Going Solo in Probate—What is an Independent Administrator in Texas?

Related Posts

Understanding the Independent Administrator in Texas Probate

When a loved one passes away, navigating the legal process of settling their estate can feel overwhelming. In Texas, a key concept that often arises is what is an independent administrator in Texas. This role is central to simplifying the probate process for many families.

Simply put, an independent administrator in Texas is:

- A personal representative (often called an executor) appointed to manage a deceased person’s estate.

- Empowered to act with minimal court supervision, unlike a dependent administrator who needs court approval for most actions.

- Responsible for gathering assets, paying debts, and distributing inheritances without constant judicial oversight.

- A unique aspect of Texas probate law designed to make the process faster and more cost-effective.

This streamlined approach is the preferred and most common method for probating estates across Texas. It allows the estate to be settled more efficiently and with fewer delays, ultimately benefiting the heirs.

What is an Independent Administrator in Texas and How Does it Differ?

Taking on the role of an estate administrator can feel like a big undertaking. But here in Texas, we have a way to make it much smoother: it’s called independent administration. This approach is quite different from what’s known as dependent administration, which means constant check-ins with the court. So, when people ask what is an independent administrator in Texas, we’re talking about someone who gets to manage an estate with a lot of freedom, largely without the court looking over their shoulder at every turn. This hands-on, less supervised way helps estates get settled quicker and often costs less, making it a favorite choice for families across our state.

Defining the Role: Less Court, More Control

Imagine being able to manage a loved one’s estate without having to ask a judge for permission for every little thing. That’s pretty much what an independent administrator does! If the person had a will and named you in it, you might be called an independent executor. Either way, your job is to handle the estate – that means gathering assets, paying bills, and making sure everyone gets what they’re supposed to – without constant supervision from the probate court. It’s like being given the keys and trusted to drive the car, rather than having someone in the passenger seat telling you every turn to make.

Our Texas Estates Code (you can look it up under Sec. 402.002) gives independent administrators a lot of power to get things done. This freedom means the whole process is often much quicker and can save a good chunk of money on legal fees and court costs. That’s why so many families prefer it! Even with this great freedom, the personal representative in an independent administration acts as a fiduciary. This simply means they have a very important legal duty to always act in the estate’s best interest. Their job is to manage everything for the good of the heirs and creditors, never for their own personal benefit. This trust is key, even without a judge watching every step.

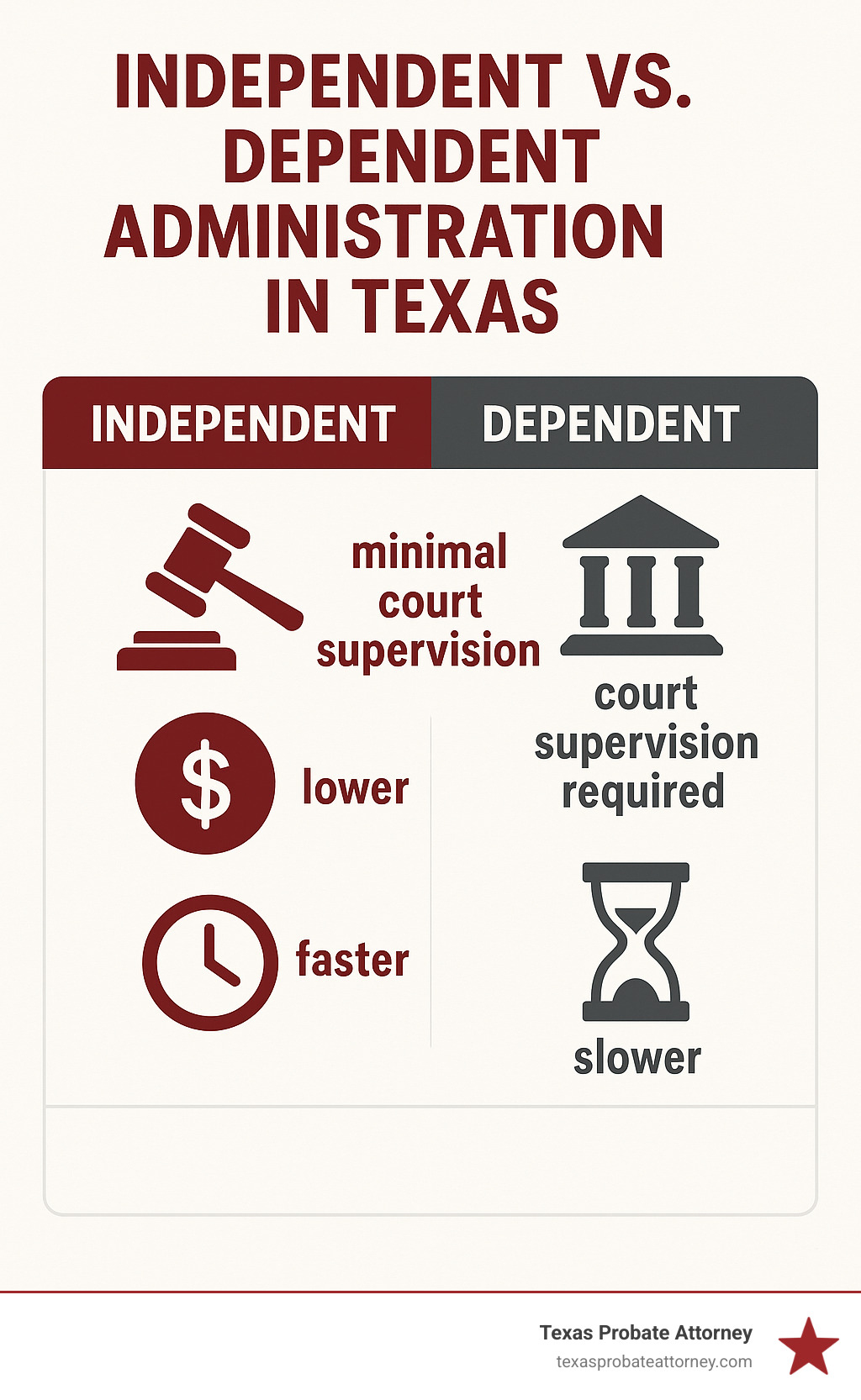

Independent vs. Dependent Administration: A Clear Comparison

Now, let’s look at the main difference between independent and dependent administration. It really boils down to how much the court is involved. With dependent administration, it’s like having a chaperone for every single decision. The administrator needs court approval for almost everything, from paying a bill to giving out inheritances. As you can imagine, this constant oversight can make the whole probate timeline much slower, more expensive, and a bit more public.

But with independent administration, once you’re appointed, you can generally handle things with very little court interference. This means greater flexibility for the executor, a much faster journey to settling everything, and more privacy for the family involved.

To give you an even clearer picture, here’s a straightforward comparison between the two methods:

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Involvement | Minimal oversight after initial appointment | Extensive, continuous court supervision |

| Cost | Generally lower due to reduced court fees and legal costs | Generally higher due to frequent court appearances and filings |

| Timeframe | Typically faster | Often slower and more protracted |

| Administrator Authority | Broad powers, can act without court approval for most tasks | Requires court approval for most actions |

| Typical Scenarios | Will specifies, or all heirs/beneficiaries agree; clear estates | Disputes among heirs, complex estates, significant debt, no will and no agreement |

| Beneficiary Agreement | Often requires unanimous agreement from heirs/beneficiaries (if no will or will is silent) | Not necessarily required, court dictates terms |

| Legal Protection | Administrator assumes more personal liability risk, often seeks legal counsel | Court approval offers more legal protection for administrator |

While independent administration truly offers some fantastic perks when it comes to getting things done quickly and affordably, it’s really important for the person in charge to fully grasp their duties and the potential liabilities. Since you’re operating with less court oversight, there’s a bit more responsibility on your shoulders. That’s why having a knowledgeable probate attorney by your side is always a smart move. They can help you steer the Texas Estates Code, make sure everything is done correctly, and help you steer clear of any costly missteps.

The Path to Appointment: Becoming an Independent Administrator

So, you understand what is an independent administrator in Texas and why it’s such a great option. But how does someone actually get appointed to this important role? It all starts with the probate court. The exact steps you’ll take depend on whether the person who passed away left behind a valid will or not.

No matter the path, the main goal is to get official court papers called “Letters of Administration” (or “Letters Testamentary” if there’s a will). These are like your official ID badge from the court. They prove you have the legal right to handle the estate’s money and property. With these letters, you can access bank accounts, sell things, and talk to financial companies on behalf of the estate.

Appointment Through a Will (Testate)

The easiest way to become an independent administrator is when the person who passed away (we call them the “decedent”) left a clear, valid will. And, in that will, they specifically named an “independent executor” and said they wanted an independent administration. This is known as testate succession.

Often, a will includes a special section that says the executor can serve “without bond.” This means they don’t have to put up money with the court as a guarantee. It also usually states that the court doesn’t need to be involved much after the will is proven valid and an inventory of assets is filed. This is the hallmark of independent administration!

For example, a will might say something like: “I name [Name] as independent executor of my estate to serve without bond. I want the probate court to do nothing more than prove and record this will and accept any required list of my estate’s property and claims.”

Once the court confirms the will is real and valid (this is called Probating a Will in Texas), the person named as independent executor takes an oath. If a bond is still needed, they’ll post it. Then, the court hands over those important “Letters Testamentary,” giving them the power to act. Sometimes a will names a backup executor, but doesn’t say that backup can also be independent. If the first choice can’t serve, this could mean you’d need the heirs’ agreement or end up with more court involvement.

Appointment Without a Will (Intestate) or by Agreement

What if someone passes away without a valid will? This is called intestate succession. Or, what if the will exists but doesn’t specifically ask for independent administration? Don’t worry, independent administration might still be possible!

However, it takes a bit more effort: all legal heirs must agree to it. In these situations, the heirs ask the court together. They agree to the independent administration and suggest a qualified person to be the independent administrator. They’ll usually sign a written paper for the court, showing they all agree.

A really important step when there’s no will is something called a “proceeding to declare heirship” or a “Judgment Declaring Heirship.” The court won’t let an independent administrator manage the estate until it officially figures out who all the heirs are. This sometimes involves a special lawyer (called an attorney ad litem) who helps find heirs who might be hard to locate or who are not yet known.

If any of the heirs are children (minors) or are unable to make decisions for themselves (incapacitated), their legal guardian (their “Guardian of the Estate”) must give permission for them. If even one heir doesn’t agree, or if the court can’t clearly figure out who all the heirs are, the estate will most likely go through a “dependent administration.” This is the standard path when there’s no will, unless all the heirs clearly say they want something else.

Powers, Duties, and Responsibilities of the Role

Accepting appointment means you are the estate’s fiduciary. You receive broad statutory power, but you must use it solely for the benefit of creditors and beneficiaries.

What is an Independent Administrator in Texas’s Key Duties?

Deadlines start the day you qualify (take the oath and, if required, file a bond):

- Take the oath of office – within 20 days.

- Obtain your Letters of Administration from the County Clerk.

- Publish notice to unsecured creditors – within 30 days.

- Mail notice to known secured creditors – within 2 months.

- File the Inventory, Appraisement & List of Claims, or an Affidavit in Lieu – within 90 days.

- Collect assets, pay valid debts and taxes, maintain insurance, and keep funds in a separate estate account.

- Make final distribution and close the estate as soon as practical.

Missing a statutory deadline can result in personal liability or removal, so organized record-keeping is essential.

Legal Authority and Court Supervision Under the Texas Estates Code

Texas Estates Code Section 402.002 lets an independent administrator do almost everything a court-supervised representative can do—take possession of property, sue or be sued, sell assets, operate a business, and settle claims—without asking the judge first. That independence speeds the process, but also eliminates the safety net of prior court approval. Any act that benefits the administrator instead of the estate (self-dealing) can lead to surcharge or removal. When a decision feels uncertain, a quick consult with a probate lawyer is the best safeguard.

Navigating the Pros, Cons, and Potential Pitfalls

Knowing what is an independent administrator in Texas is only half the story; deciding whether to use the procedure is the other half.

The Key Benefits of Choosing Independent Administration

- Cost-effective – fewer hearings mean lower court and attorney fees.

- Faster – no need to wait for docket dates or court orders.

- Efficient – the representative can act immediately when a house must be insured, a business must be kept running, or property must be sold.

- Flexible – decisions can be custom to the estate’s unique needs.

- Private – less financial information is filed in the public record.

When is Independent Administration Not the Best Option?

Independent administration can backfire when:

- The estate is insolvent or heavily indebted.

- A will contest or heir dispute is brewing.

- Minor or incapacitated beneficiaries lack a guardian.

- The assets are unusually complex (multi-state businesses, foreign property) and the administrator wants court guidance.

- The named representative would rather have the protection of court orders.

In those situations, a dependent administration—or sometimes a probate-avoidance tool such as a small-estate affidavit—can provide structure and protection.

Compensation and Risk of Removal

Independent administrators are entitled to reasonable compensation, often a statutory percentage unless the will says otherwise. They can be removed for:

- Failing to qualify or file the inventory on time.

- Mismanaging property or engaging in self-dealing.

- Failing to distribute assets within three years.

- Becoming incapacitated or developing a serious conflict of interest.

Any creditor or beneficiary may petition for removal, so staying on top of deadlines and maintaining clear records is critical.

Frequently Asked Questions about the Independent Administrator Role in Texas

What happens if the heirs do not all agree to an independent administration?

If the decedent left no will—or the will is silent—Texas law requires unanimous consent. Any objection forces the estate into dependent administration.

How long does an independent administrator have to settle the estate?

There is no rigid deadline, but the court may remove an administrator who has not distributed the estate within three years after receiving Letters. Acting diligently and keeping beneficiaries informed prevents problems.

Does an independent administrator in Texas have to be bonded?

Most wills waive bond. Without a will, the court may waive bond if all heirs agree, but it can still require one to safeguard valuable or complicated estates.

Conclusion

So, there you have it! Independent administration truly stands out as Texas’s favorite way to handle estates. It’s easy to see why – it saves families a lot of time and money, making the whole process much smoother.

But here’s the thing: with great freedom comes great responsibility, right? Being an independent administrator means you’re taking on a big legal role, and there’s a chance of personal liability if things go wrong.

That’s why knowing how to properly handle all the duties of an independent administrator is so important. It’s the key to making sure the probate process goes smoothly and successfully for everyone involved.

Feeling a bit overwhelmed? Don’t worry, you don’t have to go it alone. Our team at Texas Probate Attorney has a lot of experience guiding people just like you through every single step.

We’re here to help make this journey as clear and stress-free as possible. For personalized help with your unique probate situation, we invite you to learn more about Independent Administration in Texas.