Texas Probate Claims—Your Independent Administration Survival Guide

Related Posts

Why Claims in Independent Administration Texas Can Make or Break Your Estate

In Texas, claims in independent administration follow a unique set of rules that differ from supervised probate. For executors and creditors handling estates in Houston, Fort Worth, or Austin, understanding these procedures is essential to avoid costly mistakes and personal liability.

Quick Answer for Claims in Independent Administration Texas:

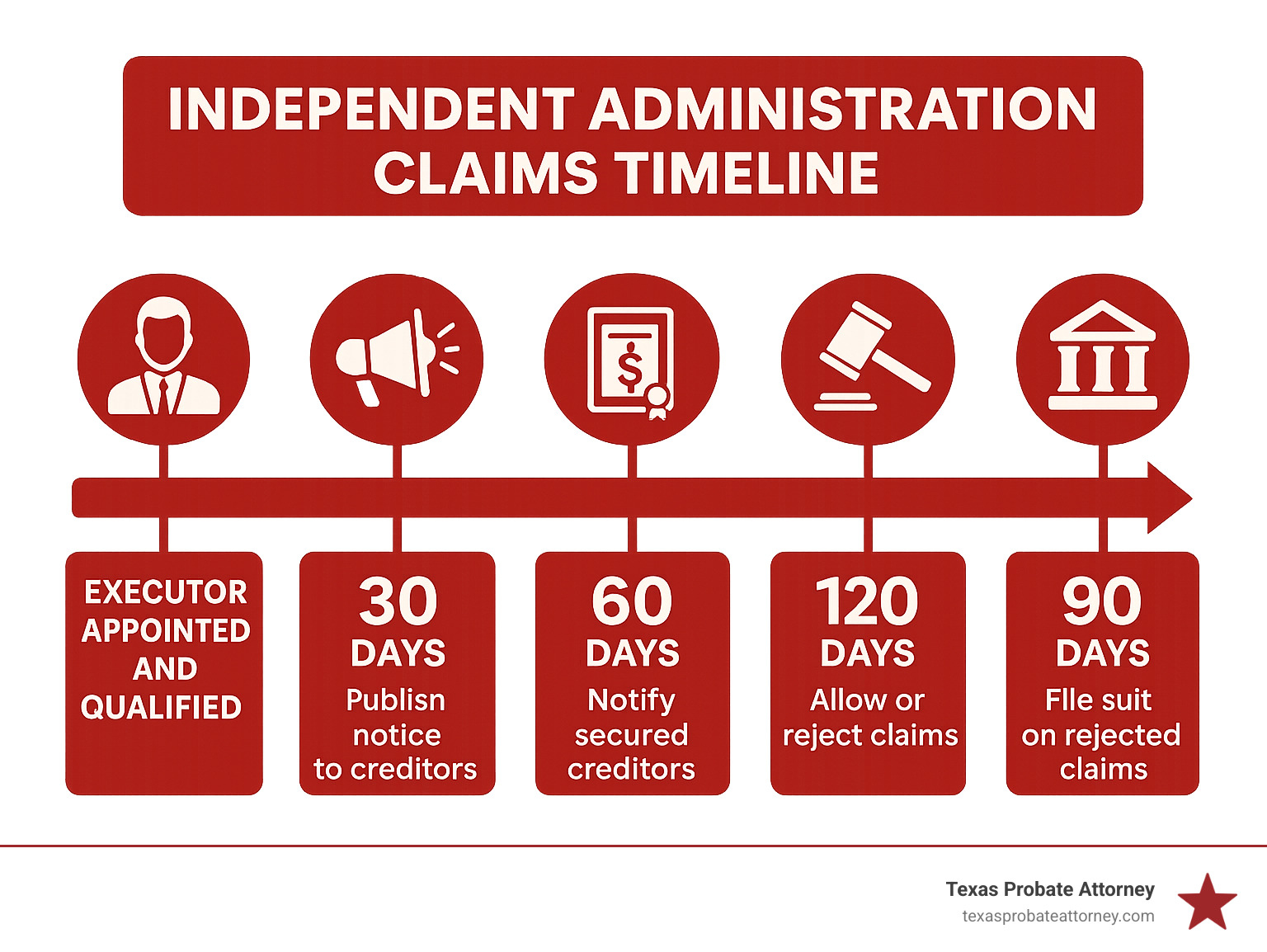

- Notice Deadlines: Executors must publish notice to creditors within 30 days and notify secured creditors within 60 days.

- Claim Presentation: Claims can be presented via written instruments, certified mail, or court filings.

- Executor Authority: No formal court approval is needed for most claim decisions.

- Secured Creditors: Must elect either “matured secured claim” or “preferred debt and lien” status.

- Tolling Limitations: The statute of limitations is only paused by the executor’s written approval or by filing a lawsuit.

- Barring Claims: Missing deadlines can permanently bar otherwise valid claims.

Unlike dependent administration, where a judge oversees every decision, independent administration grants executors broad authority to manage claims without court approval. This freedom comes with significant responsibility. The Texas Estates Code sets specific deadlines that both executors and creditors must follow. A missed notice can make an executor personally liable, while a creditor’s failure to properly present a claim can extinguish their right to payment.

Most estates in Harris, Tarrant, and Travis counties use independent administration for its efficiency and lower cost. However, this efficiency demands precision, especially given the procedural requirements established by Texas law.

Related content about claims in independent administration texas:

- duties of independent administrator texas

- independent administration texas estates code

- what is an independent administrator in texas

The Lay of the Land: Independent vs. Dependent Administration

When a person passes away in Texas, their estate goes through probate to gather assets, pay debts, and distribute the remainder. Texas offers two primary paths: independent administration and dependent administration. Understanding their differences is key to navigating claims in independent administration Texas for estates in Houston, Fort Worth, and Austin.

Think of independent administration as a smoother, less supervised journey, while dependent administration involves frequent court checkpoints and approvals.

In an independent administration, the appointed executor manages the estate with minimal court supervision. They can sell property, pay debts, and distribute assets without seeking a judge’s permission for each action. This authority is granted by the Texas Estates Code, particularly Section 402.002, which allows them to act independently.

Dependent administration, conversely, requires continuous court oversight. Every significant decision needs a petition, a hearing, and a judge’s order, making the process longer and more expensive. It is typically used for contentious or complex estates. The choice of administration type directly impacts how creditor claims are handled.

Why Independent Administration is Preferred in Houston, Fort Worth, and Austin

Independent administration is the most common method for probating estates in Houston, Fort Worth, and Austin due to its efficiency, cost-effectiveness, and flexibility.

It can be established in two ways:

- By Will Provision: If the will names an independent executor, the court typically grants independent administration.

- By Distributee Consent: If there is no will or the will is silent on the matter, all heirs can agree in writing to an independent administration.

The primary advantages for estates in these metropolitan areas include:

- Reduced Court Involvement: In busy probate courts like those in Harris, Tarrant, and Travis counties, minimizing court appearances saves significant time.

- Faster Estate Settlement: Without needing court approval for every action, the process moves much more quickly, a major benefit for estates in the dynamic real estate and business environments of Houston, Fort Worth, and Austin.

- Lower Administrative Costs: Fewer court filings and attorney appearances in Houston, Fort Worth, or Austin courts translate to lower fees and expenses.

- Flexibility: The executor can adapt to the estate’s needs—like selling a property in a fluctuating market—without being tied to rigid court schedules in Harris, Tarrant, or Travis County.

These benefits make independent administration the preferred choice for most uncontested estates in the Houston, Fort Worth, and Austin areas.

Key Differences in Handling Creditor Claims

The handling of claims in independent administration Texas differs significantly from dependent administration, primarily in the level of court involvement.

In a dependent administration, the court approves nearly every step of the claims process. Claims are filed on a court-managed “claim docket,” and a creditor has a strict 90-day window to sue on a rejected claim.

In an independent administration:

- No Formal Court Approval: The executor can allow or reject claims without a judge’s approval.

- Different Presentment Rules: The formal presentment requirements are less rigid. A creditor can often sue the executor directly without first filing a claim with the court.

- No Claim Docket: There is no court-maintained claim docket.

- Barring Claims: The automatic 90-day bar on rejected claims does not apply unless the executor takes specific steps to trigger it.

This table highlights the key distinctions:

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Approval | Minimal; executor acts independently | Required for most claim decisions |

| Claim Docket | Not applicable | Court-maintained |

| Formal Presentment | Not strictly required; can sue executor directly | Required; claim filed with court or presented to representative |

| Suit on Rejected Claim | Not automatically barred after 90 days of rejection | Must sue within 90 days of rejection or claim is barred |

| Statute of Limitations | Tolled only by written approval, existing suit, or suit against executor | Tolled by proper presentment or suit |

Knowing these differences is crucial for both executors and creditors in Houston, Fort Worth, and Austin.

The Executor’s Playbook: Handling Claims in Independent Administration Texas

As an independent executor in Houston, Fort Worth, or Austin, you have a fiduciary duty to protect the estate’s assets and the beneficiaries’ inheritance. This requires carefully managing finances and handling creditor claims according to the law.

Your duties include managing assets, paying debts in the correct priority, communicating with creditors, and avoiding personal liability. Improperly handling claims can make you personally liable for damages. Following a clear playbook is essential.

Step 1: Giving Proper Notice to Creditors

Properly notifying creditors about claims in independent administration Texas is a legal requirement. Failure to do so can result in personal liability for the executor.

There are three types of notices to consider:

- Published Notice: You must publish a general notice to all creditors in a newspaper in the county of administration (e.g., Harris, Tarrant, or Travis) within 30 days of qualifying as executor. This serves as a broad announcement.

- Notice to Secured Creditors: You must send notice by registered or certified mail to each known secured creditor within 60 days of qualifying. This provides direct notice to creditors with liens on estate property, like a mortgage holder.

- Permissive Notice to Unsecured Creditors: You may send notice by certified mail to known unsecured creditors (e.g., credit card companies). This is highly recommended, as it requires them to present their claim within 121 days of receiving the notice, or the claim can be barred. This helps finalize the estate’s debts quickly.

Always file proof of publication and delivery with the court clerk. You can find notice requirements in the Texas Estates Code. Prompt and correct notice is vital for an efficient administration.

Step 2: Responding to Presented Claims

Once claims are presented, you must decide whether to allow or reject them. This is a critical decision for an executor in Houston, Fort Worth, or Austin.

- Allowance: If a claim is valid, properly presented, and not barred by limitations, you can allow it.

- Rejection: If a claim is invalid or improperly presented, you should reject it. Keep a record of your reasons.

- Inaction (Deemed Rejection): Failing to act on a claim within 30 days is generally considered a rejection. However, a formal, written decision is better practice to avoid ambiguity.

Approving an invalid claim could make you liable to the beneficiaries, while improperly handling a valid claim could make you liable to the creditor. Careful review and timely action are essential.

Step 3: Paying Valid Debts and Special Claims

Allowed claims must be paid according to a strict order of priority set by Texas law. This is especially important if the estate is insolvent (lacks sufficient funds to pay all debts).

The general priority of claims is as follows:

- Class 1: Funeral expenses and expenses of last sickness (up to $15,000 each).

- Class 2: Administration expenses (executor fees, attorney’s fees, court costs).

- Class 3: Secured claims (e.g., mortgages).

- Class 4: Child support claims.

- Class 5: Claims for taxes.

- Class 6: Claims for confinement costs.

- Class 7: Claims for state medical assistance repayment.

- Class 8: All other unsecured claims.

Important Considerations for Houston, Fort Worth, and Austin Estates:

- Insolvent Estates: You must pay claims strictly in order of classification. You cannot pay a lower-class claim if a higher-class claim is unpaid. Creditors are paid only up to the value of the estate assets.

- Tax Obligations: Federal tax claims (IRS debts) generally take precedence over all other debts and must be handled with extreme care to avoid personal liability.

The Creditor’s Gauntlet: How to Properly Present a Claim

If you are a creditor to an estate being probated in Houston, Fort Worth, or Austin, you have rights, but you must follow strict procedures to present your claim. The Texas Estates Code provides a clear path for claims in independent administration Texas, and failing to follow it can result in your claim being permanently barred by the probate courts in Harris, Tarrant, or Travis County.

As the creditor, the responsibility is on you to properly present your claim to the estate’s representative in Houston, Fort Worth, or Austin. This requires an authenticated claim supported by a sworn affidavit confirming the debt is just and all payments have been credited. You must also include supporting documents like contracts or invoices. Strict deadlines apply, and missing these procedural steps means your claim can be forever barred by the local probate court.

Permissible Methods for Presenting Claims in Independent Administration Texas

Unlike in dependent administrations, claims in independent administration Texas must be presented in specific ways, as clarified in Texas Estates Code Section 403.056. To present your claim to an independent executor in Houston, Fort Worth, or Austin, you have several options:

- Deliver a written statement of the claim to the executor or their attorney, obtaining proof of receipt.

- Send the written claim via certified mail, return receipt requested. The return receipt is your proof of delivery.

- If a lawsuit was pending against the decedent at the time of death, the pleadings in that suit can serve as presentment.

- File a written claim or pleading with the court clerk in the county where the estate is being administered (e.g., Harris, Tarrant, or Travis).

Adhering to one of these methods is vital; otherwise, your claim may be deemed invalid. The procedures were amended by SB 1198.

Special Rules for Secured Creditors: A Critical Choice

If you are a secured creditor (e.g., you hold a mortgage on the decedent’s property), you must make a critical choice about how your claims in independent administration Texas are handled.

Your first option is to classify your claim as a Matured Secured Claim. By choosing this, you are asking for the debt to be paid from the estate’s general funds. The executor is responsible for paying the debt and can sell the secured property to do so. Your claim is paid according to its Class 3 priority. You must elect this status within six months of the executor’s appointment or four months after receiving notice, whichever is later. For real estate, you must also record this election in the deed records of the property’s county (e.g., Harris, Tarrant, or Travis).

Your second option, which is the default if you do not make an election, is a Preferred Debt and Lien. With this choice, you rely solely on your lien on the specific property for payment. The executor is not required to pay the debt from the estate’s general funds. You retain your right to foreclose on the property if the debt is in default. However, you generally cannot begin a nonjudicial foreclosure until six months after the executor is appointed.

This choice has significant consequences for both you and the estate, affecting how the property is handled and whether you can seek payment from other estate assets. It requires careful consideration.

The Ticking Clock: Statutes of Limitation and Barring Claims

Deadlines are critical for claims in independent administration Texas. Missing a deadline can permanently bar a claim, so executors and creditors in Houston, Fort Worth, and Austin must be aware of these time limits.

While general statutes of limitation (e.g., four years for contract debt) still apply, the probate process introduces unique deadlines that can alter these periods.

Key deadlines include:

- The 90-Day Rule for Rejected Claims: In dependent administrations, a creditor has 90 days to sue on a rejected claim. In an independent administration, this 90-day bar does not automatically apply unless the executor takes specific procedural steps to trigger it.

- The 121-Day Bar for Permissive Notice: If an independent executor sends a “permissive notice” to an unsecured creditor, that creditor has only 121 days from receipt of the notice to present their claim. Failure to do so can bar the claim. This is a powerful tool for executors in Houston, Fort Worth, and Austin to expedite estate settlement.

How to Toll the Statute of Limitations on a Claim

“Tolling” means pausing the statute of limitations clock. For claims in independent administration Texas, simply presenting a claim to the executor does not toll the statute. This is a critical difference from dependent administrations and a common trap for creditors.

The statute of limitations is generally only tolled by one of three actions:

- Written Approval of the Claim by the Independent Executor: If the executor formally acknowledges the claim in writing, the clock is paused.

- A Pleading in a Suit Pending at the Decedent’s Death: If a lawsuit over the claim was already in progress when the person died, the statute is tolled within that suit.

- A Suit Brought by the Creditor Against the Independent Executor: Filing a lawsuit directly against the executor in the appropriate court—such as the Harris, Tarrant, or Travis County probate courts—is the most reliable way for a creditor to toll the statute of limitations.

Creditors in Houston, Fort Worth, or Austin who only send a demand letter without getting written approval or filing suit risk having their claim become time-barred.

Consequences of Missing a Deadline for Claims in Independent Administration Texas

For a creditor, missing a deadline for claims in independent administration Texas has severe and final consequences:

- Your Claim is Forever Barred: Once a deadline passes—whether the general statute of limitations or a probate-specific bar—your claim becomes legally unenforceable against the estate.

- Loss of Your Right to Payment: You lose the legal ability to collect the debt from the estate’s assets.

- No Recourse Against the Executor or Heirs: Generally, you cannot pursue the independent executor personally or the heirs for payment of a barred claim.

For creditors dealing with estates in Houston, Fort Worth, or Austin, this highlights the importance of proactive and diligent action. For executors in these areas, understanding these barring mechanisms is key to defending the estate against invalid claims and ensuring assets are distributed only to legitimate creditors and beneficiaries.

Frequently Asked Questions about Texas Probate Claims

Navigating claims in independent administration Texas raises common questions for executors and creditors in Houston, Fort Worth, and Austin. Here are concise answers to some of the most frequent inquiries.

What happens if an independent executor fails to properly handle a claim?

An independent executor in Houston, Fort Worth, or Austin who mishandles a claim can face significant consequences. If an executor fails to give proper notice or wrongfully rejects a valid claim, they could be sued in the local probate court and become personally liable to the creditor for any resulting damages.

Conversely, if an executor approves and pays a fraudulent or time-barred claim, they could face liability to the beneficiaries for diminishing the estate’s value. Beneficiaries in Harris, Tarrant, or Travis County may sue if an executor’s mismanagement harms the estate.

How are child support and IRS tax debts handled?

Child support and IRS tax debts are high-priority claims in Texas probate. Executors in Houston, Fort Worth, or Austin should seek legal advice when these debts arise.

IRS tax debts and other claims of the U.S. government generally have the highest priority. An executor must ensure all federal tax obligations are satisfied to avoid penalties and personal liability.

Child support claims, including current payments and past-due amounts (arrearages), are a Class 4 claim in Texas. This means they are paid after funeral costs, administration expenses, and secured debts, but before most other general, unsecured debts. These claims must be handled carefully according to specific statutory procedures.

Can an executor pay a simple credit card bill without a formal claim being filed?

Yes. An independent executor managing an estate in Houston, Fort Worth, or Austin can pay a debt like a credit card bill even if a formal claim has not been presented, as permitted by Texas Estates Code Section 403.0585.

However, the executor must believe the bill is a valid debt of the estate and must act as a prudent person would in their local community. This includes confirming the debt’s legitimacy and ensuring the estate has sufficient funds to pay it without jeopardizing higher-priority debts. If the executor acts in good faith, they are generally protected from personal liability for paying such a bill.

For larger or questionable debts common in high-value estates in these cities, it is always safer to request a formal, authenticated claim before making payment.

Navigating Probate in Houston, Fort Worth, or Austin?

The process for claims in independent administration Texas is complex. For executors and creditors in Houston, Fort Worth, or Austin, a procedural misstep can lead to personal liability or the forfeiture of a valid claim.

At Texas Probate Attorney, we are familiar with the local rules and procedures of the probate courts in Harris, Tarrant, and Travis counties. We provide dedicated representation to protect your interests and guide you through this intricate legal landscape.

Don’t steer the complexities of Texas probate alone.