What Exactly Does a Texas Independent Administrator Do? Here’s the Scoop!

Related Posts

Understanding Independent Administration in Texas

When a loved one passes away, the legal steps that follow can be overwhelming for families in Houston, Fort Worth, and Austin. If you’ve been named an independent administrator in Texas, you’ll need to understand your role in the probate process.

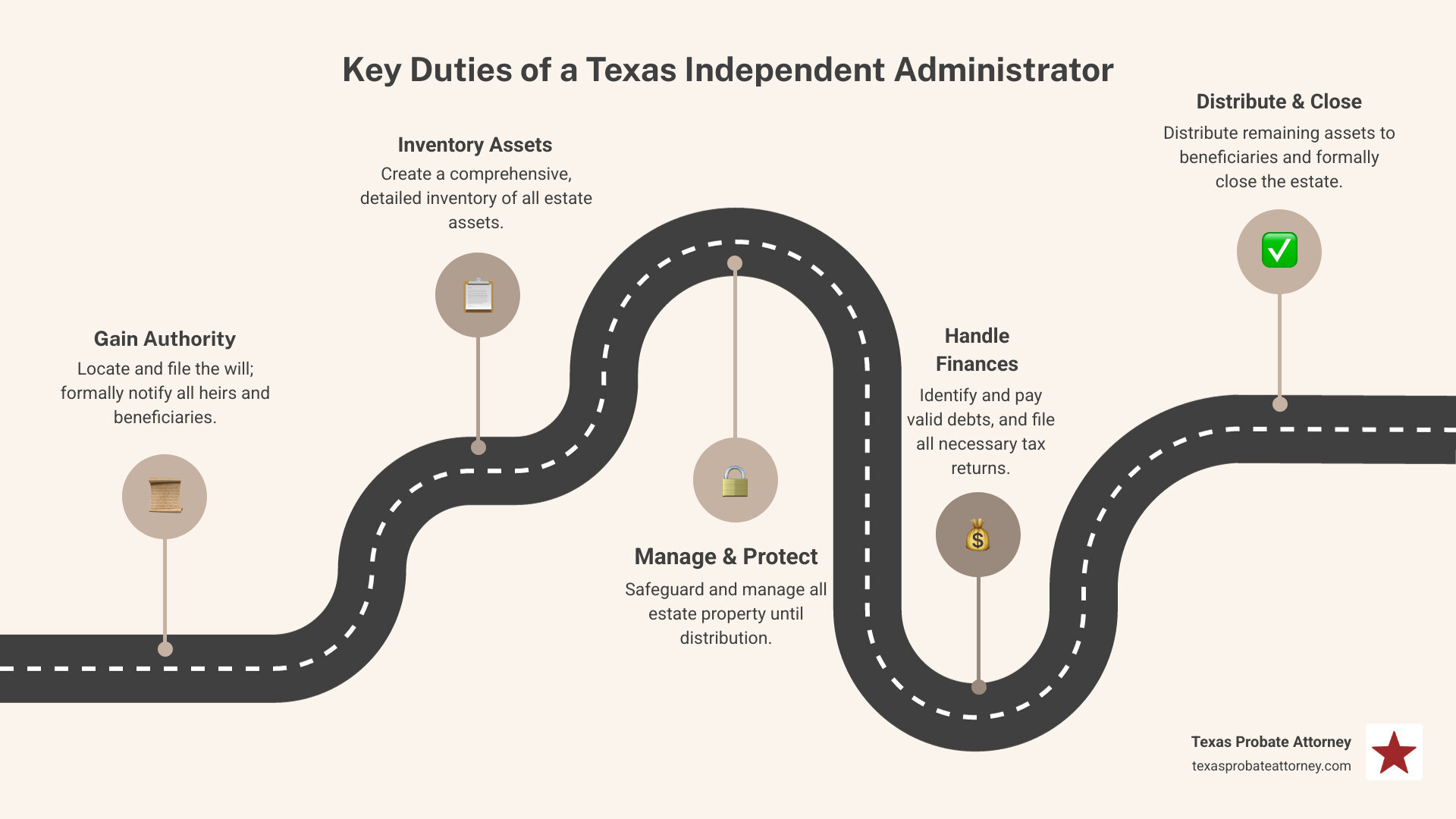

The duties of independent administrator texas are broad and crucial for settling an estate. They typically involve:

- Submitting the will to the probate court.

- Notifying heirs and beneficiaries of the probate.

- Creating a detailed inventory of all estate assets.

- Identifying and paying the estate’s valid creditors.

- Managing and protecting estate property until distribution.

- Filing necessary tax returns for the deceased and the estate.

- Distributing remaining assets to beneficiaries per the will or law.

An independent administrator manages the deceased’s estate with minimal court supervision, which can make the process faster and less costly. This role comes with significant legal obligations, known as fiduciary duties, which require you to act in the best interests of the estate and its beneficiaries.

This guide breaks down these responsibilities to help you confidently steer the process.

Important duties of independent administrator texas terms:

What is an Independent Administrator in Texas?

In Texas probate, an independent administrator is a person appointed by a court to manage and settle a deceased person’s estate. The key term is “independent,” which means they handle the estate with minimal court supervision after their appointment. This contrasts sharply with a “dependent administrator,” who requires court approval for most actions, making the process longer and more expensive for families in Houston, Fort Worth, and Austin. Independent administration is preferred because it helps settle estates faster and with less cost.

How is an Independent Administrator Appointed?

An independent administrator is appointed in one of two primary ways:

- With a Will (Testate Estate): A valid will may name an “independent executor” to serve without court oversight. The will must specifically request independent administration.

- Without a Will or if the Will is Silent (Intestate Estate): If there is no will, or the will doesn’t specify, all heirs can agree to an independent administration. This collective agreement is required for the court to grant these powers.

For estates without a will, an “heirship proceeding” is necessary first. This court process legally identifies the deceased person’s heirs. Once identified, these heirs can agree on appointing an independent administrator.

The main advantages of independent administration are reduced court supervision, less paperwork, and lower legal fees and court costs, making it a streamlined way to settle an estate in Texas.

For more detailed information, you can explore our resources on More info about Texas Probate Administration.

Here’s a quick comparison to show just how different Independent vs. Dependent Administration can be:

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Oversight | Minimal after initial appointment and inventory filing. Administrator acts independently. | Extensive. Court approval required for most actions (e.g., selling assets, paying debts). |

| Cost | Generally lower due to reduced court involvement and fewer legal fees. | Generally higher due to ongoing court filings, hearings, and attorney fees for each court-approved action. |

| Speed | Faster, as the administrator can act without delays of court dockets and approvals. | Slower, as each step requires court petition, hearing, and order, leading to potential delays. |

| Bond Required? | Often waived by the will or by agreement of heirs. | Usually required to protect creditors and heirs, adding to costs. |

| Complexity | Simpler for the administrator once appointed, but requires careful adherence to law. | More complex due to continuous court supervision and strict procedural requirements. |

| Fiduciary Duty | High. Administrator is personally responsible for proper management. | High. Administrator is responsible, but court oversight provides an additional layer of protection/scrutiny. |

The Primary Duties of an Independent Administrator in Texas

As an independent administrator, your most important responsibility is your “fiduciary duty.” This is a legal and ethical obligation to act solely in the best interests of the estate and its beneficiaries. You must manage the estate’s affairs with care, strictly following the Texas Estates Code with honesty and diligence. Mismanagement or acting in your own self-interest can lead to serious consequences, including personal financial liability. This standard applies to all administrators in Houston, Fort Worth, and Austin.

Step 1: Getting Started After Your Appointment

After the court appoints you, you must formally “qualify” to gain legal authority. This involves a few key steps.

First, you must file a sworn oath of office within 20 days of the court’s order. In this oath, you legally promise to faithfully perform the duties of independent administrator texas.

Next, you may need to file a bond, also within 20 days. A bond is often waived if the will or all heirs agree, but the court can still require one. The bond serves as a financial guarantee against mismanagement of the estate.

Once qualified, you will receive Letters of Administration (or Letters Testamentary if there is a will). These official documents prove your authority to manage the estate’s affairs, such as accessing bank accounts and dealing with creditors. Completing these initial court filings in Harris, Tarrant, or Travis County is crucial to begin the administration process.

Step 2: Managing the Estate’s Assets and Debts

With your Letters of Administration, your next duties of independent administrator texas involve managing the estate’s assets and debts.

Your first task is gathering assets. You must identify and take control of all the deceased’s property, including bank accounts, investments, real estate, vehicles, and personal belongings.

Within 90 days of your appointment, you must file a detailed Inventory and Appraisement with the court. This document lists all estate assets and their fair market value at the time of death. To maintain privacy, you may file an “Affidavit in Lieu of Inventory” if all beneficiaries agree and receive a copy.

Notifying creditors is a critical step. Within one month, you must publish a general notice to creditors in a local newspaper in the county of probate (e.g., Houston, Fort Worth, or Austin). Within two months, you must send a direct notice by certified mail to known secured creditors (like mortgage lenders). It is also wise to send a “permissive notice” to unsecured creditors (like credit card companies) to shorten their claim period from years to just four months. You can find more information on Notice to unsecured creditors under the Texas Estates Code.

Throughout the process, you are responsible for managing and protecting property. This includes securing assets, obtaining insurance, and preventing any loss in value.

Handling digital assets, such as online accounts and files, is also a key duty. The Texas Estates Code addresses these assets, and you may need a court order to access them if they hold financial or informational value.

For more insights into managing these responsibilities, you can visit our page on More info on Estate Administration Services.

Step 3: The Financial Duties of an Independent Administrator in Texas

After inventorying assets and notifying creditors, your duties of independent administrator texas shift to financial obligations, which are handled the same way whether the estate is in Houston, Fort Worth, or Austin.

You must handle paying valid debts and creditor claims. You will review all claims presented, pay valid ones from estate funds, and reject those you believe are invalid. Proper handling of claims filed in Harris, Tarrant, or Travis County courts is essential to protect the estate and avoid personal liability.

Next are taxes. You must file the deceased’s final income tax returns. For large estates, a federal estate tax return (Form 706) may also be required. While Texas has no state estate tax, this federal requirement applies to high-value estates in Austin, Houston, and Fort Worth. Professional tax or legal advice is highly recommended for this complex task.

It is vital to set up an estate bank account. All estate funds must be kept separate from your personal money in a dedicated account opened in the name of the estate. This prevents claims of commingling funds and ensures clear record-keeping for beneficiaries, a critical step in any administration in Houston, Fort Worth, or Austin.

After all debts, taxes, and administration costs are paid, your final duty is to distribute the remaining assets to the beneficiaries as directed by the will or Texas intestacy laws.

An independent administration is considered closed once all assets are distributed and all obligations are settled. While there is no formal closing document to file with the courts in Harris, Tarrant, or Travis County, you must keep meticulous records and provide a final accounting to all beneficiaries to finalize your duties.

Common Challenges for an Administrator

Independent administration streamlines probate but can present challenges. Awareness of these issues can help administrators in Houston, Fort Worth, and Austin manage the process effectively.

- Beneficiary Disputes: Disagreements among beneficiaries are common and can arise over will interpretation, asset valuation, or the administrator’s actions. These disputes can significantly delay an administration in Harris, Tarrant, or Travis County, adding stress and time. Legal guidance is often the best way to resolve these conflicts before they escalate in court. You can learn more about How to Contest a Will in Texas.

- Complex Assets: Estates in Houston, Austin, and Fort Worth often include intricate assets like family businesses, diverse investment portfolios, or real estate holdings across multiple counties. Managing, valuing, and distributing these assets adds complexity to the duties of independent administrator texas and often requires specialized local knowledge.

- Personal Liability for Mistakes: As a fiduciary, you are legally responsible for acting in the estate’s best interest. A simple mistake, like failing to properly notify a creditor in Houston or undervaluing a property in Austin, can result in personal liability, putting your own assets at risk. This underscores the importance of understanding your role and seeking proper guidance.

- Mismanagement Consequences: If an administrator fails to perform their duties properly or acts dishonestly (e.g., self-dealing), the consequences are severe. A beneficiary can petition the probate courts in Houston, Fort Worth, or Austin to have the administrator removed. If you are concerned about an administrator’s actions, our guide on How to Remove an Executor in Texas may be helpful.

The Role of a Probate Attorney

Taking on the duties of independent administrator texas is a complex task, but you don’t have to do it alone. While Texas law doesn’t require an administrator to be an attorney, partnering with a probate lawyer can prevent a smooth settlement from becoming a costly ordeal.

A probate attorney acts as your guide through the legal maze of estate administration. For estates in Houston, Fort Worth, or Austin, local counsel familiar with Harris, Tarrant, and Travis County court procedures is invaluable. An attorney provides:

- Legal Guidance: Translating the complex Texas Estates Code into clear, actionable steps, ensuring you meet all deadlines and requirements.

- Error Prevention: Helping you avoid common mistakes, like missing creditor notice deadlines, that can lead to personal liability and costly delays.

- Document Preparation: Ensuring all probate paperwork, from the initial application to the final inventory, is precise and filed correctly to prevent rejections.

- Court Representation: While minimized in independent administration, an attorney can represent you in any necessary hearings, making the experience less stressful.

- Navigating Complexities: Assisting with complicated issues like business interests, asset disputes, or family disagreements.

A probate attorney provides legal guidance and peace of mind during a difficult time. The goal is to fulfill the duties of independent administrator texas correctly, efficiently, and with confidence.

If you’re considering legal help, our article Do I Need a Probate Attorney in Texas? can help. For cost concerns, see Who Pays Probate Attorney Fees in Texas?.

Frequently Asked Questions about Administrator Duties

Here are answers to common questions we hear from clients in Houston, Fort Worth, and Austin about the duties of independent administrator texas.

How long does an independent administrator have to settle an estate in Texas?

There is no strict deadline for an independent administration in Texas. The law requires you to settle the estate in a “reasonable timeframe,” which depends on its complexity. For an estate in Houston, Fort Worth, or Austin, a simple administration might take 6-12 months, while one with business assets or disputes could take 18 months or longer. If the estate is not distributed within three years of your appointment, the probate court in Harris, Tarrant, or Travis County could consider removing you. Factors that extend the timeline include:

- The complexity of estate assets, such as commercial real estate in Houston or tech stocks in Austin.

- Resolving creditor claims.

- Beneficiary disputes or will contests filed in the local probate court.

- The time required to sell property in the competitive Austin, Houston, or Fort Worth real estate markets.

Can an independent administrator sell property without permission?

Yes, a key benefit of independent administration in Texas is the power to sell estate property—whether it’s a home in a Fort Worth suburb or a condo in downtown Austin—without prior court approval. This authority, granted by the will or a court order from a Harris, Tarrant, or Travis County judge, saves significant time and reduces costs. You can review the specifics in the Texas Estates Code on Power of Sale.

However, you still have a strict fiduciary duty to the beneficiaries. This means you must:

- Act in the estate’s best interest.

- Obtain fair market value for any property sold, which may require an appraisal in the local market.

- Avoid self-dealing or personal benefit from a sale.

- Provide a clear accounting of the sale to beneficiaries.

Failing these duties of independent administrator texas can lead to personal liability.

Does an independent administrator get paid in Texas?

Yes, an independent administrator in Houston, Fort Worth, or Austin is entitled to reasonable compensation for their services. The amount is determined in one of several ways:

- Specified in the Will: The will may set the compensation amount or method.

- Statutory Commission: If the will is silent, Texas law provides for a commission, typically 5% of money received and paid out by the estate. This applies to all administrations, whether in Harris, Tarrant, or Travis County.

- Court-Approved Fee: For unusually complex estates, you can petition the local probate court for a higher fee that reflects the work involved.

- Expense Reimbursement: You are also entitled to reimbursement for all necessary and reasonable out-of-pocket expenses, such as court filing fees in your county, property maintenance, and attorney fees.

It is crucial to keep meticulous records of your time and expenses to justify your compensation.

Your Next Steps in Estate Administration

Navigating the duties of independent administrator texas is a significant undertaking. From inventorying assets to paying debts and distributing inheritances, each step requires diligence, transparency, and a commitment to your fiduciary role. While independent administration offers autonomy, it also carries substantial responsibilities and potential liabilities where a legal partner is essential.

At Texas Probate Attorneys, we guide individuals through the complexities of probate and estate administration in Texas. We understand the challenges families in Houston, Fort Worth, and Austin face. Our commitment is to provide personalized legal representation, ensuring estates are handled with precision and care. Our experience allows us to anticipate issues and provide clear advice, helping you fulfill your duties of independent administrator texas confidently.

Let us help lift the legal burden so you can focus on your family. Our goal is to ensure your loved one’s estate is administered smoothly and correctly.

Learn more about Independent Administration under the Texas Estates Code