Dodging Probate: Your Ultimate Guide to Keeping Assets Out of Court

What is Probate and Why Should You Avoid It?

Probate is the court-supervised process of validating a will, paying debts, and distributing assets after someone dies. While it serves a purpose, many families seek to avoid it due to significant drawbacks.

- It’s Expensive: Costs can consume 3% to 7% of an estate’s value. A $500,000 estate could face $15,000 to $35,000 in fees.

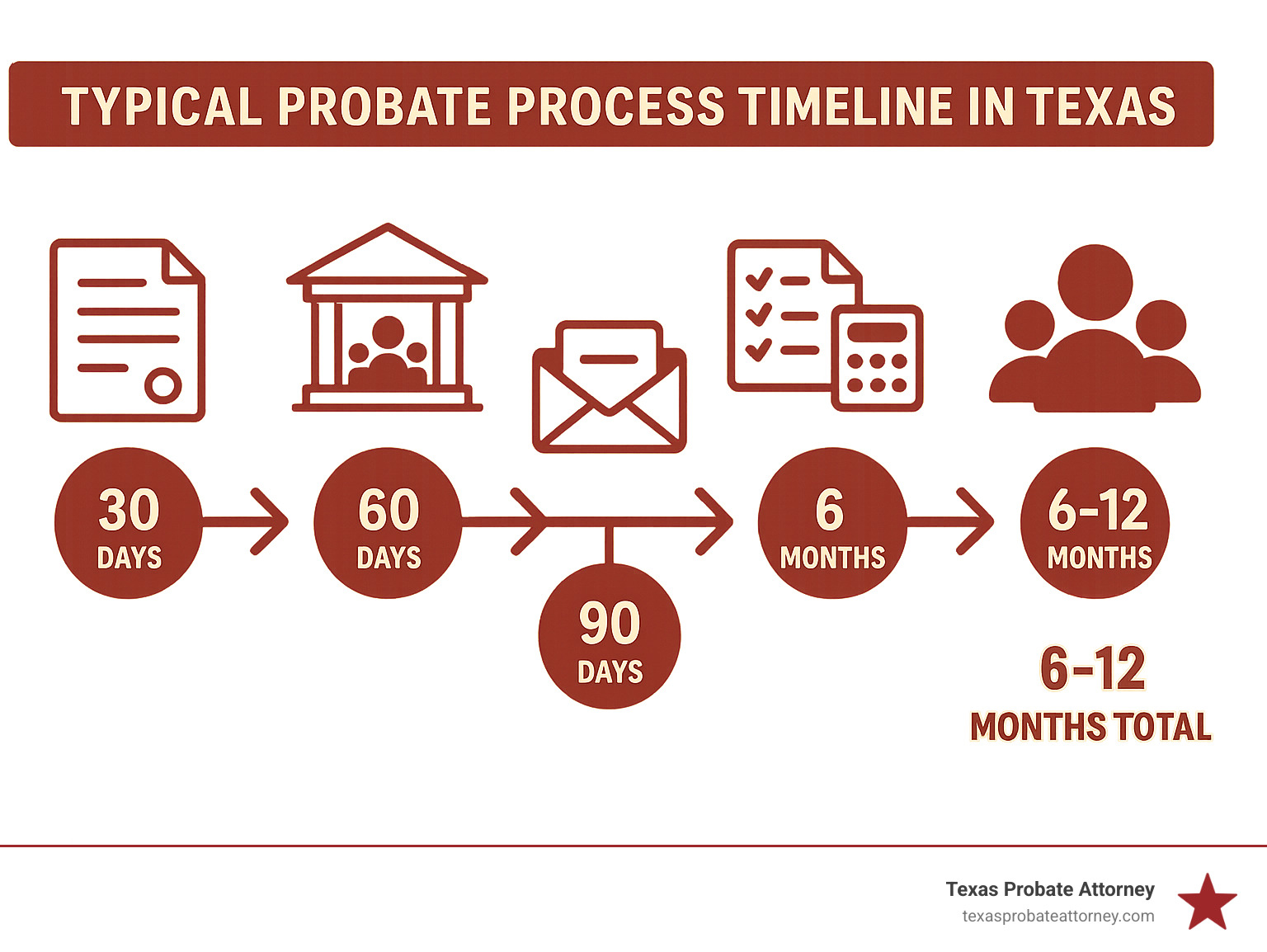

- It’s Slow: The average Texas probate takes 6-12 months, with complex cases lasting years.

- It’s Public: All court records are public, exposing your family’s financial details.

- It’s Stressful: Grieving families must steer legal procedures and deadlines.

Fortunately, you can learn how to avoid probate and spare your loved ones these issues. Key methods include creating trusts, using joint ownership, designating beneficiaries, and using special deeds for real estate. With proper planning, most of these problems are avoidable.

How to avoid probate helpful reading:

The Myth of the Will: Does It Automatically Keep You Out of Court?

A common misconception is that having a will keeps your estate out of court. The surprising truth is that a will doesn’t help you avoid probate; in fact, it’s the primary document used to start the probate process.

Think of a will as an instruction manual for the probate judge. It specifies who inherits your property, who acts as executor, and who cares for minor children. Without a will, Texas state law makes these decisions, which may not align with your wishes. So, a will is essential for guiding probate, not bypassing it.

Assets that pass through your will are called “probate assets.” These are typically items owned solely in your name without a beneficiary. However, non-probate assets bypass your will and the court entirely. These include life insurance policies, retirement accounts with named beneficiaries, and jointly owned property.

This is why a comprehensive estate plan is more than just a will. The most effective strategies combine a will with other probate-avoidance tools. A special pour-over will can work with a trust to catch any assets you forgot to transfer into it, ensuring your wishes are followed.

Using Houston Will Attorney Services Can Help You Prevent Probate Issues can provide guidance on coordinating these tools. The key takeaway is that your will is just one piece of the puzzle when learning how to avoid probate.

Key Strategies for How to Avoid Probate in Texas

Each state has unique estate planning laws, and Texas is no exception. While many states follow the Uniform Probate Code (UPC), Texas has its own distinct tools for those figuring out how to avoid probate.

Texas has a relatively streamlined probate process. A well-drafted will can often lead to an “independent administration,” a simplified procedure with minimal court supervision. This makes some complex avoidance strategies less critical for the average Texan than in other states.

However, if you want to skip the courthouse entirely, own property in multiple states, or have complex family dynamics, proactive planning is essential. The foundation of any strategy is understanding the difference between probate and non-probate assets.

- Probate Assets: Items owned solely in your name with no designated beneficiary (e.g., a car titled only to you, a solo bank account). These are subject to the court process.

- Non-Probate Assets: Items with a built-in transfer mechanism (e.g., assets in a trust, joint bank accounts, life insurance policies). These pass directly to your heirs.

The goal is to convert probate assets into non-probate assets, giving them a VIP pass to skip the probate line. As we explain in Can Probate Be Avoided?, the answer is yes—with thoughtful planning.

1. Establish a Revocable Living Trust

When people ask how to avoid probate, a revocable living trust is a primary tool. It’s like a private entity you create to hold your assets. You, as the grantor and initial trustee, maintain full control during your lifetime. The key is re-titling your assets—house, bank accounts, etc.—into the name of the trust.

You name a successor trustee to manage and distribute the assets according to your instructions after your death, all without court involvement. This process offers significant benefits:

- Privacy: Unlike public probate records, trust distributions remain private.

- Ancillary Probate Avoidance: A trust can manage properties in multiple states, avoiding separate probate proceedings in each one.

In Texas, where probate can be streamlined, a trust’s value must be weighed against its cost. A simple probate might cost around $3,000, while setting up a trust can be $5,000 to $10,000. Trusts are most beneficial for those with complex estates, assets in multiple states, or strong privacy concerns. The biggest challenge is ensuring all new assets are consistently titled in the trust’s name to prevent them from falling back into probate.

For more details, see Should You Consider a Living Trust? and Setting Up a Trust.

2. Use Joint Ownership with Right of Survivorship

Joint ownership with right of survivorship is a simple and often free way how to avoid probate. When one owner dies, their share automatically transfers to the surviving owner(s) without any court process.

In Texas, the common forms are:

- Joint Tenancy with Right of Survivorship (JTWROS): Works for bank accounts, investments, and real estate. Owners have equal shares, and the survivor inherits the entire asset.

- Community Property with Right of Survivorship: A special option for married couples in Texas, allowing community property to pass automatically to the surviving spouse.

While the automatic transfer is appealing, joint ownership carries serious risks:

- Loss of Control: A joint owner gains immediate rights and can potentially access funds or sell property without your consent.

- Creditor Claims: The asset becomes vulnerable to the joint owner’s creditors, lawsuits, or divorce proceedings.

- Gift Tax Issues: Adding a joint owner may be considered a taxable gift.

- Unintended Disinheritance: The last surviving owner gets everything and can leave it to whomever they choose, potentially cutting out other intended heirs.

For real estate, the deed must explicitly state “with right of survivorship” to avoid probate. This strategy works best for married couples and small accounts where the risks are manageable. Learn more at How to Avoid Probate Court in Texas.

3. Designate Beneficiaries on Financial Accounts

Designating beneficiaries on financial accounts is one of the easiest ways how to avoid probate. This creates a direct transfer to your loved ones, bypassing the courthouse entirely.

- Payable-on-Death (POD) accounts: Used for checking accounts, savings accounts, and CDs. Your beneficiary has no access while you’re alive but receives the funds upon your death.

- Transfer-on-Death (TOD) designations: Used for investment accounts, stocks, and bonds, ensuring they flow directly to your beneficiary.

- Retirement accounts (IRAs, 401(k)s): Beneficiary designations not only avoid probate but also preserve crucial tax benefits for your heirs.

- Life insurance policies: The death benefit is paid directly to your named beneficiary, providing immediate financial support.

This method is often superior to joint ownership because you retain full control during your lifetime, and your assets are protected from your beneficiary’s creditors or financial issues.

However, it is critical to keep your beneficiaries updated. Life events like marriage, divorce, or death can change your intentions. Forgetting to update a beneficiary after a divorce could mean an ex-spouse inherits your assets instead of your children. Review your designations every few years to prevent unintended consequences.

Learn more from our articles on Common Misconceptions About Beneficiary Designated Accounts and Probate vs. Non-Probate Assets in Texas: What You Need to Know.

4. Transfer Real Estate Without Probate

For most Texans, their home is their most valuable asset. Fortunately, there are several excellent options for how to avoid probate for real estate.

- Transfer on Death Deed (TODD): This is like a beneficiary designation for your house. You record a deed naming who inherits the property upon your death. You retain full control during your lifetime—you can sell, mortgage, or revoke the deed—and your beneficiary has no rights until you pass away.

- Lady Bird Deed: This improved life estate deed works like a TODD but can also offer protection from Medicaid estate recovery. You keep full control to sell or mortgage the property.

- Traditional Life Estate Deed: This gives property to a “remainderman” while you retain the right to live there. However, it’s less flexible, as you need the remainderman’s consent to sell or mortgage the property.

- Revocable Living Trust: Titling your home in a trust ensures it passes to beneficiaries according to the trust’s terms, which is ideal for multiple properties.

- Joint Ownership with Right of Survivorship: For married couples, this allows the surviving spouse to automatically inherit the property, but it carries the risks associated with joint ownership.

The best choice depends on your specific goals, providing a balance of control, protection, and simplicity.

Other Important Considerations and Tools

The most effective way how to avoid probate is to combine several strategies. You might use a trust for major assets, POD/TOD designations for financial accounts, and a Transfer on Death Deed for your home. This holistic approach, detailed in What Happens If You Die Without an Estate Plan?, provides comprehensive protection.

For real estate, here’s how trusts and TODDs compare:

| Feature | Revocable Living Trust | Transfer on Death Deed (TODD) |

|---|---|---|

| Control | Full control during lifetime, can amend/revoke. | Full control during lifetime, can amend/revoke. |

| Probate Avoid | Yes, for all assets titled in the trust. | Yes, for the specific property on the deed. |

| Privacy | Private document. | Public record (deed itself), but transfer is not probated. |

| Cost to Set Up | Higher (legal fees for drafting and funding). | Lower (legal fees for drafting and recording). |

| Complexity | Requires re-titling assets; ongoing administration. | Simpler; just applies to the specific real estate. |

| Incapacity | Successor trustee can manage if you become incapacitated. | No direct incapacity management; requires separate POA. |

| Multi-State Prop. | Avoids ancillary probate in other states. | Only applies to property in the state where the TODD is valid. |

Strategic Gifting: How to Avoid Probate by Reducing Your Estate

Giving assets away during your lifetime reduces your probate estate. The IRS allows an annual gift tax exclusion ($17,000 per person in 2023, projected to rise) without tax consequences. You can give this amount to as many people as you want each year. For larger gifts, a lifetime gift tax exemption applies ($12.92 million in 2023, but set to decrease significantly at the end of 2025). Check the Current gift tax exemption amounts for the latest figures.

Simplified Probate for Small Estates in Texas

Even if some assets go to probate, Texas offers shortcuts for smaller estates.

- Small Estate Affidavit: For estates under $75,000 (excluding the homestead and other exempt property), this sworn statement allows for a quicker, cheaper transfer of assets.

- Muniment of Title: If there is a valid will and no unpaid debts (other than those secured by real estate), this process validates the will and transfers title without a full probate administration.

When Might Probate Be Beneficial?

While avoiding probate is usually the goal, it can sometimes be useful:

- Court Oversight: A judge can resolve family disputes over an estate fairly.

- Creditor Claims: Probate establishes a firm deadline for creditors to make claims, protecting heirs from future surprise bills.

- Will Validation: The court legally confirms the will’s validity, settling any doubts.

- Beneficiary Protection: Court supervision can protect assets left to minors or vulnerable individuals.

Frequently Asked Questions about Avoiding Probate

Here are answers to common questions about how to avoid probate.

How much does it cost to avoid probate?

Many strategies are free. Adding Payable-on-Death (POD) or Transfer-on-Death (TOD) designations to accounts costs nothing. More comprehensive tools like a revocable living trust ($2,000-$5,000+) or a special deed involve legal fees. However, this upfront cost is almost always less than probate, which can cost 3-7% of an estate’s value ($15,000-$35,000 on a $500,000 estate). In Texas, even a streamlined probate can cost around $3,000. Proactive planning is a sound financial investment that provides privacy and peace of mind. This is why you should Avoid DIY Wills and seek professional advice.

Can I avoid probate if I have a lot of debt?

Yes, but avoiding probate does not erase your debts. Creditors can still pursue claims against non-probate assets transferred to your heirs. The probate process actually provides a formal structure for handling debts by setting a deadline for creditors to file claims. If you avoid probate, your heirs may still need to address creditor notifications and payments without the court’s guidance. It’s crucial to work with an attorney to create a plan that protects your family while properly handling your obligations.

Do I still need a will if I use these other methods?

Yes, absolutely. A will is an essential safety net for any estate plan, even one designed to avoid probate. Here’s why:

- It catches any “straggler” assets you forgot to place in a trust or assign a beneficiary to.

- A “pour-over” will ensures these overlooked assets are transferred into your trust.

- It is the only document where you can name guardians for your minor children.

- It directs the distribution of personal property without titles, like jewelry, art, and family heirlooms.

The goal is not to eliminate the will, but to minimize what passes through it, creating a comprehensive plan that covers all your wishes.

Conclusion: Building Your Probate-Proof Estate Plan

We’ve explored many ways how to avoid probate, from simple beneficiary designations to comprehensive revocable living trusts. The best approach often combines several strategies, custom to your unique assets, family dynamics, and goals. Proactive planning is always better than reactive scrambling after a crisis.

What works for one family may not be right for yours. Cookie-cutter solutions rarely provide the protection your loved ones deserve. At Texas Probate Attorney, Stacy Kelly and Stacy L. Kelly, J.D., Partner offer over 40 years of combined experience in probate, trust, and estate planning litigation. We understand that this is about protecting the people you love most.

Our personalized approach means we take the time to understand your situation and craft a plan that fits your needs. We know this process can feel overwhelming, but you don’t have to do it alone. For complex situations, strong legal guidance is crucial.

Contact us today to discuss how our Texas fiduciary litigation attorneys can help you build a comprehensive estate plan that provides true peace of mind. Your legacy is too important to leave to chance.