How to Set Up a Trust and Secure Your Legacy

Setting Up a Trust: What You Need to Know Now

If you’re searching for information on setting up a trust, here’s the quick answer you need:

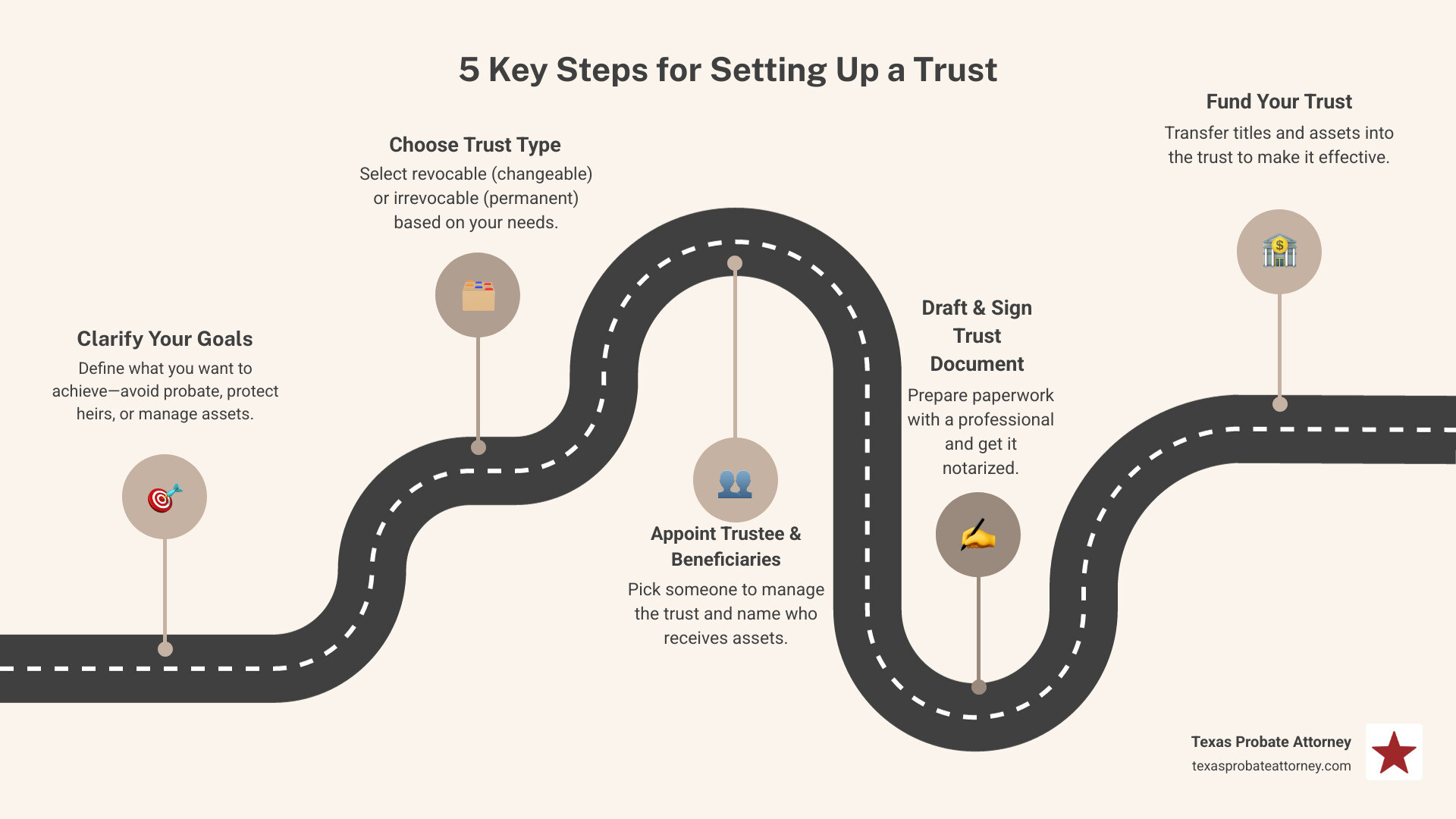

How to set up a trust in 5 simple steps:

- Decide your goals:

- Who do you want to receive your assets?

- Do you want to avoid probate court or set up protections for heirs?

- Choose the right trust type:

- Revocable: You can change or cancel it.

- Irrevocable: Permanent, with more protection.

- Pick your trustee and beneficiaries:

- Trustee: Person or company who manages the trust

- Beneficiaries: Person(s) or organization(s) who will inherit

- Create and sign the trust document:

- Draft paperwork with a lawyer or online

- Get it notarized for legal proof

- Transfer your assets into the trust:

- Move bank accounts, real estate titles, investments, and valuables into the trust’s name

Trusts aren’t just for the wealthy—they provide peace of mind by making sure your assets go to the right people, without court delays.

—NerdWallet

Losing a loved one is hard enough. The last thing any family wants is a long, public, and confusing probate court process. That’s why many Texans today turn to trusts—to keep family matters private, honor wishes, and make life easier for the next generation.

A trust is a legal tool that lets you decide who will get your property—and when they’ll get it—all while avoiding the stress and cost of probate. Trusts can guard inheritances for minor children, support loved ones with special needs, and protect against creditors or lawsuits.

Setting up a trust doesn’t have to be overwhelming. You’ll learn exactly how trusts work, the steps to set one up, and the common mistakes to avoid.

Trust Fundamentals: Key Concepts, Parties & Types

Before you jump into setting up a trust, it helps to understand what a trust really is and why it matters. At its heart, a trust is simply a legal relationship. One person—the grantor—places assets in the care of another—the trustee—for the benefit of one or more beneficiaries. This arrangement lets you decide who gets what, and when, often while keeping things private and out of the court system.

Let’s break down the key players:

- The grantor (sometimes called a settlor or trustor) is the person who creates and funds the trust.

- The trustee is the individual or institution you trust to manage those assets wisely and follow your instructions to the letter.

- The beneficiaries are those who stand to benefit from the trust—your loved ones, a favorite charity, or even a beloved pet.

Why do folks in Texas (and everywhere else) bother with trusts?

Trusts can help you avoid probate, which is the often slow and very public process of sorting out a will in court. They offer privacy, let you control how and when your heirs inherit, and can shield assets from creditors or lawsuits. Trusts are a powerful way to provide for minor children, support someone with special needs, or minimize estate taxes if you have a larger estate. If you love details, here’s a good overview of Trust basics under U.S. law.

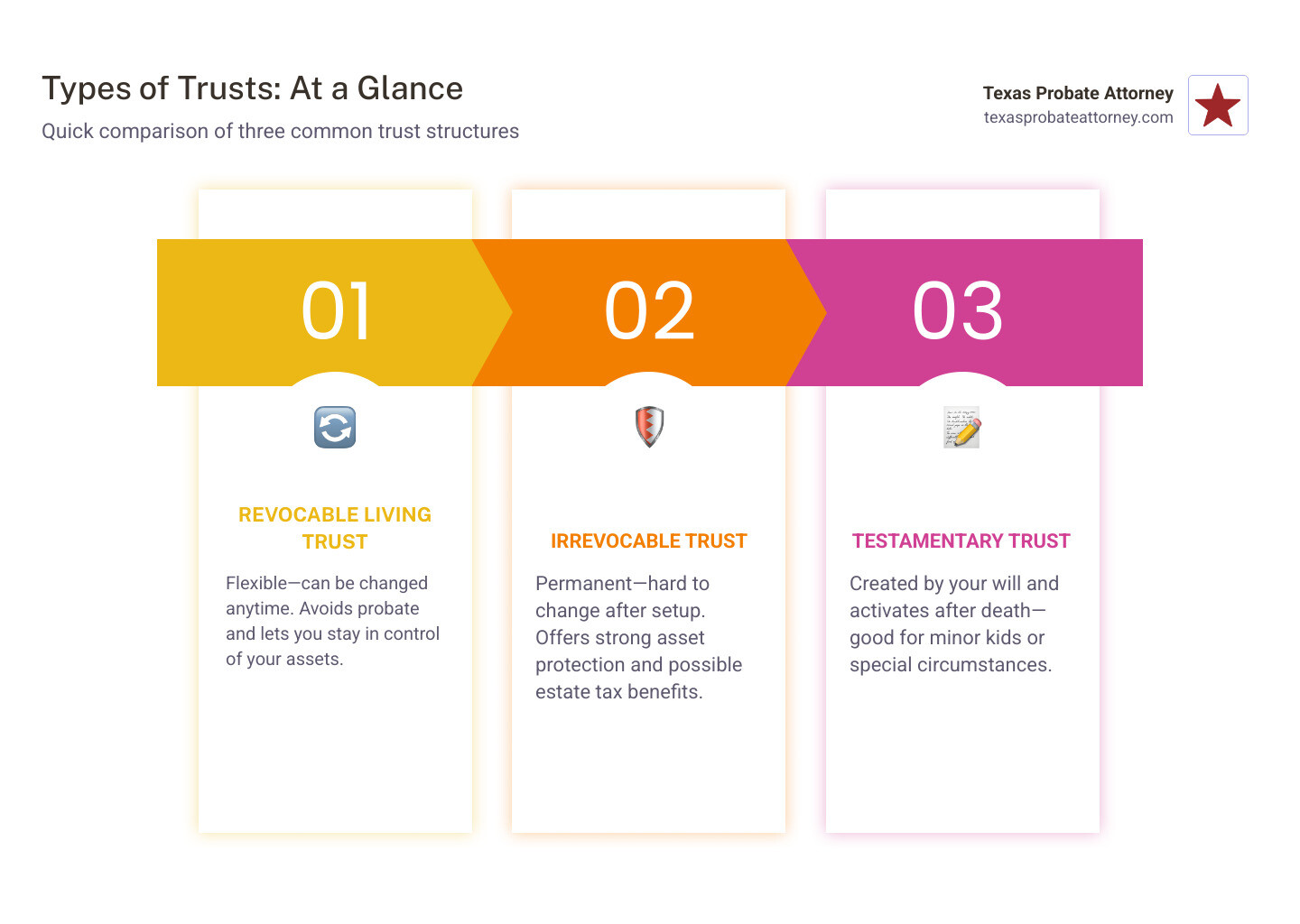

Types of Trusts

Not all trusts are created equal. The best trust for you depends on your goals and your family’s unique situation. Here are some of the main types you’ll see when setting up a trust:

- Revocable Living Trust: This is the popular choice for most families. You stay in control of your assets while you’re alive and well. You can change or even cancel the trust if you want. When you pass, everything transfers smoothly to your beneficiaries without going through probate.

- Irrevocable Trust: With this type, once it’s set up, it’s set in stone. You can’t change it easily, but in return, it offers stronger asset protection and some real tax-saving perks. Curious about the nitty-gritty? Here’s more on Irrevocable Trusts.

- Testamentary Trust: This trust is created by your will and doesn’t spring into action until after you’re gone. It’s often used to care for minor children or for special situations that need a bit more guidance.

- Special Needs Trust: Built specifically for a loved one with disabilities. It helps provide extra support without putting government benefits at risk.

- Charitable Trust: Want to leave a legacy for your favorite cause and maybe save on taxes? This trust lets you do both.

If you like side-by-side comparisons, check out this More info about Types of Trusts.

Main Roles in Any Trust

When setting up a trust, it’s important to know who does what. The grantor is the person with the vision—setting the rules, choosing the assets, and, in many cases, serving as their own trustee if they use a revocable living trust.

The trustee is the manager, handling investments, paying bills, and carrying out your wishes exactly as spelled out in the trust. Sometimes that’s a handy family member, and sometimes it’s a professional or a company.

Don’t forget the successor trustee. This is your backup plan—the one who steps in if the original trustee can’t serve due to death, illness, or simply wanting out. Life is unpredictable, so always name a backup.

Finally, there are the beneficiaries—the ones you’re doing all this for. They can be individuals, charities, or even your pets. The trust spells out how and when each beneficiary will receive their share.

Choosing the Right Trust for Your Situation

Every family is different, so the right trust for you depends on what you want to accomplish. If keeping control over your assets is a top priority, a revocable trust might fit best. If you’d rather lock things down to protect assets from creditors or future lawsuits, an irrevocable trust is worth a look.

Have minor children or loved ones who need extra guidance? A testamentary or special needs trust may be the answer, ensuring their inheritance is managed with care. And if giving back is part of your plan—or you want to be smart about taxes—a charitable trust offers real benefits.

When you’re thinking about setting up a trust, don’t be afraid to ask questions and consider your family’s unique needs. The right trust can offer peace of mind, protect your legacy, and make life a little easier for the next generation.

Setting Up a Trust: Step-by-Step Blueprint

Ready to take the next step in setting up a trust? Here’s how to go from idea to fully functioning trust, one practical step at a time. If you want even more detail, don’t miss What You Need to Know Before Setting Up a Trust.

1. Clarify Goals Before Setting Up a Trust

Before you start on paperwork, pause and ask yourself what you want your trust to accomplish. Maybe your main concern is avoiding probate, so your family doesn’t get stuck in court. Or perhaps you want to make sure your minor children are provided for, without getting too much, too soon. You might also want to protect your assets from creditors or help care for an aging parent or loved one with special needs. Others use trusts for charitable giving or to make sure everything is handled privately. Clear goals will guide every decision as you move forward.

2. Draft & Execute When Setting Up a Trust

Once you know what you want, it’s time to put it all on paper. Most folks start with a lawyer—especially if you have a complex situation or want an irrevocable trust—but some simple revocable trusts can be created online. Your trust document should clearly name the grantor, the trustee (and a successor), and the beneficiaries. It should spell out exactly how assets are managed and passed along, and include any special instructions—like what age your children should inherit, or how a loved one with a disability should be cared for.

When it comes to making the trust official, Texas usually requires notarization for trusts holding real estate, or when a bank asks for it. Even if it’s not strictly required, notarizing your documents is a smart move—it’s a simple way to head off future headaches like disputes or fraud. In some states, witnesses are needed too, but in Texas, notarization is the golden ticket.

Once signed, store your trust documents somewhere safe—a fireproof safe, a bank deposit box, or a secure digital vault all work well. Tell your successor trustee exactly where to find them; a trust isn’t much help if no one knows where it is! And here’s a tip many people miss: set up a pour-over will. This acts as a safety net, ensuring any assets you forgot to retitle in the trust during your lifetime get swept in after you’re gone, so nothing is left out.

Setting up a trust is about turning your wishes into a solid plan. It means getting the legal foundation right, protecting your loved ones, and giving yourself peace of mind for the future. If you need a hand or have questions about what makes sense in your unique situation, remember—help from an experienced Texas attorney is just a call or click away.

Funding & Maintaining Your Trust Over Time

A trust is only as powerful as the assets you place inside it. Think of setting up a trust like building a sturdy box for your treasures—but unless you move those treasures inside, the box doesn’t do much good! Funding your trust means making sure your real estate, money, investments, and valuables are legally owned by the trust, not just listed on paper.

For real estate, you’ll need to sign a new deed that changes ownership from your name to your trust’s name. This usually involves a trip (or two) to your county clerk’s office, and if you have a mortgage, you may need to notify your lender.

Bank and investment accounts require updating the account titles at your bank or brokerage. Some places will want to see a “certification of trust” that summarizes the main points of your trust without revealing all the details.

Stocks, bonds, and other securities get moved by contacting your investment company. Each one may have its own steps—so don’t be shy about asking for help.

For personal property like jewelry, art, or collectibles, a simple written assignment is usually enough, but for vehicles, you’ll need to retitle them at the DMV.

Don’t forget about life insurance and retirement accounts. Here, you’ll often name your trust as the beneficiary. This way, the proceeds are collected smoothly by your trustee, who can distribute them according to your wishes.

And in our digital world, you might own digital assets—think online accounts, cryptocurrency, or even treasured family photos stored in the cloud. Make a list in your trust documents and leave access instructions for your trustee.

Did you know? Over 40% of Americans use trusts to avoid probate—but forgetting to fund the trust can solve your plan.

Here’s a quick table to help you see how to fund different types of assets:

| Asset Type | Funding Steps |

|---|---|

| Real Estate | New deed, file with county, notify lender |

| Bank Accounts | Change title at bank, provide trust document |

| Investments | Change title with brokerage |

| Vehicles | Retitle at DMV |

| Life Insurance | Update beneficiary to trust if desired |

| Digital Assets | List in trust, provide access instructions |

For more details on these steps, you can visit our Trust Administration Attorney page.

Keeping the Trust Current

Life never stands still, and neither should your trust. After setting up a trust, remember to review and update it when big life events happen—like marriage, divorce, a new child or grandchild, buying a new house, or receiving an inheritance. Each time you add significant assets, make sure to title them in your trust’s name.

We recommend checking your trust every 3 to 5 years, or anytime your situation changes. This helps ensure your wishes are always up to date, your assets are protected, and there are no surprises for your family down the road.

It’s also smart to take a fresh look at your successor trustee and backup beneficiaries—make sure they’re still the right people for the job.

If you’d like a step-by-step reminder, our Living-Trust-Checklist is a great resource.

Taking these steps now can save your loved ones from headaches later—and help your trust work exactly as you intended.

Tax, Probate & State-Law Essentials

When it comes to setting up a trust, there’s more to think about than just who gets what. Staying on top of tax rules, probate laws, and state-specific requirements can save your family headaches down the road.

First, let’s talk about federal estate taxes. For most folks, this won’t be an issue—the current threshold is $13.99 million per person (but keep an eye out, since it will likely drop in 2026 unless Congress steps in). If your estate is under that amount, you won’t owe federal estate taxes, but it’s still smart to plan ahead.

Gift tax is another puzzle piece. Moving assets into an irrevocable trust can sometimes trigger this tax. If you’re considering this approach, it’s wise to chat with an attorney or tax professional first so you don’t get surprised.

Trusts have their own rules for income taxes. Most revocable living trusts are “invisible” for tax purposes—they use your social security number and file under your own return. Irrevocable trusts, though, need their own tax ID and might have to file a separate return, with different tax rates that can add up quickly if income stays in the trust.

If you live in Texas, you’re in a state where probate is often simpler than elsewhere—but there are still court fees, delays, and privacy concerns. The good news: assets in a properly funded trust usually avoid Texas probate entirely. And if you own property in another state, a trust can help you skip the hassle of “ancillary probate”—that’s extra court proceedings in each state where you own real estate.

Medicaid planning is another reason some people use irrevocable trusts. With the right setup and good timing, these trusts can help families qualify for Medicaid benefits, but the rules are strict—so don’t DIY this part.

When it comes to creditor protection, not all trusts are created equal. Irrevocable trusts offer much stronger shields for your assets than revocable trusts do. If protecting your legacy from lawsuits or creditors is a priority, keep this in mind as you plan.

One thing many people overlook: trustee liability. Your trustee has a legal duty to act in the best interests of your beneficiaries. If they make mistakes—intentionally or not—they can become personally liable. That’s why it’s important to choose a responsible trustee and make sure they understand their role. If you’re concerned about what happens when a trustee slips up, you can always dig deeper into Breach of Trust Texas.

Bottom line: Trusts can be powerful tools for privacy, control, and protecting your wishes—but the tax and legal side matters. A little planning now can bring your family real peace of mind later. For those with questions about the details, we’re here to help you make sense of it all.

Frequently Asked Questions about Setting Up a Trust

What assets should (and shouldn’t) go into a trust?

When it comes to setting up a trust, one of the most common questions is: “What should I actually put in my trust?” Let’s clear up the mystery!

Assets that should usually go in your trust include things like real estate, bank accounts, investment accounts, business interests, valuable personal property, and digital assets. Imagine your trust as a treasure chest—it only protects what you actually place inside. For homes and land, you’ll want to retitle the deed. For financial accounts, ask your bank or brokerage how to update ownership to the name of your trust. Digital assets (think: online accounts, cryptocurrency, or cloud photo libraries) are a new frontier—be sure to list them and provide clear instructions.

But not everything belongs in your trust. Retirement accounts like IRAs and 401(k)s typically stay in your name due to tax rules, but you can name the trust as a beneficiary if you want more control after your passing. Vehicles are another gray area. Everyday cars usually stay out (unless they’re valuable or collectible), since retitling can cause registration headaches. And don’t worry about your toaster or couch—everyday household goods are fine to leave out unless they’re truly special.

If you’re not sure whether a particular asset should go in, get in touch with us for guidance. It’s better to ask than to guess!

Does setting up a trust really let my family skip probate?

This is the heart of why many Texans consider setting up a trust. If you’ve properly transferred your assets into the trust, your family can usually avoid the delays, costs, and frustrations of probate court for those assets. That’s a huge relief during a tough time.

However, keep in mind: Any property left out of your trust might still go through probate. This is why a “pour-over will” is so important. It acts like a safety net, catching anything left out and adding it to the trust after your passing. That way, nothing slips through the cracks and your wishes are honored.

How often should I review or update my trust documents?

Think of your trust as a living document—it needs occasional check-ups, just like you do. You should review your trust after any major life event: marriage, divorce, the birth of a child or grandchild, a big move, or a significant new purchase. Moving to a new state? Check your trust, since local laws can change things.

Even without major changes, a good rule of thumb is to review your trust every 3–5 years. That way, you’ll always catch small details before they become big headaches.

Life changes. Your trust should change with you. If you’re ever unsure, reach out for a trust review. We’re here to help make sure your plan keeps up with your life—so you can have true peace of mind.

Conclusion

When it comes to setting up a trust, you’re really investing in peace of mind for yourself and security for those you love. Trusts aren’t just for the ultra-wealthy; they’re a smart way for families of all sizes to keep things private, skip unnecessary court drama, and make sure your wishes are actually carried out—no guesswork or squabbling required.

A trust can help your family avoid probate, shield inheritances from creditors, and provide for children, special needs loved ones, or even your favorite charity. And while there are plenty of DIY options for simple trusts, most Texans find a little personal legal guidance makes everything easier—especially if you have a blended family, business interests, or want to ensure nothing gets left out by accident.

At Keith Morris & Stacy Kelly, Attorneys at Law, we believe in treating every client like family. With over 40 years helping Texans with trusts and estate plans, we’ll walk you through your options, answer your questions, and help you build a plan that fits your life—no cookie cutters here.

If you’re ready to start setting up a trust (or just want to know more), we invite you to reach out. You can find more details about how we help Texans secure their futures on our Texas Estate Planning Services page.

This article is for information only and isn’t legal advice. To make sure your trust is properly created and fully funded, give us a call or visit one of our offices in Houston, Fort Worth, or Austin. Let’s work together to give your loved ones the peace and protection they deserve—confidently and simply.