Choosing Your Probate Path—Dependent vs Independent Administration in Texas

Related Posts

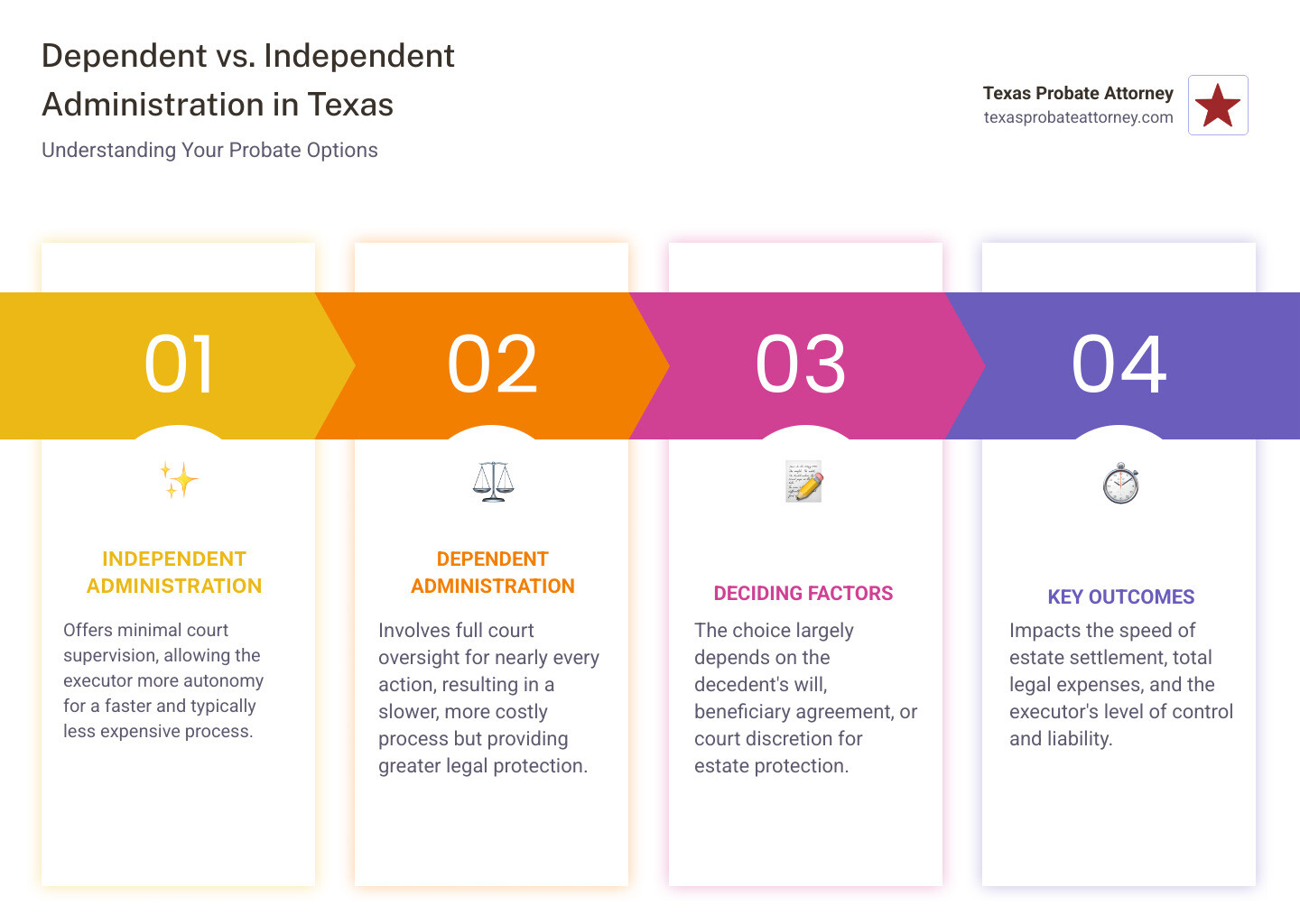

Understanding Your Probate Options in Texas

When facing the loss of a loved one in Houston, Fort Worth, or Austin, understanding dependent vs independent administration texas becomes crucial for settling their estate properly. Texas law offers two distinct paths for probate administration, each with different levels of court oversight and requirements.

Quick Answer:

- Independent Administration = Minimal court supervision, faster process, lower costs, more executor control

- Dependent Administration = Court-supervised every step, slower process, higher costs, but more legal protection

- Key Factor = Your loved one’s will language or beneficiary agreement determines which path you can take

The choice between these two administration types affects the time and cost of settling the estate. In Harris County (Houston), Tarrant County (Fort Worth), and Travis County (Austin), most families prefer independent administration when possible because it’s typically faster and less expensive.

Independent administration allows the executor to manage the estate with minimal court involvement – they can sell property, pay debts, and distribute assets without asking permission for each action.

Dependent administration requires court approval for most decisions the executor makes, creating a slower but more protected process that’s especially helpful when family disputes arise or the estate has complex debts.

The path you take depends on what your loved one’s will says, whether all beneficiaries can agree, and sometimes what the probate court decides is best for protecting the estate and its heirs.

Dependent vs independent administration texas basics:

- duties of independent administrator texas

- independent administration texas estates code

- what is an independent administrator in texas

The Core Difference: Court Supervision in Texas Probate

When a loved one passes away, their final affairs are handled through a legal process called probate, which ensures assets are identified, debts are paid, and the remainder is distributed correctly. In Texas, the primary difference between dependent vs independent administration texas is the level of court supervision.

Whether you’re named in a will as an executor or appointed by the court as an administrator, you’re stepping into a big role. An executor is usually chosen by the person who wrote the will to follow their wishes. An administrator is appointed by the court, often when there isn’t a will or the named executor can’t serve. Both roles come with a very important responsibility: a fiduciary duty. This means you must act in the best interests of the estate, its beneficiaries, and anyone owed money, not your own. Failing to act responsibly can lead to personal liability.

In busy places like Houston (Harris County), Fort Worth (Tarrant County), and Austin (Travis County), the local probate courts handle all estate settlements. The real question is: how much hand-holding will the court do?

In an independent administration, after initial court approval, the executor or administrator manages the estate with minimal oversight. They can sell property, pay bills, and distribute assets without needing court permission for each action. This streamlined approach is why most families in Houston, Fort Worth, and Austin prefer it when possible.

Conversely, a dependent administration requires the executor or administrator to get the court’s approval for most actions. This constant court involvement leads to more hearings, paperwork, and a typically longer, more costly process.

For a deeper look into the rules governing these processes, you can explore the Texas Probate Law. Understanding this core difference is key to navigating the probate process for your family’s estate in Houston, Fort Worth, or Austin.

Independent Administration: The Path of Autonomy

Independent administration in Houston, Fort Worth, or Austin allows for settling a loved one’s estate with minimal court interference, making it an efficient path that reduces the burden on the local probate courts and the estate’s representative.

This type of administration is known for its streamlined process and is generally more cost-effective due to reduced court filings and fewer court appearances. This translates directly into lower legal fees for the estate. An independent executor or administrator has broad executor authority to collect assets, pay debts, and distribute property without needing specific court orders for each step. They still must follow the law, but they don’t need a judge’s approval for every transaction.

To learn more about the role and powers of someone in this position, you can check out What is an Independent Administrator in Texas?.

Advantages and Disadvantages for the Executor

While independent administration offers freedom, it also involves significant responsibilities and potential challenges, balancing autonomy with accountability.

For the executor, the benefits are clear. The process often leads to a faster settlement of the estate. Minimal court oversight allows for quicker decisions, helping families in Houston, Fort Worth, and Austin settle the estate faster. This speed also contributes to lower costs for the estate. Plus, the executor has more control over assets, allowing for flexible and timely decisions about sales or investments without needing court permission for every step.

However, this freedom comes with a flip side. There’s high personal responsibility for the executor. The independent executor is fully responsible for ensuring all legal duties are met correctly without direct court guidance. This means there’s a risk of liability for errors. If mistakes are made, or if the executor doesn’t act in the estate’s best interest, they can be held personally responsible. Unlike in dependent administration, there’s no automatic court protection for every action taken.

Understanding these trade-offs is crucial. For detailed responsibilities, see Duties of Independent Administrator Texas.

When is Independent Administration Possible in Houston, Fort Worth, or Austin?

Independent administration isn’t always an option. The ability to pursue this streamlined path depends on a few key factors for estates in Houston, Fort Worth, and Austin:

First, the most straightforward way is if the deceased person’s will specifies it. If the will clearly states that the executor should serve independently, the court will generally honor that wish.

Second, even if the will doesn’t mention it, or if there is no will (dying “intestate”), the court can grant it if all beneficiaries agree. This requires a formal agreement presented to the court.

Third, if a person dies without a will, the default is dependent administration. However, if all legal intestate heirs agree on an administrator and consent to independent administration, the court may allow it. This can be challenging if family dynamics are strained, as everyone must agree.

The specific legal requirements for independent administration are outlined in The Texas Estates Code on Independent Administration. The application process in Harris, Tarrant, or Travis County involves filing a petition with the local probate court, proving the will (if one exists), identifying all heirs or beneficiaries, and formally requesting the court to appoint the independent executor or administrator. Once appointed and an inventory of assets is filed (or an affidavit in lieu of inventory), the executor can largely proceed with settling the estate without further court intervention.

Dependent Administration: The Path of Oversight

While often not the first choice, dependent administration is sometimes necessary. It is a court-supervised process where a judge is involved in every step, meaning nearly every major decision, from selling property to paying debts, needs judicial approval.

This constant oversight means more steps for the administrator, such as posting a bond (an insurance policy for the estate) and providing formal accountings to the court. The court acts as a careful watch to ensure everything is done correctly, which is a safety net for complex estates or when family members disagree.

Navigating this process often requires a dedicated legal partner. You can learn more about how legal professionals assist with this at Probate Lawyer in Texas.

Advantages and Disadvantages for the Executor

This level of court involvement has both advantages and disadvantages for the executor.

One big plus is legal protection from liability. Because every major action gets a judge’s approval, the executor is shielded from personal responsibility if a decision is challenged later. This is a significant benefit in Houston, Fort Worth, or Austin, especially when family situations are complex. You also get a clear process for handling debts, as the court oversees payments to creditors. For all the heirs, this constant court oversight means high transparency, which can build trust and reduce disputes.

However, there are downsides. The most common complaint is how slow the process can be, as waiting for court dates and approvals adds significant time. This also means higher attorney and court fees due to more paperwork and court appearances. Plus, the requirements can be cumbersome, as executors must follow strict court rules and reporting, which can be time-consuming.

Circumstances Requiring Dependent Administration in Houston, Fort Worth, or Austin

While many families in Houston, Fort Worth, and Austin hope for independent administration, certain situations may require dependent administration:

First, if a loved one passes away without a valid will (intestate), Texas law generally defaults to dependent administration unless all legal heirs agree to an independent administration and the court approves.

Second, if there are disputes among beneficiaries who cannot agree on how the estate should be managed, the court might require dependent administration to resolve conflicts and ensure fairness.

Third, if any heirs are minor or incapacitated, dependent administration is often preferred to provide extra protection for their inheritance.

Fourth, for estates with complex debts or potential lawsuits from creditors, the rigorous oversight of dependent administration can be beneficial.

Lastly, a probate judge in Harris, Tarrant, or Travis County can use their discretion to mandate dependent administration if they believe it’s necessary to protect the estate from fraud, mismanagement, or significant disputes. It’s a crucial safeguard in the dependent vs independent administration texas process.

A Side-by-Side Look at Dependent vs Independent Administration in Texas

When you’re navigating probate in Houston, Fort Worth, or Austin, understanding the fundamental differences between dependent vs independent administration texas is key. The two paths are fundamentally different in their process and requirements.

Here’s a quick side-by-side comparison to help you see the distinctions at a glance:

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Involvement | Minimal oversight after initial approval and inventory. | High degree of court supervision for nearly every action. |

| Cost | Generally lower, fewer court filings and attorney hours. | Generally higher, more court filings and attorney hours. |

| Timeline | Typically quicker, decisions made without court delays. | Generally longer, requires court approval for each step. |

| Executor Authority | High autonomy, broad powers without specific court orders. | Limited autonomy, requires court approval for major decisions. |

| Selling Property | Can sell without court permission (unless property is homestead or objection). | Requires specific court order for each sale. |

| Paying Creditors | Manages claims and pays debts, often without court approval. | Requires court approval for most debt payments. |

For comprehensive details on managing estates in Houston, visit Houston Estate Administration.

Key Process Differences in Houston, Fort Worth, and Austin

The impact of choosing between dependent vs independent administration texas is most apparent in these specific process steps within the Harris, Tarrant, and Travis County probate courts:

For court approval for actions, a dependent administrator in Travis County needs a judge’s order for most significant moves, like selling a home. This requires filing motions and attending hearings. In contrast, an independent administrator in Tarrant County can typically make these decisions without prior court permission, speeding up the process while still being bound by law.

The way notice to creditors is handled also differs. In both types of administration in Houston, Fort Worth, or Austin, creditors must be notified. An independent administrator publishes a general notice and notifies secured creditors. For dependent administrations, the court-supervised processes for handling creditor claims are more formal, offering more protection against future disputes.

Regarding the inventory and appraisement, both administrators must file this list of assets with the appropriate court in Harris, Tarrant, or Travis County within 90 days. For an independent administrator, this may be one of the few formal filings required. In a dependent administration, it’s just the beginning of continuous court reporting.

Finally, closing the estate looks very different. An independent administration in Houston, Fort Worth, or Austin can often close informally once all tasks are complete. A dependent administration requires a formal closing petition and a final court order from the judge.

Understanding the distinction between assets that go through probate and those that don’t is also crucial. Learn more at Probate vs Non-Probate Assets in Texas: What You Need to Know.

How a Will (or Lack Thereof) Dictates the Path in Houston, Fort Worth, and Austin

The presence or absence of a will is a primary factor in determining the path of dependent vs independent administration texas for an estate in Houston, Fort Worth, or Austin.

If your loved one left a valid will (a “testate estate“), the importance of will language is paramount. If the will names an executor and specifies they should serve “independently,” the court in Houston, Fort Worth, or Austin will almost always grant independent administration.

If a person passes away without a valid will (“intestate“), Texas intestate succession laws dictate property distribution. By default, these estates fall under dependent administration. However, if all legal heirs unanimously agree, they can petition the court in Harris, Tarrant, or Travis County for an independent administration, which usually requires a proceeding to declare heirship to legally identify the heirs.

You can explore The Texas Estates Code on heirship for more details on this process. For local guidance in Fort Worth, considering consulting a Fort Worth Probate Attorney.

Frequently Asked Questions about Estate Administration in Houston, Fort Worth, and Austin

Families in Houston, Fort Worth, and Austin often have questions about dependent vs independent administration texas. Here are answers to the most common ones.

Can we switch from dependent to independent administration in Houston, Fort Worth, or Austin?

Yes, it is possible to switch, but it’s not automatic. For an estate in Houston, Fort Worth, or Austin, all distributees (everyone entitled to receive property) must agree and petition the court together.

The process requires court approval and isn’t guaranteed. A judge in Harris, Tarrant, or Travis County will consider factors like ongoing disputes, estate complexity, and the best interests of all parties. Courts may approve the switch if the family is working together and the estate is not overly complex.

The circumstances of the estate in Houston, Fort Worth, or Austin matter. If there are minor beneficiaries, significant debts, or family conflict, the court might decide that dependent administration is still the safer path.

What are the main duties of an executor in Houston, Fort Worth, or Austin?

Whether you’re dealing with dependent vs independent administration texas in Harris, Tarrant, or Travis County, the executor’s core responsibilities are consistent.

The core duties are consistent across both types: you must gather and inventory all assets, provide proper notice to creditors, pay valid debts and taxes, and distribute the remaining property to the rightful heirs or beneficiaries.

The method and required approvals differ significantly. In a dependent administration in Houston, Fort Worth, or Austin, you must get court approval for most actions, such as selling a house or paying a large debt. With independent administration, you have the authority to make these decisions on your own, as long as you’re acting in the estate’s best interest.

Does an independent administrator in Houston, Fort Worth, or Austin have to file anything with the court after being appointed?

While “independent” suggests freedom from court, there are still key filing requirements for estates in Houston, Fort Worth, and Austin.

Yes, an independent administrator must file several key documents with the probate court in Harris, Tarrant, or Travis County. Within 20 days of being appointed, you must file an oath. You might also need to post a bond, though this is often waived if the will specifies it or all beneficiaries agree.

The main requirement is filing an Inventory, Appraisement, and List of Claims or an Affidavit in Lieu of Inventory with the court within 90 days. This document lists all the deceased’s assets and debts.

Once these initial steps are complete and the court approves the inventory, you can manage the estate without further routine court supervision.

Navigating Your Probate Journey in Texas

Understanding the distinction between dependent vs independent administration texas is vital for navigating probate in Houston, Fort Worth, or Austin. While independent administration is often more efficient, dependent administration serves as a crucial safeguard in complex or contentious situations that arise in Harris, Tarrant, and Travis County probate courts.

As you plan your journey in Houston, Fort Worth, or Austin, consider these key takeaways. First, the will provisions are paramount; a will specifying independent administration can save time and money. Second, beneficiary harmony is a powerful tool, as unanimous agreement can allow for independent administration even without a will. Lastly, estate complexity, including debts and potential disputes, will heavily influence the appropriate path determined by the local probate court.

Here at Texas Probate Attorney, we understand that settling an estate can feel overwhelming. Our attorneys, with over 40 years of combined experience, are dedicated to providing personalized legal representation. We pride ourselves on our approach, emphasizing aggressive litigation when needed and always striving for quick, effective resolutions. We understand the nuances of Texas probate law and are ready to help you make informed choices that best serve the estate and its beneficiaries in Houston, Fort Worth, and Austin.

For compassionate guidance on choosing the right path for an estate in Houston, Fort Worth, or Austin, we invite you to learn more about our Independent Administration Texas Estates Code services. We are here to help you every step of the way, making your probate journey as smooth as possible.