The Price of Peace Navigating Probate Lawyer Fees

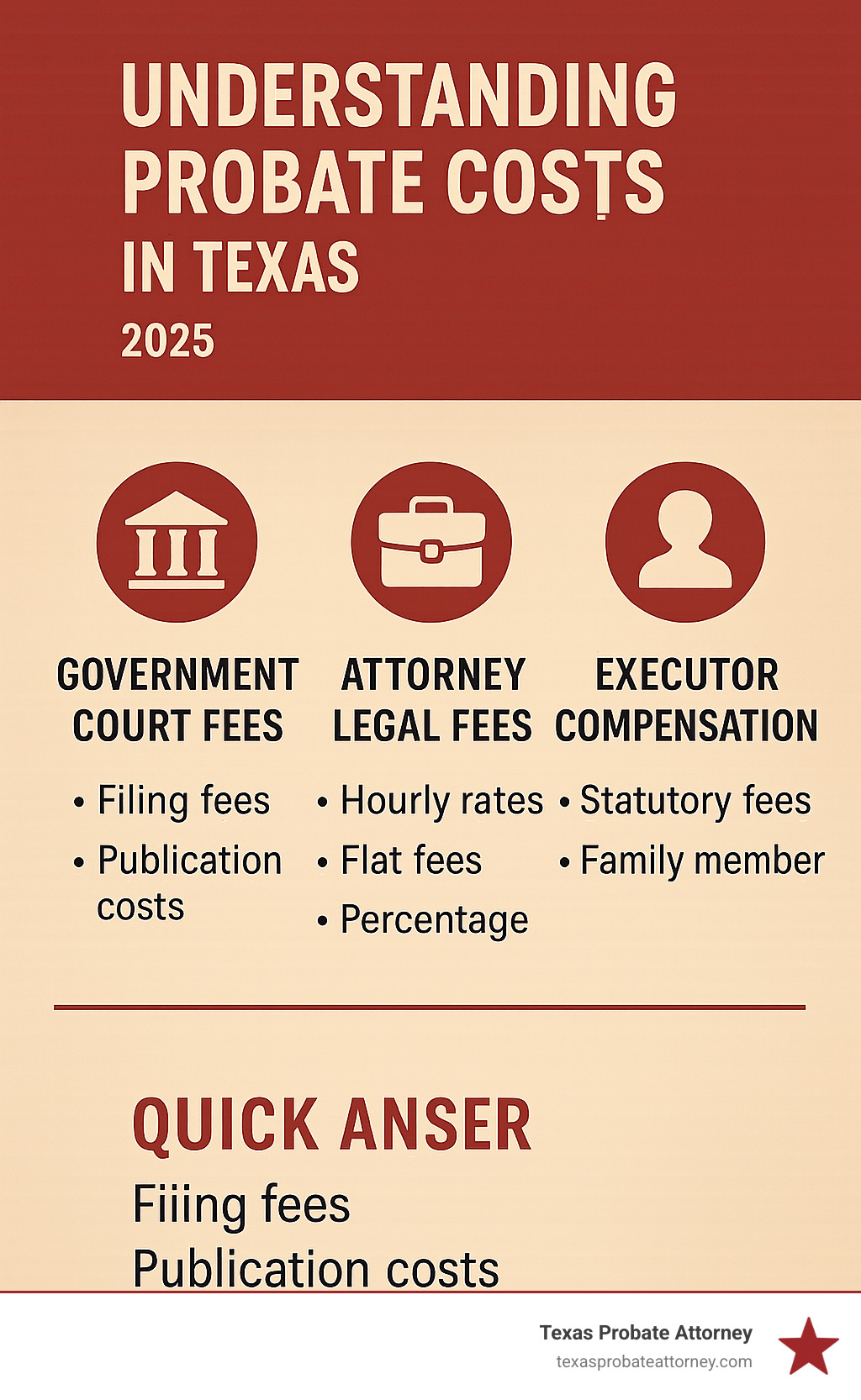

Understanding Probate Costs in Texas

When a loved one passes away in Texas, your family is faced with navigating the legal process of settling their estate, known as probate. Amid the grief, the question of probate lawyer fees often becomes a primary concern. The process can feel overwhelming, and the last thing you need is financial uncertainty. Understanding these costs upfront can empower you to make clear, informed decisions for your family during an already challenging time, allowing you to focus on what truly matters.

Quick Answer: Probate lawyer fees in the Houston, Fort Worth, and Austin areas typically range from:

- Hourly rates: $200-$500 per hour

- Flat fees: $3,000-$7,000 for simple estates

- Total costs: The entire Texas probate process can cost 3-7% of the estate’s value, with attorney fees being the largest part.

- Payment source: Estate assets (not your personal funds)

One of the most common points of relief for our clients in Houston, Fort Worth, and Austin is learning that probate costs are paid directly from the estate’s assets. This means you, as the Executor or a beneficiary, are not expected to pay these significant expenses out of your own pocket. The attorney’s fees, court costs, and other administrative expenses are settled by the estate before any assets are distributed to the heirs.

“One of the reasons that many people find hiring a probate lawyer intimidating is that there’s no price tag in sight,” as noted in probate research. This uncertainty can add significant financial stress to an emotional burden. Here in Houston, Fort Worth, and Austin, our firm addresses this head-on by offering free consultations to provide a clear and transparent discussion about all potential fees before you make any commitment. Having a local attorney who understands the specific procedures of the Harris, Tarrant, and Travis County probate courts is invaluable.

The reality is that total probate costs involve more than just what you pay your attorney. The complete financial picture includes several components. While attorney fees are often the largest single expense, you must also account for:

- Court Filing Fees: These are mandatory government fees to initiate and process a probate case. For example, filing an Application for Probate in Harris County (Houston), Tarrant County (Fort Worth), or Travis County (Austin) typically costs between $300 and $500. These fees cover the administrative work done by the county clerk’s office.

- Executor Compensation: The person named in the will to manage the estate (the Executor) is entitled to compensation under Texas law, often a percentage of the estate’s value. While a family member serving as Executor in a Houston, Fort Worth, or Austin case may choose to waive this fee, it is a potential cost.

- Appraisal and Valuation Costs: If the estate includes unique assets like real estate in the booming Austin market, business interests in Houston, or ranch land near Fort Worth, professional appraisals may be necessary to determine their fair market value for the inventory. These costs can range from a few hundred to several thousand dollars.

- Surety Bonds: In some cases, a court in Harris, Tarrant, or Travis County may require the Executor to post a bond to protect the estate’s assets from mismanagement. The cost of the bond is an administrative expense of the estate.

In Texas, probate lawyers have the flexibility to structure their fees in several ways. Some charge by the hour for their time, others offer a single flat fee for the entire process, and a few may propose percentage-based fees tied to the estate’s value. Each approach has distinct advantages depending on the specifics of your family’s situation and the nature of the estate.

The key is to achieve total clarity on what you are paying for and to ensure the fee structure aligns with your family’s needs and the complexity of the estate. With proper guidance from an attorney focused on the courts in Houston, Fort Worth, and Austin, you can steer the probate process efficiently while protecting your loved one’s legacy.

Probate lawyer fees terms explained:

Decoding the Bill: How Probate Lawyers Charge in Texas

When you’re facing the probate process in Houston, Fort Worth, or Austin, understanding how probate lawyer fees work shouldn’t feel like solving a mystery. The truth is, most attorneys use one of three main approaches to structure their fees, and each has its place depending on your family’s specific situation. The economic landscapes of these cities mean estates can vary widely, from a simple suburban home in Fort Worth to complex business assets in Houston’s Energy Corridor or valuable tech-related holdings in Austin.

The key is finding an attorney in Houston, Fort Worth, or Austin who is upfront about costs from your very first conversation. After all, you’re already dealing with the emotional weight of losing a loved one—financial surprises should be the last thing on your mind. A transparent fee agreement is the foundation of a trusting attorney-client relationship.

| Fee Structure | Best For | Typical Range in Houston, Fort Worth, & Austin |

|---|---|---|

| Hourly Rates | Complex or contested estates | $200-$500 per hour |

| Flat Fees | Simple, straightforward probates | $3,000-$7,000 total |

| Percentage-Based | Large estates (less common in Texas) | 3-5% of estate value |

Let’s break down each approach so you can have an informed conversation with potential attorneys in Houston, Fort Worth, or Austin about what makes sense for your situation.

Charging by the Hour

Hourly billing is exactly what it sounds like: you pay for the actual time your attorney spends on your case, often billed in increments of six or fifteen minutes. In the major Texas metro areas of Houston, Fort Worth, and Austin, you’ll typically see rates ranging from $200 to $500 per hour. Attorneys with decades of focused probate litigation experience will command rates at the higher end of this spectrum. For a deeper look at legal billing trends, you can review data on attorney rates by location.

This approach is best suited for complex or contested estates. If your loved one’s estate involves challenges common to the region, like business succession for a Houston-based company, oil and gas mineral rights, or disputes among beneficiaries over a high-value Austin property, hourly billing ensures you’re only paying for the specific legal work required. It provides flexibility when the path forward is uncertain. Most attorneys in the competitive Houston, Fort Worth, and Austin markets will require an upfront payment, known as a retainer, which is placed in a trust account. As the attorney and their staff work on your case, they will bill their time against this retainer, providing you with detailed monthly statements showing the work performed and the remaining balance. If the retainer is depleted, you may be asked to replenish it.

To manage costs effectively, many firms in Houston, Fort Worth, and Austin also use paralegals for routine administrative tasks like filing documents with the court or drafting standard correspondence. Paralegals bill at a much lower hourly rate—usually $75 to $150 per hour. This helps keep your overall costs down while ensuring each task is handled by the appropriate legal professional. You can learn more about how much a probate attorney costs in Texas to get a better sense of what to expect.

The primary downside of hourly billing is the lack of cost predictability. It can be difficult to estimate the total fee at the outset, which can be a source of stress for families navigating the probate courts in Harris, Tarrant, or Travis counties.

The All-Inclusive Flat Fee

Flat fee arrangements offer something many families crave during a difficult time: predictability and peace of mind. For straightforward probate cases in the Houston, Fort Worth, and Austin metro areas, you might pay a single, all-inclusive fee ranging from $3,000 to $7,000 for complete representation from start to finish.

This model works beautifully when an estate is relatively simple. A typical “simple” estate in the Austin, Houston, or Fort Worth areas might include a primary residence, a few bank accounts, a vehicle, and minimal, easily verifiable debt. In these cases, an attorney can accurately assess the scope of work and quote one price that covers all necessary services, from filing the initial application to attending the court hearing and guiding the distribution of assets.

The great advantage of a flat fee is that you know the exact cost of legal services upfront. When working with a firm in Houston, Fort Worth, or Austin, it is crucial to get a written fee agreement that clearly outlines which services are included and which are not. A comprehensive agreement should specify that the fee covers: preparing and filing the probate application in the appropriate Harris, Tarrant, or Travis County court, posting required legal notices to creditors, attending the initial court hearing, obtaining Letters Testamentary for the Executor, and preparing the estate inventory. It should also state what is excluded, such as the costs of litigation if a will contest arises, or fees for preparing estate tax returns. For more details on probate attorney costs, you can explore typical fee structures across Texas.

Percentage-Based Fees

While common in some other states, percentage-based fees are less frequently used by Texas probate attorneys, and for good reason. Under this arrangement, the attorney’s fee is calculated as a percentage of the estate’s gross value—typically 3% to 5%. Texas law does not mandate this fee structure; instead, it requires that all attorney fees be “reasonable” for the work performed.

This model can sometimes work for very large, complex estates where the percentage reflects fair compensation. However, it can also lead to disproportionately high fees. For example, an estate in Austin with a single asset—a home valued at $1.5 million—but no debts or disputes is not complex to probate. A 4% fee would amount to $60,000, which is likely far more than what would be considered reasonable for the actual work involved.

If an attorney in Houston, Fort Worth, or Austin proposes a percentage-based fee, you should not hesitate to ask for justification or inquire about alternative arrangements like a flat or hourly fee. You have options, and it’s important to understand them. You can find more information about average solicitors fees for probate to help you evaluate whether a percentage-based proposal is reasonable for your situation.

The goal for families in Houston, Fort Worth, and Austin is to find a fee structure that aligns with the complexity of the estate and provides value. Don’t be afraid to discuss fees openly with local attorneys. An experienced probate attorney practicing in Harris, Tarrant, and Travis counties will understand your concerns and should be willing to work with you to find a transparent and fair arrangement. The most important thing is choosing a fee structure that makes sense for your specific estate and gives you confidence that you’re receiving fair value for the critical legal representation you need.