Don’t Get Lost in Probate: A Texan’s Guide to Muniment of Title and Self-Proved Wills

Simplifying Estate Settlement in Texas

When a loved one passes away in Texas, settling their estate can seem daunting. For families in Houston, Fort Worth, and Austin, the legal process doesn’t have to be complex or expensive. Texas law provides a streamlined alternative to full probate called muniment of title & self proved affidavit in texas.

This process allows a will to be legally recognized so property can be transferred to beneficiaries, but without the need for a full administration. It’s a faster, more cost-effective solution when the estate meets certain criteria.

Key Requirements:

- A valid will exists.

- The estate has no unpaid debts, except for liens on real estate (like a mortgage).

- There is no need for a formal estate administration.

- The application is filed within four years of the decedent’s death.

Key Benefits:

- Faster: Typically 2-4 months, versus 6+ months for full probate.

- Lower Cost: Generally $2,000-$4,000, compared to $5,000-$15,000+ for administration.

- Simpler: No executor is appointed, and court oversight is minimal.

A self-proving affidavit attached to the will makes the process even smoother by removing the need for witness testimony in court. The probate courts in Harris, Tarrant, and Travis counties are well-versed in this efficient procedure, making it a practical option for many Texas families.

Muniment of title & self proved affidavit in texas basics:

What is a Muniment of Title? A Simpler Path for Estates in Houston, Fort Worth, and Austin

For estates in Houston, Fort Worth, and Austin, Texas probate law offers a muniment of title—a streamlined court process that validates a will without requiring a full estate administration. The term “muniments of title” refers to documents proving ownership, like deeds and wills. This specific legal procedure, recognized by the probate courts in Harris, Tarrant, and Travis counties, uses the will itself as the primary evidence to transfer property.

Instead of appointing an executor, the probate courts in Houston, Fort Worth, or Austin issue an order declaring the will valid. This order acts as a legal bridge, allowing assets to pass directly to the beneficiaries. It’s an efficient alternative to traditional probate meaning full administration, authorized under Texas Estates Code Chapter 257, and is particularly useful for simple estates in these metropolitan areas with no unpaid debts (other than mortgages).

How Muniment of Title Works in Houston, Fort Worth, and Austin

In the probate courts of Harris County (Houston), Tarrant County (Fort Worth), and Travis County (Austin), the muniment of title process is a routine matter. Once the court approves the application, the certified court order becomes the legal tool for transferring assets.

- For Real Estate: For property in Houston, the order is filed with the Harris County Clerk. In Fort Worth, it’s filed with the Tarrant County Clerk, and in Austin, with the Travis County Clerk. This filing officially updates the local property records, showing the beneficiaries as the new owners.

- For Financial Assets: The order is presented to banks, credit unions, and other financial institutions throughout Houston, Fort Worth, and Austin. They recognize it as the legal authority to release funds to the beneficiaries without needing letters testamentary.

This direct approach is especially useful in Texas’s major cities, where it helps families avoid delays in transferring valuable property. The muniment of title Texas process provides the necessary legal authority for these transfers.

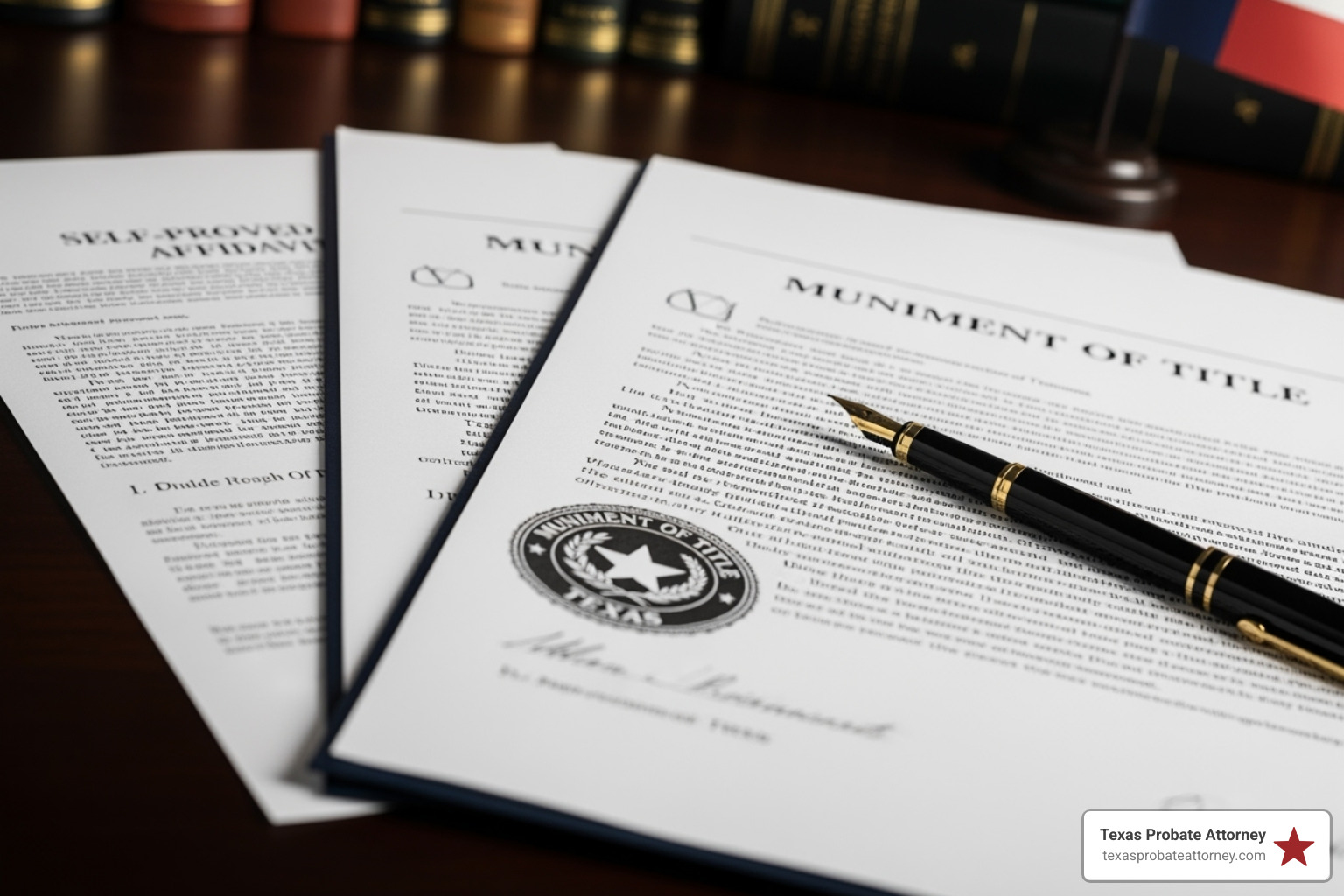

The Critical Role of a Self-Proving Affidavit

A self-proving affidavit is a notarized statement that significantly impacts the probate process in Houston, Fort Worth, and Austin. It’s attached to a will, and in it, the testator and witnesses swear that the will was signed according to legal formalities.

Normally, a will’s witnesses must testify in a Harris, Tarrant, or Travis County probate court to confirm its validity. Locating these individuals years later can be difficult or impossible. A self-proving affidavit, as outlined in Texas Estates Code §251.104, eliminates this requirement, allowing the court to accept the will as properly executed based on the affidavit alone.

For families in Houston, Fort Worth, and Austin, this means:

- Faster court hearings

- No need to locate original witnesses

- Lower legal costs

The self-proving affidavit makes a will perfectly suited for the muniment of title process, underscoring The Importance of Having a Will that is properly prepared.

The Muniment of Title & Self Proved Affidavit: A Streamlined Process in Houston, Fort Worth, and Austin

For families in Houston, Fort Worth, or Austin, the muniment of title & self proved affidavit in texas process is designed to be straightforward. Instead of months of court supervision, it offers an efficient path to settling an estate.

Key Requirements for Muniment of Title

To qualify for this process, the estate must meet specific criteria under Texas law. These requirements ensure that muniment of title is used only in appropriate situations in the probate courts of Houston, Fort Worth, and Austin.

- A Valid Will: The deceased must have left a legally valid will. A will with a self-proving affidavit is ideal, as it simplifies the court hearing.

- No Unpaid Debts: The estate cannot have any debts, with the exception of debts secured by real estate (like a mortgage).

- No Need for Administration: There must be no other reason for a formal administration, such as managing a business or resolving disputes.

- Four-Year Deadline: The application must be filed within four years of the person’s death, though some exceptions exist.

- Medicaid Claims: If the deceased received Medicaid benefits, any potential claims from the Medicaid Estate Recovery Program (MERP) must be addressed.

These rules, detailed in ESTATES CODE CHAPTER 257. PROBATE OF WILL AS MUNIMENT OF TITLE, are strictly applied by the probate courts in Harris, Tarrant, and Travis counties. If you are unsure whether an estate in the Houston, Fort Worth, or Austin area qualifies, it is wise to ask, Do I Need a Probate Attorney in Texas?.

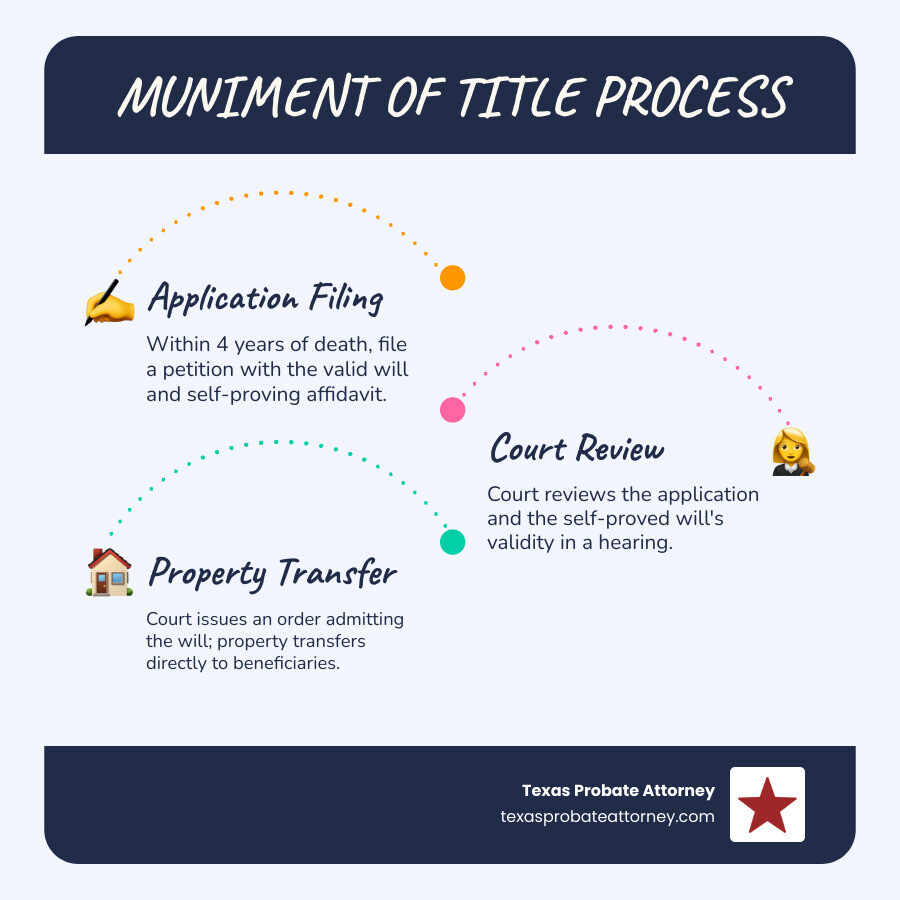

The Step-by-Step Filing Process in Houston, Fort Worth, and Austin

The process for Probating a Will in Texas as a muniment of title follows a clear path in courts across Houston, Fort Worth, and Austin.

- Prepare and File the Application: An “Application to Probate Will as a Muniment of Title” is drafted. It must be filed with the appropriate probate court in Harris, Tarrant, or Travis County, along with the original will and a certified death certificate.

- Public Notice Period: After filing, the respective county clerk in Houston, Fort Worth, or Austin posts a public notice at the courthouse for at least ten days. This is a standard legal formality in all Texas probate cases.

- Court Hearing: A hearing is held in the local probate court where the applicant provides testimony to the judge. If the will is self-proved, no witness testimony is needed. The applicant must prove to the Houston, Fort Worth, or Austin judge that all requirements for muniment of title are met.

- Judge’s Order: If everything is in order, the judge signs an “Order Admitting Will to Probate as Muniment of Title.” This order is the legal document that validates the will.

- Transfer Assets: A certified copy of the order and the will is used to transfer property. For real estate, it is filed in the property records of the county where the property is located (e.g., Harris, Tarrant, or Travis). It is also presented to financial institutions in the Houston, Fort Worth, or Austin area to transfer accounts.

The entire process typically takes two to four months, a significant time savings compared to full administration. For assistance in Harris County, a Probate Attorney Houston can guide you through these steps.

Muniment of Title vs. Full Probate Administration in Texas

For families in Houston, Fort Worth, and Austin, choosing between a muniment of title and full probate administration depends on the estate’s specific circumstances. Muniment of title is a direct path for transferring property, while full administration is a more involved process handled by the Harris, Tarrant, and Travis County probate courts for complex estates. The primary difference is the appointment of an executor and the level of court supervision.

In a full probate in Houston, Fort Worth, or Austin, the court appoints an executor who is given legal authority (Letters Testamentary) to manage the estate under its oversight. Muniment of title bypasses this, as no executor is needed. The court’s order alone is sufficient to transfer property to beneficiaries.

This table highlights the key differences for families in Houston, Fort Worth, and Austin:

| Feature | Muniment of Title | Traditional Probate Administration |

|---|---|---|

| Executor Duties | No executor appointed; no letters testamentary issued. | Personal representative (executor) appointed with formal duties. |

| Court Oversight | Minimal; court validates will and issues order for property transfer. | Ongoing; court supervises executor’s actions, asset management, and debt payment. |

| Creditor Claims | Estate must be debt-free (except secured liens); no formal creditor notice process. | Formal notice to creditors required; executor manages and pays debts from estate assets. |

| Complexity | Simpler, streamlined process. | More complex, involves inventory, appraisals, and potentially annual accountings. |

| Cost | Generally lower ($2,000-$4,000 total). | Generally higher ($5,000-$15,000+ total), especially with complex estates. |

| Timeframe | Faster (2-4 months typical). | Longer (6 months to several years, depending on complexity). |

| Flexibility | Limited to estates with no unsecured debts and no need for administration. | More flexible for estates with debts, disputes, or complex assets. |

For more complex situations, you might need to understand What is an Independent Administrator in Texas?, which is a form of full administration. The goal for simple estates is often to How to Avoid Probate Court in Texas entirely or use the simplest method possible.

Major Advantages of Choosing Muniment of Title

For qualifying estates in Houston, Fort Worth, and Austin, the benefits are significant:

- Lower Costs: By avoiding the steps of a full administration, the overall Probate Attorney Cost and court fees are substantially lower.

- Faster Resolution: The process is much quicker, allowing beneficiaries to receive their inheritance in months, not years.

- Simplicity: With fewer legal steps and no ongoing reporting to the court, the process is less stressful for the family.

- Direct Asset Transfer: The court order provides immediate authority to transfer assets directly to beneficiaries.

Limitations and When to Avoid Muniment of Title

Muniment of title is not a one-size-fits-all solution for estates in Houston, Fort Worth, or Austin. It should be avoided if the estate has:

- Unsecured Debts: Any credit card bills, medical debts, or personal loans must be paid before filing in a Harris, Tarrant, or Travis County court. Only mortgages or other liens on real estate are permissible.

- Complex Assets or Lawsuits: If the estate involves a Houston-based business, a lawsuit in a Fort Worth court, or complex assets in Austin that require management, an executor is necessary.

- Beneficiary Disputes: If there is a possibility of Contesting a Will in Texas or other family disagreements among beneficiaries in the Houston, Fort Worth, or Austin area, the structured oversight of a full administration is better suited to resolve conflicts.

Navigating Complexities and Deadlines in Houston, Fort Worth, and Austin

While the muniment of title & self proved affidavit in texas process is streamlined, it is still subject to strict legal deadlines and rules. Families in Houston, Fort Worth, and Austin should be aware of these potential complexities to avoid turning a simple process into a costly legal problem.

The Four-Year Rule for Probating a Will

Texas law, which is strictly followed by probate courts in Houston, Fort Worth, and Austin, generally requires a will to be filed for probate within four years of the date of death. This statute of limitations is a critical deadline for local families. If you miss this window, probating the will in Harris, Tarrant, or Travis County becomes much more difficult.

To file a will after four years in Houston, Fort Worth, or Austin, the applicant must prove to the court they were not in “default” (at fault) for the delay. This requires showing a good reason, such as not knowing the will existed. These late filings involve additional legal steps and costs in the local probate court, undermining the efficiency of the muniment of title process. It is crucial for families in these areas to act promptly to comply with Texas Probate Laws. This deadline is different from the time limit on How Long Do You Have to Contest a Will?.

Handling Out-of-State Wills and Estate Debts

Many residents of Houston, Fort Worth, and Austin have wills created in other states. Fortunately, Texas courts, including those in Harris, Tarrant, and Travis counties, will accept an out-of-state will for probate as a muniment of title, provided it was validly executed under the laws of that state or meets Texas requirements. A self-proving affidavit from another state is also typically recognized.

However, for estates in Houston, Fort Worth, and Austin, the most significant roadblock remains estate debts. Muniment of title is only available if the estate has no unsecured debts. If a loved one in these cities left behind credit card balances or medical bills, the estate will not qualify for this process. In such cases, a full administration in the local probate court is required to manage creditor claims properly. Attempting to use muniment of title with existing debts can lead to legal trouble for the beneficiaries. If you anticipate such issues, consulting an Estate Litigation Lawyer in Texas is a wise step.

Frequently Asked Questions for Houston, Fort Worth, & Austin Families

Families in Houston, Fort Worth, and Austin often have questions about the muniment of title & self proved affidavit in texas process. Here are answers to some of the most common inquiries.

What happens if I find debts after a will is probated as a muniment of title?

Finding unsecured debts after a muniment of title is completed in a Houston, Fort Worth, or Austin court can create significant problems. Because no executor was appointed, there is no formal process to handle the claim. Beneficiaries in these areas who received property may become personally liable for the debt, up to the value of the assets they inherited. It may be necessary to open a full administration in the original Harris, Tarrant, or Travis County court to resolve the issue, defeating the purpose of the streamlined process. This is why a thorough debt check is critical before filing in these jurisdictions.

Can I use muniment of title if the only asset is a house with a mortgage?

Yes. This is an ideal scenario for using a muniment of title in Houston, Fort Worth, or Austin. A mortgage is a debt secured by a lien on real estate, which is a specific exception to the “no debts” rule applied by local probate courts. As long as the estate has no other unsecured debts (like credit card bills or personal loans), you can use the muniment of title process to transfer ownership of a house in Harris, Tarrant, or Travis County to the beneficiaries, who will then become responsible for the mortgage.

How does a self-proved affidavit make the muniment of title process easier in a Fort Worth court?

A self-proved affidavit simplifies the process in any Texas probate court, including in Tarrant County (Fort Worth), Harris County (Houston), and Travis County (Austin). Its primary benefit is that it eliminates the need for the will’s original witnesses to testify in court. The affidavit creates a legal presumption that the will was properly signed and witnessed. This saves significant time and expense that would otherwise be spent locating witnesses and arranging for their testimony, allowing the court hearing to proceed much more quickly and efficiently.

Conclusion: Is Muniment of Title Right for Your Family?

Deciding how to settle a loved one’s estate in Houston, Fort Worth, or Austin is a significant responsibility. The muniment of title & self proved affidavit in texas process offers a valuable alternative to full probate, providing a faster, simpler, and more affordable path for the right situations.

This process is ideal when a loved one left a valid will, the only debts are secured by real estate (like a mortgage), and there is no need for an executor to manage complex assets or disputes. However, if the estate has unsecured debts, pending lawsuits, or family disagreements, a full administration is the more appropriate and protective choice.

Navigating Texas probate law, including the strict four-year filing deadline, requires careful attention to detail. The local procedures in Harris, Tarrant, and Travis county courts are consistent, but an experienced guide can ensure the process is handled correctly.

At Texas Probate Attorney, Keith Morris and Stacy Kelly offer over 40 years of combined experience helping families with probate and estate matters. We provide the personalized attention needed to determine the most effective path for your unique circumstances. Our goal is to honor your loved one’s wishes while making the legal process as smooth as possible for you.

If you are facing estate settlement decisions, Contact Us today to discuss whether muniment of title is the right solution for your family.