Navigating Texas Probate—Independent Administration with Will Annexed

Related Posts

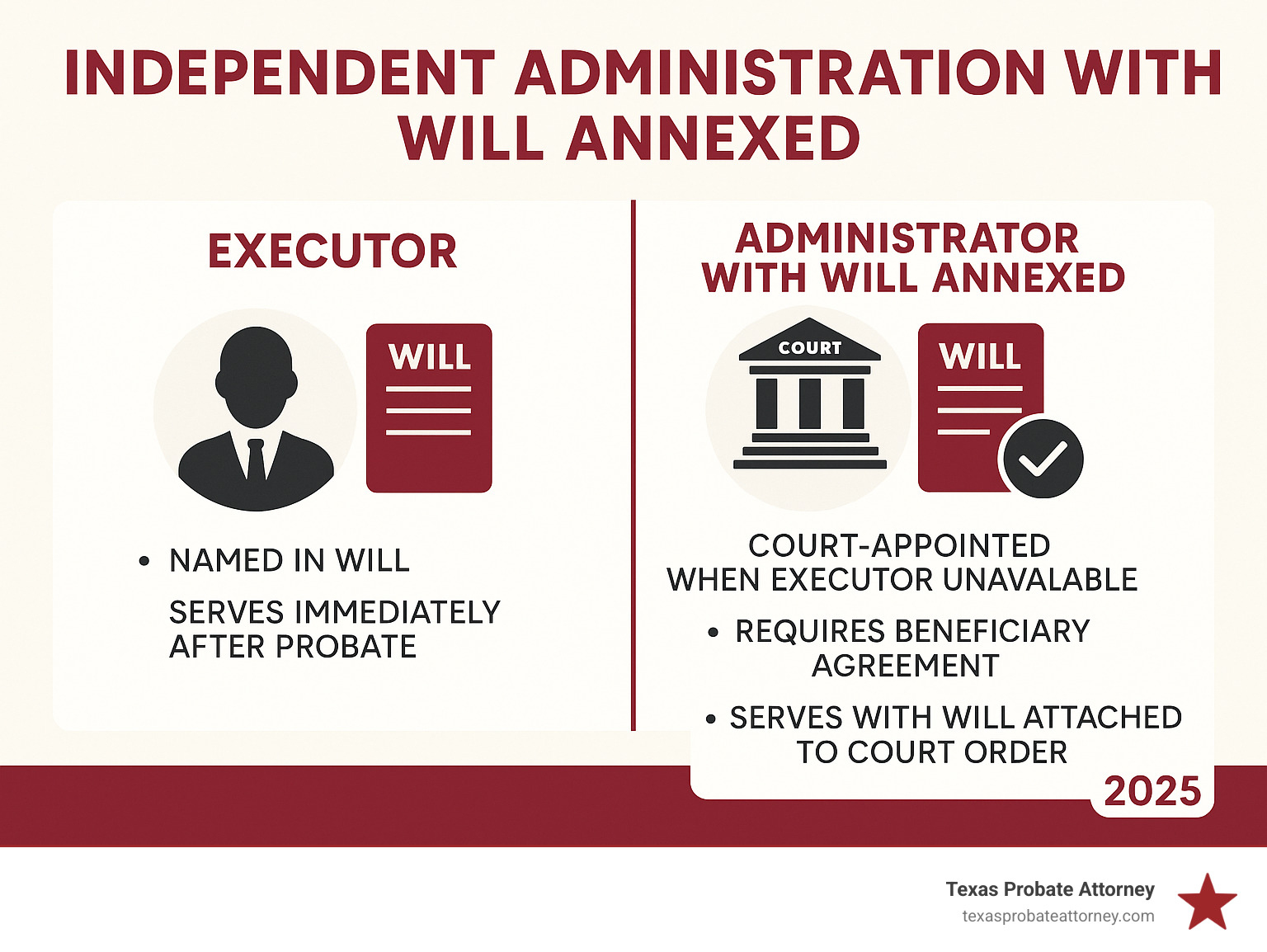

What Independent Administration with Will Annexed Means for Texas Families

When a loved one’s estate is settled in Texas, independent administration with will annexed texas is a probate process used when a valid will exists, but there is no available executor. This situation is common in Houston, Fort Worth, and Austin, where families need a court-appointed administrator to carry out the will’s terms.

Here’s what this process entails for families in Houston, Fort Worth, and Austin:

- What it is: A court-appointed administrator manages the estate with minimal supervision from the probate courts in Houston, Fort Worth, or Austin.

- When it’s needed: A will exists, but the named executor is deceased, has declined, is disqualified, or failed to qualify to serve in Harris, Tarrant, or Travis County.

- Who can serve: The court in Houston, Fort Worth, or Austin appoints an administrator, who must be approved by a unanimous agreement of all beneficiaries.

- Main benefit: It is a faster and less expensive process than a court-supervised dependent administration, saving time and money for families in these metro areas.

The term “will annexed” simply means the will is attached to the court’s order, giving the administrator the legal authority to follow the deceased’s written wishes. Without proper administration, assets remain frozen, and beneficiaries cannot receive their inheritance. This process ensures the estate can be settled efficiently.

Quick independent administration with will annexed texas terms:

- what is an independent administrator in texas

- duties of independent administrator texas

- appointment of texas executor independent administration

Understanding Independent Administration with Will Annexed in Texas

In Texas, probate is the legal process of settling a deceased person’s affairs. Independent administration is the preferred method because it allows an administrator to manage the estate with minimal court oversight, saving time and money. The term “administrator with will annexed” applies when the court appoints someone to execute a will because the named executor is unable to serve. This court-appointed individual has the same responsibilities as an executor and must follow the will’s instructions.

For families in Houston, Fort Worth, and Austin, the benefits are significant:

- Reduced Court Supervision: Fewer mandatory appearances at the probate courts in Houston, Fort Worth, or Austin.

- Lower Costs: Savings on court filing fees in Harris, Tarrant, or Travis County and reduced attorney fees.

- Faster Settlement: Decisions can be made without waiting for a judge’s approval, which is crucial in the economies of Austin, Houston, and Fort Worth.

- Greater Flexibility: The administrator can quickly manage assets, such as selling a Houston home or handling Fort Worth business interests.

- Increased Privacy: Keeps more family financial matters out of the public records maintained by the Harris, Tarrant, and Travis County clerks.

For more details, you can explore What is an Independent Administrator in Texas?

When is this type of administration necessary?

Independent administration with will annexed texas is required when a valid will exists but the executor cannot serve. Common reasons include:

- No executor was named in the will.

- The named executor has died or become incapacitated.

- The named executor is disqualified under Texas law (e.g., a convicted felon).

- The named executor refuses to serve or fails to qualify within the legal deadlines.

- The named executor fails to present the will for probate in a timely manner.

In these cases, which are common in Houston, Fort Worth, and Austin probate courts, the will remains valid; the court simply appoints a qualified person to execute it.

What are the requirements for an independent administration with will annexed texas?

To qualify in the probate courts of Harris, Tarrant, or Travis County, several legal requirements must be met. The foundation is a valid will that is admitted to probate by the local court.

Most importantly, all beneficiaries (distributees) must provide unanimous consent. Whether in Houston, Fort Worth, or Austin, every person inheriting under the will must agree to both the independent administration and the specific person chosen to serve as administrator. A single objection filed in the county clerk’s office can prevent this streamlined process.

Finally, the arrangement requires court approval. A judge in Harris, Tarrant, or Travis County must find that an independent administration is in the “best interest of the estate,” as outlined in the Texas Estates Code chapter 401. This judicial oversight ensures the process is appropriate for the specific circumstances of the estate, whether it involves Austin real estate, Fort Worth business assets, or Houston-based investments.

For more guidance, see Independent Administration Texas Estates Code.

The Step-by-Step Process for Independent Administration with Will Annexed Texas

The independent administration with will annexed texas process occurs in two phases: court appointment and estate administration. The process is consistent across probate courts in Houston, Fort Worth, and Austin.

Phase 1: Appointment by the Court

This phase establishes the administrator’s legal authority in Harris, Tarrant, or Travis County.

- File an Application for Probate: The process begins by filing an application in the probate court of the county where the decedent lived, whether Harris, Tarrant, or Travis County.

- Prove the Will: The will’s validity must be proven in the specific Houston, Fort Worth, or Austin court. This is often straightforward if the will is “self-proved,” but may otherwise require witness testimony.

- Attend a Court Hearing: The judge in the respective county court hears testimony to confirm administration is necessary and the proposed administrator is qualified. With beneficiary agreements in place, this hearing is typically brief.

- Obtain an Order Granting Administration: If satisfied, the Houston, Fort Worth, or Austin judge signs an order admitting the will to probate and appointing the administrator.

- Take an Oath and File a Bond: Within 20 days, the administrator must take a formal oath of office, typically at the county courthouse in Houston, Fort Worth, or Austin.

- Receive Letters of Administration: The Harris, Tarrant, or Travis County Clerk issues Letters of Administration with Will Annexed. These letters are the official proof of authority needed to manage estate assets in these areas.

For more details on this appointment process, check out Appointment of Texas Executor Independent Administration.

Phase 2: Administering the Estate

With Letters of Administration, the administrator can manage the estate with minimal court oversight.

- Gather Assets: The administrator must locate and secure all estate assets, including bank accounts, real estate in Houston, Fort Worth, or Austin, investments, and personal property.

- Manage Estate Funds: All estate funds must be held in a separate, dedicated bank account, often opened at a bank with branches in the Houston, Fort Worth, or Austin area.

- Pay Debts and Handle Claims: The administrator must notify creditors, review claims, and pay all valid debts of the estate, such as mortgages on Austin properties or business loans in Fort Worth.

- Act as a Fiduciary: The administrator has a legal fiduciary duty to act in the best interests of the beneficiaries and creditors, a standard enforced by the probate courts in Houston, Fort Worth, and Austin.

- Distribute Assets: After all debts and expenses are paid, the remaining assets are distributed to the beneficiaries according to the will, with property deeds filed in the appropriate county (Harris, Tarrant, or Travis).

Key documents in this process include the Application for Probate, the Will, the Order Granting Administration, the Letters of Administration, and the Inventory, Appraisement, and List of Claims. For an overview of these responsibilities, visit Duties of Independent Administrator Texas.

Key Duties and Legal Obligations for the Administrator

An administrator for an independent administration with will annexed texas has a fiduciary responsibility to manage the estate for the benefit of its beneficiaries and creditors. This is a position of trust with strict legal obligations enforced by courts in Houston, Fort Worth, and Austin.

Properly managing estate funds is a primary duty. The administrator must:

- Keep estate money separate: Open a dedicated bank account for all estate funds, ideally at a bank with a presence in Houston, Fort Worth, or Austin.

- Avoid commingling funds: Never mix estate money with personal finances. This is a serious breach of fiduciary duty that can lead to personal liability in Harris, Tarrant, or Travis County courts.

- Document all transactions: Maintain clear and accurate records of all income and expenses related to the estate’s assets, whether they are in Houston, Fort Worth, or Austin.

For comprehensive support, consider our Estate Administration Services to ensure compliance.

Notifying Creditors and Beneficiaries

Administrators must provide formal notice to interested parties within strict deadlines.

- Notice to General Creditors: Within 30 days of qualifying, a notice must be published in a newspaper of general circulation in the county of probate (Harris, Tarrant, or Travis) to alert general creditors.

- Notice to Secured Creditors: Within two months of qualifying, all known secured creditors (e.g., a lender for a Houston mortgage or a Fort Worth auto loan) must be sent notice by registered or certified mail.

- Notice to Beneficiaries: Within 60 days of the will’s probate in Houston, Fort Worth, or Austin, all beneficiaries named in the will must receive formal notice of the proceedings.

Proof of these notices must be filed with the Harris, Tarrant, or Travis County Clerk. Within 90 days of qualifying, the administrator must also file an affidavit with the court confirming that beneficiaries were notified. This is a mandatory, non-waivable deadline under Texas law.

Filing the Inventory and Handling Claims

Creating a financial record of the estate is another critical duty.

- File an Inventory: Within 90 days of qualifying, the administrator must file an “Inventory, Appraisement, and List of Claims” with the probate court in Houston, Fort Worth, or Austin. This document details all estate assets and their values, such as an Austin home or Fort Worth business.

- Use an Affidavit in Lieu of Inventory: If the estate has no unpaid debts (other than secured debts, taxes, and administration costs), the administrator may file a simpler Affidavit in Lieu of Inventory with the Harris, Tarrant, or Travis County court.

- Handle Creditor Claims: The administrator must review all claims presented by creditors, formally accepting or rejecting them within 30 days. Valid debts must be paid from estate assets before any distributions are made to beneficiaries in Houston, Fort Worth, or Austin.

Understanding which assets are subject to probate is key to this process. For more information, review Probate vs Non-Probate Assets in Texas: What You Need to Know.

Comparing Administration Types and Navigating Challenges

In Texas probate, the type of administration significantly impacts the cost and timeline of settling an estate. Independent administration with will annexed texas is far more efficient than dependent administration due to the difference in court supervision.

| Feature | Independent Administration (with Will Annexed) | Dependent Administration |

|---|---|---|

| Court Supervision | Minimal supervision from Houston, Fort Worth, or Austin courts | Extensive – court approval required for most decisions |

| Cost | Lower legal fees and court costs due to fewer filings in Harris, Tarrant, or Travis County | Higher costs from frequent court appearances and motions |

| Timeline | Faster settlement – typically 6-12 months in Houston, Fort Worth, or Austin | Longer process – often 12-24 months or more, depending on court dockets |

| Flexibility | High – administrator can quickly sell an Austin home or manage a Houston business | Limited – must wait for court approval on asset sales, debt payments |

Independent administration allows for quick decisions on time-sensitive matters, such as managing a business or selling real estate in the competitive markets of Houston, Fort Worth, and Austin.

Potential Complexities and Disputes

Even with its advantages, this process can face challenges:

- Beneficiary Disagreements: Disputes among beneficiaries in Houston, Fort Worth, or Austin can arise over the management or sale of assets, slowing the process.

- Contested Wills: If the will’s validity is challenged in a Harris, Tarrant, or Travis County court, the administration may be paused until the contest is resolved.

- Complex Assets: Managing assets like commercial real estate in downtown Houston, a family business in Fort Worth, or tech investments in Austin requires specialized handling.

- Creditor Disputes: If an administrator rejects a claim, the creditor may sue the estate, leading to litigation in the local probate court.

Clear communication and careful documentation can prevent many of these issues.

What are the implications of failing to comply with the requirements for an independent administrator with will annexed?

Failing to meet the legal duties of an administrator carries severe consequences.

- Breach of Fiduciary Duty: Putting personal interests ahead of the estate’s can lead to serious legal action in the probate courts of Houston, Fort Worth, or Austin.

- Removal by the Court: A judge in Harris, Tarrant, or Travis County can remove an administrator who is not performing their duties properly.

- Personal Liability: An administrator can be held personally responsible for financial losses to the estate caused by their mistakes or misconduct.

- Fines and Bond Forfeiture: The probate courts in Houston, Fort Worth, or Austin can impose fines, and any posted bond may be forfeited.

- Lawsuits: Beneficiaries or creditors can file lawsuits against the administrator in the local county court, resulting in costly legal battles.

These risks highlight the importance of seeking professional guidance to ensure all duties are fulfilled correctly. If disputes arise, it may lead to Probate Court Litigation.

Navigating Texas Probate—Independent Administration with Will Annexed

Families in Houston, Fort Worth, and Austin often ask what happens when a valid will is in place but the executor listed on the document can’t serve. In that situation, the probate court can switch gears and create an independent administration with will annexed texas. The “independent” label means the administrator works with very light court oversight, while “with will annexed” simply says the will is formally attached to the court’s order so its terms must still be honored.

What is an Independent Administration with Will Annexed in Texas?

- A court-appointed administrator steps in for an unavailable executor.

- The will guides every decision, but the administrator can act without coming back to court for routine approvals—a major advantage in fast-moving real-estate markets such as Houston’s Heights, Fort Worth’s Near Southside, or Austin’s Mueller District.

- Costs and delays drop sharply when compared to a fully supervised (dependent) probate, a key benefit for estates in Houston, Fort Worth, and Austin.

When is an Independent Administration with Will Annexed Necessary in Texas?

This probate tool is requested when any of the following occur:

- No executor was named in the will at all.

- The named executor has died, moved away, or lost capacity.

- The named executor is disqualified under Texas law or simply refuses to serve.

- The named executor misses the legal deadline to qualify in Harris, Tarrant, or Travis County probate court.

In each case, the will remains valid—the court just needs a new person to carry out its instructions for the Houston, Fort Worth, or Austin-based estate.

What are the Requirements to Qualify for an Independent Administration with Will Annexed in Texas?

- Valid Will: The judge in the Harris, Tarrant, or Travis County probate court must first admit the will to probate.

- Unanimous Beneficiary Consent: If the will doesn’t expressly allow independent administration, every distributee must agree to the process and the chosen administrator. This consent is crucial for cases in Houston, Fort Worth, and Austin.

- Court Approval: Even with full agreement, a Houston, Fort Worth, or Austin judge must find the arrangement is in the best interest of the estate, as detailed in Texas Estates Code chapter 401.

Meeting these three requirements gives the administrator freedom to settle the estate quickly while protecting the rights of all heirs in Houston, Fort Worth, and Austin.

The Step-by-Step Process for Independent Administration with Will Annexed Texas

Every probate court in Houston, Fort Worth, and Austin follows the same legal roadmap, but local filing rules and docket backlogs can make each county’s timing a little different. Below is a practical checklist that aligns with Texas Probate Laws and highlights what clients should expect at each stop.

Phase 1 – Securing Court Authority

- File the Application: Start in the county where the decedent resided—Harris, Tarrant, or Travis.

- Prove the Will: In the Houston, Fort Worth, or Austin court, a self-proved will often just needs a brief affidavit; otherwise, witness testimony may be required.

- Attend a Short Hearing: The judge in Harris, Tarrant, or Travis County confirms the will, reviews beneficiary consents, and determines if a bond is needed.

- Sign the Oath and Post Any Bond: This must be done at the respective county courthouse within 20 days of the court order.

- Pick Up Letters of Administration: The Harris, Tarrant, or Travis County Clerk provides these letters, which grant legal authority to deal with entities across Houston, Fort Worth, and Austin.

Phase 2 – Running the Estate

- Open an Estate Bank Account: Open a new account for the estate, never using personal accounts. This is a strict rule in Harris, Tarrant, and Travis County courts.

- Collect and Safeguard Property: From Midtown Houston condos to Fort Worth mineral interests, everything gets gathered under the estate umbrella.

- Send Creditor and Beneficiary Notices: Send required notices to parties in Houston, Fort Worth, Austin, or elsewhere, adhering to strict statutory deadlines.

- File the Inventory: File an inventory of assets with the local court within 90 days, unless an Affidavit in Lieu is permitted for the specific estate.

- Resolve Claims and Pay Debts: Pay all valid claims, such as property taxes in Austin or mortgages on Houston real estate, before any distribution.

- Distribute What Remains: Transfer assets as the will directs, file property deeds in the correct county (Harris, Tarrant, or Travis), get receipts, and file closing paperwork with the court.

Following these steps in order keeps the probate on track and reduces the risk of costly delays in any of the three metro courts.

Key Duties and Legal Obligations for the Administrator

Serving as an independent administrator with will annexed comes with strict fiduciary standards, and probate courts in Houston, Fort Worth, and Austin do not hesitate to hold administrators personally liable for errors. Below are the core responsibilities—plus the pitfalls we routinely see trip people up.

Core Responsibilities

- Segregate Estate Funds: Open a stand-alone account for the estate in a Houston, Fort Worth, or Austin bank and never mix estate money with personal funds. Our Estate Administration Services include setting up proper bookkeeping so this rule is never violated.

- Maintain Detailed Records: Every transaction involving estate assets, whether in Houston, Fort Worth, or Austin, must be documented.

- Meet Notice Deadlines: Missing a notice deadline in a Harris, Tarrant, or Travis County case can restart the creditor claim period—a costly mistake under Texas Estates Code chapter 308.054.

- File the Inventory or Affidavit in Lieu: File this document with the appropriate Houston, Fort Worth, or Austin court within 90 days unless an extension is granted.

- Act in the Best Interest of Heirs and Creditors: This fiduciary duty is strictly enforced by judges in Harris, Tarrant, and Travis counties.

Common Mistakes to Avoid

- Commingling Funds: A single personal charge on the estate debit card can trigger sanctions from a Houston, Fort Worth, or Austin judge.

- Informal Asset Transfers: Handing over assets located in Houston, Fort Worth, or Austin without written receipts invites disputes.

- Ignoring Taxes: Property taxes in Austin and income taxes for the decedent must be paid on time.

- Poor Communication: Silence breeds suspicion among beneficiaries, whether they live in Austin or across the country; regular updates avert many lawsuits.

Staying alert to these traps helps administrators close the estate smoothly and avoid personal liability.

Comparing Administration Types and Navigating Challenges

Choosing between independent and dependent administration can feel abstract, so the table below puts the two options side by side using real-world criteria that matter in Houston, Fort Worth, and Austin.

| Feature | Independent Administration (with Will Annexed) | Dependent Administration |

|---|---|---|

| Court Supervision | Minimal after appointment | Judge must approve most actions |

| Typical Legal Fees | Lower due to fewer hearings | Higher because every major task requires a motion |

| Timeline | About 6–12 months for a routine estate | 12–24 months or more, depending on court docket |

| Flexibility | Administrator can sell a Midtown condo or Fort Worth rental quickly | Must wait for court order before each sale |

Challenges Unique to Independent Administration

- Co-Beneficiary Conflict: A single objection in Travis County can shift the case back to a dependent track.

- Complex Asset Valuations: Austin tech-company stock options or Fort Worth mineral rights often require specialized handling.