Probate Attorney Fees Who’s Really Paying the Piper?

Who Really Foots the Bill for Probate Attorney Fees in Texas?

When a loved one passes away in Houston, Fort Worth, or Austin, who pays probate attorney fees becomes a pressing concern for grieving families.

Quick Answer:

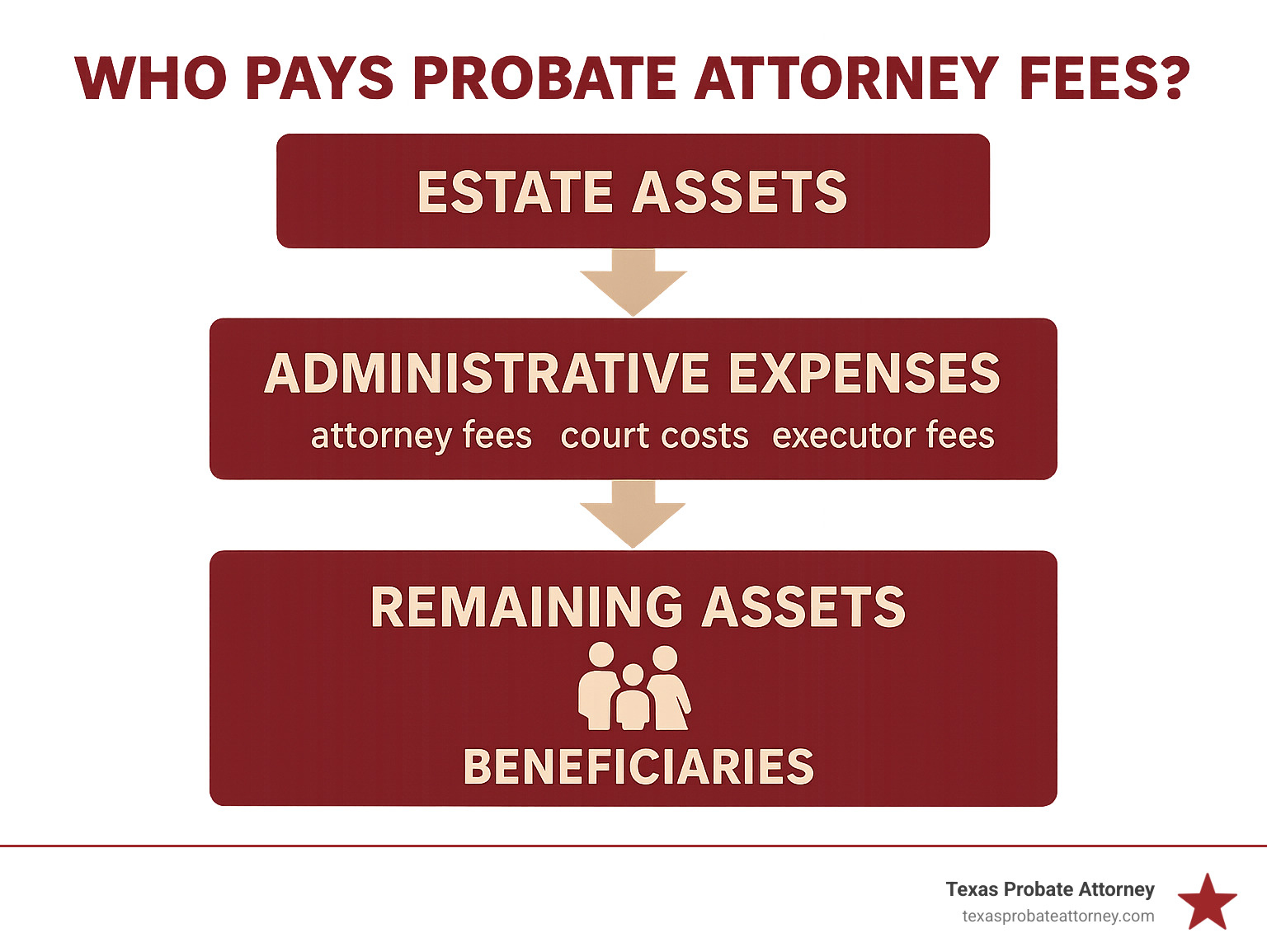

- The estate pays – Attorney fees come from the deceased person’s assets before distribution to beneficiaries.

- Not the executor personally – The person managing the estate isn’t responsible for fees out of their own pocket.

- Beneficiaries are indirectly affected – Fees reduce the total inheritance amount.

- Exceptions exist – In disputes like contested wills, the challenging party may pay their own legal costs.

The probate process can feel overwhelming. As one Texas executor recently shared: “I thought I’d have to pay thousands in legal fees myself, but learning the estate covers these costs was such a relief during an already difficult time.”

In Texas, probate attorney fees typically range from $250 to $400 per hour, with total costs often falling between 3% to 7% of the estate’s value. For a $500,000 estate, you might expect $15,000 to $35,000 in total probate expenses.

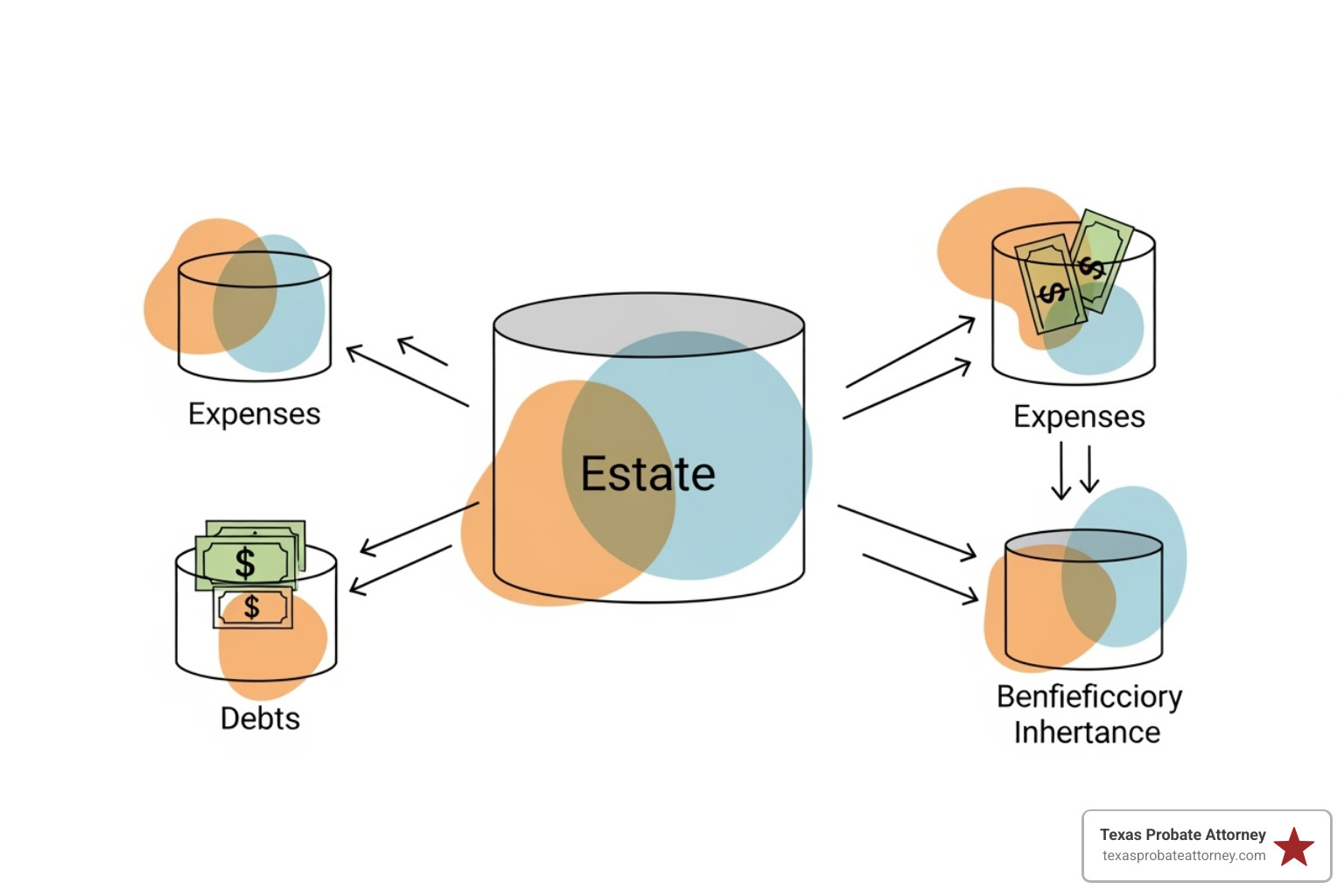

The estate acts as a business entity that must settle its debts—including legal fees—before anyone receives their inheritance. This system protects family members from financial burdens while ensuring proper legal representation during the probate process.

Simple guide to who pays probate attorney fees terms:

The Simple Answer: The Estate Pays for Probate

In Texas, the answer to who pays probate attorney fees is straightforward: the estate pays. When a person passes away, their estate uses its own assets to cover all administrative expenses, including legal fees, court filing costs, and property appraisals. This system ensures that the executor, administrator, or beneficiaries do not have to pay these costs from their own pockets.

This approach protects families in Houston, Fort Worth, and Austin from unexpected financial stress. As one Houston executor told us, “I was worried I’d have to come up with thousands of dollars myself, but when I learned the estate handles these costs, it was like a weight lifted off my shoulders.”

Understanding the costs associated with probate helps families feel more confident about the process.

How Probate Fees Impact Beneficiaries

While beneficiaries don’t pay directly, these fees do impact them. Every dollar spent on administrative costs reduces the total value of the estate, which in turn decreases the final inheritance amount distributed. For example, if a $400,000 estate in Austin incurs $25,000 in probate costs, the beneficiaries will share the remaining $375,000. The reduction happens automatically as part of settling the estate—no one receives a separate bill.

This creates a fiduciary duty for the executor or administrator to spend the estate’s money wisely and keep costs reasonable. A skilled probate attorney can often save the estate money by avoiding costly mistakes and resolving issues efficiently, preserving more of the inheritance for beneficiaries.

How Texas Probate Attorneys Calculate Their Fees

Understanding who pays probate attorney fees also involves knowing how they are calculated. Unlike some states with statutory fee schedules, Texas probate attorney fees are not set by a fixed percentage. Instead, they are based on what is “reasonable and necessary” for the work performed in Houston, Fort Worth, or Austin.

Key factors that influence the total cost include the estate’s value and complexity, the specific legal services required (e.g., simple administration vs. a will contest), the attorney’s experience, and the time needed to complete the probate process. A large, complex estate will naturally cost more to probate than a simple one.

At our firm, we believe in transparency and take the time to explain the process clearly, helping families in Houston, Fort Worth, and Austin understand the factors affecting their costs.

Common Fee Structures in Texas

Probate attorneys in Texas typically use one of the following fee structures:

| Fee Structure | Pros | Cons | When Typically Used |

|---|---|---|---|

| Hourly Rates | Pay only for time spent; transparent tracking | Final total is uncertain; can add up quickly | Complex or contested estates; when scope of work is unclear |

| Flat Fees | Know total cost upfront; budget certainty | May not cover unexpected issues; less flexible | Simple, uncontested probates; routine administrations |

| Percentage-Based Fees | Aligns attorney interests with estate value | Can be expensive on large estates; less common in Texas | Large estates; full-service administration |

Hourly rates in Texas typically range from $250 to $400. Flat fees for a simple independent administration might range from $3,000 to $8,000. Percentage-based fees, while less common, might be 3% to 7% of the estate’s value. We work with each family to determine the best fee structure for their situation.

The Court’s Role in Approving Fees

In Texas, the probate court ensures all attorney fees are “reasonable and necessary.” In a dependent administration, where court supervision is high, the judge must approve all fees before payment. This provides an extra layer of protection for the estate.

In an independent administration, which is more common and efficient, the executor can pay attorney fees without prior court approval. However, beneficiaries can still challenge those fees in court if they believe them to be unreasonable. If a court agrees, it can order a refund to the estate.

Under the Texas Estate Code fee classifications, attorney fees are a high-priority “Class 2” claim, paid after funeral and burial expenses but before most other unsecured debts. This underscores the importance of legal assistance in properly administering an estate.

Who Pays Probate Attorney Fees When Things Get Complicated?

While the estate usually pays, the question of who pays probate attorney fees can become complex during disputes or when funds are low. When complications arise in Houston, Fort Worth, or Austin, understanding who bears the financial responsibility is crucial.

When an Executor Pays Upfront and Seeks Reimbursement

An executor may occasionally need to pay for initial expenses, like legal fees, out-of-pocket if the estate lacks immediate liquid funds. To be reimbursed, the executor must keep meticulous records and file a formal claim with the estate. It is always best to get approval from the probate attorney or court before making significant personal payments to avoid any potential liability or disputes.

This is a key part of the Role of the executor or administrator, which includes a fiduciary responsibility to manage estate funds carefully.

Who Pays Probate Attorney Fees in a Will Contest?

In a will contest, the rules for who pays legal fees change:

- The Challenger: The person contesting the will pays their own legal fees. If they win, the court may award them fees from the estate, but this is not guaranteed. If they lose, they bear all their own costs.

- The Estate: The executor uses estate funds to pay the attorney fees required to defend the will. This is considered a necessary administrative expense to uphold the deceased’s wishes.

Be aware of “no-contest” clauses in wills, which can cause a beneficiary to lose their inheritance if they unsuccessfully challenge the will. However, Texas courts may not enforce this if the challenge was brought in good faith and with probable cause.

Who Pays Probate Attorney Fees if the Estate Can’t Afford It?

If an estate is insolvent (lacks funds to pay all its debts), Texas law dictates the payment priority. Attorney fees are classified as “Class 2” claims, meaning they are paid after funeral expenses and expenses of last sickness but before most general creditors.

If there still isn’t enough money to cover legal fees, an attorney may offer a payment plan. In some cases involving minimal assets in Houston, Fort Worth, or Austin, we might advise that formal probate is not beneficial and that simpler, less costly alternatives are available. Our priority is to find a practical solution for the family, not to add to their burdens.

Your Guide to Managing and Minimizing Attorney Fees in Texas

While the estate pays the legal bills, the executor and beneficiaries can take steps to manage and minimize these costs. Being organized and proactive can significantly reduce the attorney’s time, saving the estate money. For estates in Houston, Fort Worth, or Austin, this means more of the inheritance is preserved for the family.

One Fort Worth executor told us, “I wish I’d known how much my preparation would save us. Getting all the documents together before our first meeting cut our legal time in half.”

Strategies for Cost Control

Here are effective strategies to control probate costs in Houston, Fort Worth, and Austin:

- Get a Written Fee Agreement: Always get a clear, written agreement detailing the fee structure (hourly, flat, etc.) and any other potential costs. This is a critical first step with any attorney in Houston, Fort Worth, or Austin to ensure there are no surprises.

- Organize Documents: Before meeting your attorney, gather the will, death certificate, bank statements, property deeds, and debt information. Presenting an organized file to your attorney in Houston, Fort Worth, or Austin saves them billable hours, which directly reduces the estate’s costs.

- Communicate Efficiently: To control hourly billing common in the Houston, Fort Worth, and Austin legal markets, group questions into a single email or phone call instead of multiple contacts throughout the day.

- Review Bills: Regularly review billing statements and ask questions about any charges you don’t understand. We believe in complete transparency with our clients across Houston, Fort Worth, and Austin.

- Consider Mediation: For family disputes, mediation is often a faster, less expensive alternative to litigation in Houston, Fort Worth, or Austin.

- Explore Alternatives to Probate: For Texas estates under $75,000 (excluding homestead), a Small Estate Affidavit may bypass formal probate. Assets with beneficiary designations or in a living trust also avoid probate, eliminating many attorney fees.

- Choose the Right Attorney: An experienced attorney may have a higher hourly rate but can often resolve matters more efficiently, saving money in the long run. With over 40 years of combined experience in Texas probate, we focus on quick, effective resolutions for our clients in Houston, Fort Worth, and Austin.

Following these strategies can empower you to manage the financial aspects of your Houston, Fort Worth, or Austin probate case with confidence.

Frequently Asked Questions about Probate Fees in Texas

We often hear similar questions from families in Houston, Fort Worth, and Austin concerning who pays probate attorney fees. Here are some of the most common ones:

How much does an estate have to be worth to go to probate in Texas?

In Texas, formal probate is generally required if the estate’s probate assets are valued at $75,000 or more. This amount excludes non-probate assets like life insurance with a named beneficiary, accounts with a Payable-on-Death (POD) designation, or property held in a living trust.

For estates under $75,000 (excluding the homestead and other exempt property), a simpler process called a Small Estate Affidavit may be an option. This can significantly reduce or eliminate the need for formal probate and its associated attorney fees.

Can an executor pay themselves from the estate in Texas?

Yes, Texas law allows executors to receive reasonable compensation from the estate for their work. The standard commission is up to 5% of the gross value of funds the executor actually receives or pays out, though certain assets like cash on hand or life insurance proceeds are excluded from this calculation.

This compensation must be approved by the probate court as part of the estate accounting. The court can reduce or deny compensation if the executor has not managed the estate prudently. We advise executors to keep detailed records to ensure their compensation is transparent and justifiable.

Can an heir challenge the attorney fees in a Texas probate case?

Absolutely. Heirs and other interested parties in Texas have the right to challenge attorney fees they believe are unreasonable or unnecessary. To do so, they must file a formal objection with the probate court, which may lead to a hearing.

The challenger has the burden of proving the fees are excessive. If the court agrees, it can order the attorney to refund the unreasonable portion to the estate. This important safeguard ensures that more assets are preserved for the beneficiaries in Houston, Fort Worth, and Austin.

Conclusion

Navigating the probate process can be challenging, but understanding who pays probate attorney fees shouldn’t add to your stress. In Texas, the rule is simple: the estate pays for its own administration, protecting you and your family from personal financial liability.

While these fees reduce the final inheritance, you can help control costs by being organized, communicating efficiently, and working with the right legal team. For families in Houston, Fort Worth, and Austin, managing these expenses wisely ensures more of the estate is preserved for its intended beneficiaries.

The probate process doesn’t have to be a source of confusion. With over 40 years of combined experience, our firm provides the personalized attention needed to handle these financial details with confidence. We focus on efficient resolutions to protect your family’s assets and honor your loved one’s legacy.

The personalized attention offered by Texas Probate Attorney can help you manage these financial details with confidence. Every estate is unique, and we are ready to help you understand your options and protect your interests.