Decoding Trust Administration: What You Need to Know

Introduction to Trust Administration in Texas (Houston, Fort Worth, Austin)

What is trust administration? It’s the legal process of managing and distributing a trust’s assets according to the trust document and Texas law after the creator (settlor) passes away. This process is often overwhelming for families grieving a loss.

Key Components of Trust Administration:

- Asset Management: Securing, valuing, and protecting trust property.

- Legal Compliance: Following the Texas Trust Code and tax laws.

- Beneficiary Communication: Keeping heirs informed.

- Distribution: Transferring assets to beneficiaries as specified.

- Record Keeping: Maintaining detailed financial records.

For families in Houston, Fort Worth, and Austin, trust administration offers major advantages over probate. While probate can take 3% to 7% of an estate’s value and last for years, a trust avoids this public court process. This allows families to access inheritances faster and with more privacy.

The trustee manages the trust, handling duties like inventorying assets, paying debts and taxes, and distributing property. In Texas, professional trustee fees typically range from 1% to 2% of assets annually, often making it more cost-effective than probate.

As one expert notes, “Trust administration is a mechanism that protects assets by creating a trust with a specified legal outcome and managing assets for distribution according to specific instructions.”

Easy What is trust administration glossary:

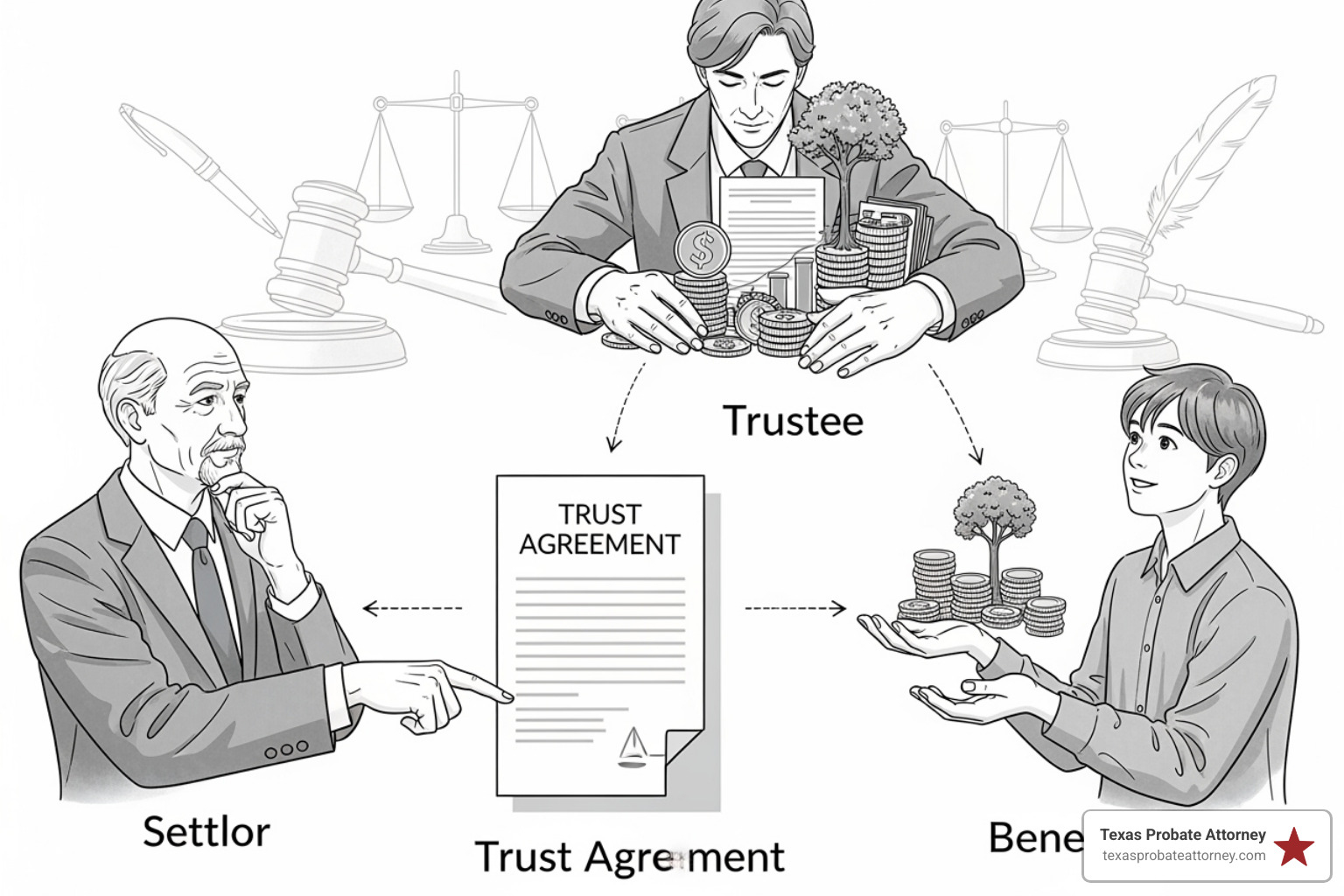

The Key Players and Structure of a Texas Trust

Understanding what is trust administration begins with knowing the key players in Houston, Fort Worth, and Austin.

- The settlor (or grantor) creates the trust, setting the rules for how assets are managed.

- The trustee holds legal title to the assets and manages them according to the settlor’s instructions. They handle everything from paying bills and taxes to making investment decisions and distributions.

- The beneficiaries are the people or organizations who receive the trust’s benefits. They have rights under Texas law to information and proper management from the trustee.

Funding a Trust in Texas

A trust document is useless until it is funded. Funding a trust means transferring assets—like real estate, bank accounts, and investments—from your name into the trust’s name. This step is critical to avoid probate. Many Houston, Fort Worth, and Austin families create a trust but forget to fund it, forcing their assets into the very court process they sought to avoid.

What to Consider Before Setting Up a Trust in Houston, Fort Worth, or Austin

Before creating a trust, define your goals. Do you want to avoid probate, minimize taxes, provide for a child with special needs, or protect assets from creditors? Your family dynamics, such as minor children or beneficiaries with debt, and the types of assets you own—from Houston real estate to a Fort Worth business—will shape the trust’s design. Clear instructions are vital to prevent future disputes and costly litigation.

Revocable vs. Irrevocable Trusts in Texas

You must decide between a revocable or irrevocable trust.

- Revocable living trusts are flexible; you can change or cancel them. You typically act as the initial trustee, maintaining control. However, they offer no asset protection during your lifetime and are part of your taxable estate.

- Irrevocable trusts are permanent. Once created, they are difficult to change. This permanence offers benefits like potential tax savings and creditor protection, but you give up control over the assets.

Types of Trusts Available in Texas

Texas law allows for many specialized trusts. Special needs trusts provide for disabled loved ones without jeopardizing government benefits. Charitable trusts support causes you care about. Life insurance trusts can keep proceeds out of your taxable estate, while spendthrift trusts protect beneficiaries from creditors or poor financial habits. Each type serves different goals for families in Houston, Fort Worth, and Austin.

What is trust administration compared to will administration in Texas?

The difference is privacy and court involvement. Will administration requires a public court process (probate), while trust administration is typically private.

Probate Court Involvement in Houston, Fort Worth, and Austin

Will administration is supervised by a probate court in Houston, Fort Worth, or Austin. The court validates the will and oversees the process. Trust administration happens privately, without a judge’s oversight, making it a more efficient choice for many Texas families.

Public vs. Private Process in Texas

Probate records are public, exposing your family’s financial details. Trust administration is private, keeping these matters confidential.

Timelines for Each Process

Probate can take months or years. Trust administration is usually faster because it avoids the court calendar, meaning beneficiaries in Houston, Fort Worth, and Austin often get their inheritance sooner.

| Feature | Trust Administration | Will Administration (Probate) |

|---|---|---|

| Court Involvement | Generally none, private process | Required, court-supervised process |

| Privacy | High, details not public | Low, public record |

| Timeline | Often faster (months to a year+) | Can be lengthy (months to several years) |

| Cost | Ongoing administrative costs (1-2% of assets annually) | Can be significant (3-7% of estate value) |

| Asset Control | Assets managed by trustee per trust terms | Assets frozen until probate concludes |

| Legal Basis | Trust document and Texas Trust Code | Will and Texas Probate Code |

| Dispute Resolution | Often handled privately or through mediation | Resolved in court, can be contentious |

What is Trust Administration: A Trustee’s Duties and Responsibilities

Serving as a trustee is a significant honor and a tremendous legal responsibility. What is trust administration is defined by the strict duties a trustee must perform under Texas law.

Texas Trust Code and Trustee’s Legal Obligations in Houston, Fort Worth, and Austin

The Texas Trust Code is the rulebook for trustees in Houston, Fort Worth, and Austin. A trustee’s core purpose is to carry out the settlor’s wishes by managing assets according to the trust document and state law. Key legal obligations include:

- Identifying and Securing Assets: Creating a full inventory of trust property, obtaining appraisals, and protecting assets from loss.

- Managing Assets Prudently: Making smart, conservative investment decisions that balance the needs of current and future beneficiaries. This includes safeguarding property, collecting income, and managing real estate or businesses.

- Paying Debts and Taxes: Identifying creditors, paying valid debts, and handling all tax matters, including filing the trust’s income tax returns and any applicable estate tax returns.

- Maintaining Records and Communicating: Keeping meticulous records of all transactions and providing regular, transparent updates and accountings to beneficiaries.

- Following Trust Terms: Distributing assets to beneficiaries exactly as the trust document specifies.

Fiduciary Duty

A trustee in Texas has a fiduciary duty, the highest standard of care under the law. This means legally promising to put the beneficiaries’ interests above all others, including their own—a standard strictly enforced in Houston, Fort Worth, and Austin courts. A breach of this duty can result in personal liability for any losses. This duty includes:

- Duty of Loyalty: The trustee must avoid all conflicts of interest and self-dealing. For example, a trustee managing a trust with Houston real estate cannot sell it to themselves at a discount. They cannot borrow from the trust, buy trust assets for themselves, or otherwise use the trust for personal gain.

- Duty of Prudence: The trustee must manage trust assets carefully and responsibly, as a prudent person in Texas would. This may require hiring professional advisors in Houston, Fort Worth, or Austin for investments or other complex matters, with the cost paid by the trust.

- Duty to Inform and Report: The trustee must keep beneficiaries in Houston, Fort Worth, Austin, or elsewhere reasonably informed about the trust and its administration, providing a copy of the trust document and accountings upon request. Transparency is key to preventing disputes and is a requirement under the Texas Trust Code.

How do you choose the right trustee in Houston, Fort Worth, or Austin?

Selecting a trustee is one of the most critical decisions in estate planning. The right choice ensures your wishes are honored, while the wrong one can lead to family conflict and financial loss.

Key Qualities to Look For:

- Trustworthiness: Absolute integrity is non-negotiable.

- Financial Acumen: They should be comfortable with financial concepts and managing money.

- Impartiality: The ability to act objectively, especially with multiple beneficiaries or complex family dynamics.

- Willingness to Serve: They must understand and accept the significant time and effort required.

Individual vs. Corporate Trustee Options in Texas

An individual trustee, like a family member, brings personal knowledge but may lack financial or legal knowledge. A corporate trustee (like a bank’s trust department) offers professional management and impartiality but charges higher fees (typically 1-2% of assets annually) and lacks a personal connection. Some Houston, Fort Worth, and Austin families use a hybrid approach, naming an individual and a corporate co-trustee to get the best of both worlds.

The Texas Trust Administration Process and Its Challenges

For a family, what is trust administration becomes a real-world process after a loved one passes. The process in Texas follows a logical sequence, though challenges can arise.

The Administration Process

- Avoid Probate: A properly funded trust avoids the public, costly, and time-consuming probate court process in Houston, Fort Worth, and Austin, ensuring privacy and efficiency.

- Notify Beneficiaries: The trustee must formally notify all beneficiaries and legal heirs—whether they reside in Houston, Fort Worth, Austin, or elsewhere—providing them with a copy of the trust document and an explanation of their rights under Texas law. This transparency helps prevent future disputes.

- Inventory and Value Assets: The trustee must locate, secure, and create an inventory of all trust assets. For assets located in the service areas, professional appraisals are often needed for valuable items like Houston real estate, Fort Worth business interests, or Austin art collections to establish their value for tax and distribution purposes.

- Pay Debts and Taxes: Before distributing assets, the trustee must pay all of the settlor’s final bills, debts, and taxes from the trust. This includes filing final income tax returns and, for larger estates in Houston, Fort Worth, or Austin, potentially federal estate tax returns.

- Distribute Assets: The trustee distributes the remaining assets to the beneficiaries according to the trust’s specific instructions. For beneficiaries in Houston, Fort Worth, or Austin, this could involve transferring title to local property or distributing funds from a local bank account.

- Close the Trust: Once all duties are complete, the trustee prepares a final accounting for the beneficiaries’ approval, gets releases signed, and formally terminates the trust, concluding the administration process for the Houston, Fort Worth, or Austin-based trust.

What are the common challenges and costs of trust administration in Texas?

Even well-planned administrations can face problems.

- Beneficiary Disputes: Disagreements over the trust’s terms or the trustee’s actions are common, especially when communication is poor. These disputes can strain family relationships and lead to costly litigation in Houston, Fort Worth, and Austin.

- Trustee Misconduct: While most trustees are honest, some engage in mismanagement, self-dealing, or misappropriation of funds. This is a serious breach of trust that can devastate a trust’s assets, whether it’s a family trust in Houston or a business trust in Fort Worth.

- Costs in Texas: Trust administration is not free. Expect costs for:

- Trustee Compensation: Professional trustees in Texas typically charge 1-2% of the trust’s assets annually.

- Legal Fees: Attorneys in Houston, Fort Worth, and Austin may charge $350-$650 per hour for guidance and resolving disputes.

- Accounting Fees: Preparing trust tax returns can cost $500 to $2,000 or more annually.

- Other Expenses: Appraisal fees and investment management fees also add to the total cost.

What happens if a Texas trustee fails their duties?

When a trustee in Texas fails to meet their legal obligations, it’s called a breach of trust. This can range from failing to provide accountings to beneficiaries in Austin to making improper investments with trust funds or stealing funds.

Beneficiaries in Houston, Fort Worth, or Austin can take legal action. A Texas court can:

- Compel the trustee to perform their duties.

- Stop the trustee from taking harmful actions.

- Order the trustee’s removal.

- Deny the trustee compensation.

- Hold the trustee personally liable for any financial damages they caused, meaning their own assets could be at risk to repay the trust.

If you are a beneficiary who suspects misconduct or a trustee facing allegations, seeking legal help promptly is critical to protect your rights and the trust’s assets.

Conclusion: Ensuring a Smooth Trust Administration in Texas

Understanding what is trust administration provides a clear path forward during a difficult time. For families in Houston, Fort Worth, and Austin, a well-managed trust offers privacy, efficiency, and significant cost savings compared to probate.

The success of the process for any Houston, Fort Worth, or Austin family hinges on a diligent and trustworthy trustee committed to their fiduciary duties under Texas law. Their role is to protect a family’s legacy—from a business in Fort Worth to real estate in Houston—and honor the final wishes of the person who created the trust.

However, even with a solid plan, challenges like family disputes over an Austin property or concerns about trustee misconduct can arise. In these complex situations that are common in Houston, Fort Worth, and Austin, experienced legal guidance is essential.

At Texas Probate Attorney, Keith Morris and Stacy Kelly offer over 40 years of combined experience in Texas trust and estate matters. We provide personalized attention to every client, understanding that each family’s situation in Houston, Fort Worth, or Austin is unique. We are prepared to litigate aggressively to protect your interests but also seek efficient resolutions to preserve family relationships when possible.

If you are a trustee needing guidance or a beneficiary concerned about the administration of a trust, you don’t have to handle it alone. We are here to ensure your family’s legacy is managed with the care and legal protection it deserves.

Contact Texas Probate Attorney today to turn an overwhelming process into a manageable path forward for your family.