Finding Your Trustworthy Trust Attorney Made Easy

Securing Your Legacy with the Right Legal Partner

When you need an attorney for trust matters, you’re looking for more than just legal paperwork – you’re seeking a trusted partner to protect your family’s future. Whether you’re creating a new trust, managing an existing one, or facing a trust dispute, the right attorney can make all the difference.

Key reasons to hire a trust attorney:

- Trust Creation: Draft legally sound documents custom to your specific needs

- Trust Administration: Guide trustees through their legal obligations and responsibilities

- Trust Litigation: Handle disputes, contests, or trustee misconduct cases

- Tax Planning: Minimize estate taxes and maximize wealth preservation

- Asset Protection: Shield your assets from creditors and legal challenges

Trust law is complex and varies significantly by state. As one legal expert notes, “Trust laws are intricate and vary significantly by state,” making professional guidance essential rather than optional. The stakes are too high to risk errors that could invalidate your trust or create costly legal battles for your loved ones.

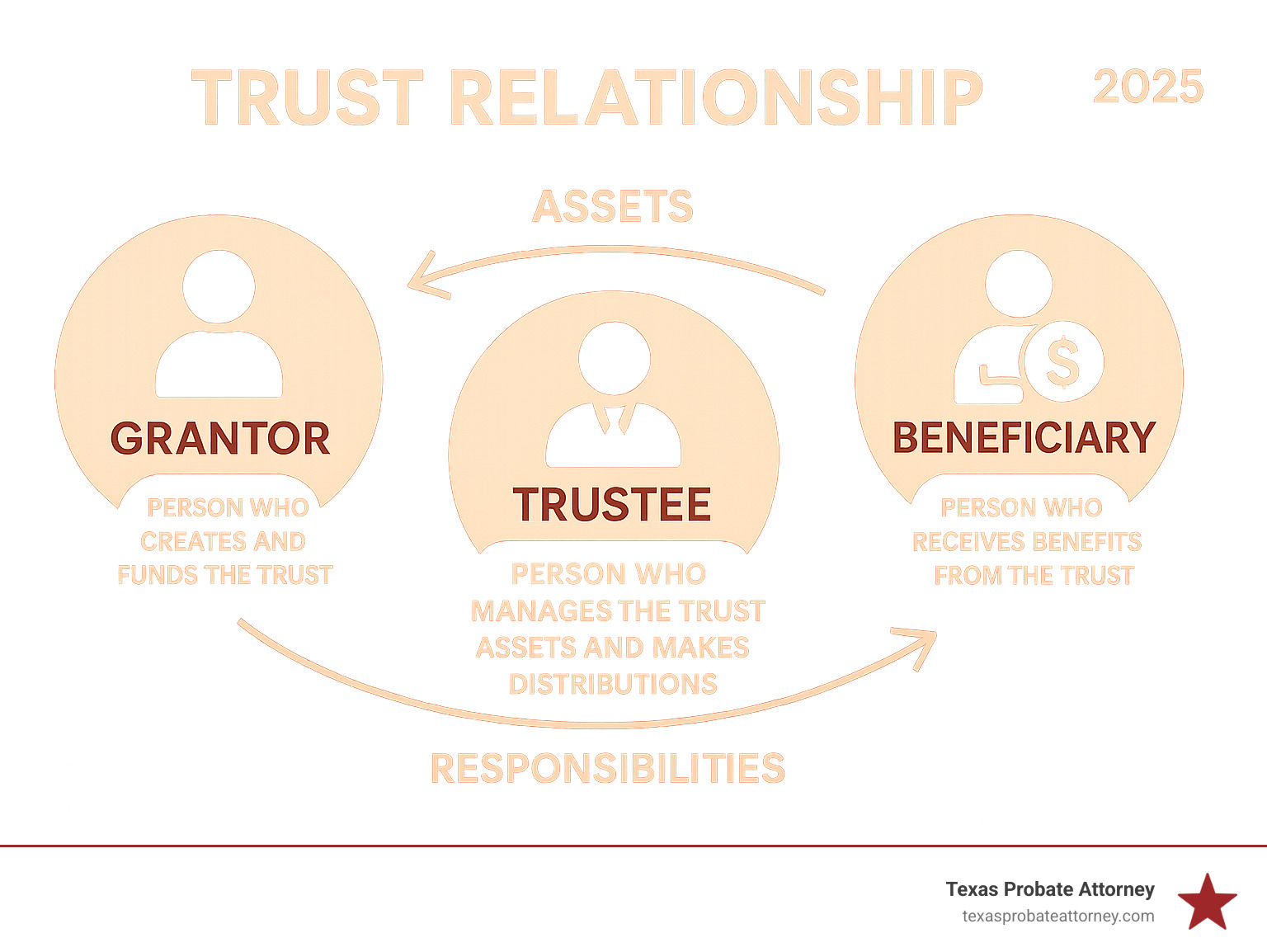

A trust attorney serves as your legal advocate in three key areas: planning (creating the trust structure), administration (managing ongoing trust operations), and litigation (resolving disputes when they arise). They understand the intricate relationships between grantors, trustees, and beneficiaries – and how to protect everyone’s interests.

The difference between a properly structured trust and a flawed one can mean the difference between preserving your family’s wealth and watching it disappear in probate court or legal fees.

Understanding the Role of a Trust Attorney

When you hire an attorney for trust matters, you gain a lawyer who concentrates on designing, interpreting, and, when needed, defending trusts. Their mission is to convert your wishes into a Texas-compliant document and guide you and your trustee long after signing.

What a Trust Attorney Delivers

- Draft clear, enforceable trust agreements

- Explain tax and asset-protection strategies in plain English

- Ensure every clause meets Texas law

- Clarify the trustee’s fiduciary duty and beneficiary rights

A trust is an agreement in which the grantor transfers property to a trustee to manage for beneficiaries. Done correctly, it keeps assets out of probate, protects privacy, and can reduce taxes. Learn more at What You Need to Know Before Setting Up a Trust.

Popular Trust Formats

- Revocable living trust – flexible, probate-avoiding, changeable while you are alive

- Irrevocable trust – largely unchangeable; used for tax reduction or asset protection

- Testamentary trust – begins after death under your will

- Special needs trust – support while preserving government benefits

- Charitable remainder/lead trust – benefit charity and earn tax breaks

- Spendthrift trust – shields assets from a beneficiary’s creditors

- ILIT – removes insurance proceeds from the taxable estate

- Bypass/credit-shelter trust – lets married couples double estate-tax exemptions

More detail: Types of Trusts.

Funding the Trust: What Goes In (and What Stays Out)

A trust works only when it is funded.

Can usually be transferred:

- Real estate

- Bank and brokerage accounts

- LLC or business interests

- Valuable personal property

Normally kept out and handled by beneficiary form:

- IRAs and 401(k)s

- Life-insurance policies

- HSAs

- Titled vehicles

Discuss the tax angle first; mistakes with retirement plans can be costly. See IRA Estate Planning Ideas to Discuss with Your Clients.

The Critical Decision: Why Professional Counsel Matters for Your Trust

Why Retain a Trust Attorney Instead of DIY Software

Every family is different. A fill-in-the-blank form cannot address blended families, special-needs children, or multi-state real estate. A seasoned attorney for trust will:

- Tailor the document to your goals

- Catch Texas-specific technicalities that void many DIY trusts

- Update the plan as marriages, births, or tax laws change

- Save money long-term by avoiding probate, taxes, and disputes

Hidden Costs of Going It Alone

DIY trusts often suffer from:

- Unenforceable or conflicting language

- Assets never retitled to the trust (an “empty” trust)

- Beneficiaries forced into probate despite the trust’s existence

- Ambiguous clauses that spark litigation and family rifts

- Surprise tax bills when retirement accounts or gifts are mishandled

“Errors in DIY trust documents are usually finded only after death, when they are impossible to correct.” For common myths, read 4 Myths About Trusts and Why You Shouldn’t Believe Them.

Comprehensive Services Offered by a Qualified Attorney for Trust Matters

Beyond Drafting: A Full Spectrum of Trust Services

- Trust funding & asset retitling – move property into the trust immediately

- Successor-trustee coaching – clear instructions and checklists

- Ongoing administration help – annual reviews, accountings, and tax filings

- Amendments & restatements – keep your plan current

- Asset-protection design – spendthrift or irrevocable structures to guard wealth

More: Trust Administration Attorney

Handling Complex Families and Portfolios

- Provide for children from former marriages while caring for a current spouse

- Supplement a disabled child’s benefits through a special-needs trust

- Fold your business into a smooth succession plan

- Coordinate out-of-state property to avoid multiple probates

Read about our Personalized Trust Services.

Tax-Smart Planning

- Credit-shelter and portability planning for married couples

- ILITs to keep insurance proceeds out of the estate

- GRATs for appreciating assets

- Generation-skipping strategies

For deeper detail, see Fiduciary Income Tax Planning Strategies.

How to Choose the Right Trust Attorney for Your Needs

Credentials That Count

- Texas bar license plus board certification in Estate Planning and Probate Law

- Membership in groups such as ACTEC

- Years devoted primarily to trusts, estates, and related litigation

- A communication style that makes you comfortable

Litigation Know-How Matters

A well-drafted document is only half the job. When families fight, you need counsel who can:

- Contest or defend the trust’s validity

- Pursue or defend breach-of-fiduciary-duty claims

- Freeze assets or remove a failing trustee fast

More on our courtroom work: Trust and Will Disputes and Breach of Trust Texas.

Smart Questions to Ask at the First Meeting

- Have you handled estates like mine?

- How do you charge, and what is included?

- Who will be my day-to-day contact?

- How often will my plan be reviewed?

- Do you personally handle litigation if needed?

Frequently Asked Questions about Trust Attorneys

Do I need a trust if I already have a will?

A will must pass through public probate. A funded trust bypasses probate, keeps details private, and often distributes assets in weeks. Most solid plans use both tools together. See The Differences Between a Will and a Trust.

How much does it cost to set up a trust with an attorney?

Fees depend on complexity. A straightforward revocable trust is usually a predictable flat fee; tax-driven irrevocable trusts cost more. The upfront investment nearly always beats the later cost of probate or litigation caused by a flawed DIY document.

What if the trust is challenged or the trustee misbehaves?

Our litigation team can:

- Defend the trust against claims of undue influence or lack of capacity

- Sue a trustee who breaches fiduciary duties, seek removal, and recover losses

- Protect honest trustees from unfounded accusations

Learn more at Houston Trust Litigation Lawyer.

Conclusion: Take the Next Step to Protect Your Family’s Future

Isn’t it wonderful to imagine a future where your loved ones are secure, and your legacy is perfectly protected? Securing that peace of mind for your family is truly one of the most important things you can do. While the idea of setting up trusts and diving into estate planning might seem a little daunting at first, the benefits of taking a proactive step with a skilled attorney for trust matters are absolutely priceless.

Throughout our conversation, we’ve seen how a well-crafted trust can be your ultimate tool. It helps you keep control over your assets, making sure they land exactly where you want them to. It helps you smoothly sidestep that often public and costly probate process, keep taxes to a minimum, and even prevent potential family squabbles. We’ve also highlighted the significant risks of trying to steer this complex area without professional guidance—it’s truly an area where a little foresight goes a long, long way!

Choosing the right attorney for trust matters isn’t just about finding someone who knows the law. It’s about finding a true legal partner who genuinely understands your unique life story, your family’s dynamics, and your deepest wishes. You need someone who can precisely draft documents, gently guide you through tricky family situations, cleverly steer tax implications, and, if push comes to shove, aggressively fight to protect your interests in court.

At Texas Probate Attorney, our dedicated team is here to be that steadfast partner for you. With over 40 years of combined experience, we are deeply committed to providing the detailed guidance needed for both meticulous planning and robust litigation. With offices conveniently located in Houston, Fort Worth, and Austin, we offer personalized legal representation designed to ensure your legacy is secure and your family’s future is beautifully protected.

Please, don’t leave your family’s financial security to chance. Take that confident next step towards complete peace of mind today. We warmly invite you to Contact our Austin probate lawyers to schedule a consultation — let’s build that secure future together.