No Fuss Probate—Muniment of Title Explained for Harris County Residents

Related Posts

Why Muniment of Title Harris County Texas is the Simplest Path Through Probate

Muniment of title harris county texas is a simplified probate process that allows you to transfer property through a will without appointing an executor or going through full estate administration. This streamlined approach can save you thousands of dollars and months of court supervision when your loved one’s estate meets specific requirements.

Here’s what you need to know about muniment of title in Harris County:

Key Requirements:

- Valid will that can be admitted to probate

- No unpaid debts except those secured by real estate (like mortgages)

- Estate consists primarily of real property or simple assets

- Filed within four years of death (with limited exceptions)

The Process:

- File application with Harris County Probate Court ($360 filing fee + $32 e-filing fee)

- Attend court hearing to prove the will and confirm no debts exist

- Receive court order that serves as legal authority to transfer assets

- File required affidavit within 180 days after the order

Benefits over traditional probate:

- No executor appointment needed

- No ongoing court supervision

- Lower costs (typically $2,000-$4,000 total)

- Faster timeline (2-4 months vs. 6-12 months)

- Less paperwork and complexity

When someone dies with a will in Harris County, many families assume they must go through lengthy probate proceedings. But if the estate has no significant debts and consists mainly of real property, muniment of title offers a much simpler alternative.

The process essentially asks the court to validate the will and confirm that no estate administration is needed. Once approved, the court order becomes your legal document to transfer ownership of property, bank accounts, and other assets directly to beneficiaries.

What is a Muniment of Title and How Does it Simplify Probate?

Settling an estate in Texas, particularly in Harris County, often conjures images of endless paperwork and high legal bills. A Muniment of Title Harris County Texas offers a simpler, more cost-effective path.

Under Texas law, a Muniment of Title is a special probate process where a valid Will is approved by the court without requiring a full estate administration or appointing an executor. The court essentially confirms the Will’s validity, allowing the document alone to transfer property. This is highly efficient for clarifying ownership, especially for real estate, ensuring a clear and legally sound chain of ownership. For more details, visit our page on Texas probate law.

Its simplicity is key. Unlike traditional probate, which involves naming a personal representative, notifying creditors, and constant court oversight, a Muniment of Title streamlines everything. The court order confirming the Will’s validity, along with a certified copy, becomes the official record for direct asset transfer to beneficiaries. This process is ideal for families seeking a quick, cost-effective way to settle an estate, especially when the primary goal is property transfer.

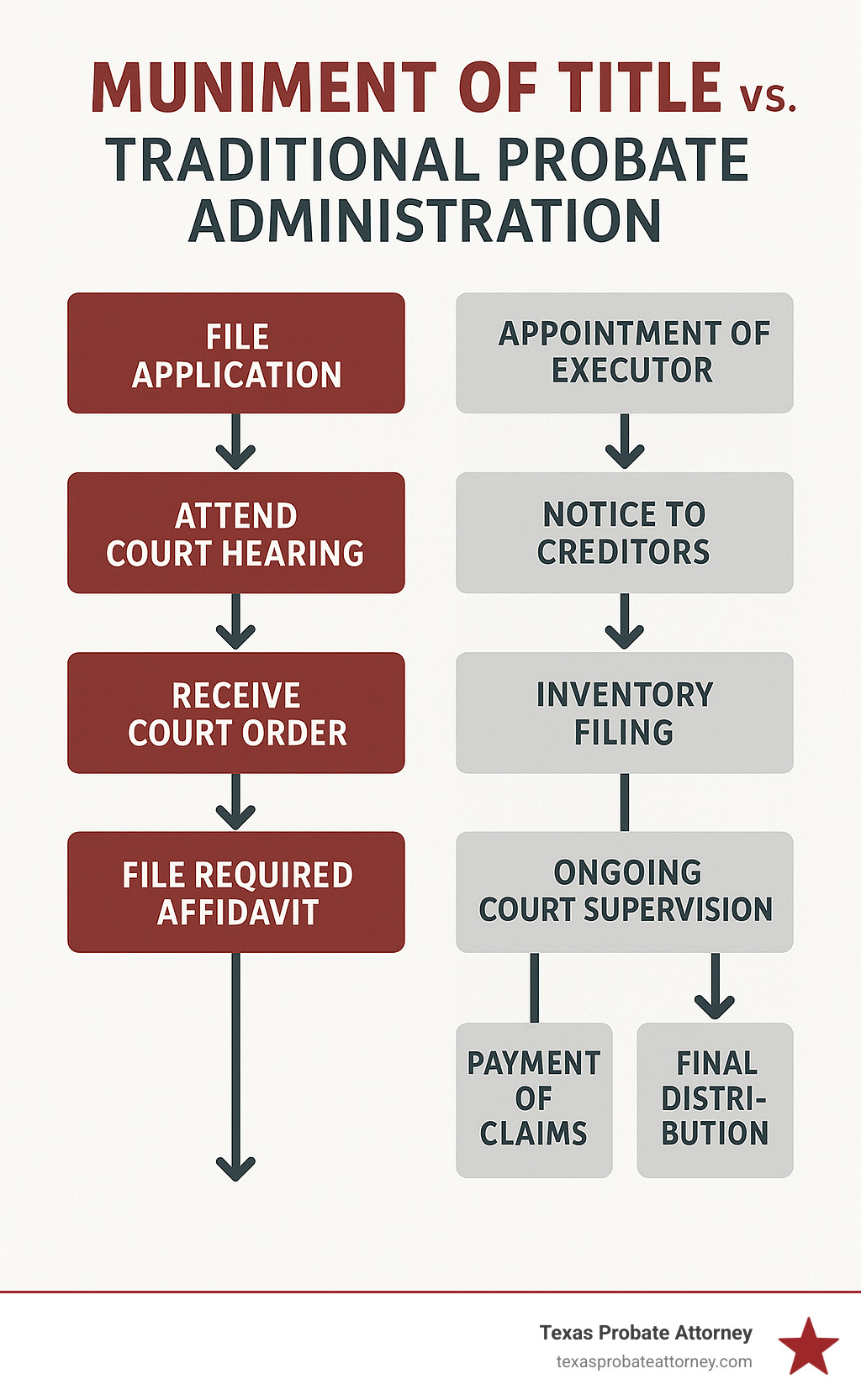

Muniment of Title vs. Traditional Probate

Think of it this way: traditional probate is a cross-country road trip; a Muniment of Title is a direct flight.

Traditional probate involves the court issuing “Letters Testamentary” or “Letters of Administration,” granting a person legal power to manage the entire estate. This includes:

- Notifying creditors: Handling estate debts.

- Filing an inventory: Listing all assets and their value.

- Ongoing court supervision: Requiring court approval for actions, leading to more hearings and paperwork.

While necessary for complex or debt-laden estates, full administration costs more and takes longer, involving attorney fees, court costs, and potentially over a year of management.

A Muniment of Title Harris County Texas bypasses most of these steps. No executor is appointed, no creditor notices are published (unless unsecured debts exist), and no detailed inventory is filed. This saves significant time and money. The process typically takes 2-4 months, with estimated costs ranging from $2,000 to $4,000, far less than full probate.

Here’s a quick look at the differences:

| Feature | Muniment of Title | Full Estate Administration |

|---|---|---|

| Executor/Admin | Not appointed | Appointed, with legal authority to manage estate |

| Court Oversight | Minimal, mainly for initial Will approval | Ongoing, with possible multiple hearings and reports |

| Debts | Not applicable if unsecured debts exist (except debts secured by real property like a mortgage) | Executor handles all creditor notices and debt payments |

| Timeframe | Typically 2-4 months | Can be 6-12 months or longer |

| Cost | Generally lower ($2,000-$4,000 total estimated) | Significantly higher, due to ongoing attorney and court fees |

| Complexity | Streamlined, less paperwork | More complex, needs detailed inventory and accounting |

| Purpose | Primarily to transfer title of property | Comprehensive management of the entire estate, including debt settlement and asset distribution |

The Legal Effect of a Muniment of Title Order

Once a Harris County Probate Court approves a Will as a Muniment of Title Harris County Texas, the order becomes a powerful legal document, allowing asset transfer without further court involvement. Texas Estates Code u00a7257.12(a) states this order provides legal authority for property transfer to the named beneficiaries. Banks, financial companies, and county clerks accept it as proof of ownership. For real estate, filing a certified copy of the order and Will in the county’s real property records creates a clear chain of title, essential for future transactions.

Is Your Estate Eligible? Key Requirements for Muniment of Title in Harris County

To qualify for the streamlined muniment of title harris county texas process, your loved one’s estate must meet specific Texas law requirements. This simplified probate option is not for every estate.

Key requirements include:

- A valid will: Muniment of Title applies only to “testate” estates, where a legally valid Last Will and Testament exists.

- No unpaid debts (except secured debts like mortgages): Unsecured debts such as credit cards, medical bills, personal loans, and funeral expenses must generally be paid.

- No need for formal administration: Complex business interests, family disputes, or other complications requiring ongoing court supervision necessitate traditional probate.

- Texas property: The will must address Texas property, and the application must be filed in the appropriate Harris County court.

For more information about probating a will in Texas, see our detailed resources.

The “No Unpaid Debts” Rule Explained

The “no unpaid debts” rule is strict.

Unsecured creditors must be paid in full before obtaining a Muniment of Title. This includes credit card balances, personal loans, medical bills, and utility bills. Creditors have a legal right to be paid, often requiring formal administration otherwise.

Funeral expenses also count as estate debts and must be settled.

Secured debts, like mortgages, typically don’t disqualify an estate. The property itself secures the debt, and the beneficiary usually assumes responsibility.

Thoroughly investigate all potential debts before filing, as even small overlooked bills can necessitate traditional probate.

Proving the Will is Valid

The Harris County Probate Court must confirm the document is your loved one’s valid Last Will and Testament.

Self-proved wills (with a notarized affidavit signed by testator and witnesses) are presumed valid under Texas law, allowing admission without additional witness testimony.

Non-self-proved wills require extra steps, typically witness testimony in court confirming they saw the testator sign, that the testator was of sound mind, and that they signed as witnesses.

Proper execution must be demonstrated, including correct witness count, signatures, and testator’s mental capacity.

More details are in the Texas Estates Code. We help steer these technical requirements.

The Step-by-Step Guide to the Muniment of Title Process in Harris County, Texas

Navigating the Harris County Probate Courts might seem daunting, but with a clear roadmap, the Muniment of Title process is quite manageable.

Here’s a simplified breakdown of the key steps:

- Gathering Your Paperwork: Collect all necessary documents for a smooth application.

- Application Filing: Prepare and file the “Application for Probate of Will as a Muniment of Title” with the Harris County Clerk’s office.

- Court Hearing: A judge schedules a brief hearing where the will and evidence are presented, and the applicant may testify.

- Judge’s Order: If requirements are met, the judge signs the Muniment of Title order.

- Post-Order Responsibilities: Crucial steps follow to ensure the will’s terms are carried out.

We help you through every step.

Gathering Your Paperwork: Required Documents for Filing

Preparation is key. Before filing with Harris County Probate Courts, gather these essential documents to ensure a complete and accurate application, minimizing delays:

- Original Last Will and Testament: The original, signed will is necessary. Lost originals present different challenges.

- Certified Copy of the Death Certificate: Proves the decedent’s passing.

- Application for Probate of Will as a Muniment of Title: The formal legal document outlining facts and affirming eligibility (especially “no unpaid debts” rule).

- Proof of Paid Debts (if applicable): Be prepared to demonstrate any unsecured debts have been paid (receipts, bank statements, testimony).

- Property Descriptions: Accurate legal descriptions for real property devised in the will.

- Heirship Information: Background on the decedent’s family tree and legal heirs.

Organizing these documents makes filing smoother.

Navigating the Harris County Probate Courts: Fees, Forms, and E-Filing

Filing in Harris County involves specific administrative steps handled by the Harris County Clerk’s Office.

- Filing Fees: The court filing fee for a Muniment of Title in Harris County is $360.00.

- E-Filing Mandate: Electronic filing is mandatory for attorneys, submitting documents digitally via an approved Electronic Filing Service Provider (EFSP).

- E-Filing Fees: An additional $32 ($30 State + $2 County) is charged for e-filing each new muniment of title harris county texas case. We carefully review submissions to avoid rejections.

- EFileTexas.gov: This state-wide portal connects to the court’s e-filing system.

- Probate Court Forms: The County Clerk’s office provides administrative forms, not application drafting forms.

- Pro-Se Filing Exceptions: While unrepresented applicants (“pro-se”) can file manually, handling a Muniment of Title without legal counsel is generally not advisable in Harris County’s complex system.

The Court Hearing and Necessary Testimony

After filing, the Harris County Probate Court schedules a brief, straightforward hearing to confirm facts and admit the will.

The applicant (often you or the beneficiary) will testify under oath, guided by us, covering key facts:

- Proof of Death: Confirming the decedent’s passing and date.

- Proof of Will Validity: Affirming the document is the Last Will and Testament, properly executed, and signed by a sound-minded decedent. Non-self-proved wills may require witness testimony.

- Proof of No Unsecured Debts: Testifying that no unpaid unsecured debts exist, or they’ve been paid.

- No Need for Administration: Confirming no necessity for formal estate administration.

The judge reviews testimony, application, and will. If aligned, the order admitting the will as a Muniment of Title is signed.

For a deeper look at navigating the Texas Probate Code, explore our detailed overview.

After the Hearing: Your Responsibilities for a muniment of title harris county texas

After the judge signs the Muniment of Title order, the applicant has key responsibilities to ensure proper documentation and fulfillment of the will’s terms:

- The 180-Day Affidavit: Within 180 days of admission, file a sworn affidavit with the court clerk detailing fulfilled and unfulfilled will terms. This ensures compliance and can be waived or extended by the court.

- Recording the Order: For real property, file a certified copy of the order (and often the probated will) in the county deed records where the property is located. This updates public records, establishing a clear chain of title essential for future sales.

- Distributing Assets: The order grants legal authority to transfer assets (bank accounts, vehicles, personal property) directly to beneficiaries without further court intervention. A certified copy is usually sufficient for institutions.

Completing these steps ensures the Muniment of Title is fully effective and the estate is settled efficiently.

Special Considerations and Potential Roadblocks

While muniment of title harris county texas is straightforward when conditions are met, estates can be complicated. Common issues include:

- Out-of-state banks or brokerage accounts: These institutions may not recognize Texas’s unique probate shortcuts, potentially insisting on “Letters Testamentary” and causing delays or requiring full administration.

- Four-year statute of limitations: Texas law generally requires filing a will for probate within four years of death. Missing this deadline complicates matters.

- Lost original will: Texas law presumes a lost will was revoked, making probate much more complex.

- Disputes: Muniment of Title is not suitable for cases with disputes over will validity or inheritance.

Understanding these roadblocks helps us advise on the best path. We also offer resources on avoiding probate court in Texas through estate planning.

The Four-Year Rule and Its Exception

The four-year rule is a critical deadline: a will, including for muniment of title harris county texas, must be filed for probate within four years of death. Beyond this, the court generally presumes “default.”

An exception allows probate after four years if the applicant was “not in default” for the delay. This applies when the delay was genuinely beyond your control or knowledge, such as:

- Lack of Knowledge: Unawareness of the will’s existence or location.

- Belief Further Action Unnecessary: Genuinely believing no further legal action was needed for property transfer.

- Fraud: Delay caused by deceptive actions or concealment.

Compelling evidence of “due diligence” is required, explaining the delay and demonstrating no fault. It’s a higher bar, but achievable.

When to Steer Clear: Situations Where Muniment of Title Isn’t the Right Choice

While muniment of title harris county texas is a valuable tool, it’s not universal. Avoid it in these situations:

- Significant Unsecured Debt: Outstanding unsecured debts (credit cards, medical bills, funeral expenses) usually require full administration to notify and pay creditors.

- Need for an Executor or Administrator: If legal authority is needed to collect assets, pursue lawsuits, manage business interests, handle complex tax matters, or sell property without all beneficiaries’ consent, Muniment of Title is insufficient.

- Complex Assets: Estates with diverse assets requiring active management or specialized transfer procedures (e.g., business interests, intellectual property) often need full administration.

- Potential for Disputes: Will contests, beneficiary disagreements, or questions about the decedent’s mental state necessitate the robust framework of full probate administration.

- Out-of-State Property (without a Texas Will): Texas-specific muniment of title harris county texas does not cover real property in other states, which will likely require separate ancillary probate.

We’ll help determine the appropriate probate method for your circumstances.

Frequently Asked Questions about Muniment of Title in Harris County

We receive many questions about Muniment of Title. Here are common inquiries from Harris County residents, with straightforward answers.

What if I can’t find the original will?

If an original will cannot be found in Texas, the law presumes it was intentionally destroyed or revoked. Overcoming this requires compelling evidence to the Harris County Probate Court. You must prove the will’s contents (e.g., via copies or testimony), prove its proper execution (signed and witnessed correctly), and most importantly, prove non-revocation (convincing the court its disappearance was accidental, not intentional). This process is complex and challenging, making legal counsel critical.

How much does the entire muniment of title harris county texas process cost?

Muniment of Title is more cost-effective than traditional probate. Costs include:

- Court filing fee: $360.00 in Harris County.

- E-filing fees: $32 ($30 state + $2 county).

- Attorney fees: Variable, typically $1,500 to $3,500 for straightforward cases, depending on complexity.

- Certified copies: $10-25 each for court order and probated will.

- Recording fees: Around $25 for the first page in county deed records.

Total estimated costs for a muniment of title harris county texas typically range from $2,000 to $4,000, a significant saving compared to full administration.

Can I handle a Muniment of Title myself without an attorney?

While legally possible (“pro se”), we strongly advise against handling a Muniment of Title without an attorney, especially in Harris County.

Legal representation is crucial because:

- The Law is Complex: Intricate rules are easily missed by those without legal training.

- Court Expectations: Harris County Probate Courts expect perfectly prepared applications; pro se errors often lead to rejections or delays.

- Unauthorized Practice of Law: Representing others’ interests (e.g., other beneficiaries) without a license can be unauthorized practice of law.

- Risk of Errors: Mistakes can cause significant delays or force conversion to a more expensive traditional probate.

- Fulfilling Duties: An attorney ensures post-order responsibilities are met correctly, protecting you and the estate.

Attempting a muniment of title harris county texas case without legal counsel often costs more in the long run due to errors, delays, and potential for complicated probate. Most Harris County probate courts prefer applicants to have legal representation for a smoother process.

Conclusion

We hope this guide clarified the muniment of title harris county texas process. It’s a valuable, simpler, and more affordable way to settle estates in Texas, allowing asset transfer, especially real property, without full administration. It aims to ease a difficult time.

At Texas Probate Attorney, we offer clear, personal guidance. With over 40 years of combined experience, we help clients achieve estate settlement goals with minimal stress. We understand Harris County Probate Courts and provide thorough, personal attention, aiming for quick, efficient solutions.

If Muniment of Title suits your needs, or for any probate questions, please reach out. We’re here to help you understand your choices and find a smooth resolution. Visit our page on finding a probate lawyer in Texas.