Texas Probate Freedom—Going from Dependent to Independent Administration

Related Posts

Converting to Independent Administration in Texas: Your Path to Simpler Probate

Dealing with a court-supervised “dependent administration” in the probate courts of Houston, Fort Worth, or Austin can be slow and costly. Fortunately, a simpler path often exists. Converting from a dependent to an independent administration Texas is possible and can significantly reduce court involvement, saving your family time, money, and stress.

Here’s the quick answer:

- Is conversion possible? Yes.

- Key condition 1: All heirs (distributees) must agree in writing.

- Key condition 2: The estate must be in good standing, with no unresolved creditor issues or major disputes.

In the busy probate courts of Houston, Fort Worth, and Austin, independent administration is the preferred path. It grants the executor freedom to manage the estate with minimal court oversight after the initial appointment, increasing efficiency. This guide explains how to make that transition.

Converting from a dependent to an independent administration texas terms to learn:

- what is an independent administrator in texas

- duties of independent administrator texas

- independent administration texas estates code

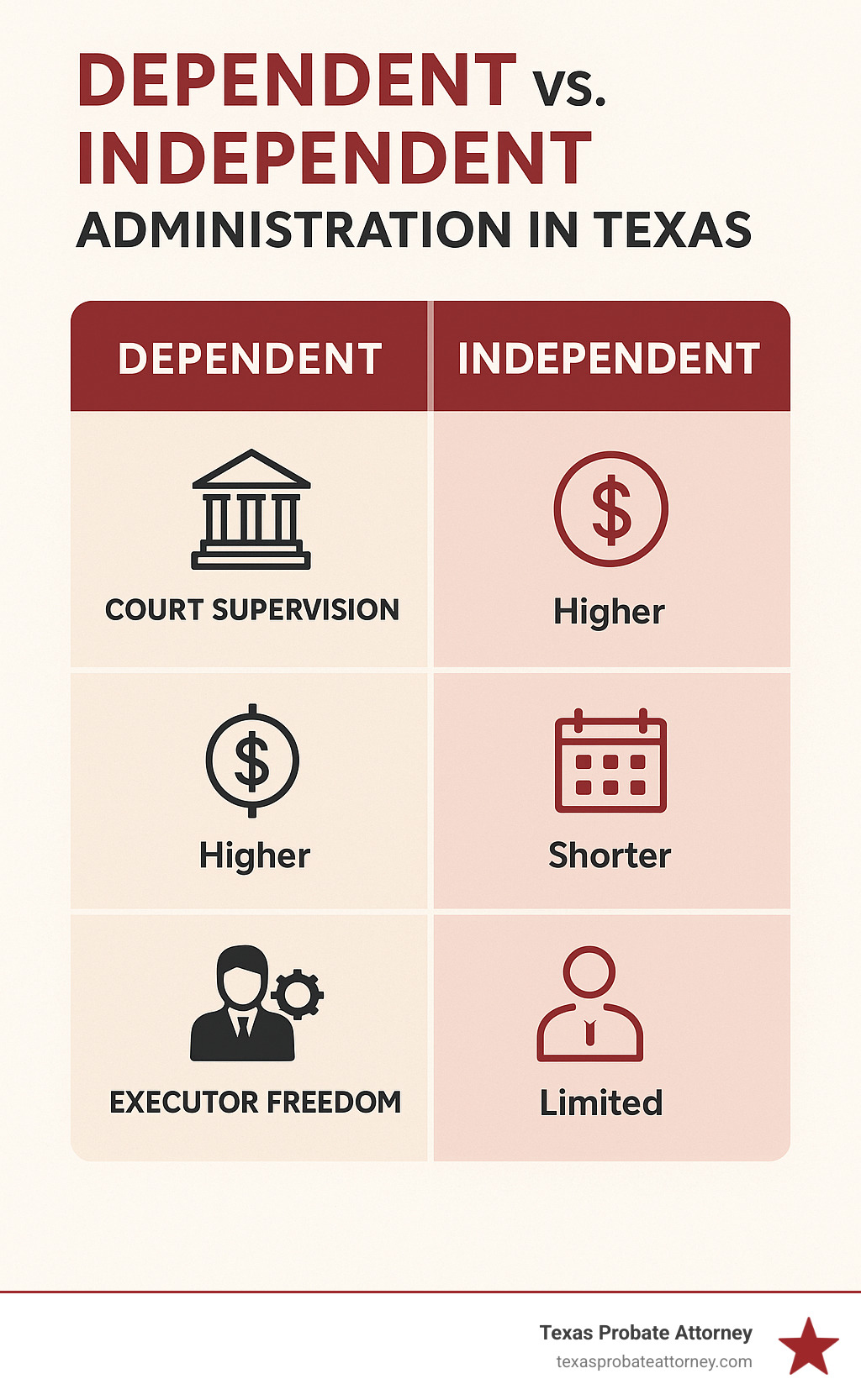

Dependent vs. Independent Administration: Understanding the Key Differences in Texas

To understand the benefits of converting, it’s important to know the two types of estate administration in Texas. The primary difference between dependent and independent administration is the level of court involvement, a factor that significantly impacts estates in Houston, Fort Worth, and Austin.

Here’s a quick look at how they stack up:

| Feature | Dependent Administration | Independent Administration |

|---|---|---|

| Court Supervision | High: Court approval required for almost every action (sales, payments, distributions) | Minimal: Court involvement largely ends after initial appointment; executor acts autonomously |

| Cost | Higher: More court filings, hearings, and attorney time | Lower: Fewer court appearances and legal formalities |

| Timeline | Longer: Delays due to required court approvals for each step | Faster: Executor can make decisions without waiting for judicial approval |

| Executor Freedom | Limited: Operates under strict court oversight, less personal discretion | High: More autonomy in decision-making within legal frameworks |

| Bond Requirement | Typically required: A substantial bond often needed to protect the estate | Often waived: Executor typically serves without a bond, especially if specified in a will |

| Privacy | Lower: More public filings and hearings | Higher: Fewer details become public record |

| Liability Protection | Greater: Court approval for actions can offer protection against beneficiary challenges | Less direct: Executor is directly responsible for actions, though fiduciary duties remain |

In both systems, whether the case is filed in Houston, Fort Worth, or Austin, the executor or administrator has a fiduciary duty to act in the best interest of the estate and its beneficiaries. This involves gathering assets, paying debts, keeping records, and distributing property according to the will or Texas law. The probate court in Harris, Tarrant, or Travis County issues Letters Testamentary (with a will) or Letters of Administration (no will) as official proof of authority to manage the estate.

The Burden of Dependent Administration

Dependent administration is defined by heavy court oversight. Nearly every action—from paying bills to selling property—requires a formal written request and a court hearing. In busy courts like those in Houston, Fort Worth, and Austin, this causes significant delays. The process also typically requires a substantial bond (an extra cost), detailed annual accountings, and formal permission to sell property. This constant court involvement makes dependent administrations far more costly and time-consuming.

In Houston, Fort Worth, and Austin, dependent administration is often necessary when someone dies without a will (intestate) and the heirs cannot agree on an independent path, or if there are serious disputes among beneficiaries.

The Freedom of Independent Administration

Independent administration is the preferred probate method in Houston, Fort Worth, and Austin because it is simple and efficient. Once the executor is appointed, they can manage the estate without constant court approval for actions like paying debts or selling property. This freedom is why converting from a dependent to an independent administration Texas is so appealing. The benefits include:

- Minimal Court Supervision: The executor acts autonomously after the initial appointment.

- Faster Settlements: Decisions are made without court delays, so the process finishes quicker.

- Lower Costs: Fewer hearings and legal filings reduce expenses, saving the estate “significant time and money.”

- Privacy: Less court involvement means fewer estate details become public record.

Independent administration is possible if a will provides for it or if all heirs agree in writing. It is the standard for smooth estate settlements in Houston, Fort Worth, and Austin.

The Step-by-Step Guide to Converting from a Dependent to an Independent Administration in Texas

If you’re in a dependent administration and all parties are ready for a smoother process, you’re in luck. Converting from a dependent to an independent administration Texas is a clear legal process in counties like Harris (Houston), Travis (Austin), or Tarrant (Fort Worth).

Step 1: Gaining Unanimous Consent from All Distributees

This first step is non-negotiable: every person entitled to a share of the estate, known as a “distributee,” must agree to the conversion in writing. This includes all legal heirs (if there is no will) and all beneficiaries named in a will. If you cannot identify or get written consent from every distributee, the court cannot approve the conversion.

For a minor or an incapacitated adult, their legal guardian must provide consent. In complex cases, a Family Settlement Agreement (FSA), a formal contract signed by all beneficiaries, can be used to document this unanimous agreement and resolve other issues.

Step 2: Filing the Application with the Probate Court

With unanimous consent secured, your attorney will file a motion to convert with the probate court in the appropriate county (e.g., Harris, Travis, or Tarrant). The application must state that all distributees have given written consent and that the estate is in “good standing.” This means there are no major unresolved creditor claims or other disputes that would prevent a smooth transition to independent administration.

Step 3: The Court Hearing and Order

After the application is filed, the court will schedule a hearing to review it and ensure all legal requirements for converting from a dependent to an independent administration Texas have been met.

The judge’s role is to confirm that the conversion is in the best interest of the estate. If satisfied, the judge will issue an order granting the conversion, formally ending the dependent administration. The court will then issue new Letters of Independent Administration, giving the executor the authority to manage the estate with less oversight, as guided by the Texas Estates Code, Title 2, Subtitle I.

Weighing the Pros and Cons of Conversion

Deciding to convert from a dependent to an independent administration is a significant step. It’s wise to weigh the advantages against potential drawbacks, and these considerations are the same for estates in Austin, Houston, or Fort Worth.

Benefits of Converting to an Independent Administration

For families in Austin, Houston, and Fort Worth, the advantages of converting from a dependent to an independent administration Texas are compelling. The primary benefits include:

- Significant Cost Savings: By eliminating constant court filings and hearings, legal fees are much lower.

- Faster Process: Without waiting for court approval for every step, the estate can be settled and distributed to beneficiaries much sooner.

- Greater Privacy: Fewer court filings mean less of the estate’s financial information becomes public record.

- Executor Flexibility: The executor has the freedom to manage assets, pay debts, and respond to situations efficiently without court delays.

Potential Challenges When Converting from a Dependent to an Independent Administration in Texas

While the benefits are significant, converting is not always the right choice for an estate in Houston, Fort Worth, or Austin. Key challenges to consider include:

- Loss of Court Protection: In a dependent administration, court approval protects the executor from beneficiary claims. This protection is lost upon conversion.

- Increased Executor Liability: The independent executor bears direct personal responsibility for their decisions. Mistakes can lead to personal liability, making legal counsel essential.

- Potential for Disputes: If new disagreements arise among beneficiaries, resolving them without court oversight can lead to costly litigation.

Conversion may be ill-advised for an estate in Houston, Fort Worth, or Austin if it is highly contentious, has complex creditor issues, the executor is inexperienced, or if one distributee doesn’t agree.

Frequently Asked Questions about Converting Administrations in Texas

Here are some of the most common inquiries we receive from clients in Houston, Fort Worth, and Austin about converting from a dependent to an independent administration Texas.

Who must agree to the conversion from a dependent to an independent administration in Texas?

For any conversion in Houston, Fort Worth, or Austin, Texas law requires unanimous agreement from all distributees. A “distributee” is anyone entitled to receive property from the estate. This includes all heirs at law if there is no will, and all named beneficiaries if there is a will. For any minor or incapacitated distributee, their legal guardian must provide consent on their behalf. Without 100% agreement, the conversion cannot proceed in the probate courts of Harris, Tarrant, or Travis County.

How does the conversion affect the executor’s responsibilities?

In Houston, Fort Worth, or Austin, the executor gains increased autonomy and no longer needs court permission for most actions, which speeds up the process. However, this comes with direct responsibility for all actions. The probate court is not pre-approving decisions, so the executor is personally accountable for managing the estate correctly under Texas law. While formal court accountings are no longer required, the executor still has a duty to provide a full accounting to beneficiaries upon request. Most importantly, the executor’s fiduciary duties to act with loyalty and care remain fully intact.

What are the typical costs associated with the conversion process?

The primary costs are attorney fees for preparing the application and representing the estate at the hearing, plus standard court filing fees in the respective county (Harris, Tarrant, or Travis). While there is an upfront cost to convert, these expenses are an investment. The long-term savings typically outweigh the initial costs significantly, as you avoid the much higher, ongoing legal fees associated with a dependent administration, which is “far more costly and time-consuming.”

Finalizing Your Estate’s Transition in Houston, Fort Worth, or Austin

Converting from a dependent to an independent administration Texas moves an estate from a slow, court-heavy process to one that is efficient and flexible. For families navigating probate in Houston, Fort Worth, or Austin, this transition provides greater control and relief.

Once an estate in Houston, Fort Worth, or Austin is converted, the independent executor can manage its affairs—paying debts, handling assets, and distributing inheritances—without constant court permission. However, this freedom comes with the significant responsibility to act in the best interests of the beneficiaries and to maintain clear records for the final accounting. Proper management is crucial until the estate is ready to be closed.

At Texas Probate Attorney, we understand that dealing with an estate can be tough, especially when you’re also coping with loss. Our team, led by Stacy Kelly, has helped countless families through these moments. With over 40 years of combined experience in Texas probate, trust, and estate planning, we’re here to offer clear, personalized legal guidance.

We’ll help you understand all your options, empowering you to make the best choices for your family. We’re dedicated to helping you achieve a smooth transition, manage the final accounting, and confidently move towards closing the estate.

Ready to explore how independent administration can simplify your probate journey? Visit us for more info about independent administration services and how we can help your family find that probate freedom: More info about independent administration services.