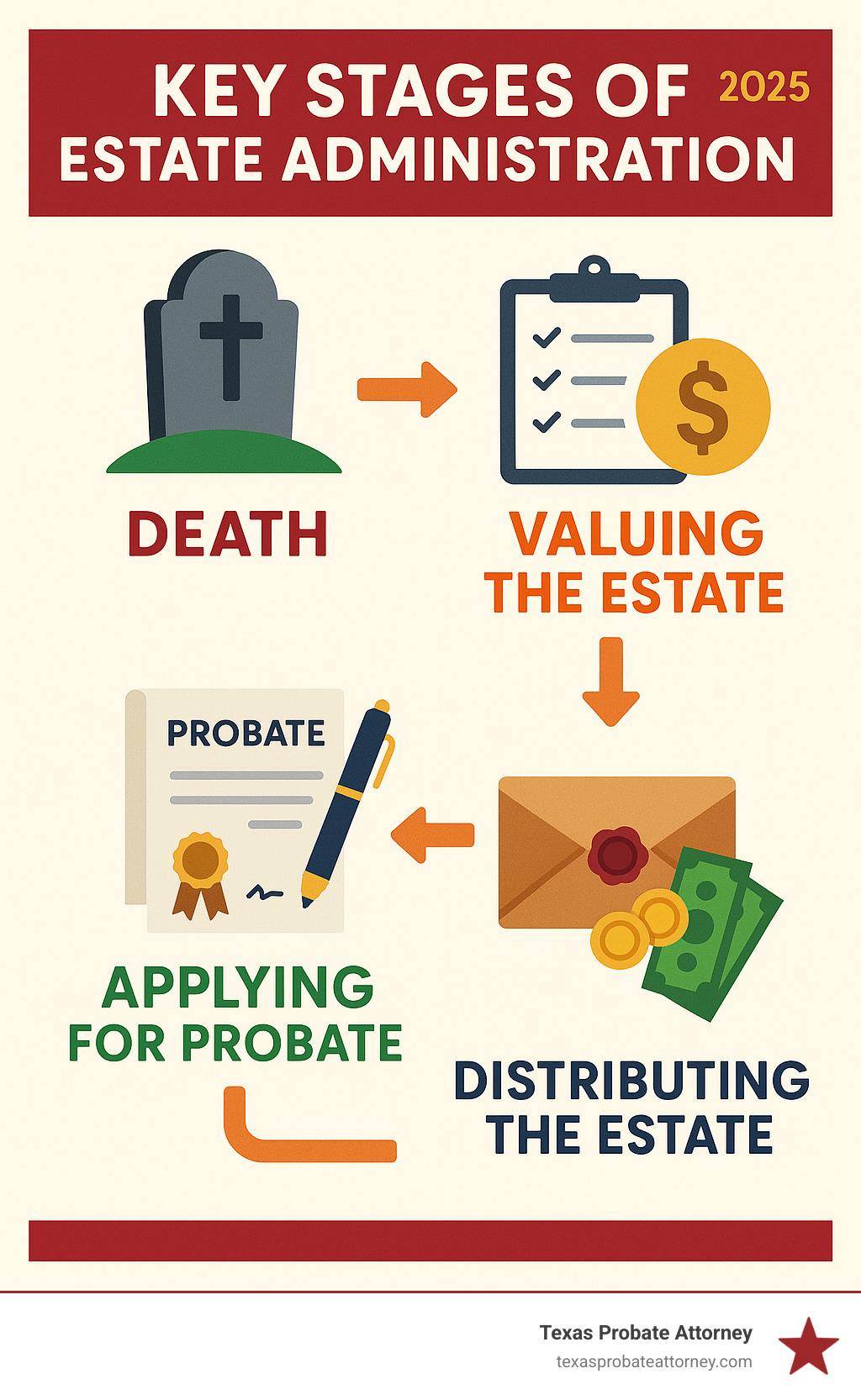

Estate Administration Fees Demystified: Solicitors Costs Explained

Understanding Solicitors Fees for Estate Administration: Common Fee Structures

When dealing with a loved one’s estate, understanding solicitors fees estate administration is a primary concern. Here’s a quick look at typical costs:

- Hourly Rates: Probate lawyers might charge $200 to $500 per hour.

- Flat Fees: For straightforward estates, this could be $3,500 to $7,000.

- Percentage of Estate Value: In some states, fees range from 1% to 7% of the estate’s total value. For example, a $500,000 estate could see legal fees from $5,000 to $35,000.

Losing someone is hard, and the complex task of settling their estate—a legal process called estate administration or probate—can feel overwhelming. Concerns about costs and making the right choices are common during this difficult time.

While the term “solicitors fees estate administration” is common, particularly in the UK, these professionals are called attorneys or lawyers in the U.S. and Texas. Regardless of the name, they guide families through probate. This guide breaks down how lawyers charge, other potential expenses, and how to manage these costs effectively.

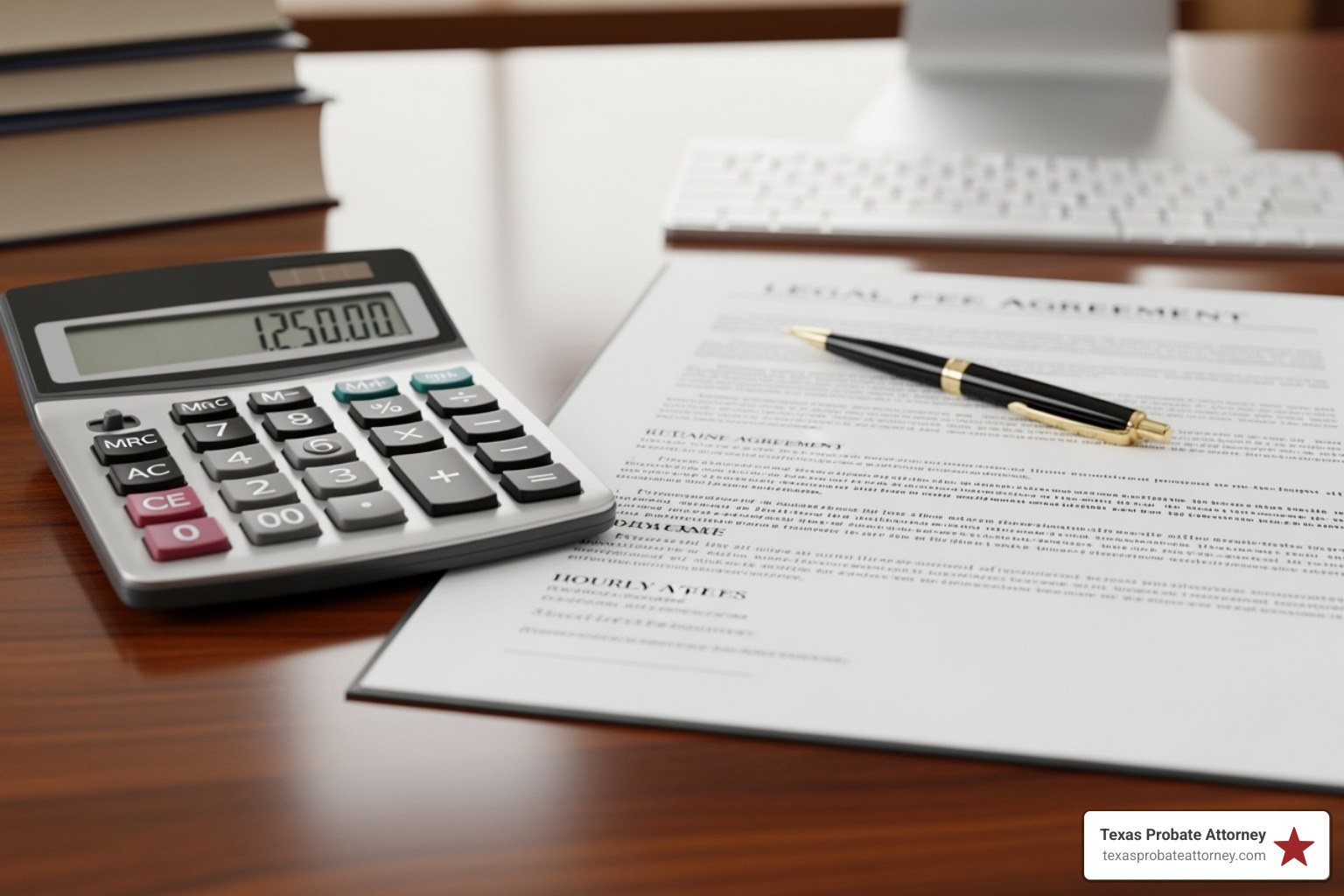

When you engage a legal professional for estate administration, understanding how they charge is crucial for managing costs. Fee transparency and written agreements are key. These should detail retainers (up-front payments) and billing increments, such as the common six-minute unit. For more information about Estate Administration Lawyer Texas, you can visit our dedicated page.

Hourly Rate Billing

With hourly rates, you pay for the actual time the attorney and staff spend on your case, including calls, emails, document drafting, and court appearances. Rates vary by location and experience, from $150-$200 per hour in small towns to $200-$500 in major cities for seasoned professionals. Paralegal rates are lower, helping manage overall costs. Since many lawyers bill in six-minute increments, even a quick call might be rounded up. It’s wise to ask about their minimum billing units.

Flat Fee Arrangements

For straightforward cases, an attorney might offer a flat fee. This provides a single, fixed price for a defined set of services, offering predictable costs. Flat fees are often used for uncontested probate cases with simple assets and no disputes among beneficiaries. For a simple estate, you can expect to pay between $3,500 and $7,000. It’s vital to clarify what services are included in a flat fee to avoid misunderstandings.

Percentage of the Estate Value

In some states, attorneys can charge a percentage of the estate’s gross value, known as statutory fees. California is a prime example, where a lawyer can collect 4% of the first $100,000 of the gross value, 3% of the next $100,000, and 2% of the next $800,000. For instance, probating a typical California estate with a gross value of $500,000 would cost around $13,000 in legal fees.

This can be costly as it’s based on the “gross value” of assets before debts are paid. For example, a fee on a $300,000 house with a $175,000 mortgage is calculated on the full $300,000. This means the percentage fee can be disproportionately high compared to the work involved. Legal fees for probate can range from 1% to 7% of the estate’s total value.

The “Value Element” Surcharge

Less common in the US, the “value element” surcharge is sometimes seen in other jurisdictions like the UK. It’s an additional percentage charge on top of hourly fees. For example, some firms might charge 1% + VAT on the gross estate (less the residence) and 0.5% + VAT on the residence. As Nash & Co Solicitors explain, this can lead to a significant additional bill. We, however, believe in transparent, time-spent billing for our services.

Key Factors That Influence the Total Cost

When navigating the process of settling an estate, you may wonder why some cases are quick and affordable while others become lengthy and costly. Many factors can influence the total cost of solicitors fees estate administration.

Understanding these elements helps you prepare and anticipate and manage costs. For more information about Common Probate Problems That Require Help of a Houston Probate Lawyer, we have a detailed guide that might help.

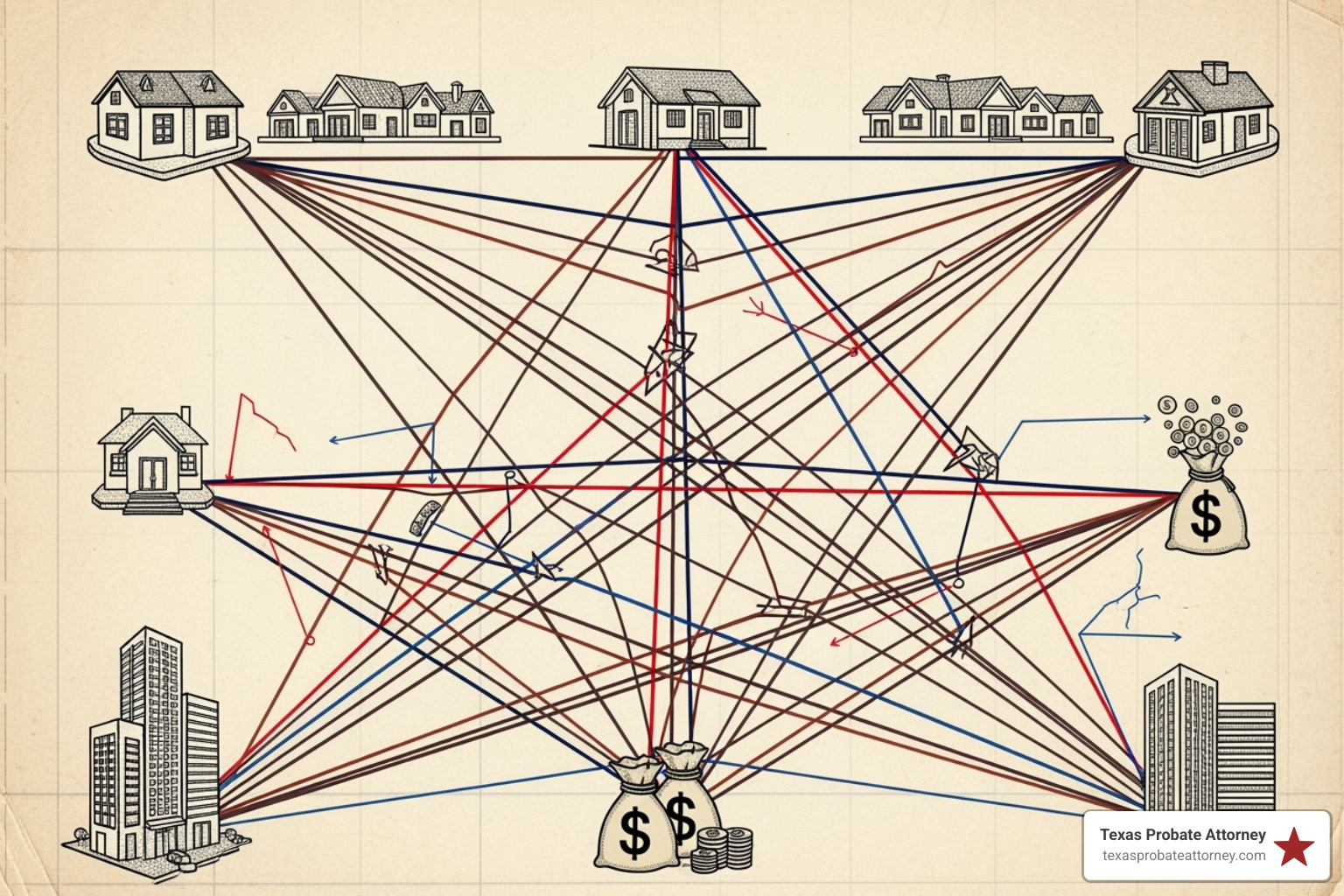

Size and Complexity of the Estate

This is often the biggest cost factor. A simple estate with a bank account and a clear will requires less legal work than one with many different parts. Factors that increase complexity and cost include:

- Gross value of assets: Higher value often means more assets to manage.

- Multiple properties: Especially if located in different states, this requires extra legal steps.

- Business interests: These require valuation, transfer, or sale.

- Diverse investments and stocks: These need careful handling.

- Foreign assets: International laws can complicate the process.

- Debts and liabilities: Numerous debts or potential insolvency require careful management.

- Tax implications: Federal estate tax or complex income tax issues require more legal and accounting guidance.

The Attorney’s Location and Background

Location plays a big role in legal fees. Lawyers in major cities like Houston, Fort Worth, or Austin typically have higher hourly rates than those in smaller towns due to higher overhead.

An attorney’s background also matters. Experienced probate lawyers, like our team with over 40 years of combined experience, may charge higher rates, but their knowledge can lead to a quicker, more effective resolution, potentially saving money by avoiding costly mistakes. The size and reputation of the law firm can also play a part, as larger firms may have higher rates but also more resources for complex cases.

The Nature of the Probate Case

This factor often determines if the process is smooth or difficult.

An uncontested will with cooperative parties is usually straightforward and less expensive. But if the will is challenged—a will contest—costs can skyrocket.

Even without a will contest, disputes between beneficiaries over asset distribution or the executor’s actions can lead to lengthy and expensive legal battles. Accusations of mismanagement can result in complex fiduciary litigation, significantly driving up costs.

While some cases require minimal court time, disputes often mean more frequent court appearances. Parties might also try mediation, which involves additional fees. Having legal representation focused on quick resolutions can be invaluable in these situations.

Beyond the Solicitor: Other Costs in Estate Administration

When dealing with an estate, you’ll find that solicitors fees estate administration (or attorney fees in Texas) are just one part of the financial picture. Other necessary “behind-the-scenes” expenses, often called disbursements, also arise. These are paid from the estate’s funds before any money goes to beneficiaries. We also offer Estate Settlement Services to help you manage all these additional costs smoothly.

Court and Filing Fees

These mandatory fees are paid to the court system to start and process the probate case.

The probate application fee is the initial charge to file the paperwork. For example, in England and Wales, the probate application fee is £273 for estates valued at £5,000 or more. You will also encounter other filing fees for various documents.

You’ll also need certified copy costs for official versions of court orders or the will, which have a small per-page fee. If hearings are transcribed, court reporter fees will be added to the bill. These court fees can range from under $100 to over $1,000, depending on the location and complexity.

Executor and Administrator Fees

The person managing the estate—the executor or administrator—is entitled to compensation for their work and fiduciary duty.

While family members may waive this fee, the option for compensation entitlement exists. The amount varies by state law based on the estate’s value, complexity, and work performed. Some jurisdictions suggest an executor can receive up to 5% of an estate’s value.

In Texas, there is no set percentage. Instead, compensation must be “reasonable” based on the work involved. If the will is silent on pay, Texas law still allows for reasonable compensation. An executor who is also a beneficiary might waive fees to avoid increasing the estate’s or their own taxable income.

Other Third-Party Expenses

Other professionals or services are often needed to settle an estate:

- Appraisal fees: Professional appraisers determine the fair market value of assets like real estate or business interests for tax and distribution purposes.

- Accounting fees: An accountant or CPA may be needed for complex finances or tax returns.

- Surety bond: The court might require the executor to get a bond, which is an insurance policy protecting the estate from mismanagement.

- Statutory notice advertising: To notify potential creditors, it’s often legally required to place statutory notice advertising in newspapers.

- Genealogist fees: If heirs are unclear, a genealogist may be hired to trace family lines.

- Land registry fees: These are incurred when transferring real property to beneficiaries or preparing it for sale.

These various costs can add up, so it’s wise to factor them into your overall budget for estate administration.

How to Manage and Minimize Solicitors Fees Estate Administration

Managing and minimizing solicitors fees estate administration is a common goal. While some costs are unavoidable, proactive steps and clear communication can save money. For Texas-specific insights, check out our guide on The Ins and Outs of Texas Probate Administration.

How can I minimize solicitors fees for estate administration?

Here are practical steps to potentially reduce your legal costs:

- DIY tasks: For very simple, uncontested estates, you might handle some tasks yourself, like gathering documents or notifying creditors. However, be cautious, as mistakes can be costly.

- Organize and gather documents: Being organized saves your attorney time and reduces your bill. Have the original will, death certificate, bank statements, property deeds, and investment papers ready.

- Limited scope representation: You can hire an attorney for specific tasks only, such as preparing initial probate filings, to control costs.

- Negotiate fees: Always ask for a clear breakdown of services and costs. For hourly billing, ask about a cap for certain tasks. For flat fees, clarify what is included.

- Choose the right lawyer: The right lawyer provides value beyond their hourly rate. An experienced probate attorney may work more efficiently and prevent costly errors, saving you money in the long run. Compare a few attorneys to find a good fit. For general information, resources like Nolo’s guide on How to Probate an Estate in California can be helpful, but Texas laws are specific.

Understanding the Fee Agreement

The fee agreement is your contract with the attorney. Get it in writing before work begins to avoid surprises. It should clearly detail:

- Scope of work: What services are included and excluded.

- Hourly rates: Rates for the attorney, paralegals, and other staff.

- Retainer terms: The initial payment amount and how it will be used.

- Billing frequency: How often you will receive an invoice.

- Disbursements: Other costs you are responsible for, like court fees.

- Dispute resolution: The process for handling billing disagreements.

A clear fee agreement protects both you and your lawyer.

Estate Planning to Avoid Probate

The best way to minimize future administration fees for your loved ones is through strategic estate planning to avoid probate. This can save significant time and money.

Popular tools to help assets bypass probate court include:

- Revocable living trusts: Assets in a trust can pass to beneficiaries without court involvement.

- Beneficiary designations: Life insurance, retirement accounts (IRAs, 401(k)s), and annuities can go directly to named beneficiaries.

- Payable-on-death (POD) accounts: Bank funds go straight to a named beneficiary.

- Transfer-on-death (TOD) deeds: In Texas, this allows real estate to go directly to a beneficiary.

- Joint ownership: Assets owned jointly with “right of survivorship” automatically go to the surviving owner.

Frequently Asked Questions about Estate Administration Fees

It’s completely normal to have questions about the costs involved in settling an estate. Let’s tackle some of the most common ones.

What are typical solicitors fees for estate administration?

The cost of solicitors fees estate administration varies widely depending on several factors.

Generally, legal fees for probate range from 1% to 7% of the estate’s total value. For a $500,000 estate, fees could be $5,000 to $35,000.

For simple, uncontested probate cases, a flat fee of $3,500 to $7,000 is common. If an attorney charges by the hour, rates can vary from $200 to $500 per hour, depending on their experience and location.

The final cost depends on the estate’s complexity, the attorney’s fee structure, and the case’s location. For more details on what average fees look like, you can check out our detailed article on Average Solicitors Fees for Probate.

Who is responsible for paying the solicitor’s fees?

The estate itself is responsible for paying all reasonable administration costs, including the solicitors fees estate administration (or attorney’s fees).

These fees are paid from the estate’s assets before any money or property is distributed to beneficiaries. The executor or administrator handles these payments.

The executor or administrator is not personally liable for these fees unless they mismanage the estate. They are also reimbursed for any out-of-pocket costs incurred while performing their duties. For more on this, we have a specific guide about Who Pays Probate Attorney Fees Texas?.

Do fees vary by location, like in Texas?

Yes, legal fees for estate administration vary significantly by location, including within Texas.

While some states have set statutory percentage fees, Texas law does not. Instead, it requires that fees for attorneys and executors be “reasonable.” Because of this, Texas probate attorneys often use hourly rates or flat fees, which can be more cost-effective than a percentage of the gross value.

Texas also offers simplified probate procedures that can reduce costs and time. For small estates (under $75,000, excluding the homestead), a small estate affidavit can help avoid formal probate. Independent administration is another common option that allows an executor to manage the estate with minimal court oversight, saving on legal fees and avoiding delays. Want to dive deeper into our local rules? Explore our insights on Decoding the Texas Probate Code: A Comprehensive Overview.

Navigating Your Estate’s Legal Costs

Understanding solicitors fees estate administration is manageable with the right information. This guide has covered attorney fee structures and the many factors that influence costs.

The most important takeaway is that transparency is key. Always insist on a written fee agreement that clearly outlines services, billing, and any additional costs. A good attorney will welcome your questions.

Proactive management can save you significant money and stress. Staying organized, understanding your fee structure, and remaining involved helps keep costs under control. Other costs like court fees, appraisals, and executor compensation also add up.

Estate planning is a valuable investment for your family. Simple steps like setting up beneficiary designations or creating payable-on-death accounts can help your loved ones avoid probate entirely, saving time, money, and stress.

In Texas, the probate landscape emphasizes “reasonable” compensation, which often works in your favor. Texas also offers helpful alternatives like independent administration and small estate affidavits that can streamline the process and reduce costs.

Every estate situation is different, which is why knowledgeable legal guidance is so important.

For personalized guidance on estate administration and potential litigation in Texas, the team at Keith Morris & Stacy Kelly, Attorneys at Law can provide the clarity you need. With over 40 years of combined experience, we understand that dealing with a loved one’s estate is both emotionally and financially challenging. We’re committed to providing personalized attention and working toward quick resolutions, whether you’re in Houston, Fort Worth, Austin, or anywhere else in Texas.

Learn more about how much a probate attorney costs in Texas by visiting our detailed breakdown of Texas-specific probate costs and procedures.