Houston Contest Attorney 101

Why You Need a Houston Contest Attorney

A houston contest attorney specializes in probate litigation when family members, heirs, or beneficiaries dispute the validity of a will or trust. These legal professionals handle cases involving fraud, undue influence, lack of capacity, and other grounds that can invalidate estate documents.

Quick Answer for Houston Contest Attorney Services:

- Will Contests – Challenge invalid wills based on fraud, capacity, or undue influence

- Trust Disputes – Contest trust terms, revocation, or fiduciary breaches

- Legal Standing – Any “interested person” under Texas Estates Code Section 55.001

- Fee Structure – Many firms offer contingency arrangements (no fee unless you win)

- Timeline – Must file within 2 years of probate admission in Texas courts

When someone you love passes away, the last thing you want is a legal battle over their estate. But sometimes, challenging a will or trust becomes necessary to protect your family’s inheritance rights.

Houston contest attorneys represent clients in Harris County probate courts where these disputes unfold. According to the research, both Jack Lawter and Dianne Lawter, leading Houston will contest attorneys, are Board Certified in Estate Planning and Probate Law by the Texas Board of Legal Specialization – a distinction held by less than 10% of Texas attorneys in this field.

The stakes are often high. One Houston firm recovered over $40 million in a single case involving five set-aside wills and trusts. Another secured a $3 million settlement in a trust-busting case due to alleged undue influence.

Common reasons families hire Houston contest attorneys include:

- Suspicious changes made to wills when the deceased was ill

- Caregivers or new spouses who isolated the deceased from family

- Missing or destroyed original estate documents

- Executors who refuse to share information or mismanage assets

The good news? Many Houston contest attorneys work on contingency, meaning you don’t pay legal fees unless your case succeeds. This arrangement helps families pursue legitimate challenges without upfront costs during an already difficult time.

Basic houston contest attorney glossary:

Role of a Houston Contest Attorney

A houston contest attorney serves as your advocate in probate litigation, representing your interests when estate documents are challenged or when fiduciaries breach their duties. We understand that these cases involve more than just legal technicalities – they’re about protecting your family’s legacy and ensuring your loved one’s true wishes are honored.

Our role extends beyond simple legal representation. We investigate the circumstances surrounding estate document execution, gather medical records to establish capacity, interview witnesses, and build compelling cases based on evidence rather than suspicion. As one research source noted, “Most reputable law firms will not take a will contest case based on mere dissatisfaction with the distribution; there must be evidence of invalidity.”

The complexity of probate litigation requires specialized knowledge. Board-certified attorneys in Estate Planning and Probate Law bring advanced training to these cases. With over 40 years of combined experience, we’ve seen how proper legal representation can mean the difference between a successful challenge and a costly defeat.

Services Offered by a Houston Contest Attorney

Will Contests form the backbone of our practice. We challenge wills based on lack of testamentary capacity, undue influence, fraud, forgery, or improper execution. Each case requires careful analysis of the testator’s mental state, the circumstances of signing, and the influence of those around them.

Trust Contests involve different legal strategies. Unlike wills, which become public during probate, trusts remain private, making them harder to challenge but also providing fewer findy opportunities. We handle trust revocation, termination, construction disputes, and trust-fund litigation.

Executor and Personal Representative Disputes arise when fiduciaries breach their duties. We pursue claims for mismanagement, self-dealing, failure to account, and other violations of fiduciary duty. These cases often involve recovering assets that have been improperly distributed or converted.

Contested Guardianships protect vulnerable adults from exploitation. We represent families seeking to establish guardianship over incapacitated relatives or challenge inappropriate guardianship appointments.

Business and Partnership Litigation often intersects with estate planning. We handle disputes over family business succession, partnership agreements, and shareholder rights that arise after an owner’s death.

Contest Types Handled in Houston Courts

Lack of Capacity challenges focus on whether the testator had sufficient mental ability to understand the nature and consequences of their actions. We gather medical records, interview healthcare providers, and present evidence of cognitive decline, dementia, or other conditions that impair decision-making.

Undue Influence cases involve proving that someone in a position of trust manipulated the testator to benefit themselves. Common scenarios include caregivers who isolate elderly clients, new spouses who pressure their partners to disinherit children, or family members who exploit their influence during times of vulnerability.

Fraud and Forgery represent the most straightforward grounds for contest. We investigate suspicious signatures, analyze document authenticity, and present evidence of deliberate deception. These cases often involve handwriting analysis and document examination by forensic specialists.

Improper Execution challenges focus on whether the will or trust was signed according to Texas legal requirements. For wills, this means the document must be in writing, signed by the testator, and witnessed by at least two individuals over age 14 (unless it’s entirely handwritten as a holographic will).

Breach of Fiduciary Duty applies to trustees, executors, and other fiduciaries who violate their obligations. We pursue claims for self-dealing, failure to account, mismanagement of assets, and other breaches that harm beneficiaries.

Legal Grounds & Standing to Challenge an Estate

Understanding who can challenge an estate and on what grounds is crucial for any successful contest. Under section 55.001 of the Texas Estates Code, any person “interested in an estate” may challenge a will in a probate proceeding. This broad definition makes will contests relatively accessible in Houston courts.

Testamentary Capacity requires that the testator understood the nature and consequences of making a will, knew the nature and extent of their property, and recognized the natural objects of their bounty (typically family members). Mental illness alone doesn’t invalidate a will – the testator must have lacked capacity at the specific time of signing.

Undue Influence involves more than simple persuasion. The influence must be so strong that it overcame the testator’s free will and caused them to act contrary to their true desires. We look for evidence of isolation, dependency, and manipulation by those in positions of trust.

Fraud requires proof that someone deliberately deceived the testator through false representations of material facts. This might involve lying about family circumstances, hiding the true nature of documents being signed, or misrepresenting the contents of estate planning instruments.

Improper Execution challenges focus on compliance with statutory formalities. Texas law requires specific procedures for will execution, and failure to follow these requirements can invalidate the entire document.

For detailed information about these grounds, see our guide on Grounds for Challenging a Will.

Who Can Hire a Houston Contest Attorney

Spouses have strong standing to challenge wills that disinherit them, particularly when community property rights are involved. Texas law provides certain protections for surviving spouses that can’t be completely eliminated through estate planning.

Children can contest wills that unexpectedly disinherit them, especially when there’s evidence of undue influence or lack of capacity. However, parents generally have the right to disinherit children if they do so intentionally and with proper mental capacity.

Creditors may challenge estate documents that improperly transfer assets to avoid legitimate debts. These cases often involve fraudulent transfer claims and require quick action to preserve assets.

Omitted Heirs include children born after will execution or family members who were accidentally excluded due to drafting errors. Texas law provides specific protections for these situations.

Trustees and Executors sometimes need legal representation when beneficiaries challenge their actions or when they find problems with the estate documents they’re required to administer.

No-Contest Clauses: How Effective Are They?

No-contest clauses, also called in terrorem clauses, attempt to discourage will contests by threatening to disinherit anyone who challenges the document. However, these clauses are less effective than many people believe.

In Texas, no-contest clauses don’t bar good-faith challenges based on reasonable grounds. If you have legitimate evidence of fraud, undue influence, or lack of capacity, you can generally contest the will without triggering the forfeiture provision.

The key is demonstrating that your challenge is made in good faith with probable cause. Courts recognize that enforcing no-contest clauses against legitimate challenges would essentially immunize fraudulent or invalid wills from scrutiny.

Estate planning tactics around no-contest clauses include:

- Leaving meaningful bequests to potential contestants

- Creating detailed explanations for unusual distributions

- Using independent witnesses and attorneys

- Documenting the testator’s capacity and intentions

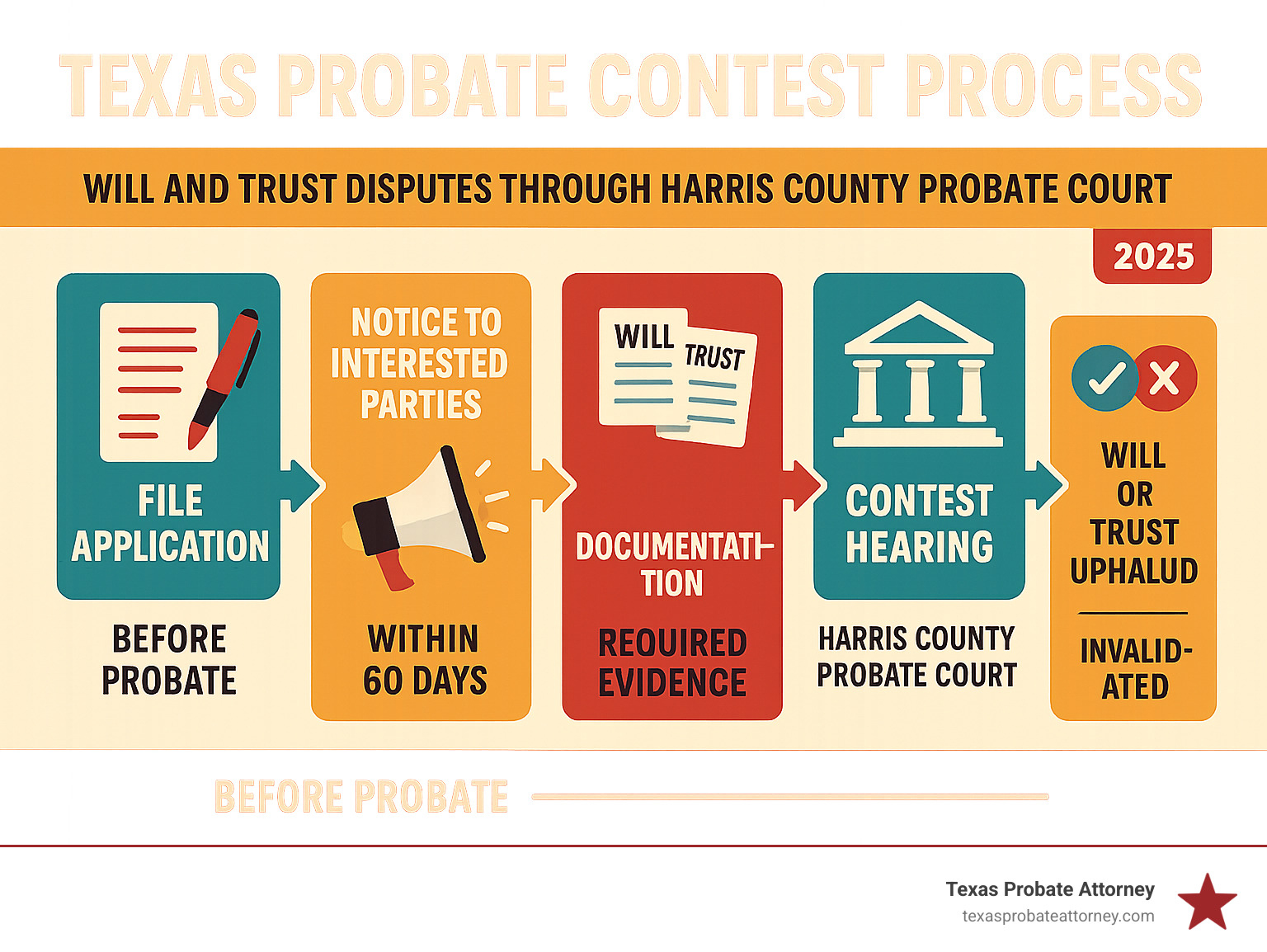

Step-by-Step: Contesting a Will or Trust in Houston

The process of contesting a will or trust in Houston follows specific procedural requirements. Understanding these steps helps families prepare for what can be a lengthy and complex legal battle.

File Application: The contest begins by filing an application in the appropriate Harris County probate court. This document outlines the grounds for challenge and requests specific relief. The application must be filed within the statute of limitations period.

Citation and Service: All interested parties must be notified of the contest through formal citation. This includes beneficiaries named in the will, heirs who would inherit under intestacy laws, and the proposed executor or administrator.

Findy: Both sides gather evidence through depositions, document requests, and interrogatories. This phase often involves obtaining medical records, interviewing witnesses, and analyzing the circumstances surrounding the will’s execution.

Mediation: Many Houston probate courts require mediation before trial. This process can resolve disputes more quickly and cost-effectively than litigation, though it requires all parties to negotiate in good faith.

Trial: If mediation fails, the case proceeds to trial where both sides present evidence and arguments. The judge or jury determines whether the will is valid and, if not, what should happen to the estate.

Appeal: Losing parties may appeal adverse decisions to higher courts, though this extends the timeline and increases costs significantly.

For more detailed information, see our guide on Contesting a Will in Texas.

Houston Contest Attorney Litigation Timeline

Statute of Limitations: In Texas, will contests must be filed within two years of the will’s admission to probate. This deadline is strictly enforced, and missing it generally bars any challenge regardless of merit.

Temporary Restraining Orders: When there’s risk of asset dissipation or destruction of evidence, we can seek emergency court orders to preserve the estate. These orders can freeze assets, require accounting, or prevent specific actions by fiduciaries.

Asset Freeze: Contest litigation often freezes estate distribution, preventing beneficiaries from receiving their inheritance until the dispute is resolved. This creates pressure for quick resolution but can also increase administrative expenses.

Evidentiary Hearing: Courts may hold preliminary hearings to determine whether the contest has sufficient merit to proceed. These hearings can eliminate frivolous challenges early in the process.

| Informal Settlement | Full Trial |

|---|---|

| 3-6 months typical timeline | 12-24 months or longer |

| Lower legal costs | Higher litigation expenses |

| Confidential resolution | Public court proceedings |

| Preserves family relationships | Often damages relationships |

| Flexible solutions | Limited to legal remedies |

| Both sides compromise | Winner-take-all outcome |

Risks, Costs, and Typical Fee Structures

Family Conflict represents one of the most significant costs of estate litigation. Will contests can permanently damage relationships between siblings, parents and children, and other family members. We work to minimize these conflicts through strategic negotiation and mediation when possible.

Asset Freeze during litigation means beneficiaries can’t access their inheritance, potentially causing financial hardship. Administrative expenses continue to accrue, reducing the estate’s value over time.

Administrative Expenses include court costs, attorney fees, expert witness fees, and other litigation expenses. These costs are typically paid from the estate, reducing the amount available for distribution to beneficiaries.

Contingency Fees are common in Houston contest cases. Many firms, including ours, offer contingency arrangements where clients pay no attorney fees unless the case succeeds. This structure aligns our interests with yours and makes litigation accessible to families who couldn’t otherwise afford it.

Hourly Rates may be appropriate for certain types of cases, particularly those involving ongoing fiduciary disputes or complex trust administration issues. We provide transparent billing and regular updates on costs.

Hybrid Models combine elements of both contingency and hourly billing, such as reduced hourly rates with success bonuses or contingency fees with cost-sharing arrangements.

For more information about working with contest attorneys, see our guide on Will Contest Law Firm.

Cost-Benefit Analysis for Hiring a Houston Contest Attorney

Estate Size significantly impacts the economics of contest litigation. Challenging a $100,000 estate involves different considerations than contesting a $10 million estate. We help families evaluate whether potential recovery justifies litigation costs.

Percentage Recovery in successful cases can be substantial. Research shows recoveries ranging from hundreds of thousands to millions of dollars in Houston contest cases. However, these outcomes depend on having strong evidence and experienced representation.

Litigation Expenses beyond attorney fees include expert witnesses, medical record retrieval, depositions, and court costs. We provide detailed cost estimates and work to control expenses throughout the process.

Emotional Toll of litigation affects families beyond financial considerations. We provide counseling referrals and work to resolve cases as quickly as possible while protecting your interests.

Strategic Planning helps families make informed decisions about whether to pursue litigation, seek settlement, or accept the estate plan as written. Our experience helps identify cases with strong potential for success.

Prevention Tips: Drafting an Unassailable Estate Plan

The best way to avoid needing a houston contest attorney is to create estate plans that are difficult to challenge successfully. Proper planning techniques can significantly reduce the risk of future litigation.

Clear Drafting eliminates ambiguities that lead to disputes. Specific language about asset distribution, explanation of unusual bequests, and detailed instructions for fiduciaries help prevent misunderstandings.

Capacity Documentation involves working with attorneys when the testator is clearly competent and obtaining medical evaluations if there are any concerns about mental capacity. This creates a record that can defend against future challenges.

Credible Witnesses should be independent individuals who can testify about the testator’s capacity and freedom from undue influence. Family members and beneficiaries generally make poor witnesses for will execution.

Digital Assets require special attention in modern estate planning. Cryptocurrency, online accounts, and digital property need specific provisions to avoid disputes over access and distribution.

Transfer-on-Death Deeds can bypass probate for real estate, reducing opportunities for contest and speeding asset distribution to beneficiaries.

For comprehensive information about estate planning disputes, see our guide on Trust and Will Disputes.

Proactive Strategies to Avoid Future Houston Contest Attorney Involvement

No-Contest Clauses can deter frivolous challenges when properly drafted and combined with meaningful bequests to potential contestants. However, these clauses won’t prevent legitimate challenges based on strong evidence.

Videotaped Signings provide powerful evidence of the testator’s capacity and freedom from undue influence. These recordings can be decisive in defending against future challenges.

Periodic Updates to estate plans demonstrate ongoing capacity and consistent intentions. Regular reviews also ensure that plans remain current with family circumstances and tax law changes.

Independent Counsel for all parties involved in estate planning helps prevent claims of undue influence or conflicts of interest. This is particularly important in family business succession planning.

Fiduciary Selection requires careful consideration of trustee and executor qualifications. Professional fiduciaries may be appropriate for complex estates or when family conflicts are anticipated.

Frequently Asked Questions about Houston Will & Trust Contests

How long do I have to contest a will in Texas?

You have two years from the date the will is admitted to probate to file a contest in Texas courts. This deadline is strictly enforced, and missing it generally bars any challenge regardless of the strength of your evidence. However, there are limited exceptions for cases involving fraud or forgery where the two-year period may be extended.

The clock starts ticking when the will is formally admitted to probate, not when the person died. If you suspect problems with a will, it’s crucial to consult with a houston contest attorney as soon as possible to preserve your rights.

Are no-contest clauses enforceable in Texas?

No-contest clauses are enforceable in Texas, but they don’t prevent all challenges. If you have probable cause and file your contest in good faith, you generally won’t trigger the forfeiture provision even if you lose the case.

The key is having reasonable grounds for your challenge based on evidence, not just suspicion or disappointment with your inheritance. Courts recognize that absolute enforcement of no-contest clauses would immunize fraudulent or invalid wills from legitimate scrutiny.

Can I hire a Houston contest attorney on contingency?

Yes, many Houston contest attorneys, including our firm, offer contingency fee arrangements for will and trust contests. This means you pay no attorney fees unless your case succeeds, making litigation accessible to families who couldn’t otherwise afford it.

Contingency arrangements align our interests with yours – we only succeed when you do. However, you may still be responsible for certain costs like court fees, expert witnesses, and medical record retrieval, regardless of the outcome.

Conclusion and Next Steps

Protecting your inheritance rights requires timely action and experienced legal representation. Whether you’re facing a suspicious will, dealing with a breach of fiduciary duty, or need to challenge estate documents, having a skilled houston contest attorney on your side can make all the difference.

We understand that estate litigation involves more than legal technicalities – it’s about protecting your family’s legacy and ensuring your loved one’s true wishes are honored. With over 40 years of combined experience in Texas probate litigation, we provide the aggressive advocacy and personalized attention your case deserves.

Don’t let the statute of limitations expire on your rights. If you suspect problems with a will or trust, contact us immediately for a consultation. We’ll evaluate your case, explain your options, and help you decide whether litigation is the right choice for your family.

At Texas Probate Attorney, Stacy Kelly is ready to fight for your inheritance rights. We serve clients throughout Houston, Fort Worth, and Austin, providing comprehensive representation in all types of probate litigation.

For more information about our probate litigation services, visit Houston Probate Attorneys: What You Need to Know.

Remember: time is critical in estate contests. The sooner you act, the better we can protect your interests and preserve crucial evidence. Contact us today to schedule your consultation and take the first step toward protecting your family’s inheritance.