Everything You Need to Know About Independent Administration Texas

Why Understanding Texas Estate Administration Options Matters for Grieving Families

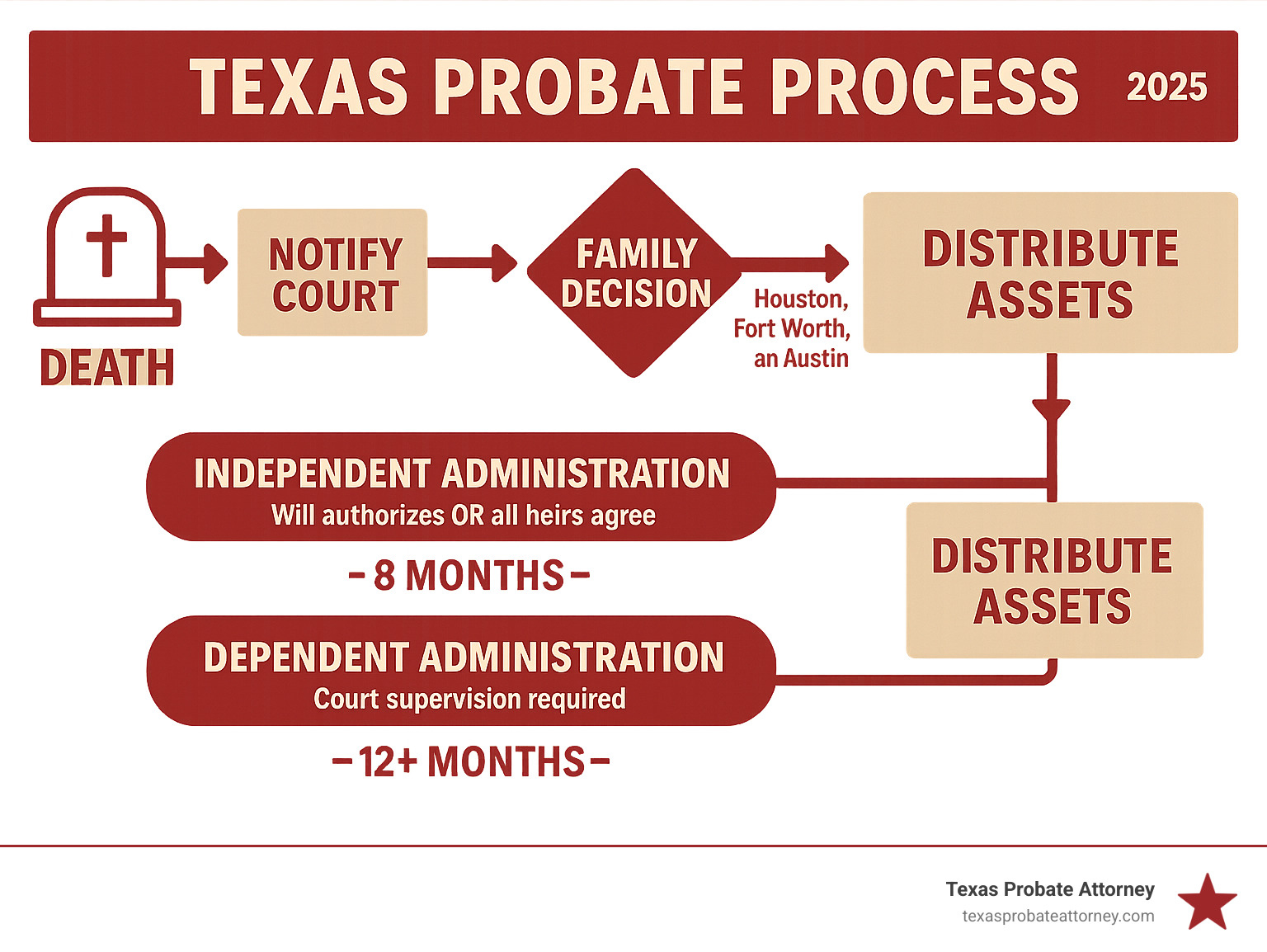

When a loved one passes away in Texas, families in Houston, Fort Worth, and Austin must decide how to settle the estate. Independent administration texas offers a streamlined path that saves time and money compared to court-supervised alternatives.

Quick Answer for Independent Administration Texas:

- What it is: Estate settlement with minimal court oversight

- Key benefit: Faster, less expensive than dependent administration

- When available: Will authorizes it OR all heirs agree in writing

- Best for: Simple estates with cooperative beneficiaries

- Available in: Harris County (Houston), Tarrant County (Fort Worth), Travis County (Austin)

Texas law provides two main paths for estate administration. Independent administration allows an executor to manage the estate with minimal court supervision after initial approval, resulting in fewer hearings, lower legal fees, and faster asset distribution. The alternative, dependent administration, requires ongoing court approval for most decisions, which costs more and takes longer.

Most estates in Houston, Fort Worth, and Austin qualify for independent administration, making it the preferred choice for straightforward situations. However, complex estates or family disagreements may need the protection of court supervision. Understanding these options is crucial, as the choice affects legal costs and how quickly beneficiaries receive their inheritance.

Simple guide to independent administration texas terms:

- appointment of texas executor independent administration

- attorney ad litem texas probate independent administration

- duties of independent administrator texas

Understanding the Two Paths of Estate Administration in Texas

When someone dies in Houston, Fort Worth, or Austin, their estate must go through a formal legal process called estate administration to wrap up their financial life. Governed by the Texas Estates Code, this process involves validating a will, gathering assets, paying debts and taxes, and distributing the remaining property to heirs.

For families in Houston, Fort Worth, and Austin, Texas law offers two distinct paths: independent administration texas or dependent administration. This choice significantly impacts court oversight, cost, and the time required to settle the estate.

The person in charge, either an executor (named in a will) or an administrator (appointed by a court), has a fiduciary duty to act in the estate’s best interest. The probate courts in Harris County (Houston), Tarrant County (Fort Worth), and Travis County (Austin) enforce this duty, each with its own local procedures.

What is Independent Administration?

Independent administration allows an executor or administrator to manage the estate with minimal court supervision. Once the probate judge grants initial approval, the administrator can handle most tasks without seeking permission for each decision.

This freedom makes independent administration texas the preferred choice for most families. It saves money by reducing attorney fees and court costs, and it saves time by eliminating the need to wait for court dates. For families in Houston, Fort Worth, and Austin, this streamlined approach allows them to focus on honoring their loved one’s wishes instead of navigating bureaucracy.

To learn more about this role, see What is an Independent Administrator in Texas?.

What is Dependent Administration?

Dependent administration involves close court supervision. A dependent administrator must get a judge’s permission before making most significant decisions, such as selling property, paying debts, or distributing assets to beneficiaries.

This level of oversight increases costs due to more court hearings and attorney fees, and the process can take much longer. However, this supervision is sometimes necessary for complex estates, situations with significant family disputes, or when an estate’s debts may exceed its assets. The probate courts in Houston, Fort Worth, and Austin may require dependent administration to provide extra protection for the estate and its beneficiaries.

Independent vs. Dependent Administration: A Head-to-Head Comparison

For families in Houston, Fort Worth, and Austin, understanding the differences between independent administration texas and dependent administration is key to saving money and time. The choice between these two probate paths affects decision-making autonomy, legal fees, and settlement speed.

| Feature | Independent Administration | Dependent Administration |

|---|---|---|

| Court Involvement | Minimal after initial appointment and inventory filing | Extensive; court approval required for most actions |

| Costs | Generally lower due to fewer court filings and hearings | Generally higher due to continuous court involvement and legal fees |

| Time Frame | Typically quicker as decisions don’t require court approval | Generally longer due to delays from court approval process |

| Administrator Authority | Broad autonomy; acts without court orders for most tasks | Limited; requires court orders for most significant actions |

| Privacy | Higher; fewer public filings after initial steps | Lower; more detailed financial information filed regularly |

| Bond Requirement | Often waived (if specified in will or by heir agreement) | Usually required |

| Liability Protection | Administrator bears more personal responsibility | Court oversight offers some protection for administrator |

The financial impact is significant. Independent administration leads to lower court costs and reduced attorney fees due to less paperwork and fewer court appearances. Dependent administration, in contrast, incurs ongoing legal fees for petitions and hearings.

Court Involvement: How Much Oversight is There?

In independent administration oversight, once the probate courts in Harris, Tarrant, or Travis County approve the appointment, the executor operates with little direct supervision. They can handle routine tasks without court hearings or judicial approval.

Dependent administration oversight is the opposite. Every significant action requires a formal petition and judicial approval, leading to a constant cycle of court filings and hearings that can prolong the process for years.

Cost & Timeframe: The Impact on Estate Resources

Independent administration is more cost-effective, with lower attorney fees, minimal court filing costs, and often waived bond premiums. The faster settlement means beneficiaries get their inheritance sooner and the estate stops incurring ongoing expenses. A straightforward estate in Houston, Fort Worth, or Austin can often be settled in under a year.

Dependent administration is more expensive. The prolonged process increases legal bills, court costs, and bonding fees. The extended timeline also means the estate pays for property taxes, insurance, and upkeep for a longer period.

Administrator’s Authority: Who Makes the Decisions?

The executor’s power in independent administration is substantial. After appointment by a court in Houston, Fort Worth, or Austin, they can manage most estate matters, including selling assets, paying creditors, and distributing property, without bureaucratic delays. This authority comes with personal administrator liability for mismanagement.

In dependent administration, the administrator has limited authority and needs court permission for nearly every action. This protects the administrator but causes significant delays, often meaning missed opportunities while waiting for a court date.

Choosing the Right Path for a Texas Estate

Deciding between independent and dependent administration in Houston, Fort Worth, or Austin depends on several factors. The existence of a will, heir cooperation, estate solvency, and potential family disputes all influence the best choice. Most estates in Houston, Fort Worth, and Austin qualify for independent administration texas, but court supervision is sometimes the wiser path.

For custom guidance, explore Estate Administration Services.

When Independent Administration is the Preferred Choice

Independent administration is faster and less expensive, making it ideal when certain conditions are met.

- A Clear Will: If a valid will requests independent administration and names an “independent executor,” the probate courts in Houston, Fort Worth, and Austin will almost always honor that wish.

- Family Harmony: If there is no will or it doesn’t specify, all legal heirs can unanimously agree in writing to use independent administration. This requires complete cooperation.

- A Solvent Estate: The process works best when estate assets are clearly greater than its debts, allowing the administrator to pay creditors without court oversight.

- Simple Assets: Estates with straightforward assets like bank accounts, a home, and personal property are perfect for this streamlined approach.

For these estates, families in Houston, Fort Worth, and Austin can expect reduced costs and faster distribution of inheritances.

When Dependent Administration is Necessary or Advisable

While independent administration texas is common, some situations require the protection of court supervision.

- No Will and No Agreement: If a person dies without a will (“intestate”) and the heirs cannot agree on independent administration, a court in Houston, Fort Worth, or Austin will typically require dependent administration.

- Financial Insolvency: If the estate owes more than it owns, dependent administration provides a court-supervised process for paying creditors according to legal priority, protecting the administrator from liability.

- Family Conflict: When a will contest, beneficiary disputes, or questions about a will’s validity are likely, dependent administration’s judicial oversight can prevent litigation by ensuring a judge approves all major decisions.

- Vulnerable Heirs: If an heir is a minor or an incapacitated adult who cannot consent or protect their own interests, a court in Harris, Tarrant, or Travis County may mandate dependent administration for their protection.

In these cases, the added cost and time are justified by the essential protection provided to the estate, beneficiaries, and administrator. If you face estate disputes, get professional help. Learn more about Help with Probate Estate Litigation.

The Nuts and Bolts of Independent Administration Texas

Once the initial steps are completed, the process is far less burdensome than dependent administration.

How to Establish an Independent Administration in Houston, Fort Worth, and Austin

The path to creating an independent administration depends on the will.

- With a Will: If the will names an independent executor, the process is straightforward. The executor petitions the court to admit the will to probate and requests appointment. Courts in Houston, Fort Worth, and Austin generally honor these wishes.

- Without a Will (or if not specified): Independent administration is still possible if every legal heir provides written consent. This unanimous agreement must cover both the type of administration and the person who will serve. If an heir is a minor, their guardian must consent.

After the court in Houston, Fort Worth, or Austin signs the appointment order, the administrator must take an oath of office within 20 days and post a bond if required. Only then are they “qualified” to act for the estate.

For more on this process, see Appointment of Texas Executor: Independent Administration.

Key Documents and Legal Requirements

An independent administrator has several critical, time-sensitive duties.

- Letters Testamentary/of Administration: These official court documents prove your authority to act for the estate. Banks and other institutions will require certified copies.

- Notice to Creditors: This is a two-part step. Within 30 days of qualifying, you must publish a general notice in a newspaper of general circulation within the relevant county (Harris, Tarrant, or Travis). Within two months, you must send certified mail notices to known secured creditors.

- Inventory and Appraisement: You must file a complete inventory of all estate assets and their values within 90 days. Alternatively, you can file an Affidavit in Lieu of Inventory, which states that all debts are paid and beneficiaries have received a detailed inventory. This option offers more privacy.

- Digital Assets: Managing email, social media, and online accounts is now a key part of administration. The Texas Estates Code provides for access, but a court order from a probate judge in Houston, Fort Worth, or Austin may still be needed to comply with privacy laws.

Failure to meet these requirements can lead to removal or personal liability. For more details, see the guide on Estate Administration in Texas explained by TexasLawHelp.org.

Eligibility, Alternatives, and Potential Complications

To serve as an administrator in Texas—a statewide requirement enforced by courts in Houston, Fort Worth, and Austin—you must be at least 18, of sound mind, and not a convicted felon. An out-of-state resident serving an estate in Houston, Fort Worth, or Austin must appoint a resident agent in Texas.

Full administration isn’t always needed.

- Muniment of Title: If there’s a will and no unpaid debts (other than on real estate), this process, available through the courts in Harris, Tarrant, and Travis counties, transfers property ownership without an administrator.

- Small Estate Affidavit: For estates under $75,000 (excluding homestead/exempt property) with no will, this affidavit, an option for qualifying families in Houston, Fort Worth, and Austin, can transfer assets without formal administration.

Complications can arise. An administrator can be removed for misconduct like embezzlement or gross neglect. Personal liability is a risk if you mismanage assets or fail to pay creditors. In rare cases, an estate can be converted to dependent administration if disputes arise or a judge in Houston, Fort Worth, or Austin deems more oversight is necessary.

Frequently Asked Questions about Independent Administration in Texas

We understand that estate matters can be overwhelming. Here are answers to the questions we hear most often from families in Houston, Fort Worth, and Austin about independent administration texas.

Can we have independent administration if there is no will in Texas?

Yes. Independent administration is possible without a will if every legal heir provides written consent. They must all agree on both the independent administration and who will serve as the Independent Administrator. The probate court in Houston, Fort Worth, or Austin will review this agreement. If even one heir objects, the court will likely require dependent administration.

How long does independent administration typically take in Houston, Fort Worth, or Austin?

Independent administration is much faster than the dependent alternative. Most straightforward cases in the Houston, Fort Worth, and Austin areas are substantially completed within 6 to 12 months. The timeline depends on the complexity of the assets and any creditor issues. Selling real estate or resolving tax issues can extend the process, but the key advantage is avoiding the long delays caused by waiting for court approval for every step.

What are the main costs involved in an independent administration?

One of the primary benefits of independent administration is cost savings. Because there are fewer court hearings and less paperwork, expenses are much lower. Key costs include:

- Attorney’s fees: The largest expense, but significantly less than in dependent administration.

- Court filing fees: Standard fees paid to the county clerk in Harris, Tarrant, or Travis County to open the case.

- Publication costs: The fee for publishing the required newspaper notice to creditors in a local Houston, Fort Worth, or Austin area newspaper.

- Appraisal fees: May be needed to value certain assets.

- Bond premiums: Often waived if the will allows it or all heirs agree, saving thousands.

Overall, families in Houston, Fort Worth, and Austin save money because the process is more efficient and requires less court intervention.

How a Probate Attorney Can Guide You in Houston, Fort Worth, & Austin

Navigating estate administration while grieving is challenging. An experienced probate attorney can provide essential guidance and prevent costly errors.

At Texas Probate Attorney, Keith Morris and Stacy Kelly offer over 40 years of combined experience to families in Houston, Fort Worth, and Austin. We provide the personalized attention needed to turn an overwhelming process into a manageable one.

- Navigating Legal Choices: We help you decide if independent administration texas or dependent administration is right for your family, explaining the pros and cons in plain English based on your unique situation.

- Ensuring Compliance: We manage all required legal documents and deadlines for the probate courts in Harris, Tarrant, and Travis counties, protecting you from personal liability and ensuring the process moves smoothly.

- Protecting the Administrator: As an executor, you have significant legal duties. We guide you through managing assets, handling creditors, and distributing property to ensure you meet your responsibilities and protect the estate.

- Resolving Disputes: When conflicts arise, we focus on quick resolutions, using aggressive litigation only when necessary to protect your interests.

Our firm is defined by personalized legal representation. You work directly with Keith and Stacy, ensuring you receive dedicated attention. This approach leads to better outcomes and gives families peace of mind.

Whether you are starting the probate process or have encountered complications, we are here to help. You can Contact a Probate Attorney in Houston or Find a Probate Attorney in Fort Worth.

For skilled guidance on independent administration in Texas, schedule a consultation with our team today.