Ticking Probate Clock – How Long Do You Have to Contest?

The Urgency of Contesting Probate Time Limits in Texas

Dealing with the loss of a loved one in a busy city like Houston, Fort Worth, or Austin is incredibly difficult. On top of your grief, you might face the complex legal processes of the Harris, Tarrant, or Travis County probate courts. If you have concerns about a will, understanding contesting probate time limits is absolutely critical. Missing these deadlines can mean you lose your chance to challenge the will forever, especially in these high-value environments.

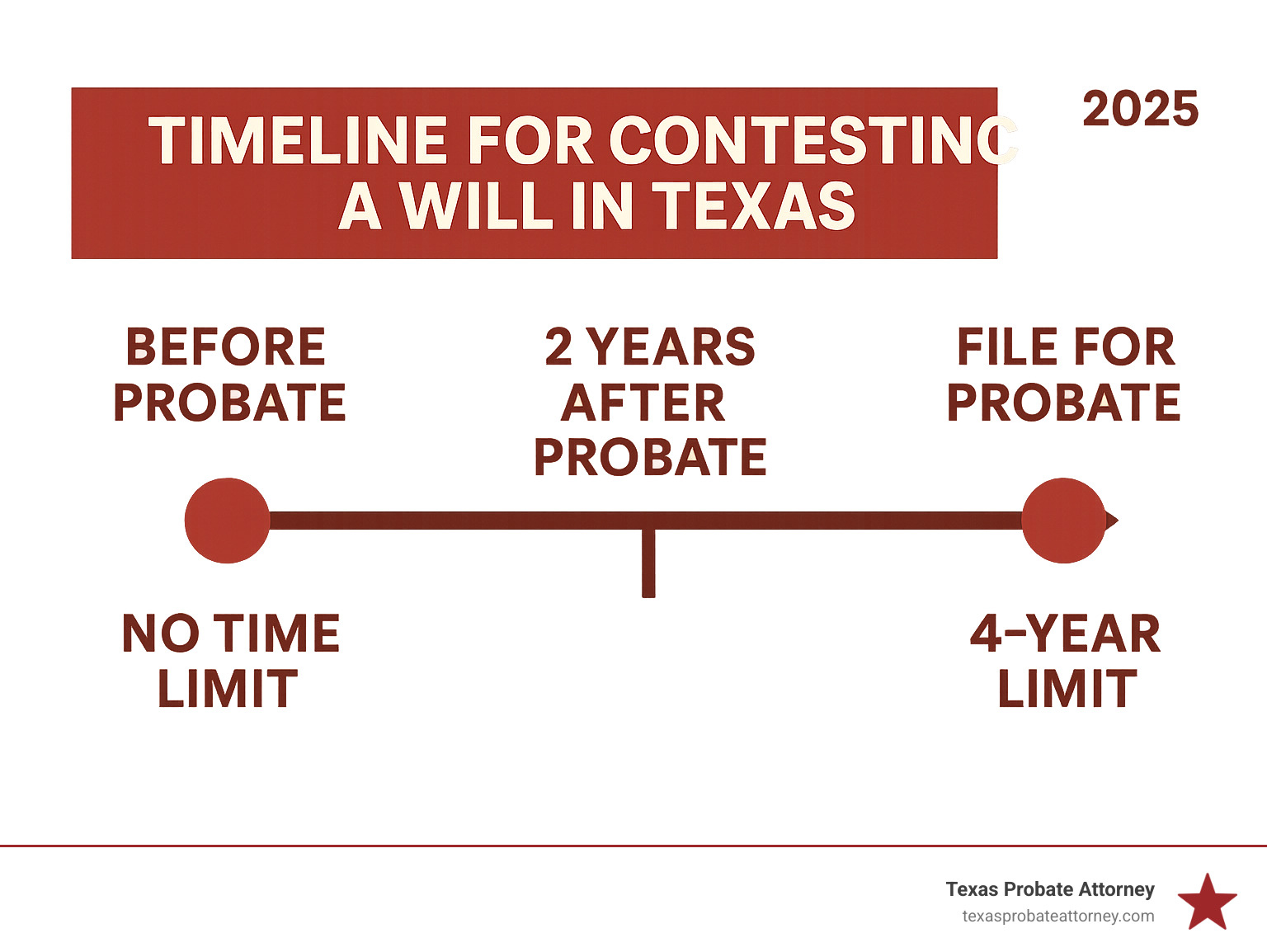

Here’s a quick look at the key time limits for contesting a will in Texas:

- Before the Will is Probated: If the will has not yet been formally accepted by a court in Houston, Fort Worth, or Austin, there is generally no specific deadline to file a contest. You can object before probate begins.

- After the Will is Probated: Once a will has been admitted to probate in Texas, you typically have two years from that date to file a contest. This is a strict deadline.

- Filing for Probate Itself: A will must generally be filed for probate within four years of the person’s death. While this isn’t a contest deadline, it affects when a will can be probated, which then starts the clock for post-probate contests.

These rules apply across Texas, but navigating them in the busy probate courts of Houston, Fort Worth, and Austin presents unique challenges. It’s easy to feel overwhelmed by the pace and complexity, but knowing these timeframes is your first step to protecting your rights and your loved one’s wishes in these major Texas cities.

Understanding the General Time Limit to Contest a Will in Texas

When a loved one passes away, facing the legal process of probate can add a heavy layer to your grief. This is the official court process where a Texas probate court, whether it’s in busy Houston, historic Fort Worth, or vibrant Austin, validates a will and gives authority to the person named as executor to manage the estate. But what if you have a nagging feeling that something isn’t quite right with the will? What if you believe it doesn’t truly reflect your loved one’s final wishes? This is exactly where understanding contesting probate time limits becomes incredibly important.

In Texas, if you want to challenge a will after it has already been accepted by the court, you generally have a strict deadline of two years. This isn’t just a suggestion; it’s a firm rule set by law in the Texas Estates Code § 256.204. While two years might sound like a lot of time, it can fly by when you’re dealing with loss, especially when managing estate matters in a major metropolitan area like Houston, Fort Worth, or Austin. If you miss this crucial deadline, you usually lose your chance to challenge the will, no matter how strong your reasons might have been. That’s why we always tell people: act quickly!

For more detailed information on challenging a will, you can check out our comprehensive guide: More info about contesting a will in Texas.

When Does the Clock Start Ticking?

This is often the trickiest part for families in Houston, Fort Worth, and Austin. In Texas, that two-year clock for challenging a will after it’s been probated doesn’t start on the day your loved one passed away. It doesn’t even start the day you first heard about the will. Instead, it begins ticking from the exact date the will is admitted to probate. This is the moment a judge in a Harris, Tarrant, or Travis County probate court signs the official order, formally accepting the will as valid.

For example, if a Harris County judge signed the Order Probating Will on October 31, 2020, your deadline to file a will contest would be October 30, 2022. Every single day truly counts! This distinction is super important because the probate process itself can sometimes take months, or even longer, depending on how complicated the estate is and how busy the probate courts are in places like Harris County (Houston), Tarrant County (Fort Worth), or Travis County (Austin).

Once the will is admitted, there’s usually a formal notice process. People who are considered “interested parties” might get a notification that the will has been probated. This legal notification acts like a starting gun for the statute of limitations. Even if you don’t get a direct notice, the act of admitting the will to probate is a public record. These records are maintained by the County Clerks in Harris, Tarrant, and Travis counties and are often accessible online, meaning the court expects diligence from potential challengers in these areas.

Who Has the Right to Contest a Will in Texas?

You might be upset about what a will says, but that doesn’t automatically give you the legal right to challenge it in a Houston, Fort Worth, or Austin court. In Texas, you must be what’s called an “interested person” to have the legal standing to contest a will. So, who fits into this category?

Simply put, an interested person is someone who has a financial stake or interest in the estate. This usually includes folks like:

- Named beneficiaries who are mentioned in the current will.

- Heirs-at-law, which are the people who would inherit under Texas law if there wasn’t a will at all (like a spouse, children, parents, or siblings).

- Disinherited family members who might have inherited under an older will or if there was no will.

- Sometimes, even creditors of the estate, but only in special situations where the will’s terms might prevent them from collecting a legitimate debt.

Whether you are a disinherited child in a high-asset Houston estate or a spouse in Fort Worth concerned about a recent will change, establishing your status as an “interested person” is the first hurdle you must clear with the court. The law wants to make sure that only those who are truly affected by the will’s validity can bring a challenge in the busy courts of Harris, Tarrant, and Travis counties.

Navigating the Complexities of Contesting Probate Time Limits in Texas

The world of probate litigation in major Texas hubs like Houston, Fort Worth, and Austin can feel like a labyrinth, and understanding contesting probate time limits is just one piece of the puzzle. While the two-year deadline for post-probate contests in Texas seems straightforward, there are complexities and specific situations that can affect this timeline. It’s definitely not always as simple as marking a date on a calendar.

For instance, what if you find something truly egregious, like outright fraud or forgery, long after the typical deadline has passed? Texas law does account for certain legal exceptions that might extend or “toll” (pause) the statute of limitations. But these exceptions are quite rare and require strong, clear evidence. Navigating these nuances, especially amidst the busy estate dispute landscape of Austin, Houston, or Fort Worth, absolutely requires experienced legal guidance.

A will contest isn’t just about being unhappy with your inheritance; it’s about proving that the will itself is legally flawed in a Harris, Tarrant, or Travis County court. There are specific grounds for challenging a will, such as a lack of testamentary capacity (meaning the deceased wasn’t of sound mind when they signed the will), undue influence (someone coerced the deceased into signing), improper execution (the will wasn’t signed or witnessed correctly), or indeed, fraud and forgery. You can learn more about these important grounds here: Grounds for Challenging a Will.

Exceptions That Can Extend the Contesting Probate Time Limits

While the two-year statute of limitations for contesting probate time limits in Texas is indeed strict, there are narrow exceptions where the clock might be extended. These usually involve situations where something was deliberately hidden from you.

The most significant exception is for fraudulent concealment. Imagine if the existence of the will, or a serious defect in it (like a forged signature), was intentionally hidden from you by someone in Houston, Fort Worth, or Austin. In such cases, the two-year deadline might be extended. This is often tied to what’s known as the “findy rule” in Texas. Essentially, the clock doesn’t start ticking until you knew, or with reasonable effort, should have known about the fraud. However, proving fraudulent concealment is a very high legal standard. You’ll need to show that the fraud was purposefully kept secret and that you couldn’t have finded it through reasonable diligence.

Another potential exception, though less common for will contests specifically, can involve the legal incapacity of the challenger. If the interested person who would normally bring the claim is a minor heir in Austin, Houston, or Fort Worth, or is legally incapacitated at the time the will is admitted to probate, the statute of limitations might be “tolled” until their disability is removed. This means the clock doesn’t start running until they reach adulthood or regain their capacity.

These exceptions are never automatic. The burden of proof falls squarely on the person claiming the exception. You must present compelling evidence to a Harris, Tarrant, or Travis County court to show why your case should be heard outside the typical two-year window. This is complex legal territory, and it’s precisely where an experienced probate litigation attorney becomes absolutely invaluable.

Consequences of Missing the Contesting Probate Time Limits

Missing the statutory deadlines for contesting probate time limits is not just a minor inconvenience; it can have severe and often irreversible consequences for your claim and your inheritance rights in Houston, Fort Worth, or Austin. It’s a real “use it or lose it” situation.

The most immediate and impactful consequence is that your claim will likely be barred from filing. If you attempt to file a will contest in a Harris, Tarrant, or Travis County court after the two-year deadline, the court will almost certainly dismiss your case. This means you won’t even get the chance to present your arguments or evidence, no matter how compelling they might be. The door to challenging that specific will slams shut.

This leads directly to the loss of inheritance rights or any other beneficial interest you might have had if the will were successfully overturned. If the will stands as probated, its terms dictate the distribution of assets, and you will be legally bound by those terms. For example, if you were unjustly disinherited in a fraudulent will but missed the deadline to contest, you would unfortunately remain disinherited.

The principle here is the finality of probate. Once a will is probated and the contest period expires, the law aims for certainty and stability in the distribution of the deceased’s estate. Executors in Houston, Fort Worth, or Austin will proceed with distributing assets based on the validated will, and it becomes incredibly difficult, if not impossible, to undo those distributions. Imagine trying to recover diverse assets, from real estate in Austin to oil and gas interests managed from Houston, that have already been legally transferred – it’s a logistical and legal nightmare.

Missing these deadlines means you forfeit your opportunity to seek justice or ensure the deceased’s true wishes are honored. This is why we cannot stress enough: time is truly of the essence in probate litigation in Houston, Fort Worth, and Austin.

Immediate Steps to Take to Protect Your Rights

It’s completely understandable if you feel overwhelmed right now, especially when facing the probate system in a major city like Houston, Fort Worth, or Austin. But if you have even a tiny suspicion that something isn’t quite right with a will or the probate process, please know that acting quickly is your absolute best move. The clock is truly ticking when it comes to contesting probate time limits, and every day counts.

Your immediate action is your shield, protecting your rights and ensuring your loved one’s true wishes are honored. In the environments of Houston, Fort Worth, and Austin, evidence can disappear, memories can fade, and that strict deadline just keeps getting closer. Getting legal counsel is truly the most important step you can take. An experienced probate litigation attorney who serves these areas can assess your unique situation, help you see if you have a valid reason to contest, and guide you through every complex legal step, ensuring you hit all critical deadlines.

For a little more insight into whether challenging a will might be right for you, we invite you to watch our video: 3 Signs You May Need to Challenge a Will in Texas.

Secure a Copy of the Will and Probate Filings

One of your very first concrete steps should be to get your hands on copies of the will and all the related probate paperwork filed in the relevant county court. These documents are like the roadmap to the estate, and you simply can’t figure out your next move without seeing them.

Good news: in Texas, once a will is filed for probate, it becomes a public record. This means you can typically get copies from the County Clerk’s office in the county where the probate case was opened. For instance, if the person who passed away lived in Houston, you’d reach out to the Harris County Clerk. If they were in Fort Worth, it’s the Tarrant County Clerk. And for folks in Austin, you’d look for the Travis County court filings.

If you have a decent relationship with the executor, you can politely ask them or their attorney for copies. If that doesn’t work out, or you just prefer the official route, head to the appropriate County Clerk’s office. The clerks in Harris, Tarrant, and Travis counties have handy online portals, allowing you to search for records and order copies right from your home, saving you a trip!

Taking the time to review these documents will give you some really vital information. You’ll see the exact date the will was officially admitted to probate (which starts that two-year clock for a contest!), who the named executor is, and all the specific details of how the will plans to distribute assets.

Consult with a Probate Litigation Attorney

Once you have those documents in hand (or even if you’re struggling to get them), your next, and arguably most important, step is to talk to a probate litigation attorney who practices in Houston, Fort Worth, or Austin. This isn’t just a suggestion; it’s truly a must-do.

An experienced attorney is so incredibly valuable because they can quickly assess your situation to see if you have a real legal reason to contest. They’ll evaluate how strong your evidence is, tell you what other documents you might need (like medical records if capacity is an issue), and explain what might happen next in the local probate court.

More than that, a great attorney will craft a smart plan just for you. They know exactly when and how to file your contest to make sure you don’t miss any of those crucial deadlines. They’ll also make sure all the legal steps are followed correctly, helping you avoid common mistakes that could cause your case to be thrown out by the busy probate courts in Harris, Tarrant, or Travis County. Plus, they handle all the tricky conversations with the executor and other parties, always protecting your best interests.

Here at Texas Probate Attorney, our dedicated attorneys, Stacy Kelly and Stacy Kelly, bring over 40 years of combined experience to the table. We focus on aggressive litigation and finding quick solutions, fighting hard to protect our clients’ rights, whether they’re in Houston, Fort Worth, or Austin. We believe in giving you personalized attention, so you never feel like just another case file.

Hiring a lawyer who truly specializes in the complex estate and trust litigation common in Houston, Fort Worth, and Austin is absolutely key to navigating the local court rules and protecting your interests.

Don’t let that clock run out on your opportunity to seek justice. Find a trusted will contest lawyer today: Find a Will Contest Lawyer in Texas.

Frequently Asked Questions about Texas Will Contest Deadlines

We understand that diving into probate law in Houston, Fort Worth, or Austin can feel like trying to solve a Rubik’s Cube blindfolded, especially when you’re also navigating the emotional waters of losing a loved one. It’s a lot to take in! Here, we’ll try to clear up some of the most common questions we hear regarding contesting probate time limits in Texas, helping you understand your options without all the confusing legal jargon.

Can I contest a will in Texas if a “no-contest” clause is included?

Ah, the “no-contest” clause – it sounds a bit scary, doesn’t it? Sometimes called an “in terrorem” clause (which literally means “in fear”), it’s a statement within a will that basically says, “If you challenge this will, you’ll lose any inheritance I’ve left you.” The idea behind it is to discourage arguments and keep things peaceful among beneficiaries.

Now, in Texas, these clauses are generally enforced by the courts in Houston, Fort Worth, and Austin. They want to honor the wishes of the person who wrote the will. However, there’s a big, important exception! A no-contest clause typically won’t be enforced if you challenge the will with “good faith and just cause.” This means if you have a genuine, solid reason to believe the will is invalid – perhaps due to fraud, someone pressuring the deceased (undue influence), or the person not being of sound mind when they signed it – and you’re acting honestly, a Texas court might agree that the clause shouldn’t apply to you.

It’s a tricky area, though. The risk of losing your inheritance is very real if your challenge isn’t successful or isn’t seen as being made in good faith. That’s why, if you’re in Houston, Fort Worth, or Austin and a will you’re looking at has one of these clauses, it’s absolutely vital to talk to a probate litigation attorney before you take any steps. We can help you weigh the strength of your case against the potential risks.

What if I find fraud after the two-year deadline has passed?

This is a great question, and it brings us back to those rare exceptions we mentioned earlier. What if you find clear evidence of fraud – say, a forged signature or someone deliberately hiding the will’s existence from you – after that strict two-year deadline for contesting a probated will has come and gone?

Thankfully, Texas law does offer a path forward in such specific situations, thanks to something often called the “findy rule.” Essentially, if the fraud was intentionally hidden from you, the two-year clock for challenging the will might not start ticking until the date you finded the fraud, or when you reasonably should have finded it. It’s like pressing pause on the deadline until the truth comes to light.

However, a word of caution: proving fraudulent concealment is a very high bar to clear in a Harris, Tarrant, or Travis County court. You don’t just need to show that fraud happened; you also need to demonstrate that it was actively concealed from you and that you couldn’t have uncovered it through reasonable effort within the original two-year window. It’s not a shortcut for those who simply missed the deadline, but a crucial safeguard against true deceit. If you suspect fraud, whether you’re in Harris County, Tarrant County, or Travis County, don’t delay – contact us right away.

How long do I have to contest a will that was probated as a muniment of title?

Probating a will as a “muniment of title” is a bit of a special process here in Texas. It’s a simplified way to get a will recognized by the court, often used for less complex estates in Houston, Fort Worth, and Austin where the estate doesn’t have many debts (other than those tied to real estate) and there’s no need for an executor to actively manage a complex estate. Think of it as a court order that simply confirms the will is valid and outlines who now owns the property, without the full, lengthy administration process.

Even with this simplified process, the rule for filing the will itself for probate is generally four years from the date the person passed away. Once a court in Harris, Tarrant, or Travis County signs the order admitting the will as a muniment of title, the two-year clock for contesting probate time limits typically begins from that date, just as it would with a standard probate.

So, while the procedure itself is a bit different, the core idea remains the same: there’s a limited window to challenge the will once it’s been legally recognized by the court. Always make sure to verify the exact date the court signed the order.

For even more details on the ins and outs of Texas probate, including different ways estates can be handled, please visit: More info about Texas Probate Litigation.

Don’t Let the Clock Run Out on Your Inheritance Rights

It’s clear that dealing with a loved one’s estate in a major Texas city, especially when there are concerns about a will, can be an emotional rollercoaster. And when you add the strict rules around contesting probate time limits, it can feel like a race against the clock. We’ve seen how quickly that two-year window to challenge a probated will can slam shut. Whether you’re in Houston, Fort Worth, or Austin, the message is the same: you have to act fast, or you might lose your chance to make things right.

At Texas Probate Attorney, we truly understand how overwhelming this time can be. The legal process in the probate courts of Houston, Fort Worth, and Austin is complex, and your grief can make it even harder to focus. That’s where we come in. Our dedicated attorneys, Stacy Kelly and Stacy Kelly, bring over 40 years of combined experience to the table. We’re committed to helping our clients steer these tricky waters, offering strong legal representation and working hard for quick, fair resolutions. We believe in giving each client in Houston, Fort Worth, and Austin personalized attention because you’re not just another case file to us.

If you have any nagging doubts about a will, or if you feel you have solid reasons to challenge it, please don’t hesitate. Time is truly of the essence in these cases. Waiting too long could mean you miss your window and jeopardize your claim entirely. Let us help you understand the legal landscape of Harris, Tarrant, and Travis counties and fight to protect your interests and your loved one’s true wishes.

Ready to take that important first step?