Texas Probate 101—Understanding Independent Administration

Related Posts

Understanding Texas Probate: Why Independent Administration Matters

The definition of independent administration texas refers to an estate settlement process where a personal representative manages the deceased’s affairs with minimal court supervision. This streamlined approach is the most common method for handling estates in Houston, Fort Worth, and Austin.

Key Definition:

- Independent Administration = Estate settlement with minimal court oversight

- Personal Representative = The person appointed to handle the estate (executor or administrator)

- Court Supervision = Limited to initial appointment and inventory filing

- Powers = Broad authority to sell property, pay debts, and distribute assets without court approval

When a person passes away in Houston, Fort Worth, or Austin, settling their estate through the local probate courts can be daunting. Fortunately, Texas law provides for independent administration, a faster and less expensive alternative to traditional court-supervised probate.

Independent administration allows the executor or administrator to:

- Sell estate property without court orders

- Pay debts and claims against the estate

- Distribute assets to beneficiaries

- Manage estate business operations

- Complete most tasks without ongoing court approval

This method differs from dependent administration, where a judge must approve every major decision. For families in Houston, Fort Worth, and Austin, independent administration means quicker access to inheritance, lower legal fees, and less time in court.

This process is possible because the Texas Estates Code grants broad powers to independent administrators. After their appointment and filing an estate inventory with the appropriate court in Harris, Tarrant, or Travis County, they can manage the property as the deceased would have, without constant court oversight.

Definition of independent administration texas word list:

- duties of independent administrator texas

- independent administration texas estates code

- what is an independent administrator in texas

The Core Definition of Independent Administration Texas

At its heart, the definition of independent administration texas centers on freedom from court oversight. It allows the personal representative (an executor or administrator) to manage the deceased’s affairs with minimal judicial supervision. This hands-off approach is a cornerstone of Texas probate law, simplifying what can be an overwhelming process for families in Houston, Fort Worth, and Austin.

Once the court approves the independent executor or administrator, they can settle the estate without seeking a judge’s permission for most actions, like selling assets, paying debts, and distributing property. This autonomy makes independent administration much faster and less expensive than its court-supervised counterpart, dependent administration. It reduces court costs, attorney fees, and delays, which is a significant relief for families navigating the probate process in Houston, Fort Worth, and Austin.

The Texas Estates Code authorizes this streamlined process, which is particularly effective for estates in Houston, Fort Worth, and Austin, granting broad powers to independent executors and administrators. This unsupervised administration style provides significant executor autonomy and administrator freedom. For more details on the legal framework, you can explore the Independent Administration Texas Estates Code.

What is an Independent Administrator?

For an estate in Houston, Fort Worth, or Austin, an Independent Administrator, or an Independent Executor if named in a will, is the court-appointed personal representative who manages a deceased person’s estate. Their duties include collecting assets, paying debts, and distributing the remainder to beneficiaries or heirs.

An executor is named in a will (appointed by will). If there is no will, or the named executor cannot serve, the court in Houston, Fort Worth, or Austin appoints an administrator, who is often selected by the heirs (designated by heirs). In an independent administration, both roles have significant responsibilities and powers.

A crucial aspect of this role for any estate in Houston, Fort Worth, or Austin is the fiduciary duty. This legal obligation requires them to act with the utmost good faith and in the best interests of the estate, its beneficiaries, and creditors, a standard upheld by the probate courts in Harris, Tarrant, and Travis counties.

For a deeper dive into this role, check out our guide on What is an Independent Administrator in Texas?.

The Goal: Efficiency in Houston, Fort Worth, and Austin Estates

Independent administration is popular in Houston, Fort Worth, and Austin because its ultimate goal is efficiency. It offers a welcome alternative to the time-consuming and emotionally draining court process by:

- Reduced legal fees: Less court involvement means fewer hearings, less paperwork, and ultimately, lower legal costs.

- Quicker access to inheritance: Without constant court approvals, the process of liquidating assets and distributing inheritances can move much faster.

- Less administrative burden: The personal representative has more flexibility to make decisions and execute tasks without needing to file motions and wait for court orders.

- Simplified process for beneficiaries: With a capable independent administrator, beneficiaries often experience a smoother, less stressful journey through probate.

- Avoiding court backlogs in major Texas counties: Independent administration helps bypass many potential bottlenecks in busy Houston, Fort Worth, and Austin probate courts.

Independent vs. Dependent Administration: A Key Distinction

When settling an estate in Houston, Fort Worth, or Austin, the choice between independent and dependent administration is pivotal. The key difference, which is central to the definition of independent administration texas, is the level of court oversight.

This section will help you understand the significant differences in procedure, cost, and control for estates in Houston, Fort Worth, and Austin.

Court Involvement and Oversight

The primary difference is the level of court involvement throughout the process.

In a Dependent Administration in Houston, Fort Worth, or Austin, the personal representative needs the judge’s approval for nearly every action, such as to sell property, pay debts, or distribute assets. This high level of oversight can be useful in complex or contentious cases but makes the process slower and more expensive due to more court hearings and paperwork in these busy courts.

In an Independent Administration, after the executor is appointed and files an inventory, court interaction is minimal. The Texas Estates Code, particularly Texas Estates Code Sec. 402.002, grants them broad powers to manage the estate. They can sell real property, pay claims, and distribute assets to beneficiaries without waiting for a judge’s approval, streamlining the process for families in Houston, Fort Worth, and Austin.

Comparing Costs, Timelines, and Complexity

The level of court involvement directly impacts the time, cost, and complexity of probate. For families in Houston, Fort Worth, and Austin, these factors are critical.

Here’s a quick look at how the two methods stack up:

| Criteria | Independent Administration | Dependent Administration |

|---|---|---|

| Court Costs | Generally lower due to fewer filings and hearings in Houston, Fort Worth, or Austin probate courts. | Higher due to frequent court appearances and approvals required by Houston, Fort Worth, or Austin courts. |

| Attorney Fees | Often lower, as less attorney time is needed for court appearances and detailed filings in Harris, Tarrant, or Travis County. | Higher, as attorneys must prepare for and attend numerous court hearings and prepare detailed orders for judges in Harris, Tarrant, or Travis County. |

| Time to Close Estate | Usually much faster, often 6 months to 1 year, as there are no delays waiting for court approvals from busy judges in Houston, Fort Worth, or Austin. | Significantly slower, can take 1-3 years or more, due to the crowded court schedules and formal approval processes in Houston, Fort Worth, and Austin. |

| Paperwork Required | Less ongoing paperwork required by the Harris, Tarrant, or Travis County courts after initial filings. | Extensive and continuous paperwork for court petitions, orders, and accountings filed with the probate courts in Houston, Fort Worth, or Austin. |

| Executor Flexibility | High; the executor has broad discretion to act in the estate’s best interest without prior approval from a Houston, Fort Worth, or Austin judge. | Low; the administrator must seek court approval from a judge in Houston, Fort Worth, or Austin for almost every action, limiting their autonomy. |

As you can see, independent administration typically wins on efficiency, making it an appealing option for many Texas estates.

Executor and Administrator Autonomy

The definition of independent administration texas implies significant freedom for the personal representative in Houston, Fort Worth, and Austin. This autonomy improves efficiency but also carries great responsibility.

An independent executor in Houston, Fort Worth, or Austin operates under a fiduciary duty, a legal obligation to act honestly and in the best interest of the estate, its beneficiaries, and creditors. They must manage estate assets, settle claims against the estate, and distribute property according to the will or Texas law. They must also adhere to a “prudent person standard,” managing the estate’s affairs with the care a reasonable person would use for their own matters, a standard enforceable by the local probate courts.

For estates in Houston, Fort Worth, or Austin, they have broad powers to act without constant court approval, including the ability to identify and collect all estate assets, pay valid debts and expenses, sell estate property if necessary, manage any businesses the deceased owned, and distribute the remaining assets to the rightful heirs or beneficiaries.

For a comprehensive look at these important responsibilities, you can explore our page on the Duties of Independent Administrator Texas.

How to Establish an Independent Administration in Texas

Establishing an independent administration is an excellent choice for a smoother probate process for families in Houston, Fort Worth, and Austin. There are two primary methods, depending on whether the deceased left a will.

Creation Through a Will (Testate Estates)

The most direct path to an independent administration is through the will. If the will names an “Independent Executor” and includes language limiting court action (e.g., “no action shall be had in the probate court…”), the testator’s intent for a streamlined process is clear. This is the most common and preferred method for estates in Houston, Fort Worth, and Austin.

Texas Estates Code Sec. 401.001 authorizes this method, which is recognized by the probate courts in Houston, Fort Worth, and Austin, reinforcing the core definition of independent administration texas: executor freedom. Including this language in a will is a crucial step to simplify the process for loved ones in Houston, Fort Worth, and Austin.

Creation by Agreement (Intestate Estates)

If there is no will (an “intestate” estate) for a decedent in Houston, Fort Worth, or Austin, independent administration is still possible. All legal heirs (“distributees”) must unanimously agree to an independent administration and select a qualified person to serve as the independent administrator.

The heirs’ agreement is presented to the court. The court must first formally identify all legal heirs through a Judgment Declaring Heirship. Once the heirs are confirmed and all agree, the court can establish the independent administration. This process requires careful legal navigation in Harris (Houston), Tarrant (Fort Worth), and Travis (Austin) county courts to ensure all heirs are identified and their consent is valid.

The Basic Procedural Steps

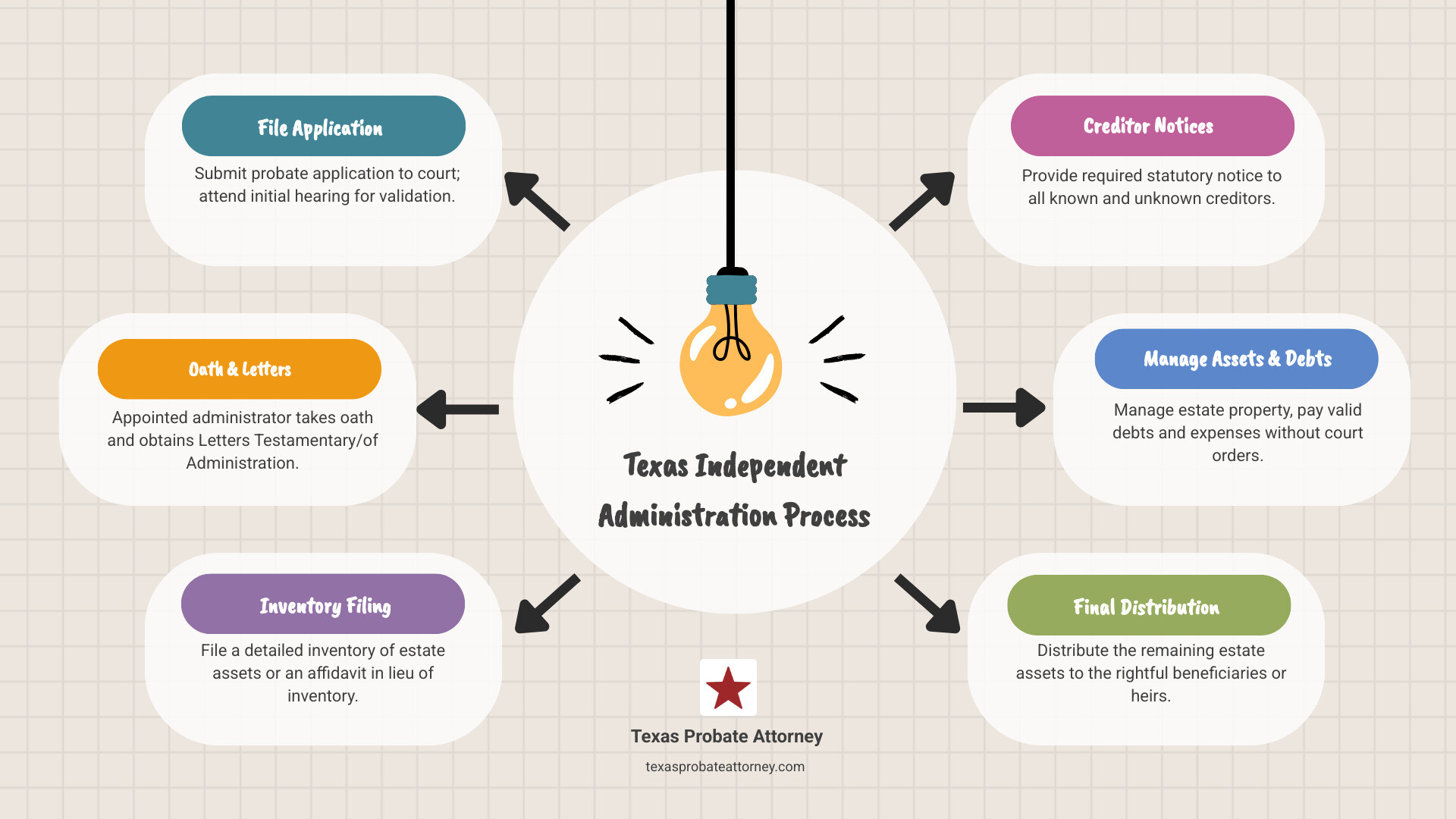

Regardless of how it’s established, the initial procedural steps for an independent administration are similar:

- Filing the Application for Probate: This initial court filing is submitted to the appropriate probate court in Harris, Tarrant, or Travis County, presenting the will (if one exists) and requests the appointment of an independent executor or administrator.

- The Court Hearing: A judge in a Houston, Fort Worth, or Austin probate court holds a brief hearing to admit the will to probate (if applicable), formally appoint the independent executor/administrator, and confirm legal requirements are met.

- Taking the Oath of Office: The appointed person must take an oath, typically within 20 days of the court order from the Harris, Tarrant, or Travis County court, promising to faithfully perform their duties.

- Posting Bond (if it’s not waived): Often, no bond is required in an independent administration if the will waives it or all heirs agree. However, a Houston, Fort Worth, or Austin court can still require a bond to protect the estate, creditors, or heirs. If required, it must be filed within 20 days.

- Obtaining Letters Testamentary or Letters of Administration: After the oath (and bond, if required) is filed, the court in Houston, Fort Worth, or Austin issues these “Letters.” These official documents grant the executor or administrator legal authority to manage the estate, such as accessing bank accounts and selling property.

Powers, Duties, and Potential Pitfalls

While the definition of independent administration texas implies freedom from court oversight for estates in Houston, Fort Worth, and Austin, this autonomy comes with significant legal responsibilities. It requires diligence and a clear understanding of the administrator’s powers and duties.

What an Independent Administrator Can Do

For an estate in Houston, Fort Worth, or Austin, the powers of an independent administrator are broad, allowing them to:

- Pay debts and expenses

- Sell estate property without a court order

- Distribute assets to beneficiaries

- Manage estate business

- Fund trusts created by the will

- Settle claims against the estate

- Act without court approval for most actions

Key Responsibilities and Duties

An independent administrator’s key duties include:

- Notice to Creditors: Within one month of appointment, publish a notice in a local newspaper for general creditors in Houston, Fort Worth, or Austin. Within two months, send notice via certified mail to known secured creditors (e.g., mortgage holders).

- Notice to Beneficiaries: Notify will beneficiaries that the will has been probated and that they have been appointed.

- Inventory and Appraisement of the estate: File an Inventory, Appraisement, and List of Claims with the court in Harris, Tarrant, or Travis County within 90 days of appointment, detailing all estate assets, their values, and any claims.

- Affidavit in Lieu of Inventory: File an Affidavit in Lieu of Inventory with the Houston, Fort Worth, or Austin court if there are no unpaid debts (other than secured debts, taxes, and administration expenses) to simplify the process.

- Fiduciary duty to heirs and creditors: Uphold a fiduciary duty to act in the best interest of the estate, heirs, and creditors, a standard enforced by the probate courts of Harris, Tarrant, and Travis counties. This involves managing assets prudently and fairly, avoiding self-dealing or favoritism.

Potential Risks: When the Definition of Independent Administration Texas Can Be a Drawback

Independent administration is not always the best choice for estates in Houston, Fort Worth, or Austin. The freedom it provides can be a liability in certain situations:

- Beneficiary disputes: If heirs in the Houston, Fort Worth, or Austin area are likely to dispute the will or distributions, the lack of court oversight can escalate conflicts. A dependent administration may be better to ensure court intervention.

- Contested wills: If the will’s validity is challenged in a Harris, Tarrant, or Travis County court, judicial intervention is necessary, which can halt an independent administration. For more on this, see our information on Contesting a Will in Texas.

- Insolvent estates (high debt): If an estate in Houston, Fort Worth, or Austin has debts that outweigh assets, a dependent administration is often advisable to ensure creditors are paid fairly under court supervision, protecting the administrator from personal liability.

- Administrator misconduct: Without direct supervision from a Houston, Fort Worth, or Austin court, an administrator could mismanage assets, leading to significant personal liability.

- Risk of personal liability: Independent administrators carry a higher risk of personal liability for mistakes or breaches of fiduciary duty. Working with an experienced probate attorney in Houston, Fort Worth, or Austin is a wise decision.

Frequently Asked Questions about Texas Independent Administration

Here are answers to common questions about independent administration for those in Houston, Fort Worth, and Austin.

What is the official definition of independent administration Texas according to the Estates Code?

The definition of independent administration Texas, according to the Texas Estates Code, refers to an estate settlement process with minimal court supervision. After the initial appointment and filing of an inventory, the executor or administrator can pay debts, sell property, and distribute assets without needing court approval for each action. This efficiency is why it is the preferred method for many families in Houston, Fort Worth, and Austin.

Can an independent administration be challenged or converted to a dependent one?

Yes. An interested party, such as an heir or creditor, can petition the court to intervene if an independent administrator is mismanaging the estate, failing to file documents, or has a conflict of interest. The court can remove the administrator and convert the case to a dependent administration. This provides court oversight for every step and is often used in cases with significant family disputes or concerns about mismanagement, ensuring a fair process for all involved in Houston, Fort Worth, and Austin.

Does an independent administrator in Texas have to post a bond?

Often, no. A bond, which is an insurance policy protecting the estate, is typically not required if the will waives it. If there is no will, all heirs can agree to waive the bond requirement, saving the estate money. However, the court retains the final say and can order a bond if it deems one necessary to protect the estate, its creditors, or beneficiaries in Houston, Fort Worth, or Austin. This provides an important safeguard.

Navigating Your Estate Administration Duties in Texas

Choosing the right way to administer an estate is a critical decision for families in Houston, Fort Worth, and Austin. As explored, independent administration is often the preferred route for estates in Houston, Fort Worth, and Austin, offering a faster, more affordable process with minimal court supervision and greater flexibility for the personal representative.

This freedom, however, comes with significant responsibility. The definition of independent administration texas empowers the executor but also imposes a strict fiduciary duty on executors in Houston, Fort Worth, and Austin to act honestly and in the best interests of the estate, its heirs, and creditors. This role demands careful attention to legal duties.

Navigating Texas probate law is complex. The attorneys at Texas Probate Attorney offer personalized legal representation to guide you through it. With over 40 years of combined experience assisting families in Houston, Fort Worth, and Austin, we can help ensure your peace of mind during a difficult time.