Houston’s Probate Powerhouses: Lawyers You Can Trust

Why Finding the Right Probate Lawyer Houston Texas Matters

When you’re dealing with the loss of a loved one, finding a qualified probate lawyer houston texas can feel overwhelming. Here’s what you need to know right now:

Top Houston Probate Services:

– Independent Administration – Most common, less court supervision

– Small Estate Affidavit – For estates under $75,000

– Probate Litigation – Will contests and disputes

– Heirship Determination – When there’s no will

Average Costs:

– Simple probate with will: Under $4,000 (flat fee)

– Complex cases: $300-500/hour

– Most cases take 6-12 months

When You Need a Lawyer:

– Estate has real property or titled assets

– Will is contested or missing

– Beneficiaries disagree

– Estate owes significant debts

Houston has over 100 probate attorneys serving Harris, Fort Bend, Montgomery, Galveston, and Brazoria counties. The challenge isn’t finding a lawyer – it’s finding the right one for your specific situation.

Texas probate law is actually more straightforward than most states, but that doesn’t make the process any less stressful when you’re grieving. Many Houston probate attorneys offer free consultations and flat-fee pricing to remove financial uncertainty during an already difficult time.

Essential probate lawyer houston texas terms:

– challenging power of attorney

– contesting will after probate

– houston no contest divorce attorney

Why This Guide Matters

We’ve created this comprehensive guide to help you steer Houston’s probate landscape with confidence. After reviewing dozens of law firms, we understand that choosing the right attorney can mean the difference between a smooth 6-month process and a years-long ordeal.

This guide provides peace of mind by breaking down complex legal concepts into plain English. We’ll help you understand local Harris County procedures, typical timelines, and what questions to ask before hiring representation.

What Probate Means in the Bayou City

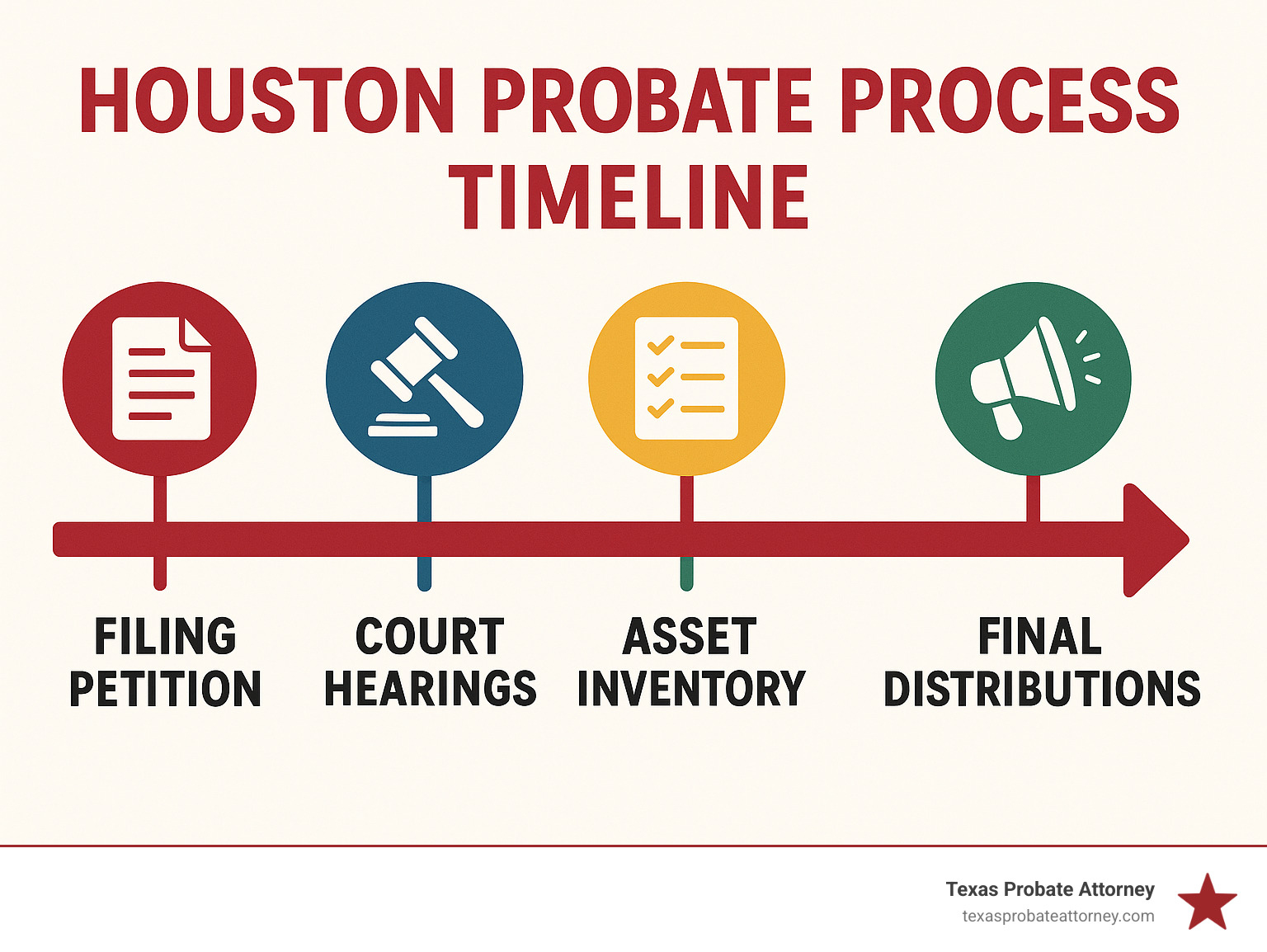

If you’ve never dealt with probate before, think of it as the legal process that makes sure everything gets sorted out properly after someone passes away. In Houston’s Harris County, probate is the court-supervised process that validates wills, pays off debts, and gets assets into the right hands.

Here’s how it works: When someone dies with a will, the probate court needs to make sure that document is legitimate before anyone can start handing out inheritances. Without a will, Texas takes over with something called intestate succession – basically, the state has a predetermined list of who gets what, usually starting with spouses and children.

The good news? Harris County has specialized statutory probate courts that handle these cases day in and day out. Unlike regular courts that might see everything from traffic tickets to major crimes, these judges understand estate law inside and out.

Don’t miss these crucial Texas probate deadlines:

– You have 4 years to file a will after someone dies

– The executor gets 90 days to provide an asset inventory

– Creditors have 4 months to make claims once they’re notified

Miss these deadlines, and you could face serious complications that even the best attorney might struggle to fix.

Key Reasons Probate Is Necessary

Debt payment is probably the most important reason probate exists. The court makes sure all legitimate debts get paid before anyone receives their inheritance. This protects you from suddenly finding that Uncle Bob’s credit card company expects you to cover his $50,000 balance just because you inherited his house.

Title transfer creates another essential function. You can’t just walk into a bank with a death certificate and expect them to hand over someone’s life savings. Real estate, vehicles, investment accounts – they all need proper legal authority to change ownership.

Creditor claims get handled systematically during probate, creating a formal deadline for anyone owed money to speak up. Once that period expires, beneficiaries can rest easy knowing they won’t face surprise claims years down the road.

Alternatives to Formal Probate

Not every situation requires the full probate treatment. Texas offers several shortcuts for simpler estates.

Small Estate Affidavit works beautifully for estates under $75,000 where everyone gets along. Instead of months of court supervision, all beneficiaries sign an affidavit and assets can transfer within weeks.

Affidavit of Heirship helps when someone dies without a will but owns real estate. This document gives title companies the paperwork they need to transfer property ownership.

Transfer-on-Death designations represent the ultimate probate avoidance strategy. Bank accounts, investment portfolios, and even real estate can be set up to automatically transfer when someone dies.

Top Services Every Probate Lawyer Houston Texas Offers

Finding the right probate lawyer houston texas means understanding what services you actually need. After four decades of helping Houston families, we’ve seen how the right legal support can transform a potentially overwhelming process into something manageable.

Independent Administration is what most Houston families choose, and for good reason. Your executor gets to handle the estate without constantly asking the court for permission to pay bills or sell assets. It’s faster, costs less, and gives your family more control over the timeline.

When courts require Dependent Administration, it usually means there’s no will naming an independent executor, or family members can’t agree on how things should be handled. It involves more court supervision and paperwork, but sometimes that extra oversight helps keep peace in the family.

Small Estate Affidavit services can be a lifesaver for families dealing with smaller estates under $75,000. Instead of months of probate proceedings, you might wrap everything up in just a few weeks.

Heirship Determination becomes necessary when someone dies without a will and the family needs to legally establish who inherits what. This involves gathering family records, interviewing relatives, and presenting evidence to the court about family relationships.

Not every probate attorney handles Probate Litigation, but when family disputes arise, you need someone who’s comfortable in a courtroom. Will contests, executor disputes, and inheritance fights require a different skill set than routine probate administration.

Guardianship proceedings help families care for adults who can no longer manage their own affairs due to illness or disability. While technically separate from probate, these cases often overlap when families are dealing with multiple challenges at once.

For comprehensive guidance on these services, visit Houston Probate Attorneys: Your Guide to Legal Services.

When Is a Probate Lawyer Houston Texas Required?

Texas law doesn’t technically require you to hire an attorney for probate, but that’s a bit like saying you don’t technically need a mechanic to rebuild your car engine.

Will contests always demand professional representation. When someone challenges whether a will is valid, you’re not just dealing with paperwork anymore – you’re in a legal battle that can drag on for years.

Real property transfers involve layers of title requirements that can create expensive problems down the road. We’ve seen families struggle to sell inherited property years later because the probate paperwork wasn’t handled correctly the first time.

Contested estates where beneficiaries disagree need someone who understands both the legal framework and family dynamics. Many disputes can be resolved through skilled negotiation before they explode into expensive litigation.

How Much Does a Probate Lawyer Houston Texas Cost?

Houston probate attorneys typically structure their fees in three ways:

Flat fees work beautifully for straightforward cases where there’s a valid will and everyone gets along. Most experienced attorneys charge under $4,000 for simple independent administration, giving you cost certainty when everything else feels uncertain.

Hourly fees make more sense for complex cases where it’s impossible to predict how much time will be needed. Experienced Houston probate attorneys typically charge $300-500 per hour.

Contingency fees primarily apply to probate litigation where the attorney’s payment depends on what they recover for you. This arrangement aligns the attorney’s interests with yours – they only get paid if you win.

For detailed information about fee arrangements, check out Who Pays Probate Attorney Fees in Texas?

How Long Does the Process Take?

Most Houston probate cases wrap up in six to twelve months, but several factors influence this timeline.

Simple cases with valid wills and cooperative families often close in six to eight months. The executor files paperwork, sends required notices, pays legitimate debts, and distributes assets according to the will’s instructions.

Complex estates involving business interests, multiple properties, or significant tax issues typically take twelve to eighteen months or longer. These cases need extra time for professional asset appraisals, tax return preparation, and sometimes ongoing business management.

Disputed cases throw the timeline out the window entirely. Will contests, executor removal proceedings, or beneficiary fights can extend probate for years. However, many disputes resolve through mediation or settlement negotiations before reaching trial.

Choosing Your Houston Probate Powerhouse

Finding the right probate lawyer houston texas feels a bit like dating – you need someone you can trust during one of life’s most stressful times.

Start by looking at credentials and board certification. Texas offers board certification in Estate Planning and Probate Law, which is like a gold star for attorneys who’ve proven their knowledge through rigorous testing. While not every great attorney has this certification, it’s definitely a good sign when they do.

Local experience matters more than you might think. Houston’s Harris County has its own quirks, procedures, and unwritten rules. An attorney who knows which judge prefers detailed briefs versus bullet points can save you weeks of delays.

Pay close attention to communication style during your initial meeting. If an attorney talks over your head with legal jargon or makes you feel rushed, imagine how you’ll feel six months into the process. You want someone who explains things clearly and checks to make sure you understand.

Client reviews tell the real story, but don’t just read the five-star reviews. Look at how attorneys respond to complaints and whether the criticism seems fair. A few negative reviews aren’t necessarily deal-breakers, but patterns of poor communication or hidden fees should raise red flags.

| Fee Model | Best For | Typical Cost | Pros | Cons |

|---|---|---|---|---|

| Flat Fee | Simple probate with will | Under $4,000 | Cost certainty, faster resolution | May not cover complications |

| Hourly | Complex or contested cases | $300-500/hour | Flexible, covers all issues | Unpredictable total cost |

| Contingency | Probate litigation | 33-40% of recovery | No upfront cost | Only applies to recovery cases |

Must-Ask Questions Before Signing

Before you sign anything, ask these questions:

“How many years have you been practicing probate law specifically?” You want someone who handles probate regularly, not someone who took one estate planning class in law school and calls themselves a probate attorney.

“Do you offer remote options for meetings and document signing?” The world changed after 2020, and smart attorneys adapted. Being able to handle routine matters via video call or electronic signature can save you hours of driving downtown.

“How will you keep me updated on case progress?” Some attorneys provide online portals where you can check your case status anytime. Others prefer regular phone calls or detailed email updates. Neither approach is wrong, but you need to know what to expect.

“What’s your typical timeline for cases like mine?” An experienced attorney should be able to give you realistic expectations based on your specific situation.

Red Flags to Avoid

Some warning signs should make you run:

Lack of inventory or asset discussion during your consultation suggests the attorney doesn’t understand what they’re getting into. A thorough attorney will ask detailed questions about assets, debts, and family dynamics before quoting fees or timelines.

Poor communication during the courtship phase only gets worse after you’re married to the relationship. If they don’t return calls promptly or seem distracted during your consultation, imagine how responsive they’ll be when you have urgent questions six months from now.

Hidden fees or vague pricing are relationship killers. Reputable attorneys provide clear, written fee agreements that explain exactly what’s included and what might cost extra.

Common Probate Pitfalls & How Lawyers Resolve Them

Nobody expects probate to be simple, but some complications can turn a straightforward process into a family nightmare. The good news? Most problems have solutions when you work with an experienced probate lawyer houston texas.

Will contests represent one of the most emotionally charged situations families face. Maybe Uncle Bob suddenly claims Dad wasn’t mentally capable when he signed the will, or a distant relative appears claiming undue influence. These disputes can freeze an entire estate for months or years while families argue in court.

Smart attorneys tackle will contests by building strong evidence early. They gather medical records showing mental capacity, interview witnesses who were present during will signing, and sometimes bring in handwriting experts or medical professionals to testify.

Executor misconduct creates another common headache. Sometimes well-meaning family members get overwhelmed and stop communicating. Other times, executors help themselves to estate assets or make decisions that benefit them personally rather than following the will’s instructions.

When executors go rogue, attorneys have several tools available. They can petition the court for detailed accounting of all transactions, demand removal of the problematic executor, and even pursue recovery of stolen or misused assets.

Inheritance theft often happens before families even realize there’s a problem. Someone empties Mom’s bank account the day after the funeral, or valuable jewelry mysteriously disappears from the house. These situations require immediate action because trails get cold quickly.

Experienced attorneys use asset tracing techniques to follow the money and recover stolen property. They work with forensic accountants when necessary and aren’t afraid to pursue civil litigation against family members who take what doesn’t belong to them.

Creditor claims can surprise families who thought they understood the estate’s financial situation. Sometimes legitimate creditors appear with valid debts, but other times questionable claims pop up from companies trying to collect money that isn’t really owed.

A skilled attorney reviews every creditor claim carefully, challenges invalid demands, and negotiates payment terms when the estate can’t cover all debts immediately.

For cases involving serious disputes or complex litigation issues, working with an Estate Litigation Attorney Houston who focuses specifically on contested probate matters can make all the difference.

What Beneficiaries Can Do If the Executor Delays

Waiting months for updates from an unresponsive executor feels incredibly frustrating, especially when you’re trying to move forward after losing someone you love. Fortunately, Texas law gives beneficiaries real tools to hold executors accountable.

Requesting formal accounting represents your strongest legal weapon. Every beneficiary has the right to demand detailed records showing exactly what assets exist, how money has been spent, and what steps the executor has taken.

Sending certified letters creates an important paper trail that proves you’ve tried to communicate. Document every phone call, email, and meeting attempt. When you eventually need to ask the court for help, this evidence shows you made reasonable efforts to resolve problems outside of court.

Filing court petitions gives you direct access to the judge overseeing the probate case. The court can order the executor to provide information, meet specific deadlines, or explain why they haven’t fulfilled their duties.

Preventing Future Disputes Through Planning

The smartest families learn from probate challenges and take steps to prevent similar problems in the future.

Living trusts offer one of the most effective ways to avoid probate entirely. Assets placed in properly funded trusts transfer directly to beneficiaries without court supervision. The key with trusts is making sure they’re properly funded during your lifetime.

Beneficiary designations on retirement accounts, life insurance policies, and bank accounts create automatic transfers that bypass probate completely. These designations take precedence over will instructions, so keeping them current is crucial.

Joint ownership with rights of survivorship automatically transfers property to surviving owners without any probate involvement. This works well for married couples and some family situations, though it requires careful consideration of tax implications.

Frequently Asked Questions about Houston Probate Lawyers

When families first contact our office, they often have the same concerns about the probate process. After helping Houston families for years, we’ve learned that addressing these common questions upfront helps reduce anxiety during an already difficult time.

Do I Need to Attend Court in Person?

The good news is that Houston’s probate courts have acceptd technology, making the process much more convenient for grieving families. Remote hearings are now available for most routine probate matters, so you can participate from the comfort of your home.

E-filing systems allow your probate lawyer houston texas to submit documents electronically, which means fewer trips to the courthouse for paperwork. This digital approach has streamlined the entire process and reduced delays that used to plague probate cases.

However, some situations still require your physical presence. Contested hearings where disputes need resolution often require in-person attendance. Final distribution hearings may also need your presence, especially if the judge wants to verify your identity before authorizing large asset transfers.

What Documents Should I Bring to My First Meeting?

Coming prepared to your first consultation helps your attorney understand your situation quickly and provide better guidance.

The death certificate is absolutely essential – you’ll need multiple certified copies throughout the probate process. Banks, insurance companies, and the court all require original certified copies, not photocopies.

The original will must be presented to the court if one exists. Copies won’t work for probate filing, so locate that original document. If you can’t find it, don’t panic – your attorney can help determine if a copy might be acceptable or if other legal options exist.

Asset information helps your attorney understand the estate’s scope. Bring recent bank statements, investment account summaries, real estate deeds, and vehicle titles. Don’t worry about organizing everything perfectly – your attorney can help sort through the paperwork.

Debt documentation is equally important. Gather information about mortgages, credit card balances, medical bills, and any other outstanding obligations.

Can Probate Be Avoided Altogether?

This is probably the most common question we hear, and the answer is yes – with proper advance planning, many estates can bypass probate entirely. However, this requires setting up the right legal structures before death occurs.

Living trusts are the most comprehensive probate avoidance tool. Assets placed in a properly funded trust pass directly to beneficiaries according to the trust terms, without court involvement.

Payable-on-death accounts and transfer-on-death designations work well for financial accounts and investment portfolios. These designations allow assets to transfer directly to named beneficiaries, bypassing probate completely.

Beneficiary deeds for real estate have become increasingly popular in Texas. These deeds allow property to transfer automatically to designated beneficiaries upon death, avoiding the need for probate court involvement.

The key is comprehensive planning that addresses all assets and potential issues. Partial probate avoidance can sometimes create more problems than it solves, so it’s important to work with an experienced attorney who understands how all these strategies work together.

Conclusion

Finding the right probate lawyer houston texas doesn’t have to feel like searching for a needle in a haystack. Throughout this guide, we’ve walked through everything you need to know to make this important decision with confidence during an already difficult time.

The reality is that Houston has plenty of qualified attorneys, but the difference between a good outcome and a great one often comes down to finding someone who truly understands your situation. The best probate attorneys don’t just know the law – they know how to guide families through grief while protecting their interests.

Here’s what matters most when making your choice: Look for attorneys who specialize in probate rather than general practitioners. Expect transparent pricing, typically under $4,000 for straightforward cases with flat-fee arrangements. Plan for a 6-12 month timeline in most situations, and remember that early legal guidance prevents small issues from snowballing into expensive problems.

Most importantly, trust your instincts about communication style. You’ll be working closely with your attorney during a vulnerable time, so choose someone who explains things clearly and makes you feel heard.

At Texas Probate Attorney, Keith Morris and Stacy Kelly understand that probate is deeply personal. It’s about honoring someone you loved while making sure your family is protected. With over 40 years of combined experience helping Texas families, we’ve learned that every case is unique, even when the legal steps look similar on paper.

We believe in straight talk, fair pricing, and treating every family with the respect they deserve. Whether you’re dealing with a simple estate or family conflicts that threaten to tear everyone apart, we’re here to provide both the legal knowledge and emotional support you need.

The next step is easier than you might think. We offer free consultations because we know you need to understand your options before making any commitments. No pressure, no sales pitch – just honest answers to your questions.

Ready to move forward? Schedule your Free Consultation Probate Attorney session today. Let’s talk about your situation and create a plan that brings you peace of mind.

You don’t have to handle this alone. The right legal guidance can transform what feels overwhelming into a manageable process that honors your loved one’s memory while protecting your family’s future.