit for a quicker transfer of assets.

- Representation in Local Probate Courts: We provide dedicated representation in all court hearings in Travis, Harris, Tarrant, and surrounding counties, advocating on your behalf.

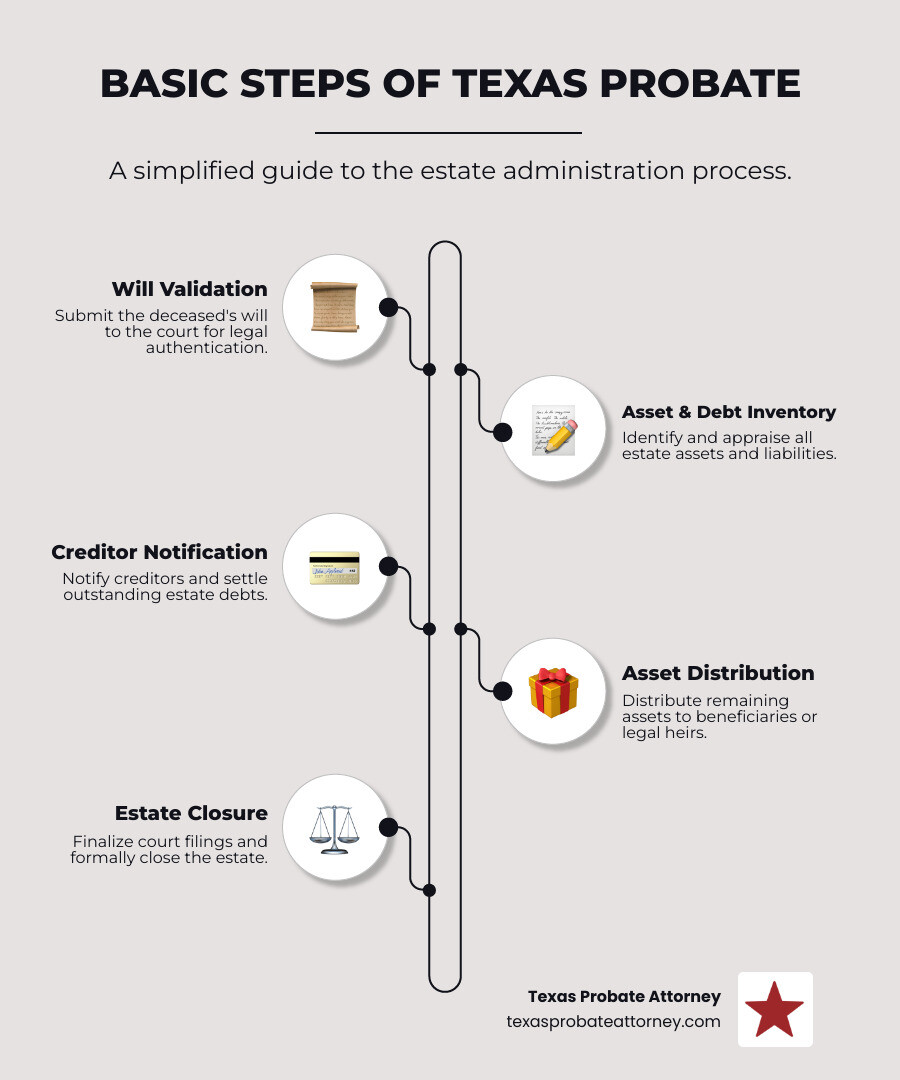

The Texas Probate Process Explained

Understanding the probate process in Texas is more manageable with the guidance of a local attorney. The process is how a deceased person’s assets and debts are managed and transferred under court supervision.

In Texas, probate begins by filing the will and an application for probate with the appropriate county court — Travis County for Austin, Harris County for Houston, or Tarrant County for Fort Worth. If there is no will, an application for administration is filed instead. (You can review specific filing requirements on the official Travis County Probate Court website).

Next, a court hearing is scheduled. The judge recognizes the death, verifies the will’s validity, and appoints an executor (with a will) or an administrator (without a will). This step is often simple if the will is valid and undisputed. Texas can have a straightforward probate process when there are no disputes.

After appointment, the executor or administrator receives “Letters Testamentary” or “Letters of Administration,” which grant them authority to act for the estate. They then notify creditors, typically by publishing a notice in a local newspaper.

Next, the executor or administrator will gather all of the deceased’s property, which may be located across the Austin, Houston, or Fort Worth metroplex, and then pay debts from the estate’s assets.

Finally, after all debts and taxes are settled, the remaining assets are distributed to beneficiaries as directed by the will or Texas law, a process overseen by the Travis, Harris, or Tarrant County court. The process ends with the closing of the estate.

A will must generally be probated within four years of the death, highlighting the need to act promptly. An austin probate attorney from our firm can ensure a smooth and efficient administration in Austin, Houston, or Fort Worth.

Independent vs. Dependent Administration in Texas Probate Courts

In Texas, estates are managed through either independent or dependent administration. The choice impacts the level of court oversight. Our attorneys, Keith Morris & Stacy Kelly, can determine the right path for your situation in Austin, Houston, or Fort Worth.

Independent administration is the most common form of probate in Texas because it involves minimal court supervision. Once an independent executor is appointed, they can manage and distribute estate assets without seeking court approval for every action. This means fewer court appearances, less paperwork, and a quicker, more cost-effective process in Travis, Harris, or Tarrant County. Most Texas estates qualify for independent administration, especially if the will provides for it or all beneficiaries agree.

Dependent administration, in contrast, involves extensive judicial oversight. The probate judge must approve nearly every action, such as selling assets or paying debts. This requires filing petitions and attending hearings, making the process longer, more complex, and more expensive. Dependent administration is often necessary when someone dies without a will and the beneficiaries cannot cooperate, or when the will does not allow for independent administration.

In short, independent administration offers minimal oversight and high executor autonomy, leading to lower costs and faster timelines. Dependent administration involves extensive oversight and low autonomy, resulting in higher costs and longer timelines. We always strive for independent administration when possible in Austin, Houston, and Fort Worth.

What Happens When There Is No Will (Intestacy) in Austin, Houston, or Fort Worth?

When a person dies without a valid will in Texas, they have died “intestate.” In these cases, Texas law determines how their property is distributed, which may not align with their wishes.

If someone dies intestate in Austin, Houston, or Fort Worth, their estate undergoes heirship proceedings in the local probate court (Travis, Harris, or Tarrant County). The court’s job is to formally identify the legal heirs according to Texas succession laws. This can require extensive documentation and research to establish relationships.

State succession laws dictate a specific inheritance order. For example, a surviving spouse might have to share property with the deceased’s children from a previous marriage, which can create tension and complications. This highlights the problems that can arise when attorneys without specific probate experience handle estate planning, as mistakes are often found too late.

For smaller estates, an Affidavit of Heirship can sometimes be used to transfer property without a full court administration, but this is only applicable in specific situations.

The potential for family disputes is much higher without a will. Disagreements over asset distribution can lead to prolonged and costly court battles in Austin, Houston, or Fort Worth.

In intestate cases, the court appoints an administrator to manage the estate. This administrator inventories assets, pays debts, and distributes property according to the court’s orders. This process typically requires a more cumbersome dependent administration.

The best approach is to plan ahead with a qualified attorney. It is a disservice to spend a lifetime providing for your family only to let the state decide how your assets are distributed after your death.

Handling Complex Cases: Contested Probate in Austin, Houston, and Fort Worth

While many probate cases are smooth, disputes can arise, leading to a “contested probate.” These situations are often emotionally charged, and our attorneys, Keith Morris & Stacy Kelly, specialize in aggressive litigation and quick resolutions for clients in Austin, Houston, and Fort Worth.

A will contest occurs when someone believes a will is invalid. Common grounds for contesting a will in Texas include:

- Undue influence: When someone improperly pressured the deceased, causing the will to not reflect their true wishes.

- Lack of capacity: If the deceased was not of sound mind (due to dementia, illness, etc.) when they signed the will.

- Fraud or forgery: Deception, such as tricking the deceased into signing the document or forging their signature.

- Improper execution: If the will does not meet Texas legal requirements, like being signed and attested to by two credible witnesses.

Disputes can also arise from a breach of fiduciary duty, where an executor mismanages or steals estate assets. Beneficiaries can take legal action in such cases, especially when others are taking advantage of the situation after a loved one’s death.

Contested probate in Austin, Houston, or Fort Worth often involves mediation and litigation. Mediation attempts to find a settlement outside of court, which can save time and money. If it fails, litigation is necessary. Our attorneys are prepared to represent your interests vigorously in Travis, Harris, or Tarrant County probate courts, whether through negotiation or trial.

These proceedings are complex and require a thorough grasp of Texas probate law. Having an austin probate attorney with a proven history in contested matters in these cities is essential. We are committed to achieving quick resolutions, allowing our clients to move forward.

Beyond Probate: Estate Planning and Avoidance Strategies in Austin, Houston, and Fort Worth

While probate is the legal process after death, estate planning is what you do now to ensure a smooth transition later. It’s about being proactive to protect your wishes and potentially simplify or avoid the probate process for your family in Austin, Houston, or Fort Worth. Our attorneys, Keith Morris & Stacy Kelly, can help with both.

The key difference is timing and control. Estate planning happens while you are alive, giving you control over your assets. Probate occurs after you’ve passed, often with court supervision. Without a plan, Texas law decides how your assets are distributed, which might not be what you intended.

Fortunately, several tools can help your loved ones avoid or streamline probate in Austin, Houston, or Fort Worth:

-

Wills and Trusts: While a will guides the probate court in Travis, Harris, or Tarrant County, a living trust can often bypass probate entirely. Assets held in a trust can be distributed to beneficiaries in Austin, Houston, or Fort Worth privately and efficiently, saving time and money.

-

Powers of Attorney: These documents let you choose someone to make financial or healthcare decisions for you if you become incapacitated. This avoids the need for a court-appointed guardianship in Austin, Houston, or Fort Worth, which is a complex and public form of probate.

-

Beneficiary Designations: Life insurance policies and retirement accounts (IRAs, 401ks) can have named beneficiaries. These assets pass directly to the designated person—whether they live in Austin or elsewhere—outside of the probate process overseen by local Texas courts.

-

Payable-on-Death (POD) or Transfer-on-Death (TOD) Accounts: You can set up bank accounts, vehicles, and even real estate in Texas to automatically transfer to a named beneficiary upon your death, bypassing the probate courts in Austin, Houston, and Fort Worth.

The main takeaway is to plan ahead. Creating a comprehensive plan now with an austin probate attorney from our firm ensures your final wishes are honored and makes the transfer of your assets as smooth as possible for your loved ones in Austin, Houston, or Fort Worth.

Frequently Asked Questions about Probate Attorneys in Austin, Houston, and Fort Worth

It’s normal to have questions about the probate process and how an attorney can help. Here, we address common inquiries from clients in Austin, Houston, and Fort Worth.

How long does probate take in these Texas cities?

The duration of probate in Austin, Houston, and Fort Worth varies. A straightforward, uncontested probate with a clear will and no disagreements can often be completed in 6 to 12 months. This includes filing paperwork, notifying creditors, and distributing assets.

However, a contested case involving disputes over the will or among family members can take much longer, sometimes stretching for years if it leads to extended court battles. The complexity of the estate also plays a role. An estate with numerous properties, business interests, or significant debts will take more time to settle than a simple one.

Finally, the court dockets in Travis, Harris, and Tarrant counties can influence the timeline. As busy courts, scheduling hearings can sometimes cause delays. Our goal at Keith Morris & Stacy Kelly is always to seek quick resolutions and move the process along as efficiently as possible.

Can I handle probate in Texas without a lawyer?

While Texas law allows individuals to represent themselves in court, handling probate without a lawyer in busy districts like Austin, Houston, or Fort Worth is generally not recommended. The Texas Estates Code is complex, and the local court rules add another layer of difficulty, especially for someone grieving.

For certain types of probate, like dependent administration, Texas courts often require the administrator to be represented by an attorney to ensure all legal steps are followed correctly.

Even when not required, an austin probate attorney from our firm provides essential support. If the estate has significant assets, real estate, multiple beneficiaries, or any potential for disagreement, a lawyer is crucial. An attorney helps you avoid common mistakes, meet all legal obligations, and protects you from personal liability. This allows you to focus on healing rather than legal burdens in Austin, Houston, or Fort Worth.

What is the difference between an executor and an administrator?

Both an “executor” and an “administrator” manage a deceased person’s estate in Austin, Houston, or Fort Worth, but they are appointed differently.

An executor is the person named in a will to carry out its instructions. The probate court in Travis, Harris, or Tarrant County formally appoints this person, giving them “Letters Testamentary” to act on behalf of the estate.

An administrator is appointed by the court when a person dies without a will (intestate) in Austin, Houston, or Fort Worth, or if the will fails to name an executor. The court selects an individual, often a close family member, who receives “Letters of Administration.”

Both roles share similar duties and responsibilities within the local probate system. They have a fiduciary obligation to act in the best interests of the estate. Their duties include inventorying assets in the Austin, Houston, or Fort Worth area, paying debts, filing tax returns, and distributing the remaining property to the rightful heirs or beneficiaries. The main distinction is their source of authority: an executor is chosen by the deceased in their will, while an administrator is appointed by the court.

Conclusion

The probate journey in Austin, Houston, and Fort Worth doesn’t have to be a confusing ordeal. While losing a loved one is difficult, understanding the legal process can provide clarity during a challenging time.

This guide has covered the essential steps of Texas probate, from proving a will to distributing a loved one’s legacy. Whether dealing with a simple administration or a complex contested case, the guidance of a local probate attorney is critical.

Probate in Travis, Harris, and Tarrant counties requires a thorough understanding of the Texas Estates Code and local court procedures. Attempting to steer this alone while grieving can lead to costly mistakes and added stress.

This is where a dedicated austin probate attorney from our firm provides essential support. At Keith Morris & Stacy Kelly, Attorneys at Law, we have over 40 years of combined experience helping families in these situations. We provide personalized legal representation custom to your specific needs in Austin, Houston, and Fort Worth.

Our approach combines aggressive litigation when needed with a commitment to quick resolutions. We aim to transform an overwhelming process into manageable steps, giving you space to focus on honoring your loved one.

Whether you face a simple estate administration or a complex family dispute, we are here to provide the steady hand you need. We know the local courts, are well-versed in Texas probate law, and are committed to helping you with clarity and compassion in Austin, Houston, and Fort Worth.

Don’t let legal complexities add to an already difficult time. You deserve advocates with proven experience in these cities to guide you toward resolution.

Contact our Austin, Houston, and Fort Worth Texas Probate Lawyers for a consultation