Texas Probate Paperwork—Independent Administration Forms Made Easy

Related Posts

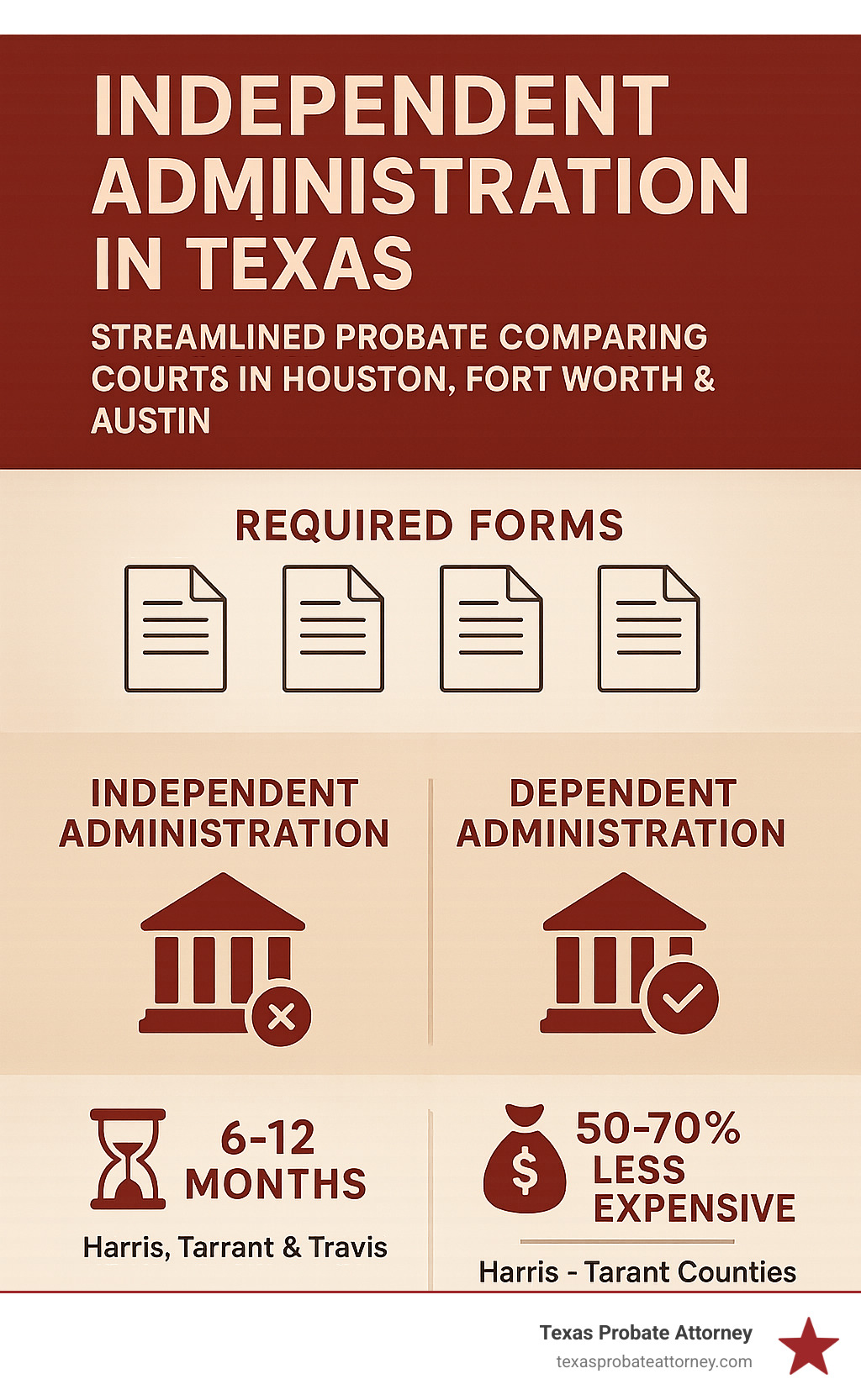

Why Independent Administration Texas Forms Matter for Houston, Fort Worth, and Austin Families

When you’re dealing with the loss of a loved one in Texas, independent administration texas forms can make the difference between a smooth estate settlement and months of costly court supervision. These essential documents allow families in Houston, Fort Worth, and Austin to handle probate with minimal court oversight, saving both time and money during an already difficult period.

Essential Independent Administration Forms in Texas:

- Application for Probate of Will and for Letters Testamentary (with will)

- Application for Letters of Administration (without will)

- Waiver of Citation and Bond forms

- Inventory, Appraisement, and List of Claims

- Letters Testamentary or Letters of Administration

- Notice to Creditors forms

- Final Account documentation

Independent administration is available in about 95% of Texas estates and offers significant advantages over dependent administration. While dependent administration requires ongoing court approval for most decisions, independent administration allows the executor or administrator to manage the estate with minimal court supervision after the initial appointment.

The key difference lies in efficiency. In Harris County (Houston), Tarrant County (Fort Worth), and Travis County (Austin), independent administration typically takes 6-12 months to complete, while dependent administration can stretch for years. The cost savings are equally dramatic – independent administration often costs 50-70% less than its dependent counterpart.

However, getting the paperwork right from the start is crucial. Missing forms, incorrect filings, or procedural errors can convert your independent administration into a dependent one, eliminating all the time and cost benefits you sought.

Important independent administration texas forms terms:

- what is an independent administrator in texas

- duties of independent administrator texas

- appointment of texas executor independent administration

What Independent Administration Means for Houston, Fort Worth, and Austin Families

For families in Houston, Fort Worth, and Austin, independent administration is the express lane of Texas probate. It’s a streamlined process designed to settle an estate with minimal interference from the busy probate courts in Harris, Tarrant, and Travis Counties, saving significant time, money, and stress.

Under the Texas Estates Code (Chapters 401-405), a person appointed as an independent executor (with a will) or independent administrator (without a will) can manage the estate largely on their own. After receiving initial court approval, they can collect assets, pay debts, and distribute property to beneficiaries without asking a judge for permission for every action.

The process typically begins with the court appointment, followed by the filing of an inventory, appraisement, and list of claims—a detailed list of what the deceased owned and owed. After that, the administrator is free to handle the estate’s business without constant court check-ins.

The difference between independent and dependent administration is striking:

| Feature | Independent Administration (Houston, Fort Worth, Austin) | Dependent Administration (Houston, Fort Worth, Austin) |

|---|---|---|

| Cost | Typically 50-70% less expensive | Significantly more expensive due to ongoing court fees |

| Speed | Faster (6-12 months average) | Slower (can take years) |

| Court Involvement | Minimal after initial appointment | Extensive, requiring court approval for most actions |

| Flexibility | High, administrator acts independently | Low, administrator must seek court orders |

This efficiency and privacy are why most families we work with in Houston, Fort Worth, and Austin choose independent administration.

More info about Texas Probate Laws.

When is Independent Administration Appropriate?

Independent administration is suitable for most estates in Houston, Fort Worth, and Austin, particularly in a few key scenarios.

If there is a will, the process is often straightforward. A well-drafted will that specifically requests independent administration and names an independent executor carries significant weight with judges in Harris, Tarrant, and Travis Counties. The court typically honors the testator’s intent (what the person who made the will wanted).

If there is no will (a situation called intestate succession), independent administration is still possible. However, it requires heir consent, meaning all legal heirs must agree in writing to both the independent administration and the person who will serve as the independent administrator.

Uncontested estates, where beneficiaries agree on how the estate should be handled, are ideal candidates for independent administration. When everyone is cooperative, the process can conclude in months instead of years.

Key Advantages of Independent Administration

The primary benefits of independent administration for families in Houston, Fort Worth, and Austin are significant:

- Cost Savings: By eliminating the need for constant court hearings and attorney appearances, independent administration dramatically reduces legal and administrative fees.

- Faster Process: Most independent administrations are completed within 6 to 12 months, compared to the multi-year timeline of a dependent administration. This allows beneficiaries to receive their inheritance sooner.

- Flexibility and Control: The administrator has the freedom to manage estate matters—like selling property or paying debts—promptly and efficiently, without waiting for a judge’s approval. This autonomy allows for better financial management of the estate’s assets.

These advantages provide families with real peace of mind during a difficult time.

More info about Estate Settlement Services.

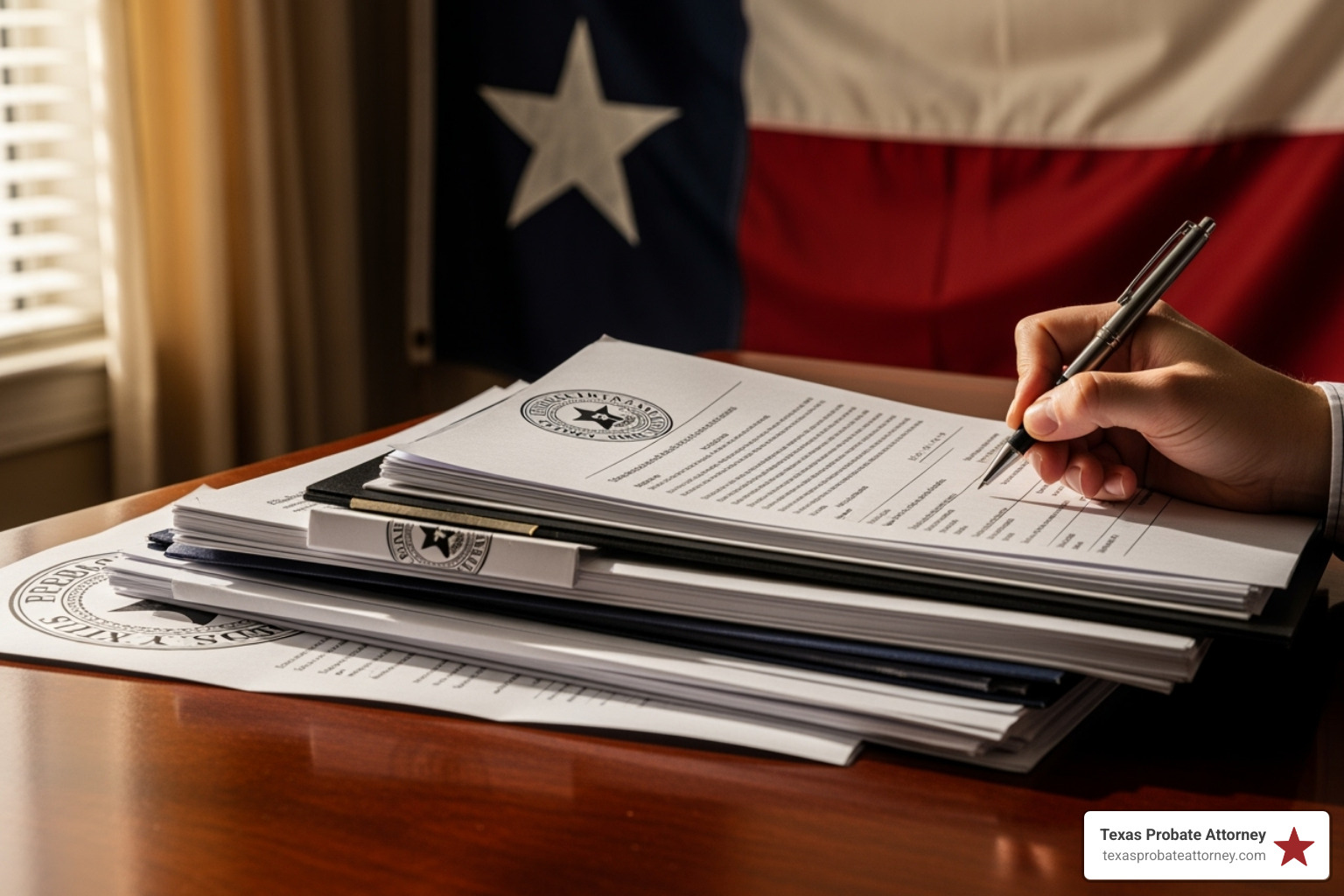

The Core Independent Administration Texas Forms You’ll Need

To settle an estate in Houston, Fort Worth, or Austin, you need the correct independent administration texas forms. These documents are the legal foundation for an efficient probate process.

Texas courts do not publish a standard set of “official” probate forms. Instead, the necessary documents are typically drafted by attorneys to meet the requirements of the Texas Estates Code and the local rules of Harris, Tarrant, and Travis Counties. A mistake on these forms can cause long delays or force the estate into a more expensive dependent administration.

Understanding which forms you need is the first step. For additional background, the Legal Forms – Probate Law – Texas State Law Library offers helpful information.

Forms for Administration With a Will (Testate)

When a will exists, it provides instructions for the estate. The following forms are used to legally carry out those wishes:

- Application to Probate Will and for Issuance of Letters Testamentary: This is the initial filing that asks the court to recognize the will and appoint the named executor.

- Proof of Death and Other Facts: This provides the court with formal verification of the death and the will’s validity.

- Order Admitting Will to Probate: This is the judge’s signed order validating the will and authorizing the appointment of the executor.

- Oath of Independent Executor: The executor must sign a sworn statement promising to faithfully perform their duties.

- Letters Testamentary: This crucial document is issued by the county clerk and serves as official proof of the executor’s authority to act on behalf of the estate. Banks and other institutions require it to grant access to assets.

More info on Probating a Will in Texas.

Forms for Administration Without a Will (Intestate)

When there is no will, the court must first determine the legal heirs before an administrator can be appointed. This requires a different set of forms:

- Application to Determine Heirship: This filing establishes a legal record of the deceased’s family tree to identify all rightful heirs under Texas law.

- Order Determining Heirship: After reviewing the evidence, a judge issues this order, which legally declares who the heirs are and their share of the estate.

- Application for Letters of Administration: This asks the court to appoint an independent administrator to manage the estate.

- Waiver of Citation, Waiver of Bond, and Consent to Appointment of Independent Administrator: This is a critical form that all heirs must sign. It shows their unanimous agreement to the independent administration and the chosen administrator.

- Letters of Administration: Similar to Letters Testamentary, this document gives the administrator the legal authority to manage the estate.

More info on the Independent Administration Texas Estates Code.

Key Ancillary Independent Administration Texas Forms

After the appointment, several other forms are needed to manage and close the estate:

- Inventory, Appraisement, and List of Claims: Within 90 days of appointment, the administrator must file this detailed report of all estate assets and debts. It creates a clear record and protects both the administrator and the beneficiaries.

- Notice to Creditors: The administrator must publish a notice in a local newspaper to alert potential creditors. Secured creditors, like mortgage lenders, must be notified directly via certified mail.

- Waiver of Bond: If not waived in the will, all beneficiaries can sign this form to waive the requirement for the administrator to post a bond (a type of insurance for the estate).

- Final Account and Closing Documents: To formally close the estate, it is good practice to prepare a final account showing all income and expenses. Closing also requires gathering receipts from beneficiaries, proof of debt payment, tax clearances, and new deeds for any real estate transfers.

The Role and Responsibilities of an Independent Administrator in Houston, Fort Worth, and Austin

Serving as an independent administrator in Houston, Fort Worth, or Austin is a significant legal responsibility overseen by the probate courts of Harris, Tarrant, and Travis Counties. It goes beyond filling out independent administration texas forms; it involves becoming the trusted manager of a person’s final affairs, with a direct duty to the estate’s beneficiaries.

An independent administrator has a fiduciary duty to the estate and its beneficiaries—a legal requirement to act with complete honesty, loyalty, and care. In the busy jurisdictions of Houston, Fort Worth, and Austin, this duty is taken very seriously. The role also comes with personal liability, meaning an administrator can be held financially responsible by the beneficiaries for mistakes or mismanagement of estate assets.

Key responsibilities include:

- Gathering and protecting all estate assets, from bank accounts to family heirlooms.

- Managing creditor claims by notifying creditors, reviewing claims, and paying valid debts from estate funds.

- Distributing the remaining assets to the beneficiaries according to the will or Texas inheritance laws.

The “independent” nature of the role means there is less court supervision, but this increases the personal responsibility of the administrator, who is directly accountable to the beneficiaries.

More info on the Duties of an Independent Administrator in Texas.

Legal Requirements to Serve as an Administrator in Harris, Tarrant, and Travis Counties

While the Texas Estates Code sets the baseline requirements for who can serve as an independent administrator, the probate courts in Houston, Fort Worth, and Austin apply these rules strictly to protect estates and beneficiaries.

- An individual must be at least 18 years old and of sound mind.

- Texas residency is generally required. An out-of-state resident can serve, but the courts in Harris, Tarrant, and Travis Counties will require them to appoint a local resident agent to accept legal service.

Certain individuals are disqualified by law, and judges in these metropolitan courts are vigilant in identifying them:

- A convicted felon, unless their civil rights have been restored and the specific court finds them suitable.

- An incapacitated person who has been legally deemed unable to manage their own affairs.

- A person a court finds unsuitable, a determination that can arise from a conflict of interest or other issues brought before the judges in Houston, Fort Worth, or Austin.

Corporate fiduciaries, such as banks or trust companies authorized to do business in Texas, are also eligible to serve and are a common choice for complex estates in these major urban centers.

More info on What is an Independent Administrator in Texas?.

What are Letters Testamentary or Letters of Administration in Houston, Fort Worth, and Austin?

Letters Testamentary (with a will) or Letters of Administration (without a will) are the official documents that grant an administrator their legal authority. Issued by the county clerks in Harris, Tarrant, or Travis County after a judge approves the appointment, these “Letters” are essential for managing the estate. Financial institutions, from local banks in Houston to title companies in Fort Worth and Austin, require certified copies of these Letters as proof that you have the legal right to access accounts, sell real estate, and handle other transactions on behalf of the estate. Without these court-issued documents, an administrator cannot perform their duties.

What Are Letters Testamentary and Letters of Administration?.

Where to Find Forms and Legal Help in Houston, Fort Worth, and Austin

When you need independent administration texas forms, knowing where to look can be challenging, as Texas does not provide a single, official set for all situations. However, there are resources available for families in Houston, Fort Worth, and Austin.

County court websites are a good starting point, though their offerings vary:

- Harris County (Houston): The Clerk’s Office website provides probate court information and general guidance.

- Tarrant County (Fort Worth): The District Clerk’s office offers some forms for common scenarios.

- Travis County (Austin): This county often provides more comprehensive online resources, including specific probate forms and checklists.

While these resources and legal libraries can be helpful, they come with a major limitation: they cannot provide legal advice. The forms are intended for use by attorneys, and court staff cannot tell you which form is right for your case. This is a significant risk for pro se applicants (people representing themselves).

Here are direct links to get you started:

Due to the complexity of probate, most families find that professional guidance is necessary for a successful outcome.

The Role of a Probate Attorney

Getting the independent administration texas forms right the first time is critical, and this is where a probate attorney is invaluable. A simple mistake can turn a streamlined process into a costly and complicated one.

At Texas Probate Attorney, Stacy Kelly and her team handle all aspects of drafting forms and navigating court procedures. We ensure every document is prepared to meet the specific local rules of the courts in Harris, Tarrant, and Travis Counties.

Our primary goal is avoiding pitfalls. We identify potential issues early, such as beneficiary disputes or creditor problems, and address them before they cause delays. The legal guidance we provide helps you understand your responsibilities as an administrator and make informed decisions with confidence.

Understanding the Houston, Fort Worth, and Austin-specific rules is key, as each court has its own practices. With over 40 years of combined experience, we know how to guide families through the probate process efficiently, saving them time, money, and stress.

More info on Houston Probate Attorneys; More info on a Fort Worth Probate Attorney.

Frequently Asked Questions about Independent Administration

When families in Houston, Fort Worth, and Austin face probate, they have many questions. Based on our years of helping clients with independent administration texas forms and procedures, here are answers to the most common concerns.

How does a will influence the process of independent administration in Texas?

A will can greatly simplify the process. If it names an “independent executor” and includes language waiving the need for a bond, it creates a strong legal presumption in favor of independent administration. Courts in Harris, Tarrant, and Travis Counties typically honor this request, which often eliminates the need to get written consent from all beneficiaries.

How much court oversight is there in an independent administration?

Court oversight is minimal, which is the primary benefit in the busy probate courts of Houston, Fort Worth, and Austin. After the administrator is appointed and files the required estate inventory with the court in Harris, Tarrant, or Travis County, they can manage most estate business—such as paying debts, selling property, and distributing assets—without seeking a judge’s permission for each action. The administrator still has a legal duty to act in the beneficiaries’ best interests, but they operate with significant freedom from the court.

Can the requirement for an administrator’s bond be waived?

Yes, and it’s a common way to reduce costs in probate cases across Houston, Fort Worth, and Austin. A bond is an insurance policy that protects the estate from mismanagement. The requirement can be waived in two ways that are routinely accepted by judges in Harris, Tarrant, and Travis Counties: 1) the will can explicitly state that no bond is required, or 2) all estate beneficiaries can sign a “Waiver of Bond” form, agreeing to proceed without one. This is common in uncontested cases where a trusted family member is serving as administrator.

Navigating Your Next Steps with Confidence

Independent administration is the most efficient and cost-effective way to settle an estate in Houston, Fort Worth, and Austin. It allows you to manage estate matters directly, saving time and reducing stress during a difficult period.

However, success hinges on filing the correct independent administration texas forms from the very beginning. A single error can force the estate into a lengthy and expensive dependent administration. The local rules in Harris, Tarrant, and Travis counties add another layer of complexity that can be difficult to steer alone.

At Texas Probate Attorney, Stacy Kelly and her team use their 40+ years of combined experience to guide families through this process. We provide personalized attention and handle the legal complexities so you can focus on what matters most—your family.

We understand the unique challenges that can arise, from out-of-state heirs to complex assets, and we know how to manage them efficiently. The peace of mind that comes from knowing your case is handled correctly is invaluable.

Ready to move forward with confidence? For personalized assistance with your probate matter, explore the Independent Administration Texas Estates Code.