Everything You Need to Know About Muniment of Title Texas

Understanding Muniment of Title Texas: Your Streamlined Probate Option

When you hear “muniment of title,” it might sound like complex legal jargon. But for families in Houston, Fort Worth, and Austin navigating the loss of a loved one, understanding muniment of title Texas can be a real game-changer.

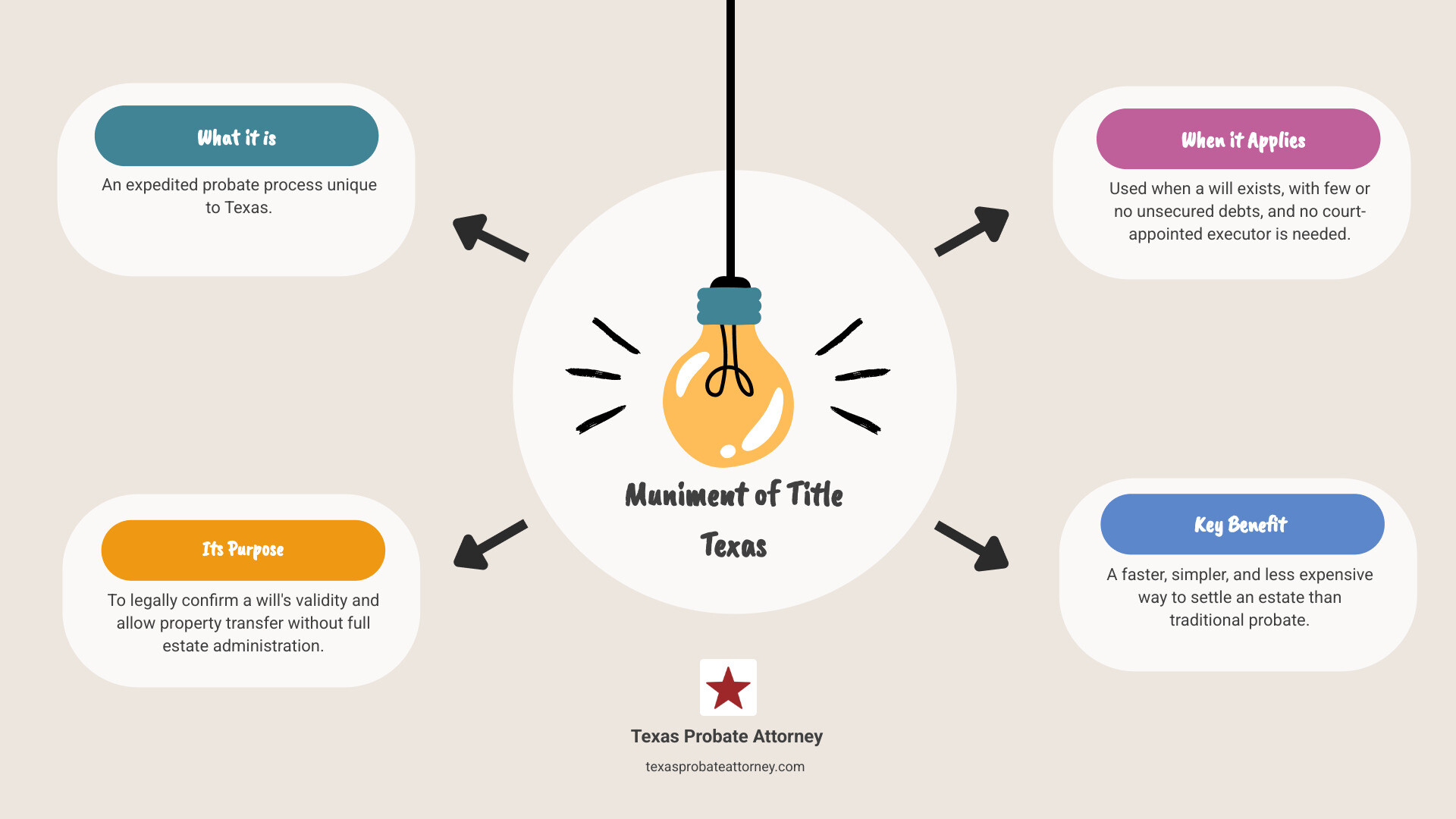

Here’s the quick rundown:

- What it is: A specialized, expedited probate process unique to Texas.

- Its purpose: To legally confirm a will’s validity and allow property transfer without a full estate administration.

- When it applies: Typically used when someone dies with a will, has few or no outstanding unsecured debts, and there’s no need for a court-appointed executor.

- The benefit: It’s often a faster, simpler, and less expensive way to settle an estate than traditional probate.

Dealing with a loved one’s estate in Houston, Fort Worth, or Austin can feel overwhelming. You’re grieving, and suddenly you’re faced with legal terms that make no sense. The good news? Texas law offers unique paths to make this process easier, especially for simpler estates in Harris, Tarrant, and Travis counties.

Imagine a shortcut. That’s essentially what muniment of title can be for some families in Houston, Fort Worth, and Austin. It’s a way to get court approval for the will, confirming it’s the legal document that dictates who gets what, without all the extra steps of a full-blown estate administration.

This process is designed to help you transfer assets like real estate in Harris County or bank accounts in Austin directly to the people named in the will, using the court’s order as your authority. It’s particularly useful when there aren’t many loose ends to tie up.

What is Muniment of Title? A Texas-Specific Probate Shortcut

Let’s start with the basics. The word “muniment” itself simply means “evidence.” So, a “muniment of title” generally refers to any document that proves ownership of property. Think of it as a super important paper that helps defend your claim to something, like a deed for your house in Houston or even a will drafted in Austin. These are the pieces of paper that prove who truly owns what.

Now, for the Texas twist! While the general definition applies, in our great state, muniment of title Texas takes on a very specific and unique meaning within probate law. It’s not just a piece of evidence; it’s an entire, expedited legal process.

Imagine you’ve lost a loved one in Houston, Fort Worth, or Austin, and they left a will. You want to make sure their wishes are followed, and their property goes to the right people without a huge fuss. That’s where muniment of title Texas can come in handy. It’s a special type of probate action designed to prove the validity of that will without needing a full-blown estate administration.

This means you don’t need to appoint an executor or administrator to manage every detail of the estate. Instead, the court’s order admitting the will to probate as a muniment of title becomes the legal authority you need. It confirms the will and becomes the direct path to clearing title to assets and transferring property, like real estate in Tarrant County or bank accounts in Austin, straight to the beneficiaries named in the will. It’s truly a direct route!

This unique process is all laid out in the Texas Estates Code, specifically Section 257.12(a). It’s a streamlined approach that allows the will itself, once validated by the court, to serve as the direct means of transferring property, especially real property. This means you don’t have to go through the often lengthy and costly process of administering an entire estate.

For many families in Houston, Fort Worth, and Austin, particularly those whose loved one left a will and had a relatively simple estate, this can be a tremendous relief. It often saves time, money, and a whole lot of headaches. It’s definitely one of the simpler options we discuss when explaining the probate meaning to our clients.

Qualifying for Muniment of Title in Texas: The Strict Requirements

While muniment of title Texas is a fantastic tool, it’s not a universal solution for every estate in Houston, Fort Worth, or Austin. There are strict eligibility requirements that must be met. Our goal is always to find the most efficient and least stressful path for your family, and sometimes that means a different probate method. Think of it like a special express lane – it’s wonderful if you qualify, but not every car can use it!

Core Eligibility Criteria

To even consider muniment of title Texas, several foundational conditions absolutely must be in place. If these aren’t met, this particular streamlined process simply won’t work for your loved one’s estate in Harris, Tarrant, or Travis County:

First off, your loved one absolutely must have left behind a valid Texas Will. This is non-negotiable. Muniment of title is exclusively for individuals who died “testate,” meaning they had a legally sound will in place. If there’s no will, or if the will isn’t valid, this option is off the table.

And, of course, the person needs to be deceased! The court will require proof of this, usually in the form of a death certificate.

You’ll also need to file the application in the proper county. This is typically the county where your loved one lived. For our clients, this means filing in Harris County for those in Houston, Tarrant County for Fort Worth residents, or Travis County if your loved one was in Austin.

Perhaps the biggest hurdle is proving there’s no necessity for administration. This means the court must be satisfied that a full-blown estate administration isn’t needed. Essentially, all assets can be transferred directly to the beneficiaries using the will and the court’s order, without requiring an executor to gather assets, pay debts, or resolve disputes. If an estate in Houston is complex or needs active management, muniment of title Texas won’t be the right fit.

You can learn more about how different assets are handled in our guide on Probate vs Non-Probate Assets in Texas.

The Critical Role of Estate Debts

This is often the trickiest part of qualifying for muniment of title Texas. The law is quite clear about debts:

The estate generally must have no unpaid unsecured debts. What are these? Think common debts like credit card balances, medical bills, utility bills, or even funeral expenses. If these types of debts exist and haven’t been paid, you typically can’t use muniment of title. They usually need to be settled before you can successfully pursue this option.

But here’s a crucial exception! Secured debts, like a mortgage on a house or a car loan, usually do not prevent an estate from qualifying. If the only debt is a mortgage on the family home in Fort Worth, for example, you can still proceed. The property will simply transfer to the beneficiary, and they will take it subject to that existing mortgage.

Then there’s the Medicaid Estate Recovery Program (MERP). This is a specialized area that requires careful attention. If the deceased received certain Medicaid benefits after March 1, 2005, MERP might have a claim against the estate. In such cases, your application for muniment of title Texas must include a certificate stating the status of any MERP claim. Specific language is even required in the court order, depending on whether a MERP claim exists or has been waived. We always ensure these detailed requirements are carefully handled for our clients in Houston, Fort Worth, and Austin.

Sometimes, if there are just a few minor unsecured debts, the beneficiaries may choose to pay them out of their own pocket to make the estate eligible for muniment of title Texas. This can still be a much more cost-effective and quicker route than going through a full probate administration in Harris, Tarrant, or Travis County.

When Muniment of Title is Not the Right Choice

Even if it seems like a perfect fit, muniment of title Texas isn’t always the best path. Here’s when it generally won’t work or isn’t advisable:

It’s likely not an option if the estate has significant unsecured debt that isn’t paid off by the beneficiaries. If there are substantial outstanding credit card bills, large medical expenses, or other unsecured loans, a full administration might be necessary to properly deal with creditors.

If the Will is contested or invalid, meaning there are disputes over its authenticity, its terms, or if someone is challenging its validity, muniment of title Texas won’t work. These kinds of situations require a full probate proceeding to resolve the disagreements in a Houston, Fort Worth, or Austin court.

You also can’t use muniment of title if the estate needs to file a lawsuit or actively collect assets. For example, if the estate in Austin needs to sue someone (perhaps for personal injury or wrongful death), or if an executor is needed to actively collect assets from a difficult debtor, muniment of title is insufficient. It doesn’t appoint anyone with the legal authority to act on behalf of the estate in that way.

While muniment of title Texas works well for real estate and bank accounts, many financial institutions, especially those dealing with publicly traded stocks, bonds, or complex investment accounts, may still demand “Letters Testamentary” before they’ll transfer assets. These “Letters Testamentary” are only issued in a full probate where an executor is officially appointed. This is a common practical issue we help our clients in Houston, Fort Worth, and Austin steer through.

A Texas muniment of title order only has authority over assets located within Texas. If your loved one in Houston, Fort Worth, or Austin owned property in other states, you would likely need separate probate or administration processes in those jurisdictions.

Finally, if the estate is particularly large and complex, especially if it’s substantial enough to require a formal inventory for tax purposes, a full administration is usually necessary. This ensures all assets are properly accounted for and any tax obligations are met.

The Muniment of Title Texas Process: From Application to Order

So, you’ve determined that muniment of title Texas might be the right fit for your family’s situation in Houston, Fort Worth, or Austin. That’s great! Now, let’s talk about what happens next. We’ll walk you through each step, making sure everything is handled correctly and smoothly.

The process is generally pretty straightforward, but it does require careful attention to detail to make sure all legal boxes are checked. Our firm knows the ins and outs of the probate courts in Harris County (Houston), Tarrant County (Fort Worth), and Travis County (Austin), so you’re in good hands.

Step 1: Filing the Application with the Court

Your journey begins by getting the “Application to Probate Will as a Muniment of Title” ready and filing it with the right probate court in Harris, Tarrant, or Travis County.

First, we’ll make sure we file in the correct county. This is super important! We always file the application in the county where your loved one lived when they passed away. For instance, if they called Houston home, we’ll file in Harris County. If they were in Fort Worth, it’s Tarrant County. And for our Austin neighbors, we head to Travis County.

The application itself is a formal document, and it needs to include specific information, all laid out by Texas law. Think of it as telling the court the whole story of the will and the estate. This includes important details like who you are and who your loved one was, along with the last three numbers of their driver’s license and social security numbers for identification. We’ll also include where and when they passed away, confirm we’re in the right county (like Harris, Tarrant, or Travis), and give the court a general idea of the estate’s property and its value. You’ll also need to share details about the will itself – when it was signed, who witnessed it, and who was named as an executor (if anyone). It’s also important to tell the court about any children born or adopted after the will was made, and to confirm that there are no unpaid unsecured debts in the estate (remember, secured debts like mortgages are usually okay!). Finally, we’ll include information about any dissolved marriages or charitable organizations mentioned in the will.

Along with the application, we’ll also need to attach the original Will. This is the actual, physical will. If for some reason the original can’t be found, we’ll need to explain why to the court.

There are also standard court filing fees when we kick off the process. These usually run anywhere from $250 to $400, depending on which county we’re in – whether that’s Houston, Fort Worth, or Austin. We’ll always give you a clear breakdown of these costs upfront.

Step 2: The Court Hearing

Once the application is filed, the court will set a date for a hearing. Don’t worry, these are usually pretty quick in the Harris, Tarrant, and Travis County probate courts, often just 20 to 30 minutes, especially if everyone agrees and there are no disputes in your muniment of title Texas case.

During the hearing, the judge’s main job is proving the Will’s validity. They’ll look over your application and the will itself. If the will has a special “self-proved” affidavit (meaning the person who made the will and the witnesses signed it in front of a notary), this step is much faster. If not, one or more witnesses to the will might need to testify to the judge that the will was properly signed.

You, as the applicant (the person who filed the paperwork), will typically give applicant testimony under oath. You’ll confirm the facts you put in the application – things like confirming your loved one has passed away, that the application was filed on time (or that there’s a good reason for any delay), that the court has the right to hear the case, and, most importantly, that there are no unpaid unsecured debts and that a full estate administration isn’t needed.

The judge will usually have a few questions to make sure all the legal requirements are met and that muniment of title Texas is truly the best way to handle the estate.

If everything looks good, the judge will then sign an Order Admitting Will to Probate as a Muniment of Title. This order is the key document! It’s what gives you the legal authority to transfer your loved one’s property in Houston, Fort Worth, or Austin exactly as their will says.

For a broader understanding of how wills are generally probated in Texas, you can also check out our guide on Probating a Will in Texas.

Step 3: After the Court Order is Granted

Hooray! You’ve got the court order. But you’re not quite done yet. There are a few important steps to take after the order is signed.

The order itself acts as the legal green light for anyone holding your loved one’s property – like a bank in Houston or a title company in Fort Worth – to directly transfer it to the people named in the will. These are your applicant responsibilities.

If the estate includes any real estate (like a house or land), you’ll need to get certified copies of the court order and the will. Then, these certified copies must be filed in the deed records of every county where your loved one owned property, such as Harris, Tarrant, or Travis County. This step is crucial because it creates a clear paper trail, showing the property officially moved from your loved one to the beneficiaries.

Texas law generally asks for a 180-day compliance affidavit, meaning you’d file a sworn statement with the court within about six months, saying you’ve followed the will’s terms. However, the court can sometimes waive this. Even if it’s not filed, don’t worry, it doesn’t undo the property transfer.

Finally, for other assets like bank accounts or investment accounts, you’ll simply present the certified order to banks and financial institutions in Houston, Fort Worth, Austin, and beyond. This order tells them to release the funds or transfer the assets to the rightful beneficiaries, as directed by the will.

Benefits vs. Drawbacks and Special Circumstances

Choosing the right probate path for your family in Houston, Fort Worth, or Austin is like picking the right tool for a job. While muniment of title Texas is a fantastic shortcut for many, it’s not a one-size-fits-all solution. It’s all about balancing the good with the not-so-good to find what truly fits your loved one’s estate.

Key Advantages Over Traditional Probate

When it comes to settling an estate in Houston, Fort Worth, or Austin, everyone hopes for a process that’s as smooth and stress-free as possible. This is where muniment of title Texas often shines, offering several wonderful benefits compared to a full, traditional probate.

First off, it’s typically a faster process. Because you’re not going through all the steps of a full administration, like appointing an executor and managing every detail of the estate, things can move much more quickly. This means less time waiting and more time focusing on what truly matters. Second, it usually results in lower legal costs. Fewer court appearances in Harris, Tarrant, or Travis County and less paperwork naturally translate to reduced fees, saving your family precious resources.

Beyond speed and cost, it offers a simplified procedure. There’s no need for an ongoing court-supervised administration, making the entire journey less complicated. This also means more privacy for your family, as fewer details of the estate become public record compared to a full probate. And perhaps one of the biggest reliefs? There’s no need for an Independent Administrator in Texas. The court’s order acts as the authority to transfer assets directly, so you don’t have the added layer of an appointed individual managing the estate. You can learn more about what an Independent Administrator does in Texas here. It’s a wonderful option for families in Houston, Fort Worth, and Austin seeking a straightforward resolution.

Potential Limitations and Problems

While the benefits are clear, it’s important to understand that muniment of title Texas isn’t suitable for every estate in our service areas. It comes with some significant limitations that might make it the wrong choice for certain situations.

The biggest hurdle is its strict eligibility. It’s only for estates with a valid will and, crucially, very few (or ideally, no) unsecured debts. If your loved one in Houston left behind a complex financial situation, especially with lots of creditors, this process simply won’t work. It’s definitely not for complex estates that require an executor to actively collect assets, manage ongoing business affairs, or resolve disputes among heirs.

Another common issue arises with out-of-state financial institutions. While Texas law requires local banks to honor a muniment of title Texas order, some banks or investment firms outside of Texas might not be familiar with this unique Texas-specific process. They might still insist on “Letters Testamentary” (which are only issued in a full probate with an appointed executor), causing frustrating delays. And, of course, a Texas muniment of title order cannot be used for property outside Texas. Any real estate or significant assets located in another state would require a separate probate process in that state.

Filing for a muniment of title texas After Four Years

Life happens, and sometimes, for various reasons, a will isn’t probated right away. Texas law generally requires a will to be presented for probate within four years of the person’s death. This is known as the “general four-year rule.”

However, there’s an important exception! If the person applying to probate the will can prove they were “not in default” for the delay, the court may still allow the will to be probated as a muniment of title Texas even after the four-year mark. Being “not in default” means showing the court in Harris, Tarrant, or Travis County that you weren’t negligent or at fault for the delay. Perhaps you didn’t know about the will, or you were unaware of the need to probate it, or there was a good reason for the postponement.

If you find yourself in this situation, you’ll need to clearly present your case to the judge, proving your lack of fault for the delay. There might also be additional notice requirements for heirs to ensure everyone is aware of the late filing. Even if years have passed, don’t lose hope. Our team in Houston, Fort Worth, and Austin can help you assess if this exception applies to your family’s unique circumstances.

Before deciding, it’s always wise to explore all your options, including ways to simplify the process or even how to avoid probate altogether.